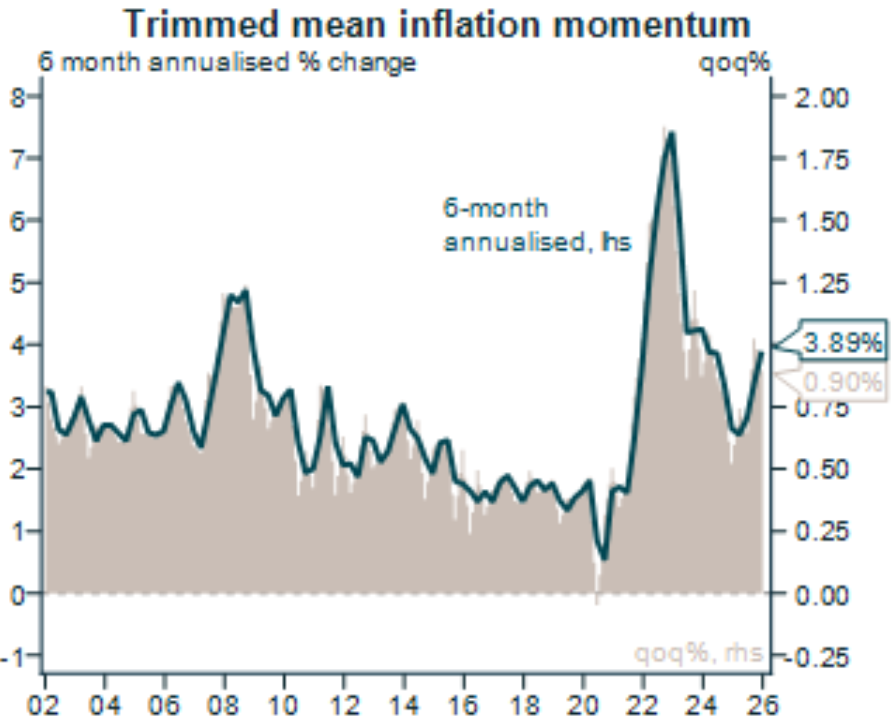

Alex Joiner, chief economist at IFM Investors, posted the following chart on Twitter (X) showing how underlying (trimmed mean) inflation in Australia has accelerated, raising the prospect that the Reserve Bank of Australia (RBA) will lift the official cash rate (OCR) by 25 bps at next month’s monetary policy meeting.

Source: Alex Joiner (IFM Investors)

