From the Market Ear:

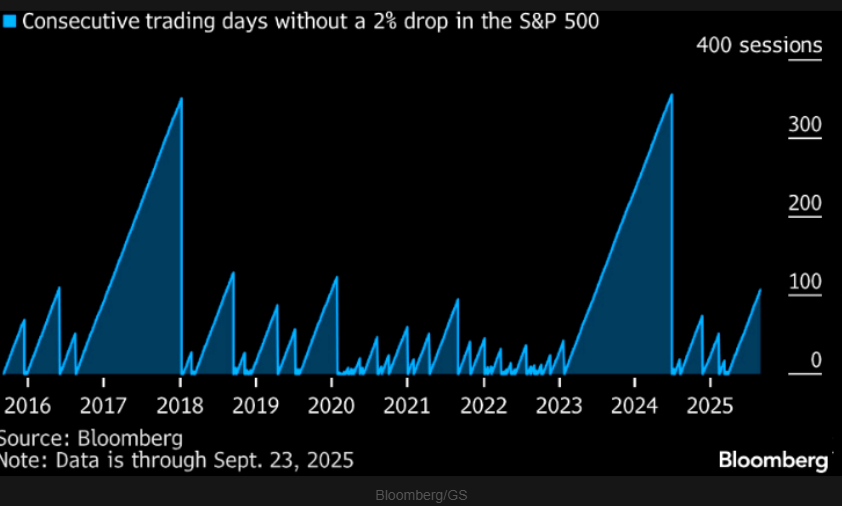

Can’t put a good man down

SPX has gone 107 sessions without posting a drop of at least 2%…its longest streak since July 2024.

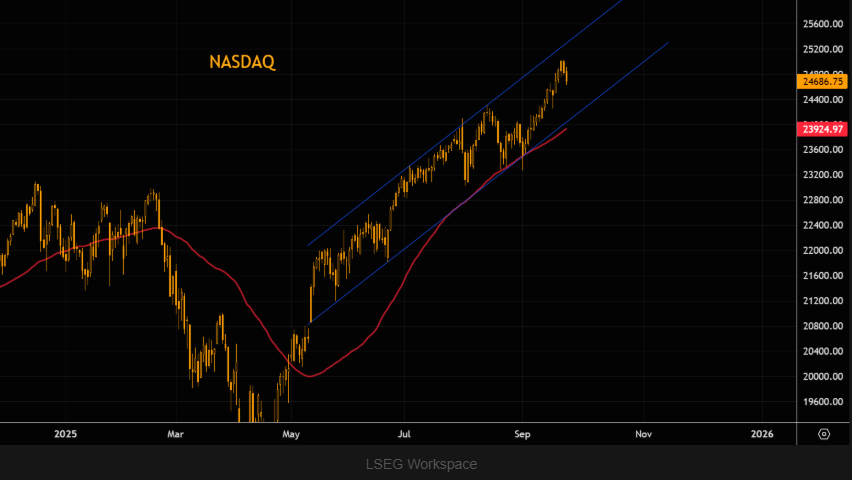

NASDAQ technicals

NASDAQ remains trading inside the trend channel that has been in place since May. Note we never even tried the upper part of the channel before reversing lower in the past 2 days. Support: trend channel lows and the 50 day. Resistance: ATHs.

Low bond volatility…

…remains supportive when it comes to equity multiples.

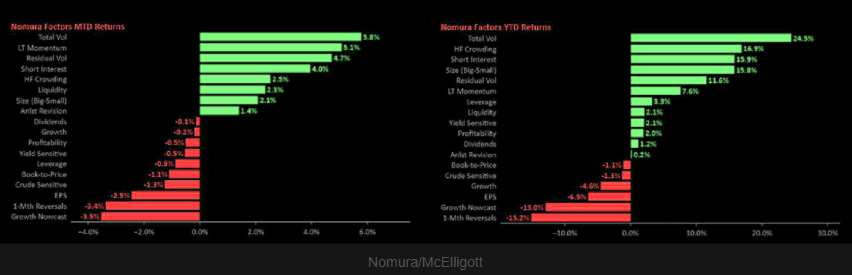

Pushing it

“Equities factor performance shows “out on risk-curve, up in net (leverage)”: high vol- / high beta- / short interest- momentum breaking-out, while profitability- / eps- break-down.”

Trapped

DXY very tight inside a “dynamic” formation. We are seeing positive RSI divergence. A close above the longer term negative trend line, and things could get “fluid” to the upside.

