Chris Joye, a portfolio manager with Coolabah Capital, recently wrote an article in the Australian Financial Review arguing that the expansion of government spending was placing upward pressure on inflation and, by extension, interest rates.

“At the federal level, the annualised monthly trend budget deficit has deteriorated rapidly from $12 billion in December 2024 to $24 billion in June 2025 and now $35 billion in November”, Joye wrote.

“This deficit represents the shortfall between public revenues and spending. And it does not account for spending at the state and local government levels”.

“If we sum up the gargantuan deficits being produced at all levels of government, the total consolidated loss will balloon to about $88 billion this financial year”, Joye argued.

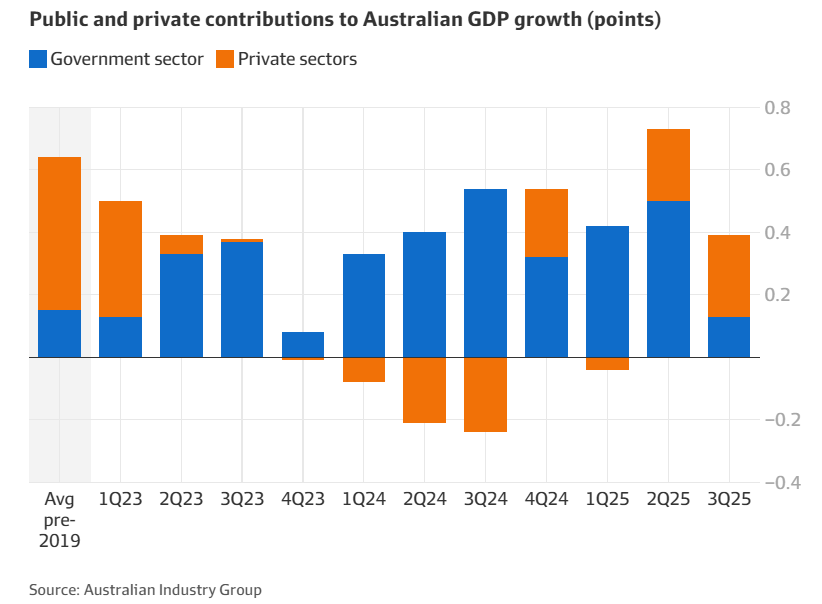

In a similar vein, the Australian Industry Group (AiG) noted that government spending accounted for 90% of the nation’s economic growth in 2023 and 2024, which it argues has driven the nation’s inflation shock.

Ai Group has used its pre-budget submission to urge the federal government to prioritise curbing inflation in its 2026 budget, warning that rising inflation is deterring business investment and that reducing cost pressures is necessary if the private sector is to become the key driver of economic growth.

Both Chris Joye and AiG make sound points.

