Thursday’s labour force data from the Australian Bureau of Statistics (ABS) has put the Reserve Bank of Australia (RBA) under more pressure to hike interest rates.

Australia’s headline unemployment rate remained at 4.1% in January amid solid employment growth of 17,800.

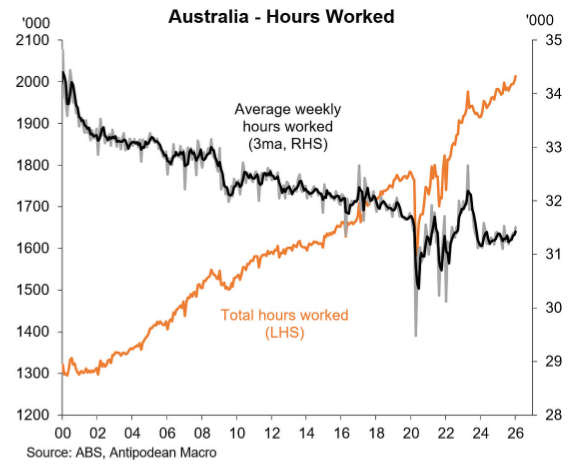

The number of hours worked also rose by a solid 0.6% in January.

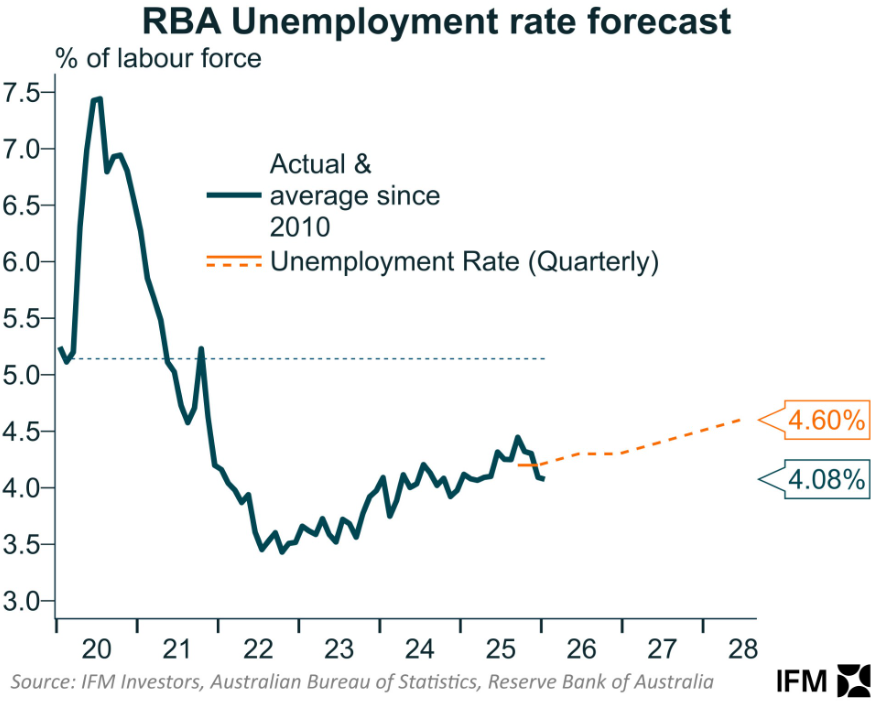

As illustrated below by Alex Joiner, chief economist at IFM Investors, the unemployment rate is tracking well below the RBA Statement of Monetary Policy’s latest forecast:

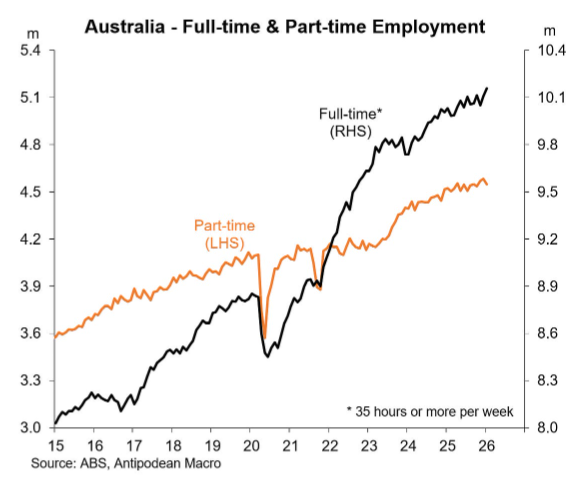

While it would be easy to dismiss the data as an aberration, the following charts from Justin Fabo at Antipodean Macro illustrate how the weight of the data points to a tightening labour market.

