Announcing targets is easy. Delivering on them is the hard part.

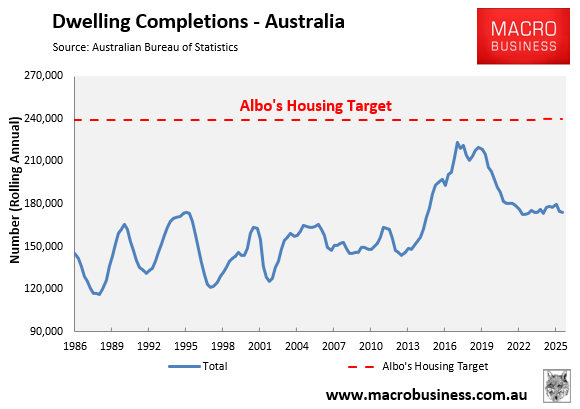

Two years ago, the Albanese government, alongside the states, announced the National Housing Accord, which set a target of building 1.2 million homes over five years from 1 July 2024, equating to 240,000 housing completions annually.

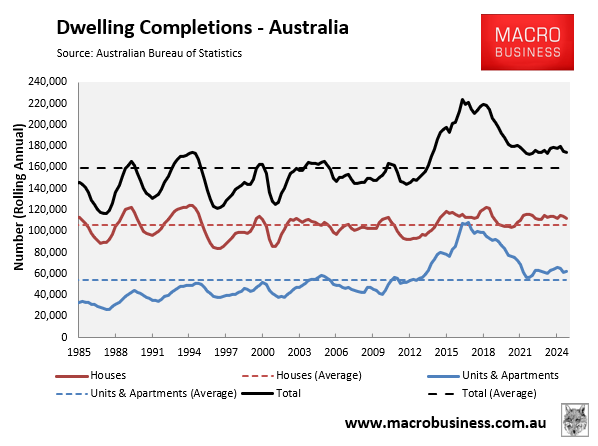

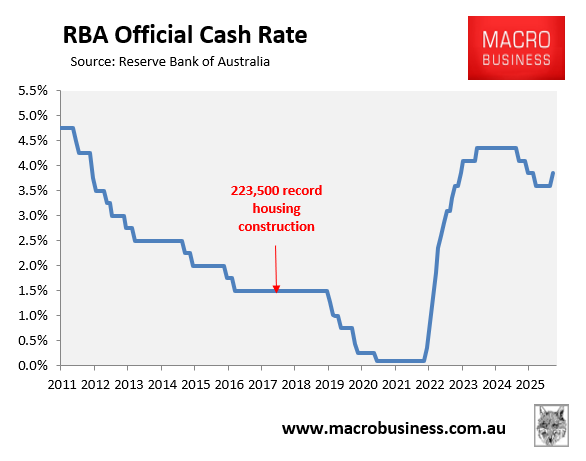

This target was always overly ambitious, given that the largest year of housing construction in Australia’s history was 2017, when 223,500 homes were completed.

As illustrated below, this record year of construction was driven by a surge in apartment construction, many of which turned out to be low-quality shoebox apartments with severe structural defects.

The macroeconomic picture around housing construction has worsened significantly since those heady days of 2017.

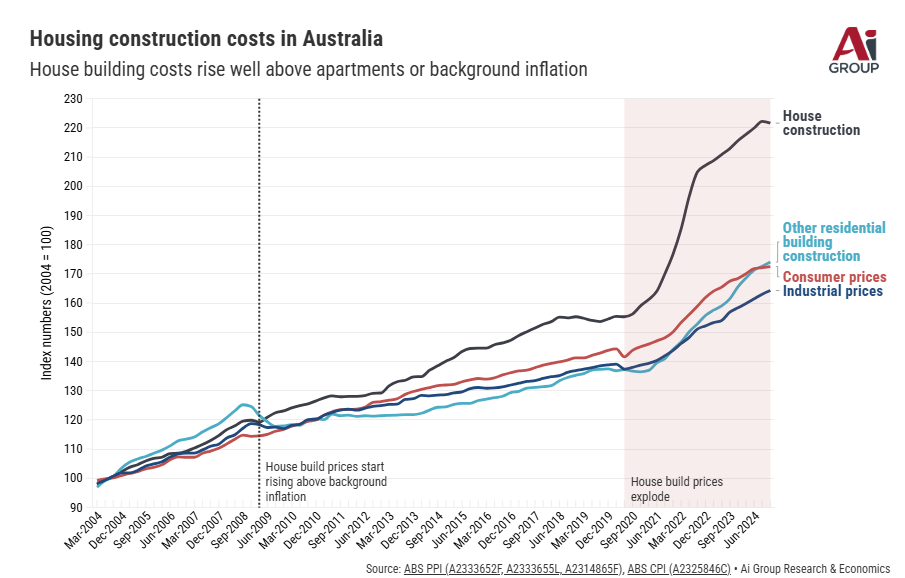

First, the Covid-19 pandemic saw construction costs soar by around 40%, which has dramatically increased the cost of building new homes.