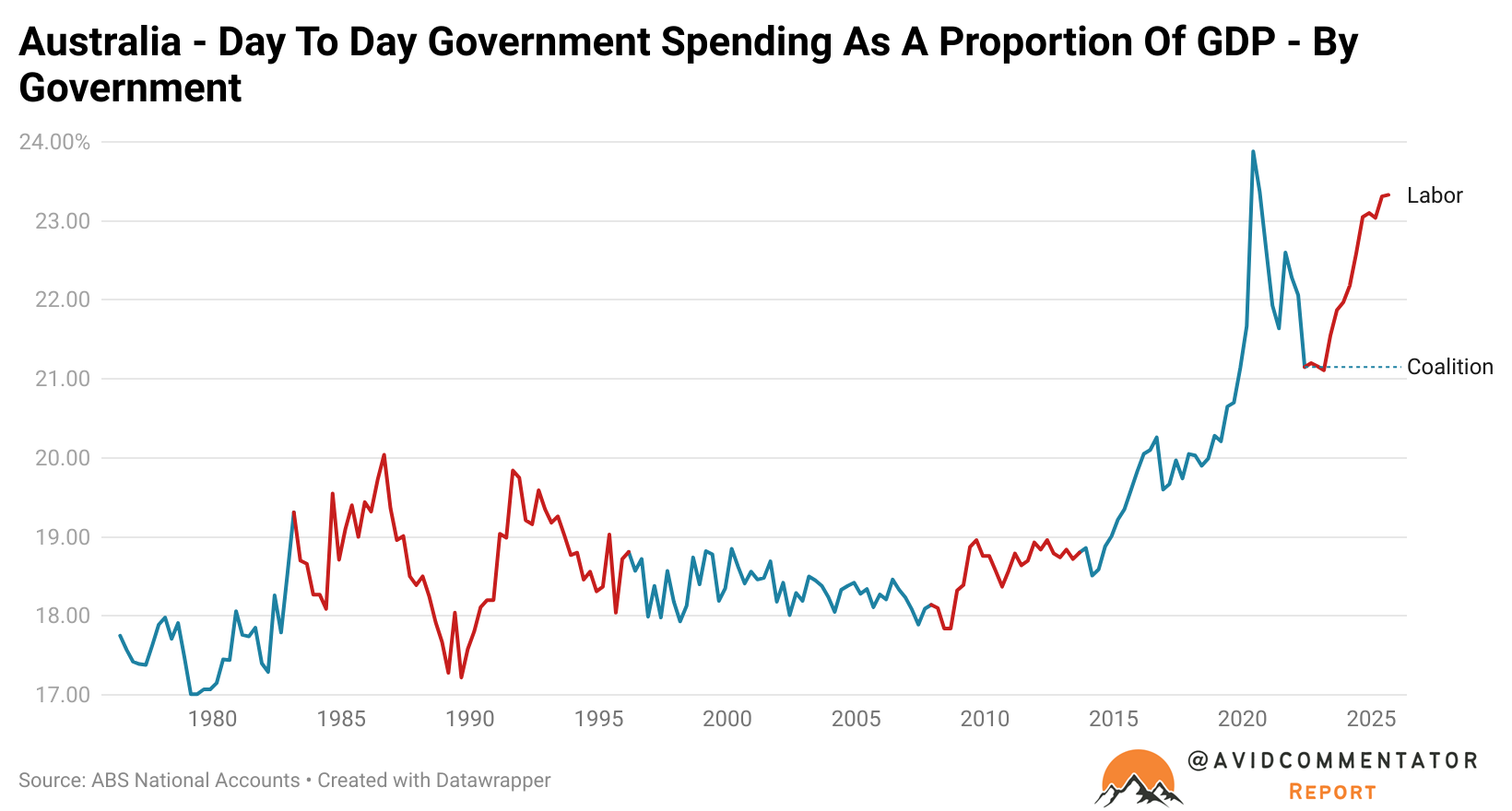

As illustrated below by Tarric Brooker, day-to-day government spending as a share of GDP reached its third-highest level on record in the third quarter of 2025:

Source: Tarric Brooker

In fact, the only times that have exceeded current government spending levels were during the height of the Covid-19 pandemic, in the June and September quarters of 2020.

