The Reserve Bank of Australia’s (RBA) decision to hike the official cash rate by 0.25% last week has failed to dampen buyer enthusiasm in the housing market.

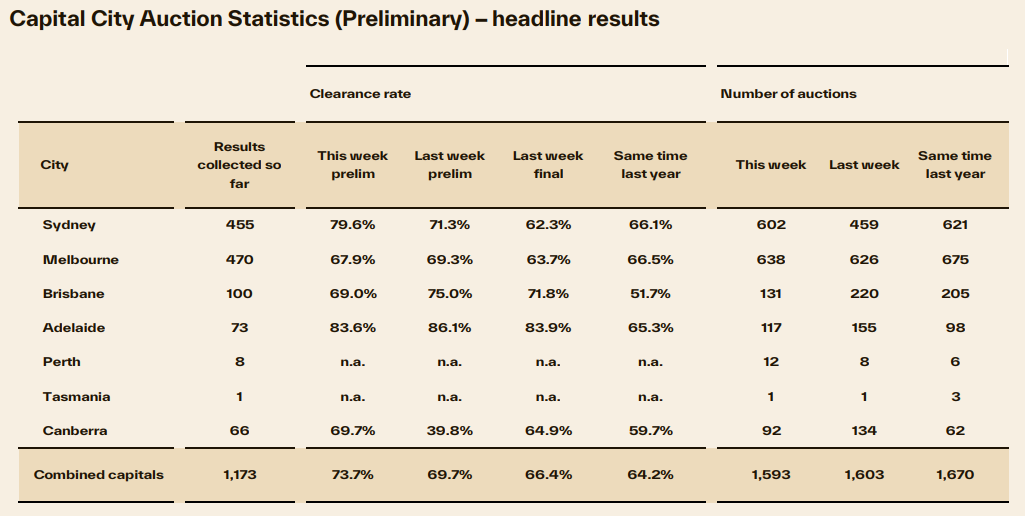

According to Cotality, the nation’s preliminary auction clearance rate rose to 73.7%, up from 69.7% last weekend. It was also significantly higher than the 64.2% preliminary clearance rate recorded at the same weekend last year.

Source: Cotality

Most of the strength in clearance rates came from Sydney, which recorded a 79.6% early result. This was the highest preliminary outcome since the last week of August 2025 (80.3%). The strong result came alongside a 31% uplift in volumes, with 602 homes taken to auction over the week.

Melbourne recorded a higher volume than Sydney, with 638 homes taken to auction. However, its preliminary clearance rate was significantly lower at 67.9%, down from 69.3% a week ago, which was revised back to 63.7% on final numbers.

Cotality’s director of research, Tim Lawless, described the beginning of the 2026 auction season as “surprisingly strong”.

I will add that the results are also surprising given last week’s interest rate hike from the RBA, which is widely expected to be followed by more.

The latest financial market pricing suggests that the RBA will hike two more times, which would take the official cash rate back to its recent peak of 4.35% and variable mortgage rates above 6%.

Every 0.25% interest rate increase reduces borrowing capacity by around 4%. It also increases monthly mortgage payments on the average new mortgage of $700,000 by around $110 per month.

Therefore, if the RBA were to deliver three rate hikes—i.e., 0.75% in total—then borrowing capacity would be lowered by around 12%, and average new mortgage repayments would be lifted by around $330 per month.

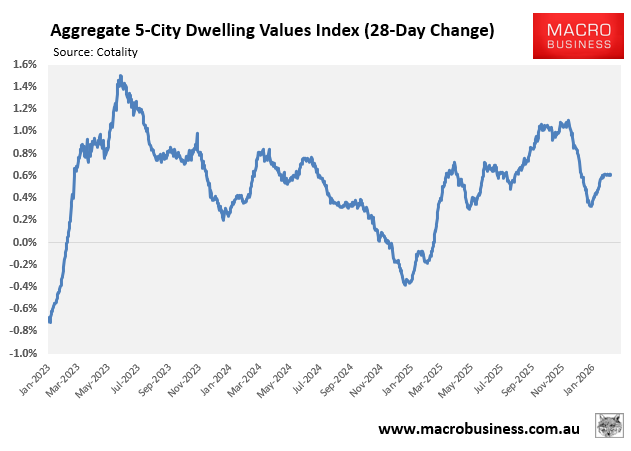

Regardless, housing demand in Australia remains strong, and this strong demand is being reflected in the latest auction clearance numbers, alongside Cotality’s daily dwelling values index, which continues to rise at a solid pace.

For now at least, homebuyers seem unperturbed by the prospect of further rate hikes from the RBA.