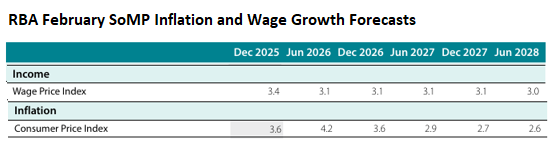

The Reserve Bank of Australia (RBA) revised its forecasts on CPI inflation and wage growth in the February Statement of Monetary Policy (SoMP), as summarised below:

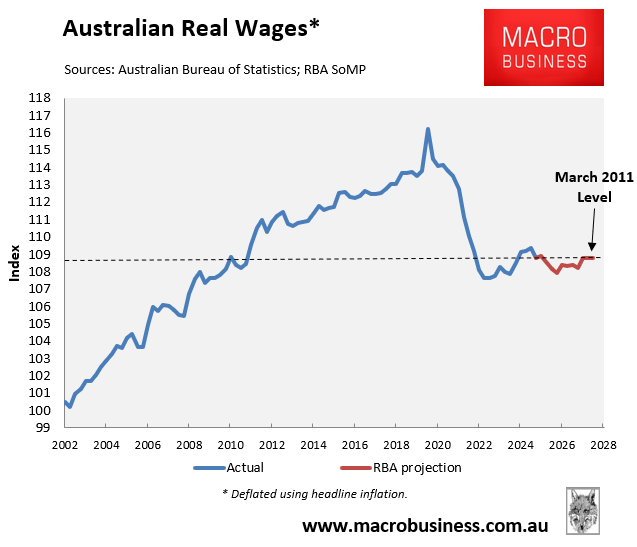

The key takeaway was that the RBA does not anticipate that real wages will recover over the forward estimates, as illustrated below:

By the June quarter of 2028, Australia’s real wages are forecast to still be tracking 6.4% below their mid-2020 peak at around the same level as the March quarter of 2011.

Therefore, the RBA expects no rebound in real wages from their current level.

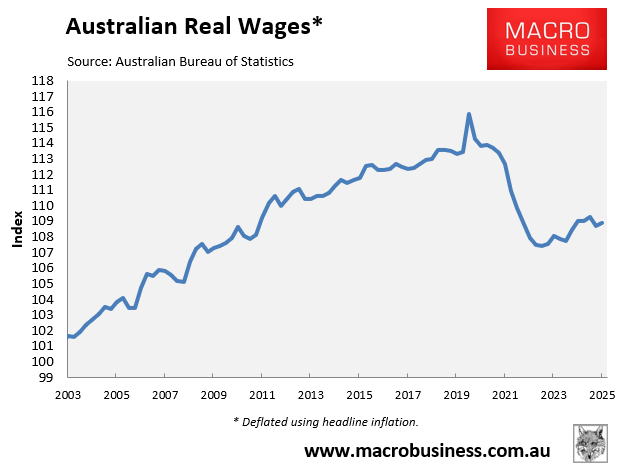

On Wednesday, the Australian Bureau of Statistics (ABS) released its wage price index for the December quarter of 2025, which confirmed that real wages fell for the second consecutive quarter.

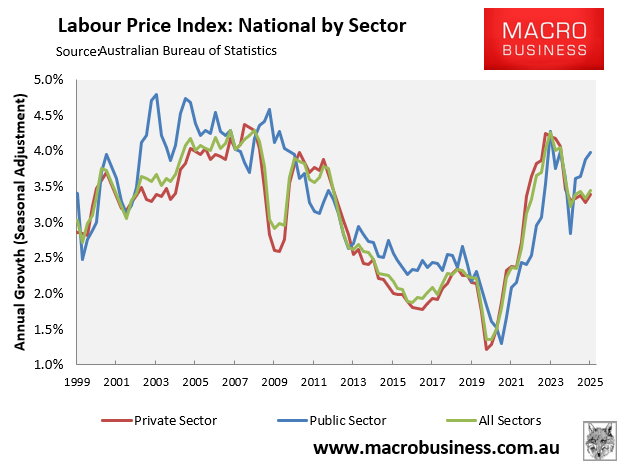

Nominal wages grew by 0.8% in the December quarter to be 3.4% higher year over year.

Across both the private and public sectors, wages rose by 0.8% over the quarter.

On an annual basis, public sector wages grew at a faster pace than the private sector for the fourth consecutive quarter.

Annual public sector wage growth was 4.0% in the year to December 2025, up from 2.8% at the same time last year.

Private sector wages rose 3.4% over the same period. This was higher than the 3.3% growth recorded in the year to December 2024.

Australian real wages fell by around 0.3% in 2025, although they recovered marginally in the December quarter:

Australian real wages in the December quarter of 2025 were still tracking 6% below their Covid-19 ‘bubble’ peak at around late 2011 levels.

The RBA’s forecasts and this latest result suggest it may take over a decade for Australian real wages to recover.