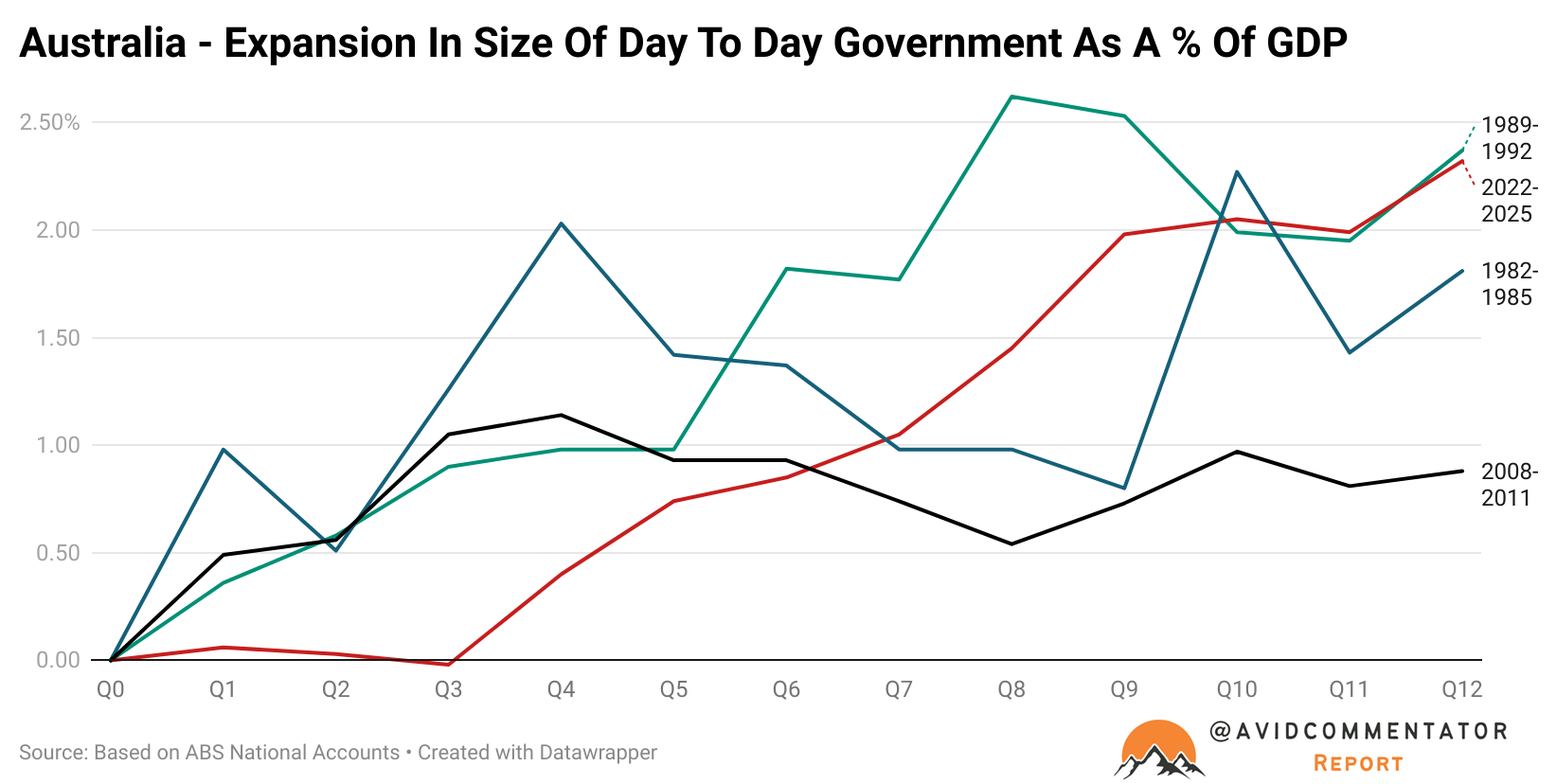

As Brooker’s chart shows clearly above, day-to-day government spending has been rising as a share of the economy since around 2015. However, the current rise under the Albanese government has been meteoric, mirroring the expansion of government after the 1990-91 recession:

So basically, government spending has expanded despite the economy not being in a recession. And, as Chris Joye points out below, this is driving inflation as excess demand chases limited supply while destroying productivity:

“If we want to avoid interest rate hikes, we need to dramatically pare back public spending. We need to back our people rather than our politicians to power prosperity in an extraordinarily competitive world.”

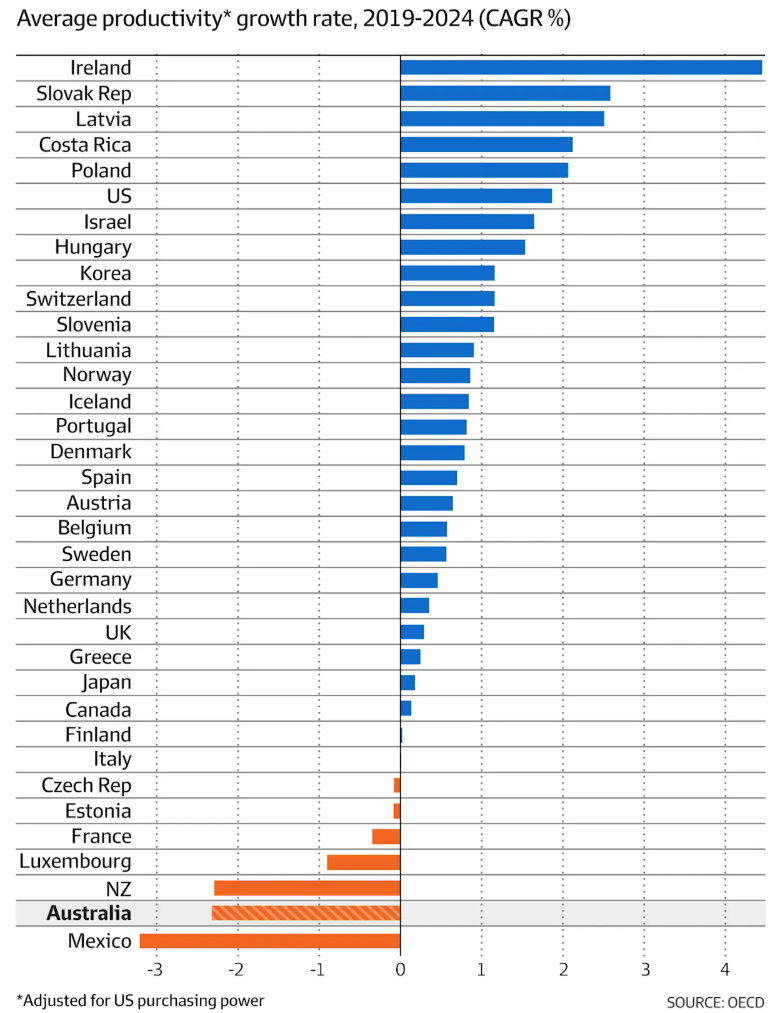

“Today we are trading away whatever remaining edge we have left, forcing the nation to rely on selling its natural resources and physical amenities. We are turning into Asia’s Ibiza”, Joy wrote.

