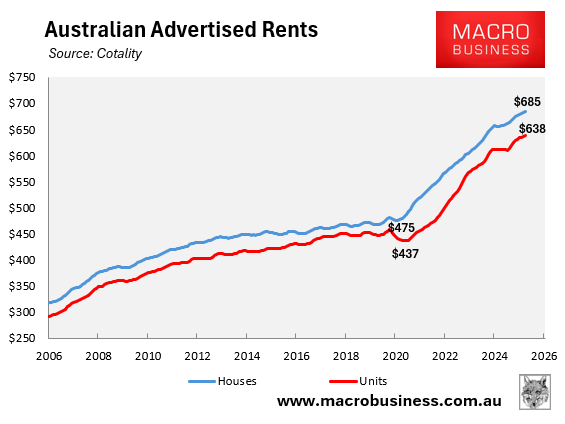

The past five years have been a shocker for Australian tenants, with the median national advertised rent soaring by 44%, according to Cotality.

This surge in rents has added around $10,600 to the annual cost of renting the median advertised home.

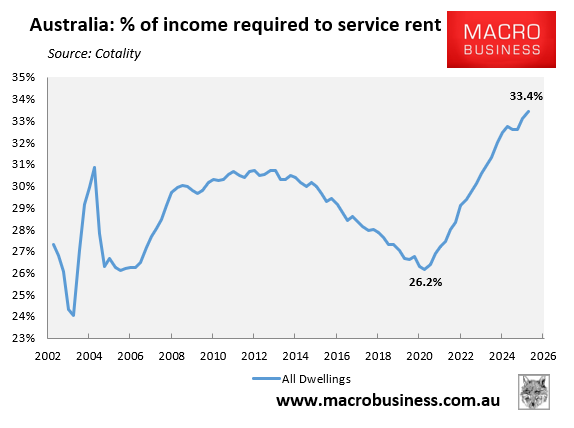

As a result, the share of household income required to rent the median Australian home hit a record high of 33.4% in the September quarter of 2025, according to Cotality.

After showing some moderate improvement in late 2024, the rental affordability picture worsened again in 2025.

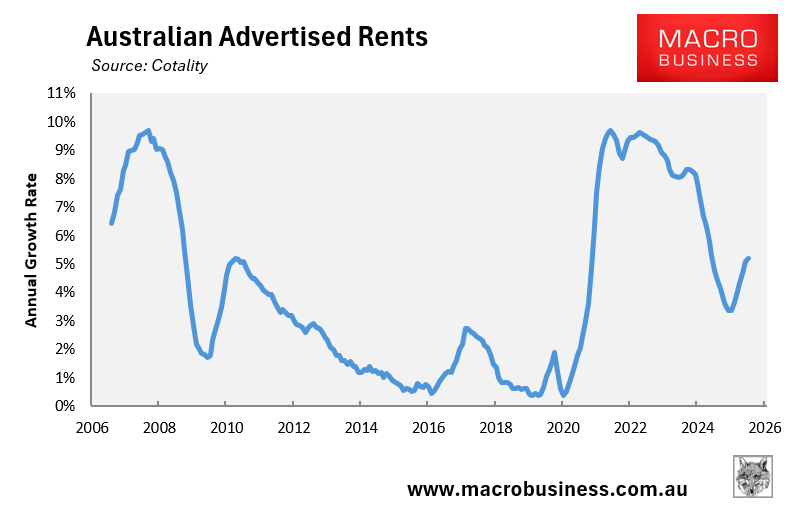

According to the latest data from Cotality, the median advertised rent in Australia reaccelerated to 5.2% in the 2025 calendar year, up from 4.8% in 2024:

The only upside is that the national rental vacancy rate eased marginally to 1.6%, up from a record low of 1.5% in November. Monthly rental growth also eased to 0.3% from 0.5%, although Cotality notes that this could be due to “seasonal factors”.

“Rental conditions tend to be highly seasonal through December and January, with leasing cycles disrupted by university breaks and the festive season”, Cotality head of research Tim Lawless said.

“We will get a better feel for rental conditions in February. However, even if conditions have loosened a little, it’s from an extremely tight position, and rents are likely to rise further through 2026”.

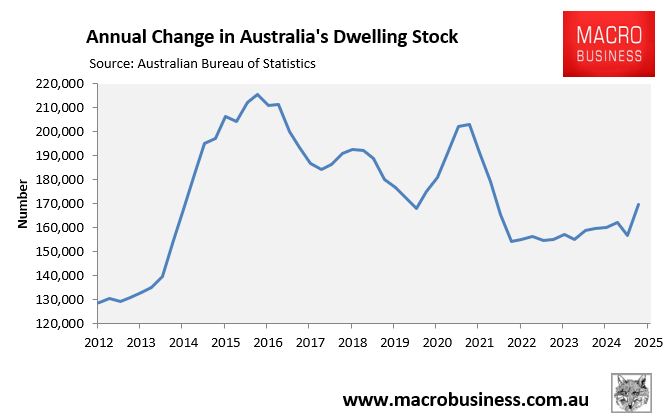

With immigration remaining historically high and new dwelling supply depressed, Australia’s rental market will remain tight in 2026.

Ultimately, to ease the rental crisis, Australia’s federal government needs to slash immigration to a level below the nation’s capacity to build housing and infrastructure, as Canada’s government has done (see here and here).

Otherwise, Australian tenants will continue to suffer unnecessarily.