First, full-time employment has trended higher for several months:

Second, average hours worked have risen in recent months, another sign of an improving labour market:

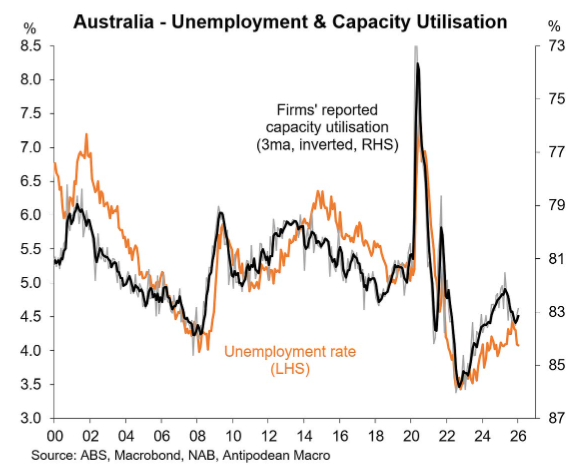

Third, businesses have reported rising capacity utilisation, which has been associated with the decline in the unemployment rate:

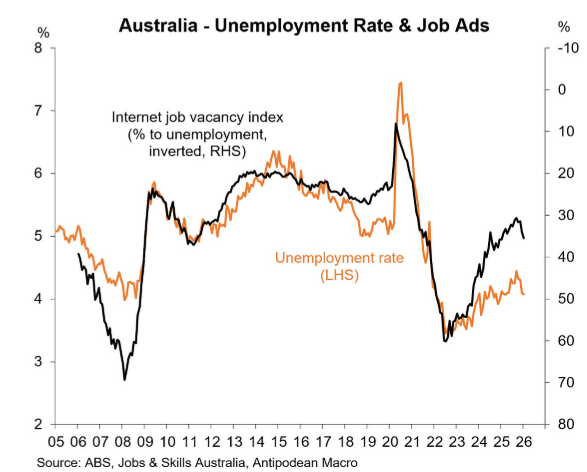

Fourth, Jobs & Skills Australia has reported rising job vacancies, which has corresponded with the decline in the unemployment rate:

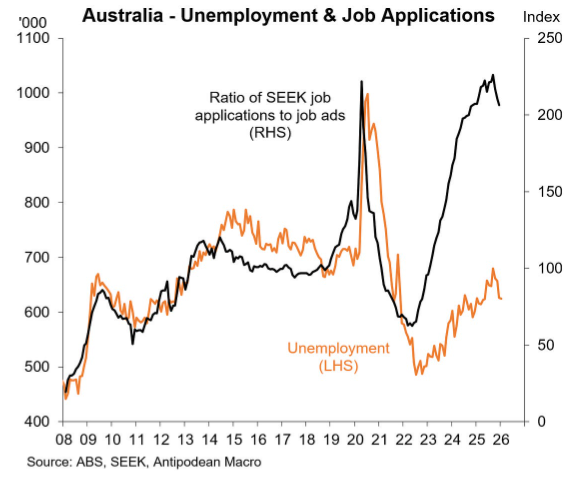

Finally, SEEK has reported a decline in the number of applicants per job, which has also been reflected in the decline in the unemployment rate:

The RBA’s latest minutes stated that it would make future rate decisions “based on incoming data”, subject to “preserving as many of the gains in employment as possible”.

Given that the Australian labour market has unambiguously tightened and trimmed-mean inflation remains well above the 2% to 3% target band, the RBA will be under intense pressure to tighten rates again at its next monetary policy meeting on 16-17 March.