XLE breaking out

XLE taking out the negative trend line with a decisive up candle. Note this could be a huge triangle breakout formation.

The gap

China tech has performed well YTD, but zoom out and compare the HSTECH to NDX for some perspective. Don’t forget, you can’t spell China without AI…Chart shows % performance over the past 5 years.

BABA bull

In early September we pointed out the massive break out in BABA. We wrote: “A close above March highs, and things risk going much more dynamic to the upside.” Fast forward to today and the stock is substantially higher, but zoom out and you realize this has more squeeze potential..

Tight

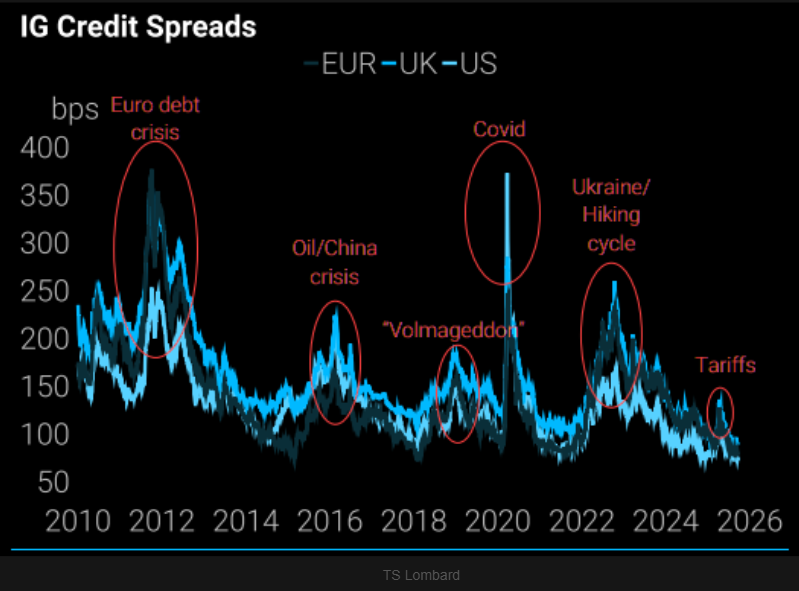

Tightest IG spreads since 1998…

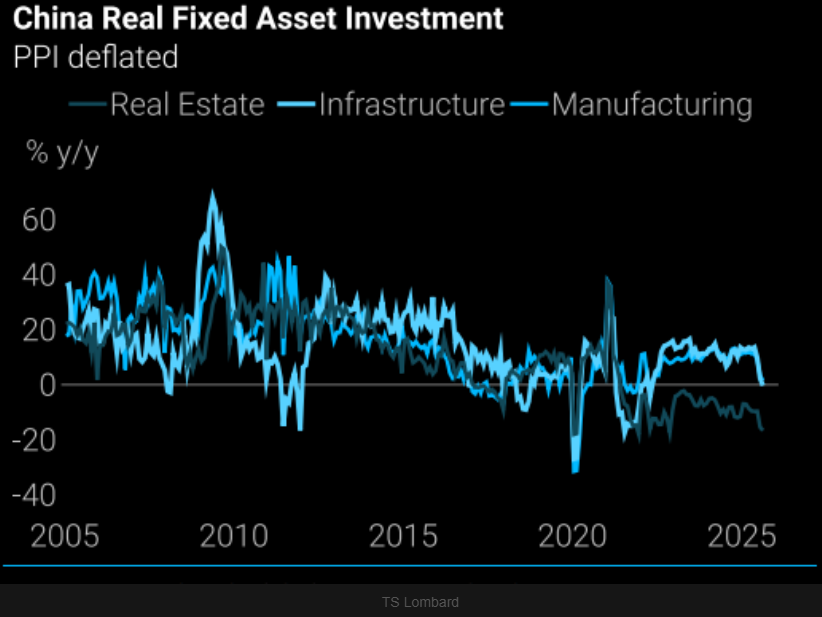

Risk to HY spreads

China risks are growing. TS Lombard: “The most prominent risk to global HY spreads is likely the current Chinese macro slowdown. The latest batch of data confirms our longstanding call of a H2 slowdown and highlights the need for Beijing to “go” again with another round of stimulus. We expect further easing measures this year equivalent to 0.2% of GDP but are concerned about the speed of the investment slowdown, which is faster than we expected”.