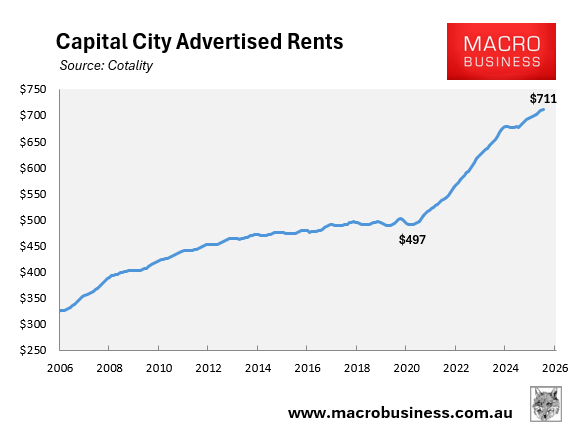

Australia is already experiencing its worst rental crisis in modern history, with capital city advertised rents soaring by 43% over the past five years (to Q4 2025), adding $11,115 to the annual rental bill of the median tenant, according to Cotality.

The Australian Bureau of Statistics (ABS) released housing construction data for the September quarter of 2025, indicating that Australia’s housing shortfall had worsened.

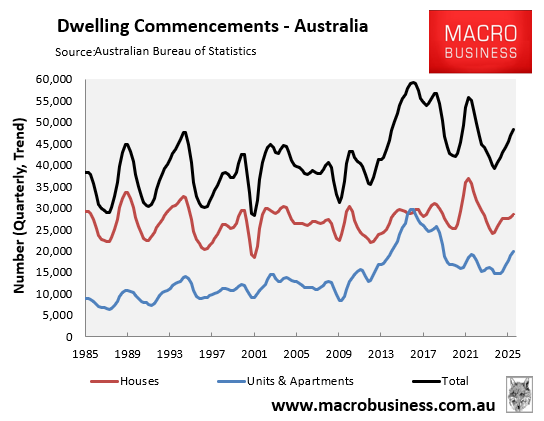

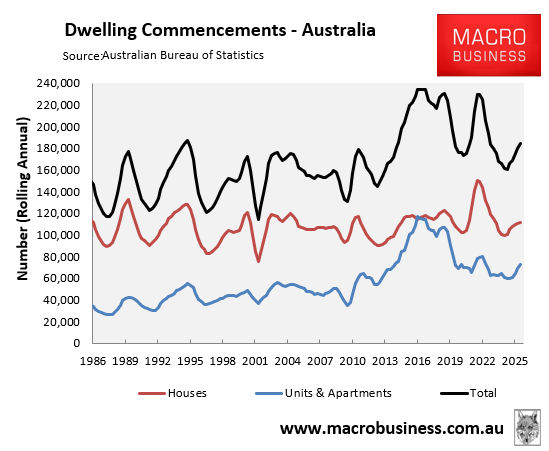

First, the good news. The number of homes that began construction in the September quarter increased by 3.0% in trend terms to 48,376, driven by a 4.7% increase in unit and apartment commencements.

Over the year to the September quarter of 2025, total dwelling commencements increased by 11.6% to 184,463, driven by a 23.5% increase in units and apartments.