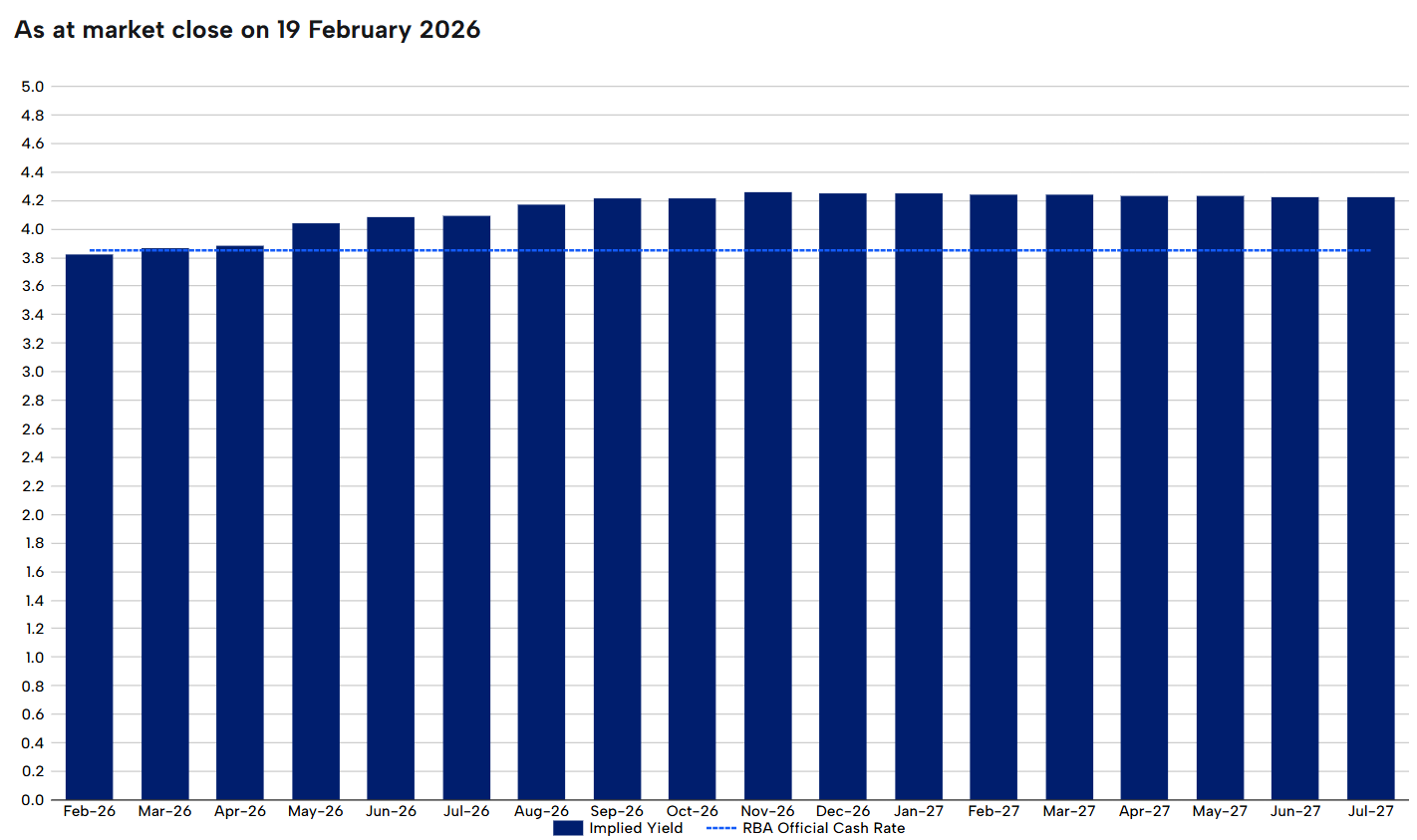

Indeed, the interest rate futures market has assigned a 100% likelihood that the RBA will hike again in March, with a strong likelihood of another hike by late 2026.

If true, the official cash rate would return to its post-pandemic peak of 4.10%.