Chart from the Australian Industry Group

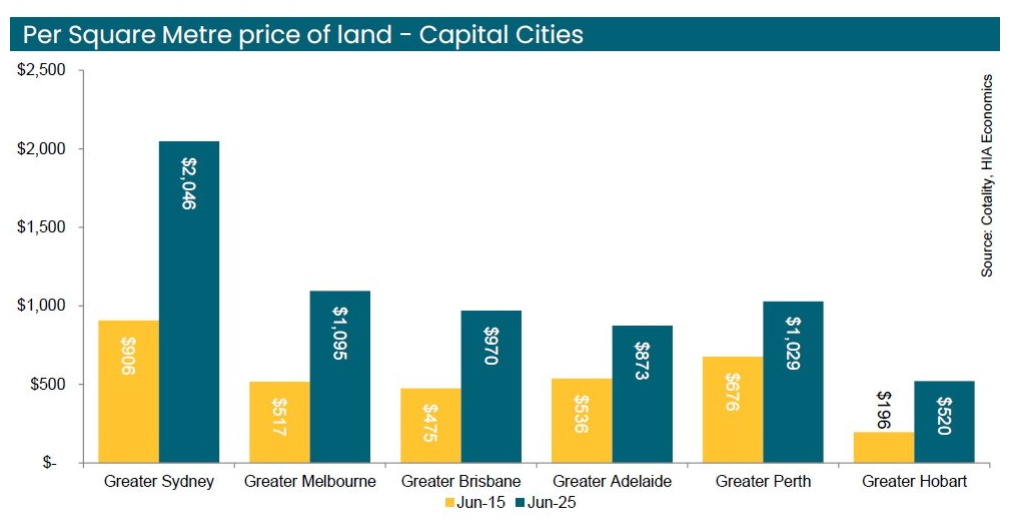

Second, the cost of housing lots has increased by around one-third since the pandemic, adding to the costs of building new housing.

