We have repeatedly warned that Victoria is headed toward financial ruin.

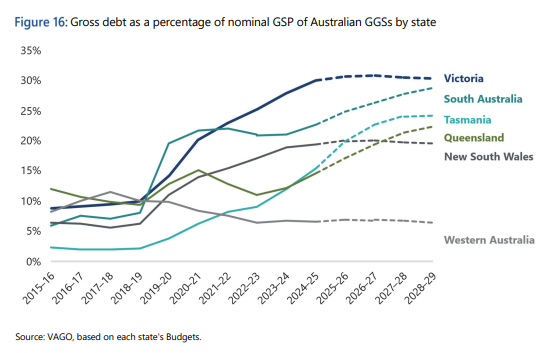

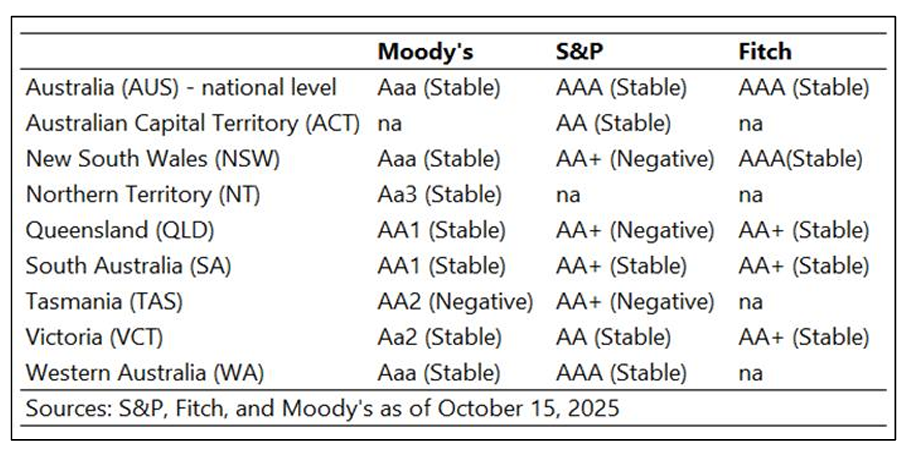

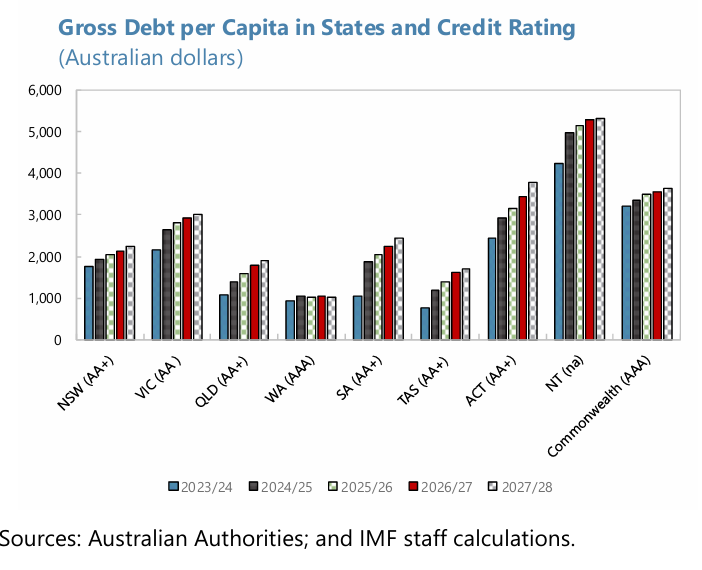

Victoria has the highest per capita debt and the lowest credit rating among the states.

State and Territory Credit Ratings (Source: IMF)

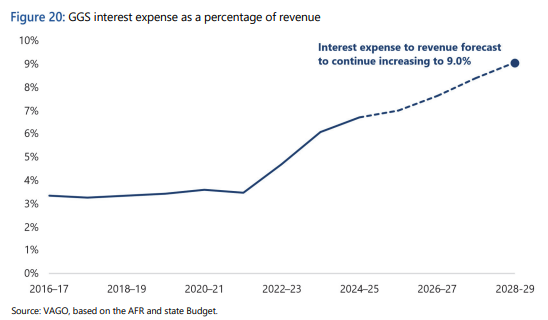

In November, the Victorian Auditor-General warned that debt, deficits, and infrastructure cost blowouts pose long-term dangers to the state’s financial viability.

Victoria’s liabilities currently surpass $150 billion, with debt payments posing a significant financial strain.

The world’s two main credit rating agencies, S&P and Moody’s, have also warned that Victoria faces more rating downgrades if it does not address its financial position.