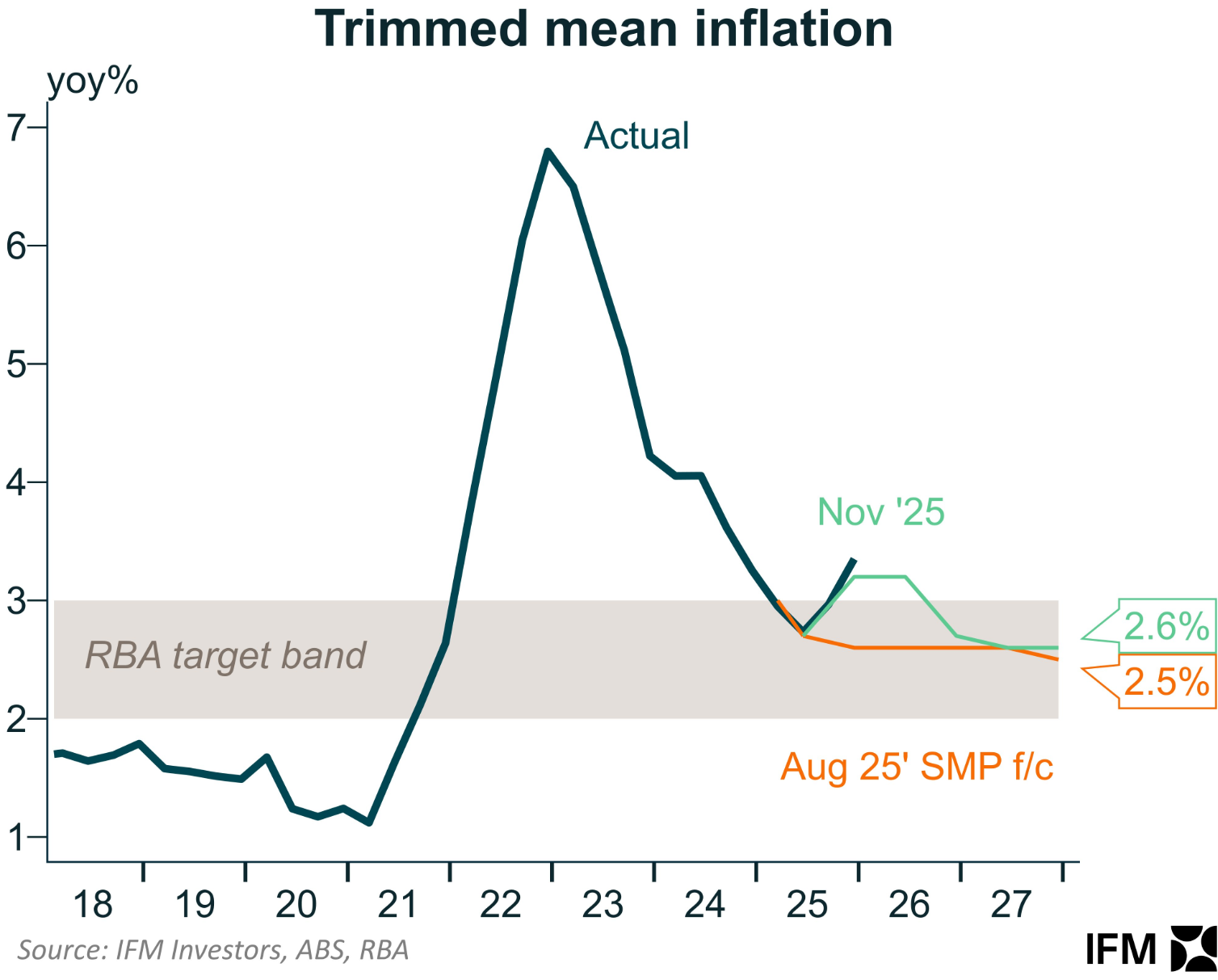

The result meant that trimmed mean inflation is tracking well above the RBA’s target:

“Along with the upside surprise on headline inflation, there’s a strong case for the RBA to hike next week”, Joiner said on Twitter (X).

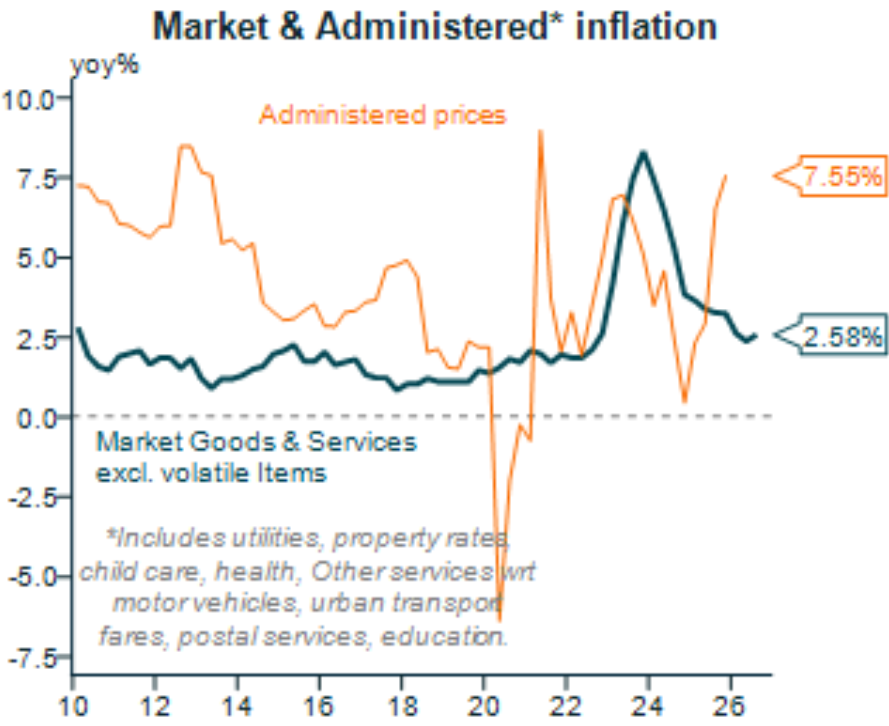

Joiner subsequently posted the following chart showing how administered price inflation—i.e., price increases in goods and services where the government or a regulator, not the market, sets or heavily influences the price—has driven the latest bout of inflation:

Source: Alex Joiner (IFM Investors)

Administered prices typically comprise essential services where the government sets the price directly, or a regulator approves price changes, or pricing is tied to policy decisions rather than market forces.

Common examples include

- electricity and gas network charges

- water and sewerage services

- council rates

- public transport fares

- vehicle registration

- hospital and aged‑care fees

- education fees (e.g., TAFE, some university charges)

- some insurance levies.

As illustrated above, administered price inflation surged to 7.55% last calendar year compared with only 2.58% inflation for market goods and services (excluding volatile items).

“Non-tradables or domestically generated inflation was the culprit”, noted Joiner on Twitter (X). “Administered price inflation has accelerated sharply, which may be an issue for the RBA given its policy does have the same effect in that space”.