Chart from the Housing Industry Association

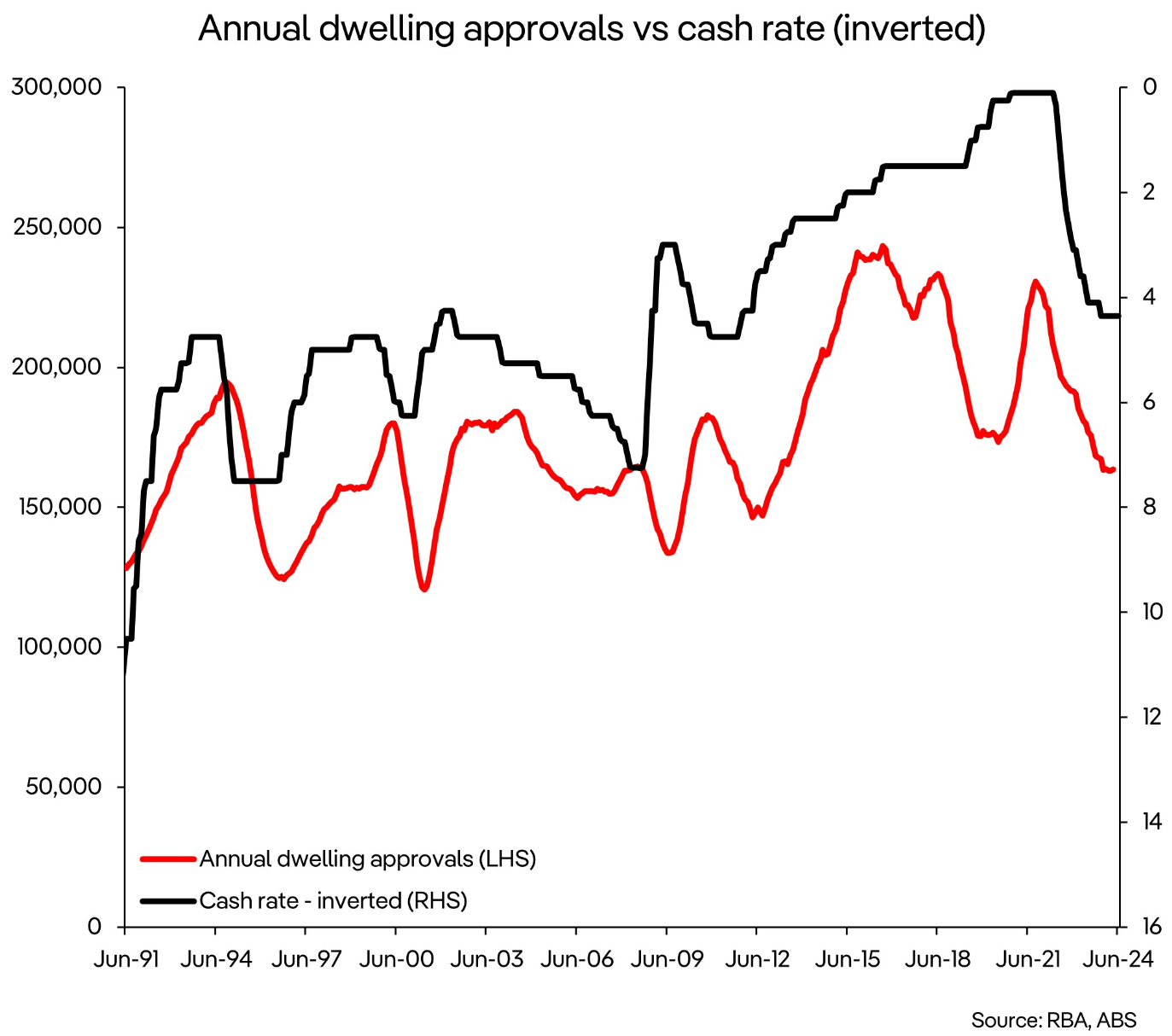

Third, the official cash rate was only 1.5% in 2017, versus 3.85% today (with further increases likely). Higher interest rates makes it more expensive for buyers of new homes as well as developers.

Finally, there are severe labour shortages in the construction sector, made worse by competition from government ‘big build’ infrastructure and energy projects.

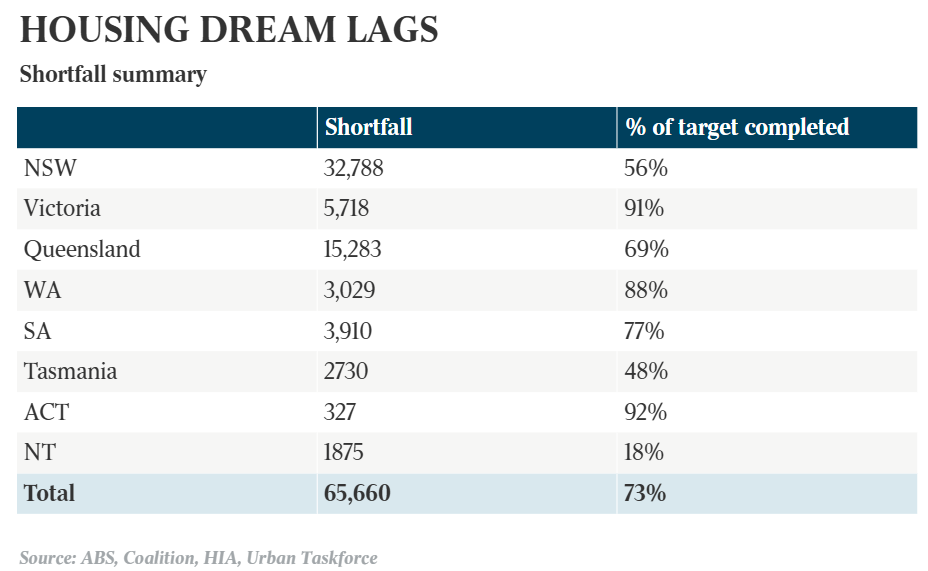

Given the above barriers to new home construction, it is no surprise that over the first 15 months of the National Housing Accord, the Albanese government has already fallen 81,000 homes (27%) short of the target.

