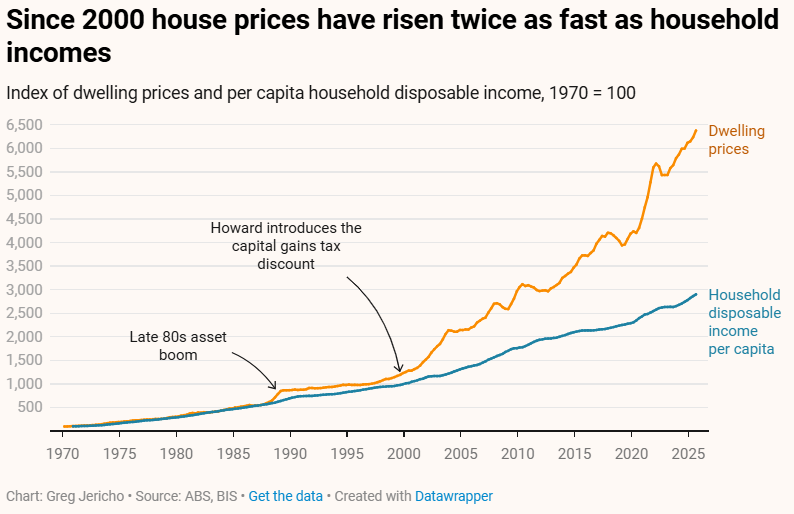

Commentators like Greg Jericho from The Australia Institute argue that the Howard Government’s decision to halve the rate of capital gains tax (CGT) in 1999 was the primary driver of Australia’s house price boom and affordability crisis:

Chart by Greg Jericho (The Guardian)

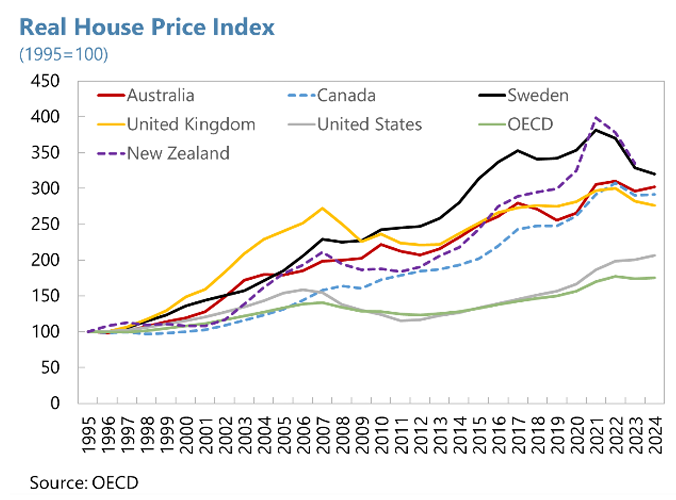

While there are good reasons to reduce the CGT discount on equity and budget sustainability grounds (explained here), the notion that changes to the CGT discount in 1999 were a major driver of Australia’s house price surge is contradicted by the following chart from the International Monetary Fund (IMF) showing real house prices globally booming in unison:

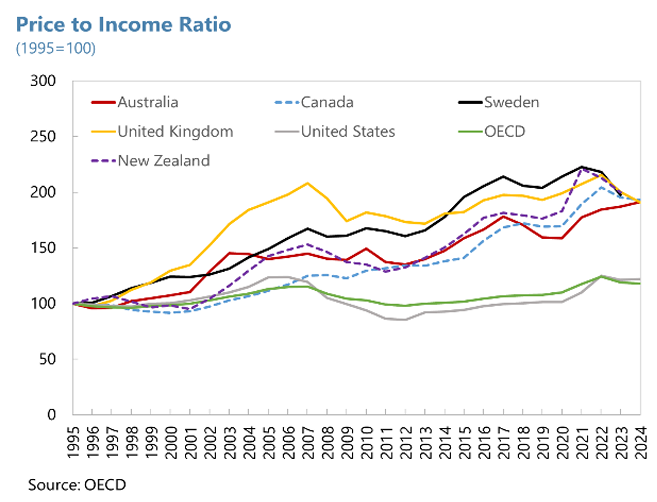

The IMF also shows that the United Kingdom, Canada, New Zealand, and Sweden have equally expensive housing markets as Australia’s when measured on a price-to-income ratio basis:

The IMF’s 2025 Article IV Consultation staff report on Australia explicitly singles out the nation’s inability to build enough housing to keep pace with its world-leading population growth (i.e., immigration) as a key driver of the strong house price increases recorded this century.