“The likelihood being it has to work harder to dampen inflation elsewhere”.

The surge in administered price inflation poses a headache for the RBA. These prices often behave differently from the rest of the inflation basket because they are not set by supply and demand.

Since administered prices are not market‑driven, the RBA can’t directly influence them with interest rates, meaning they will need to squeeze other areas harder to get overall CPI inflation down.

Ultimately, Australia’s governments need to take responsibility for taming inflation via fiscal and energy policies. The simple blunt instrument of interest rates won’t cut it.

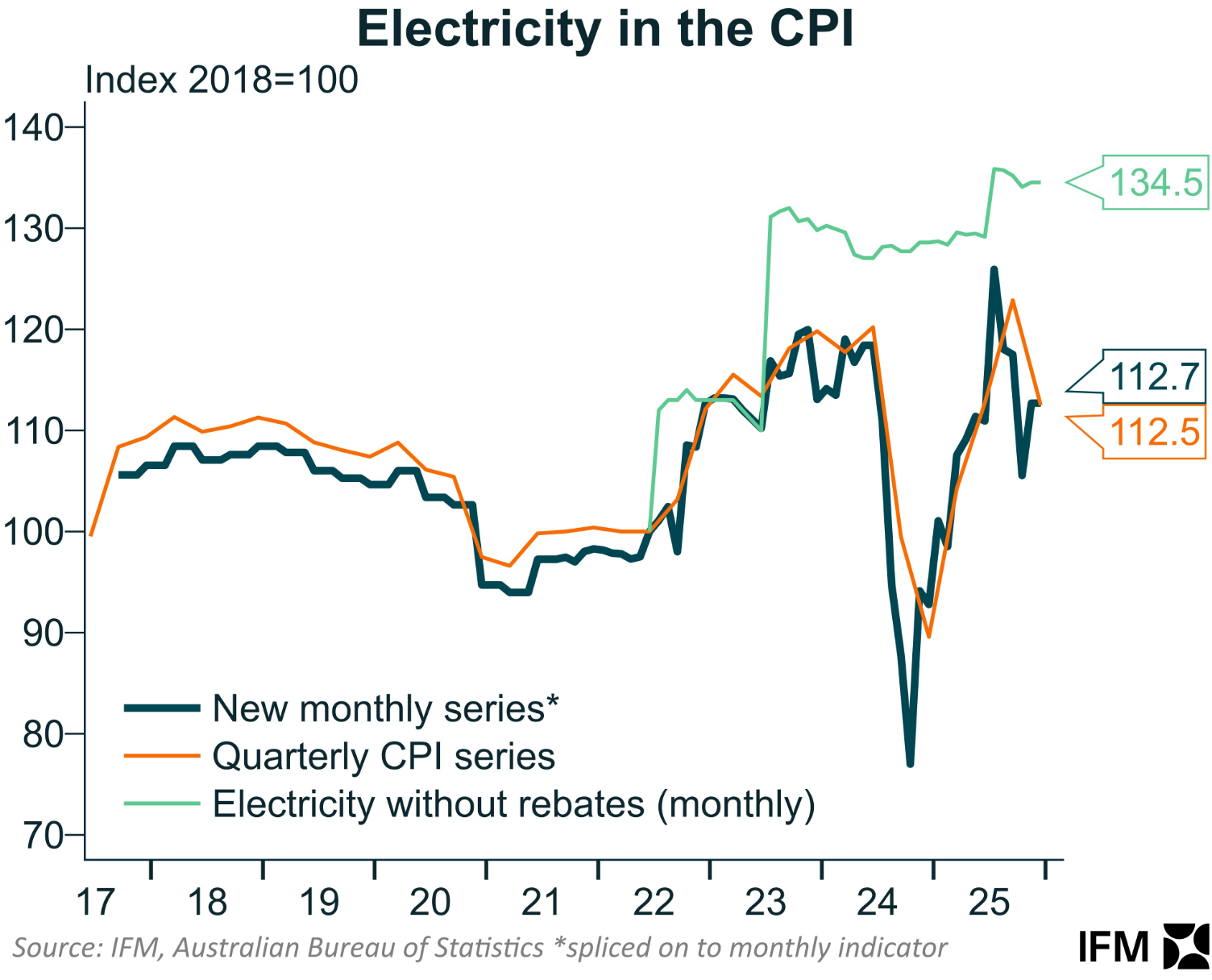

A case in point is electricity prices, illustrated below by Alex Joiner. While they fell in the quarter according to the CPI figures, the respite will be short-lived as rebates roll off and the reality of actual electricity prices flows through to households:

As gas and electricity prices continue to rise due to government policy failure, such increases will continue to stoke inflation across the supply chain.