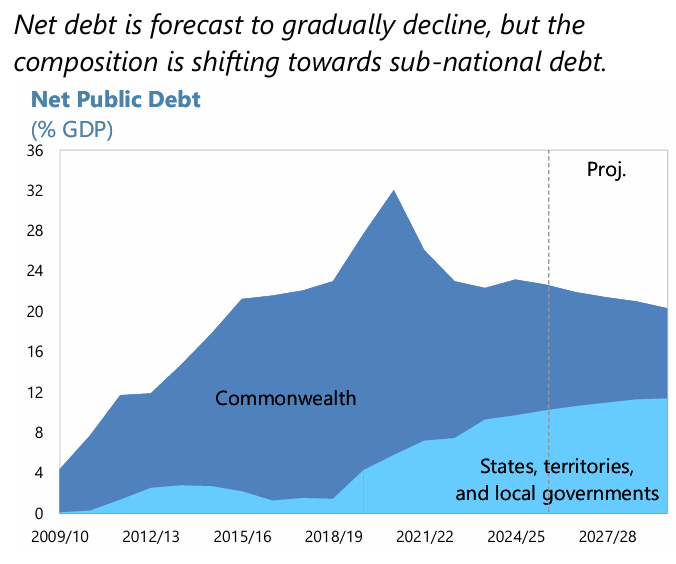

The International Monetary Fund’s (IMF) 2025 Article IV Consultation staff report on Australia warns that the federal government may ultimately need to bail out highly indebted states and territories, most notably Victoria, unless state spending is brought under control.

This is the strongest intervention the IMF has made on Australian state finances in decades.

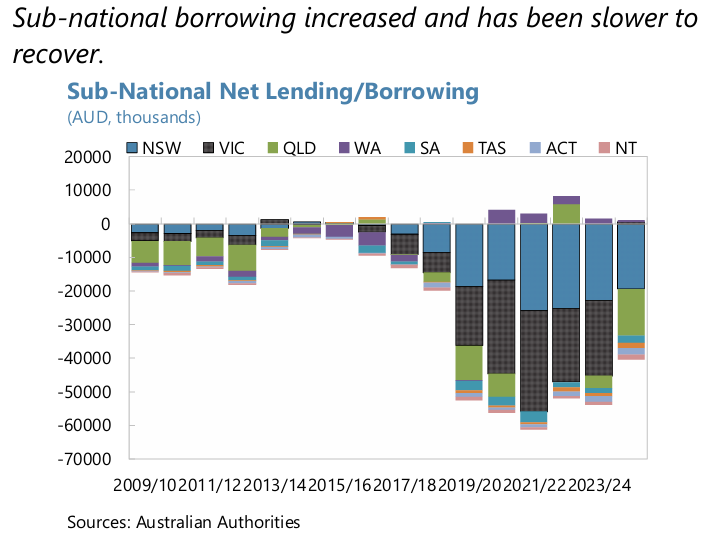

“Since 2016-17, state governments’ net debt-to-GDP ratio has increased 7.5 times from a low base of 1.3 percent”, the IMF states.

Source: IMF

The IMF’s staff report warns:

- State debt has surged due to post‑pandemic spending, infrastructure blowouts, and cost‑of‑living programs.

- Several states have breached their own fiscal rules and suffered credit rating downgrades.

- Credit agencies increasingly view the Commonwealth as a de facto guarantor of state debt.

- Rising state debt could eventually push up federal borrowing costs.

Victoria is singled out as the most concerning case, given its size and debt profile, followed by the Northern Territory.

Source: IMF

The IMF projects that Victoria’s gross debt will exceed $240 billion by 2028–29, with per capita debt above $3,000.

Source: IMF

Victoria faces additional risks from:

- a $15 billion cost from corruption in construction

- a funding shortfall in the $34.5 billion Suburban Rail Loop

- a double‑notch credit downgrade during the pandemic.

The Takeaway:

The IMF staff report on Australia warns that ballooning state debt has become a national economic risk, with Victoria the biggest risk vector.

The message from the IMF is blunt: without action, the Commonwealth may eventually be forced into state bailouts, as it is the ultimate guarantor of state debt, which threatens Australia’s broader fiscal stability.

The IMF calls for tighter spending discipline and better coordination between federal and state governments.

It also urges the federal and state governments to cooperate in pursuing tax reform, including increasing the GST, scrapping stamp duty, and expanding the land tax regime.

I will add that any downgrade of the Commonwealth credit rating could also raise mortgage rates, given the federal government’s implicit guarantee of the banking sector.