From the Market Ear:

Mighty NVDA

NVDA takes out resistance levels, breaking above the consolidation that has been in place since mid July. Weak hands have been shaken out, so we could be seeing a short-term vacuum kick in…

Will…

…NVDA lead us higher, or ORCL lower?

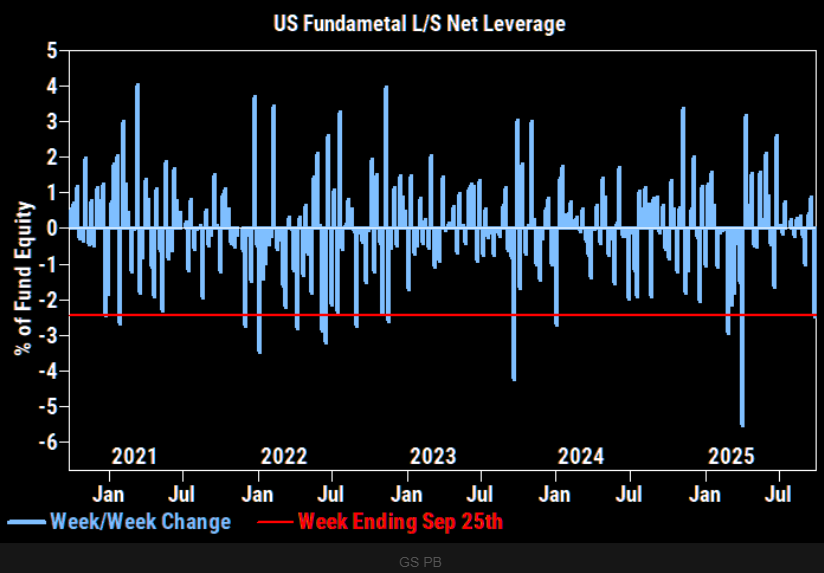

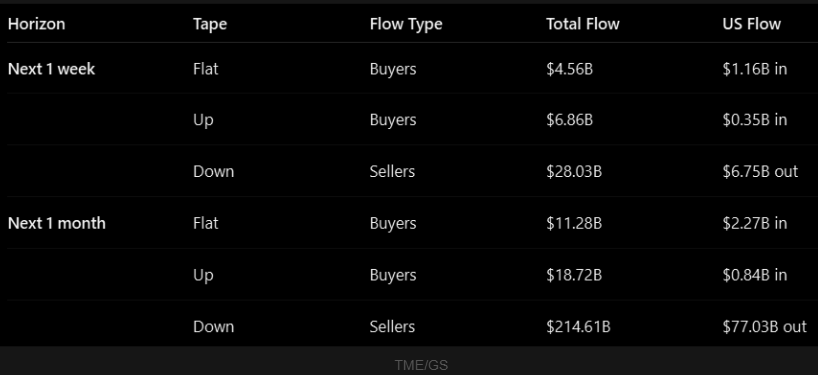

De-leveraging

Last week we saw US Fundamental L/S Net leverage decrease by -2.5 pts – the largest weekly decrease since the week of Liberation Day – to 50.7% (28th percentile 3-year), according to GS.

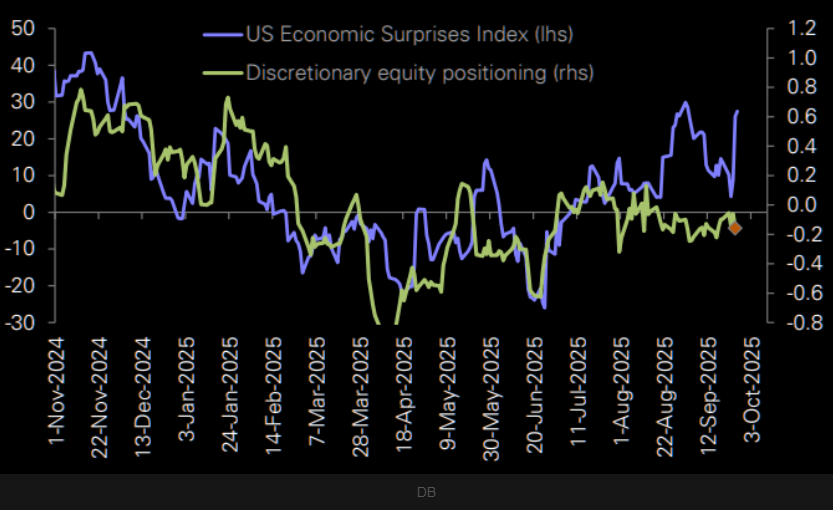

Hmmm

Discretionary positioning lagging economic surprises big time.