“Research highlights the influence of aggregate demand, household formation, immigration, and subsidies”, the IMF noted.

“Australia’s population growth has been among the fastest in the OECD and well above the average. Combined with the downtrend in average household size, this has generated robust growth in fundamental housing demand. However, housing investment has not always kept pace with this rising demand, particularly during periods of abrupt change”.

“These imbalances between housing supply and demand are found to have significantly influenced housing prices both in the short term and over the long run”, the IMF noted.

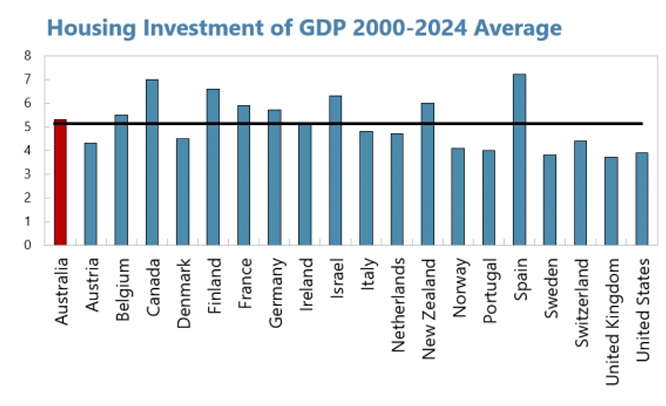

The following chart from the IMF shows that Australia’s dwelling investment as a share of GDP slightly exceeded the OECD average from 2000 to 2024:

Source: IMF

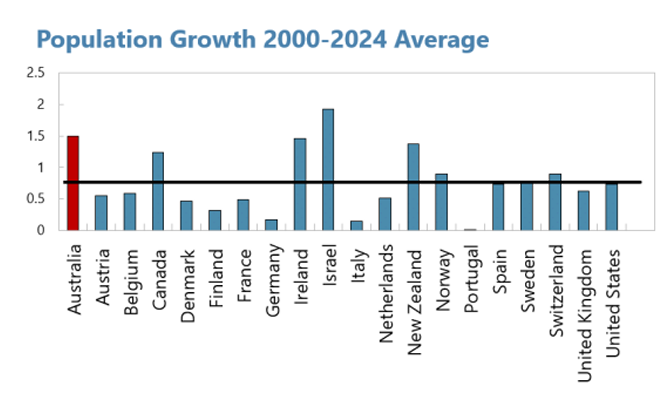

However, Australia’s population growth was the second highest in the OECD over the same period, behind Israel:

Source: IMF

As a result, Australia has suffered from a chronic housing shortage, which has helped to push up home prices.