To Joye’s point, recent OECD analysis published in the Australian Financial Review found that Australia ranked second-last among wealthy nations in productivity growth since the COVID-19 pandemic.

Much of the recent expansion in government spending relates to the NDIS, which has contributed to the productivity malaise.

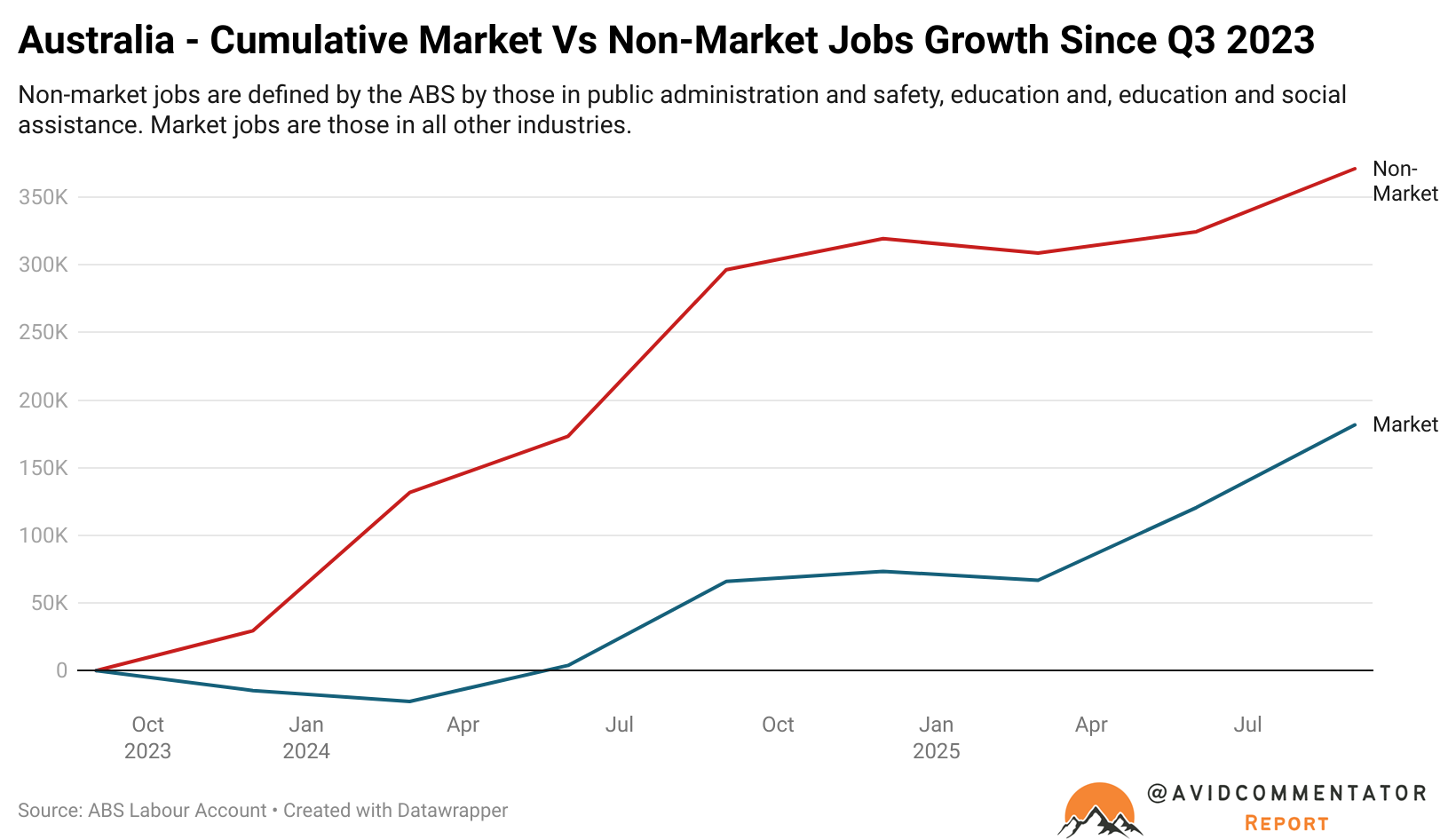

As illustrated below by Tarric Brooker, non-government jobs driven by the NDIS have driven the lion’s share of job growth since Q3 2023, while market (private) sector job growth has been soft:

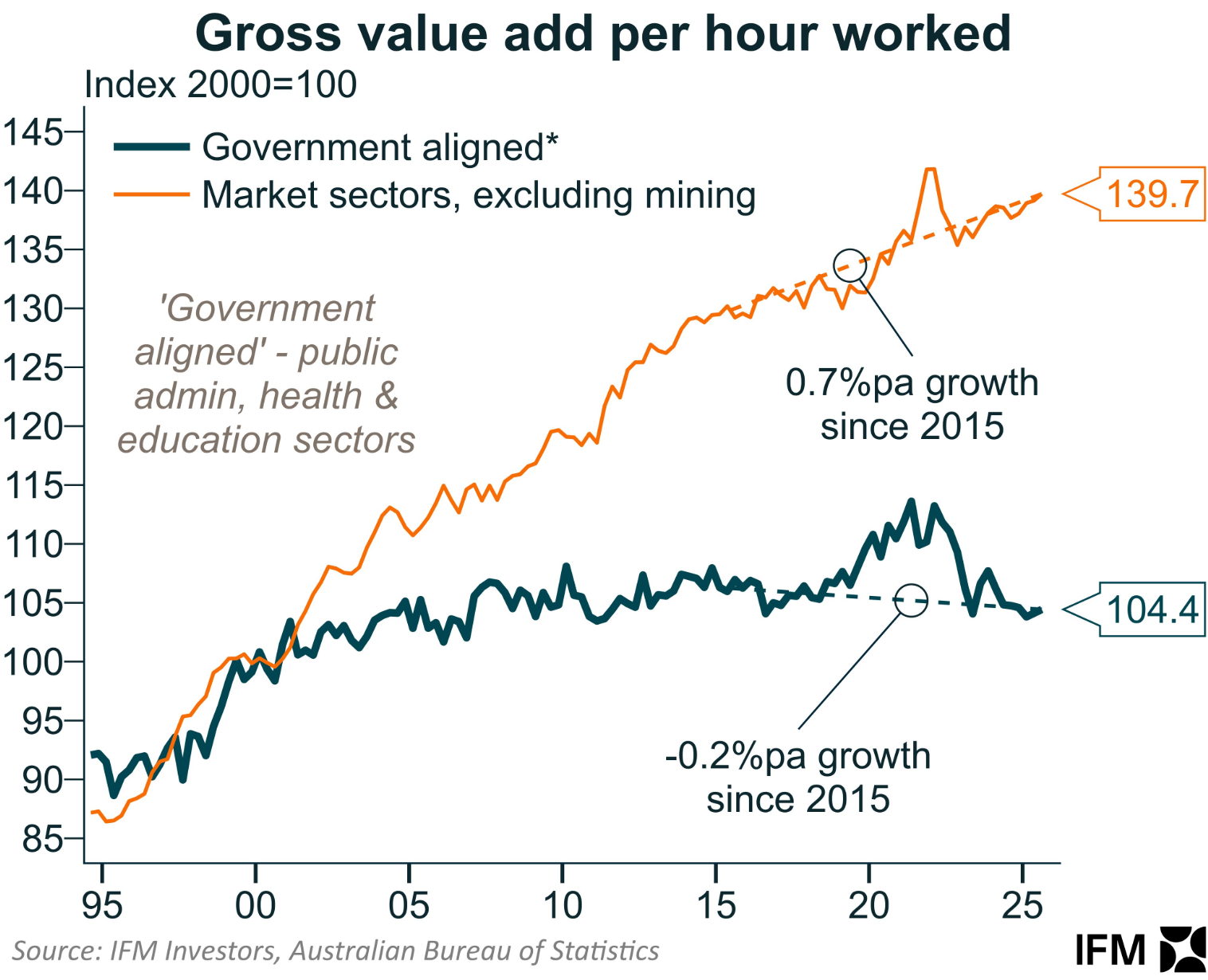

This explosive growth in non-market sector jobs is a major reason why Australia’s recent productivity performance has been so poor:

As illustrated above by Alex Joiner from IFM Investors, gross value added per hour worked in the non-market sector has fallen by 0.2% annually since 2015, whereas the market sector has experienced positive annual productivity growth of 0.7% annually.

The bottom line is that excessive government spending is helping to fuel inflation while also contributing to the nation’s productivity malaise.

Australia’s governments need to pull back and stop crowding out the private sector.