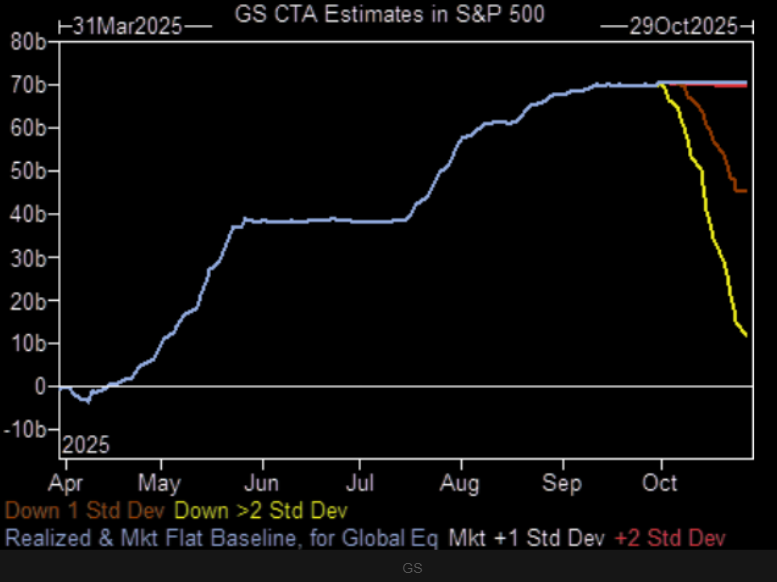

Downside convexity

Big asymmetry is to the downside in equities.

China tech

HSTECH printed new recent highs. We are breaking up post the little consolidation, trading inside the short term trend channel. Zoom out and you realize just how much this space could squeeze. Chart 2 shows the weekly longer term chart where we just took out new recent highs. Note the 50/200 cross in place.

King BABA

BABA continues to be our favorite name when it comes to fine China tech. The September squeeze has resulted in the weekly RSI trading at the most overbought levels in “modern times”. We have the first resistance around here, and then the big 200 area. Maybe BABA is ready for a pause, but we would treat it as a short term thing only.

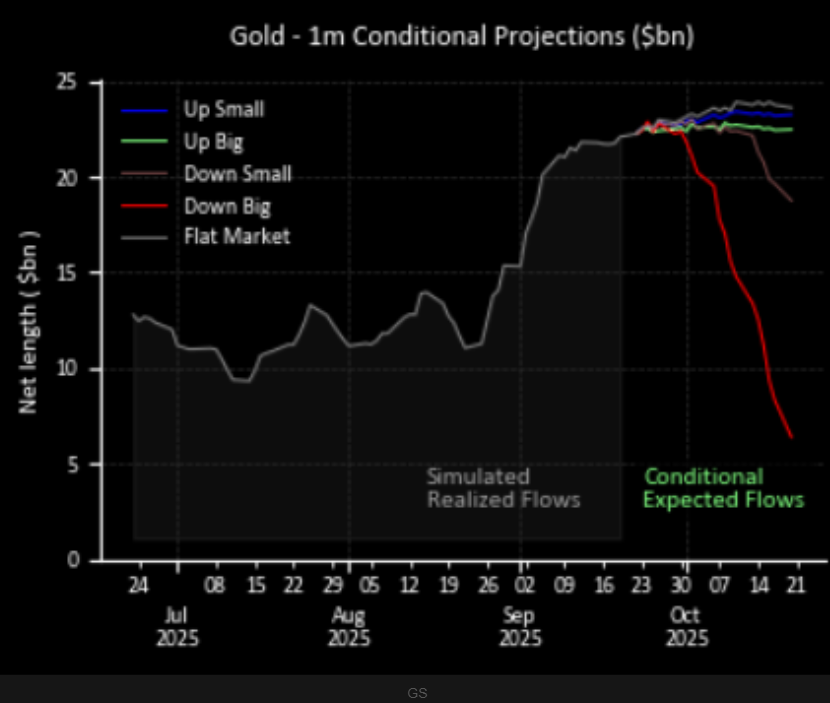

Gold’s downside convexity

CTAs are running big gold longs. Downside convexity could become a short term “issue”.

Dislocation

“US economic data has shown clear evidence of a re-acceleration, but the 2yr Treasury yield is still around its lows for the last 12 months… After all, we only have to look back to Q4 of 2024, when both inflation and growth surprised on the upside, leading the Fed to signal slower rate cuts ahead. Back then, that backdrop saw the 2yr Treasury yield rise +60bps in Q4 2024, moving up from levels pretty similar to today (3.5-3.6%), to more than 4.3% by Christmas.” (DB macro)

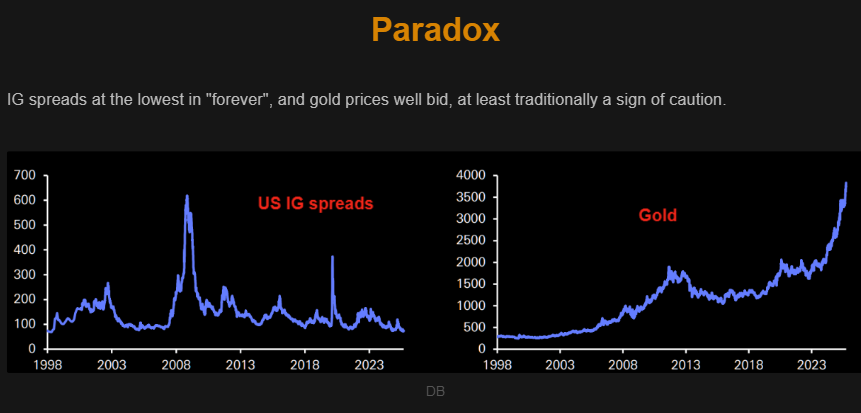

Paradox

IG spreads at the lowest in “forever”, and gold prices well bid, at least traditionally a sign of caution.