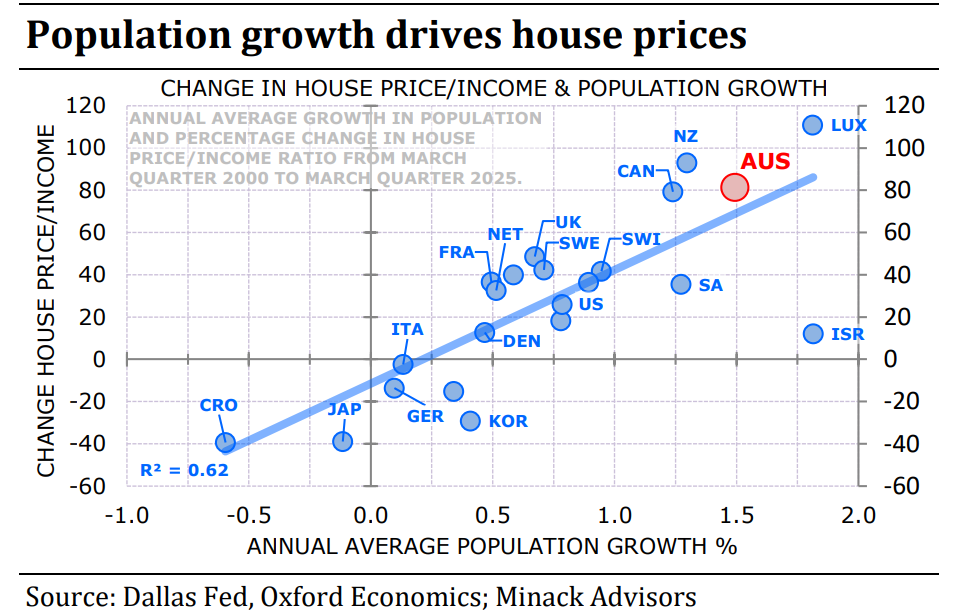

The following chart from independent economist Gerard Minack also shows that “population growth has been a contributor—probably the single most important contributor—to Australia’s high house prices”:

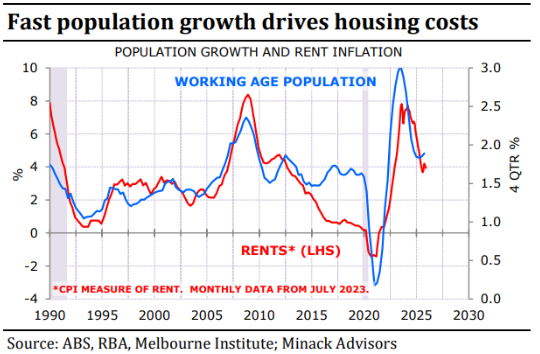

The same can be said for Australian rents, which have risen alongside strong population growth, according to Minack:

The reality is that Australia’s chronically high rate of immigration is the bigger contributor to Australia’s expensive housing (both to purchase and rent) than tax settings like the CGT discount.

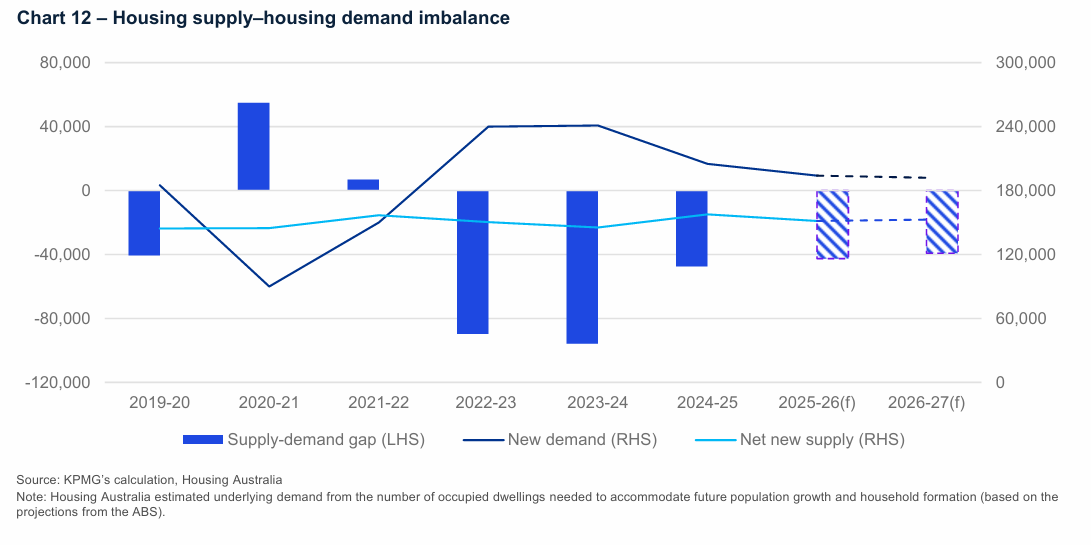

The affordability situation is also unlikely to improve in the near term, given that the National Housing Supply and Affordability Council and KPMG both forecast that housing demand, driven by population growth and household formation, will outpace new supply for the foreseeable future.

Chart by KPMG