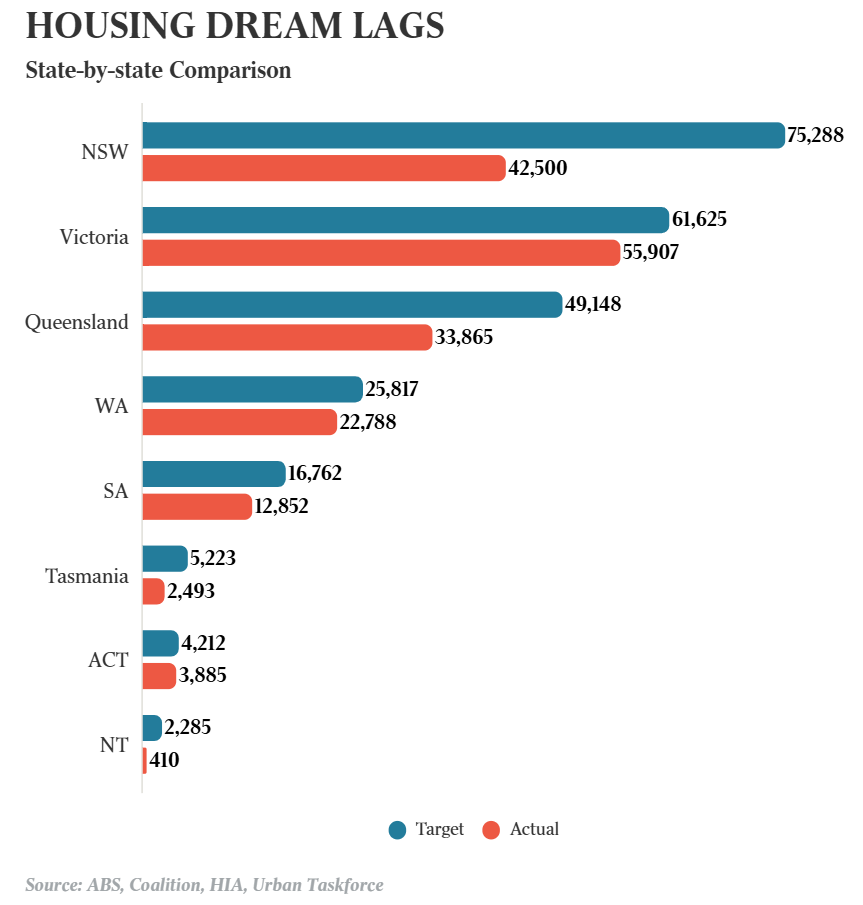

The Australian newspaper published an analysis of how the housing target is tracking at the state level.

As you can see below, all states are running behind the target, with New South Wales and Queensland the biggest laggards:

New South Wales is tracking 44% behind target, with Queensland tracking 31% behind. At the other end of the spectrum, Victoria is only tracking 9% behind target and Western Australia 12% behind.

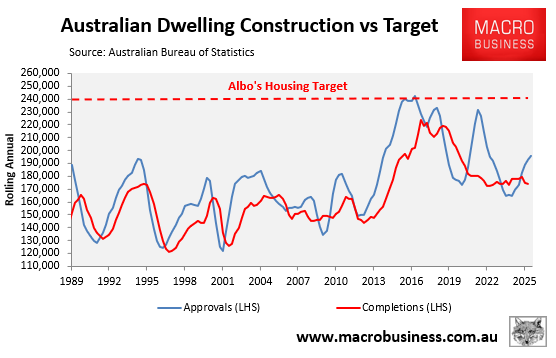

Housing Minister Clare O’Neil continues to cling to hope that the housing targets can be met, pointing to positive momentum in approvals.

“The ambitious target that was set in partnership with states and territories is pushing things in the right direction with new home approvals hitting a four-year high at the start of this year, but we know there’s a lot more to do” O’Neil said to The Australian.

“The consistent upward trajectory of new home approvals shows that the focus of our government’s housing reforms, and our ambitious $45bn agenda, is starting to bear fruit”.

However, dwelling approvals are also tracking 20% behind target, with 287,200 homes approved for construction over the first 18 months of the Housing Accord, versus a required run rate of 360,000 approvals.

Moreover, only 95% of approvals have historically proceeded to construction. And the latest tightening of monetary policy is likely to crimp momentum going forward.

With the National Housing Accord target slipping further behind each month, the federal government should revise the target down to a level that is actually realistic and deliverable.

The government should also slow immigration to a level that is compatible with housing and infrastructure supply. Otherwise, Australia’s structural housing shortage will only worsen.