Australia’s auction market has continued to fade following the Reserve Bank of Australia’s (RBA) interest rate hike this month.

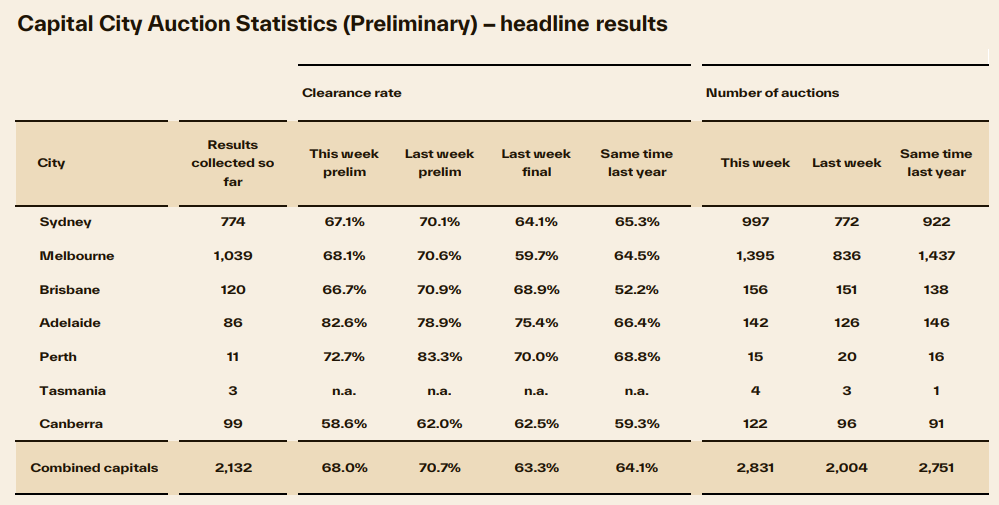

According to Cotality, the national preliminary auction clearance rate declined to 68.0%, down from 70.7% last weekend (revised to 63.3% on final numbers) and 73.7% two weeks ago (revised to 66.1% on final numbers).

Source: Cotality

This weekend’s soft result followed the busiest week of auction activity since mid-December last year, with 2,831 capital city homes going under the hammer.

Melbourne’s preliminary clearance rate fell to 68.1% this week, down from 70.6% the week prior (revised down to 59.7% on final numbers) and 67.9% two weeks ago (revised to 60.1% on final numbers).

Melbourne remains the auction volume epicentre, with 1,395 homes taken to auction this week, a 67% increase on the volume of auctions a week ago.

Sydney’s preliminary auction clearance rate fell to 67.1%, down from 70.1% last weekend (revised down to 64.1% on final numbers) and 79.6% two weeks ago (revised down to 70.8% on final numbers).

Sydney’s auction volumes were up 29% this weekend to 997.

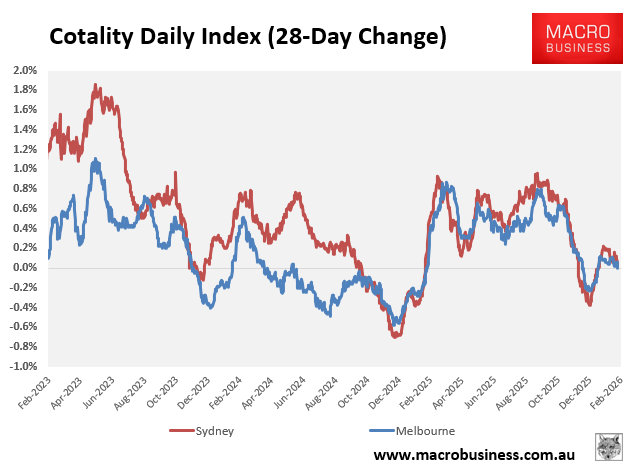

The decline in auction clearance rates across Melbourne and Sydney has been reflected in house prices, which have softened following their early 2026 rebound.

According to Cotality, both Melbourne’s and Sydney’s daily dwelling values indices have recorded zero (0%) growth over the past 28 days, and current trends suggest that value growth will soon turn negative:

It appears that both markets have been negatively impacted by the latest rate hike from the RBA and widespread expectations that rates will rise further.

The latest price from futures markets ascribes a 100% probability that the RBA will hike rates again in March, with a high probability that it will deliver another hike later in 2026.

ASX Futures Cash Rate Pricing

If true, Melbourne and Sydney dwelling values seem likely to fall in 2026.