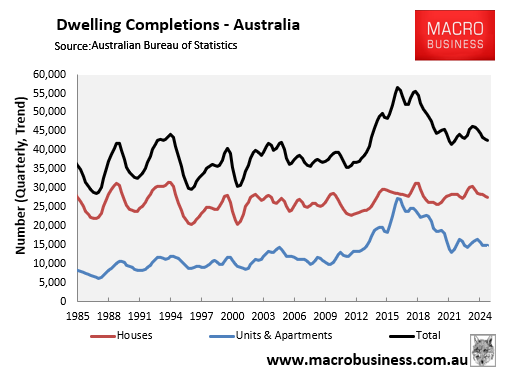

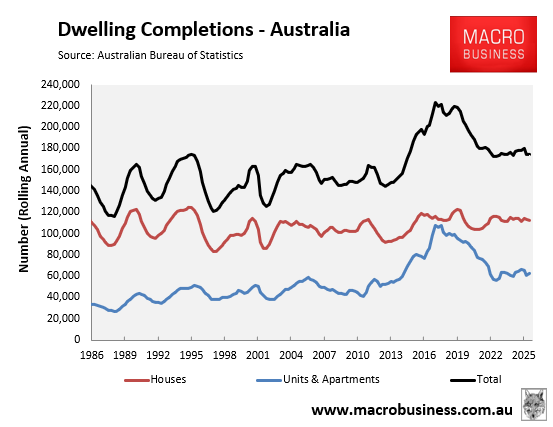

That is where the good news ends, however, with actual supply—i.e., dwelling completions—continuing to fall.

The number of homes that completed construction in the September quarter decreased by 0.3% in trend terms to 42,690.

In the year to the September quarter of 2025, overall residential completions fell by 1.5% to 174,212, led by a 5.1% decrease in detached houses.

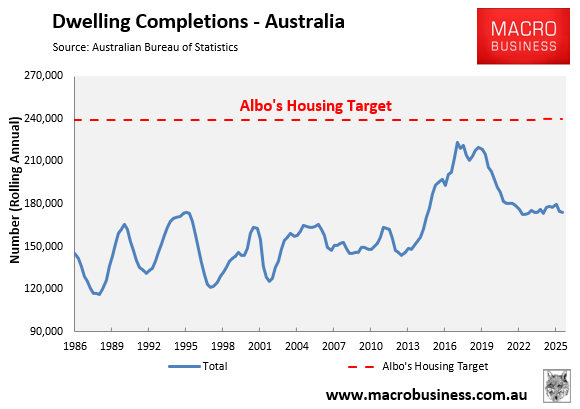

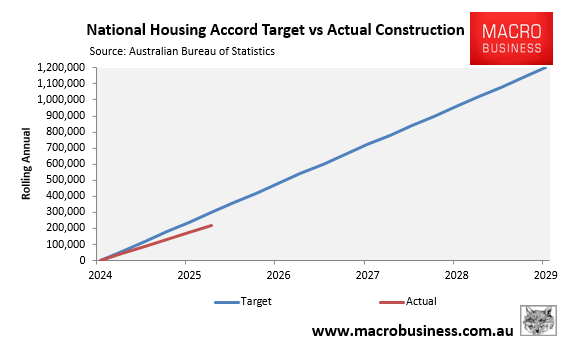

Australia’s housing construction continues to fall considerably behind the Albanese government’s Housing Accord objective of 240,000 homes per year for five years (a total of 1.2 million homes).

The five quarters of the Housing Accord, which began on July 1, 2024, saw just 218,974 homes completed, 81,026 (27%) fewer than the 300,000 target.

It also means that Australia would need to build approximately 261,607 homes each year over 3.75 years to catch up and meet Labor’s 1.2 million target.

There are several reasons why home construction has remained sluggish, including:

- Interest rates are structurally elevated.

- Construction costs have increased by more than 40% since the start of the Covid-19 pandemic.

- Residential lot values have increased by around 33% since the pandemic.

- Government infrastructure initiatives have resulted in labour shortages.

- High insolvency rates in the construction sector.

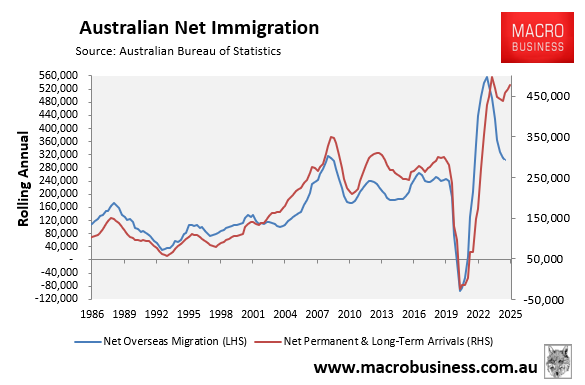

Meanwhile, the ABS’s most recent data on net permanent and long-term (NPLT) arrivals continues to surge, recording the strongest year-to-November numbers on record in 2025, with annual growth also accelerating back toward record levels:

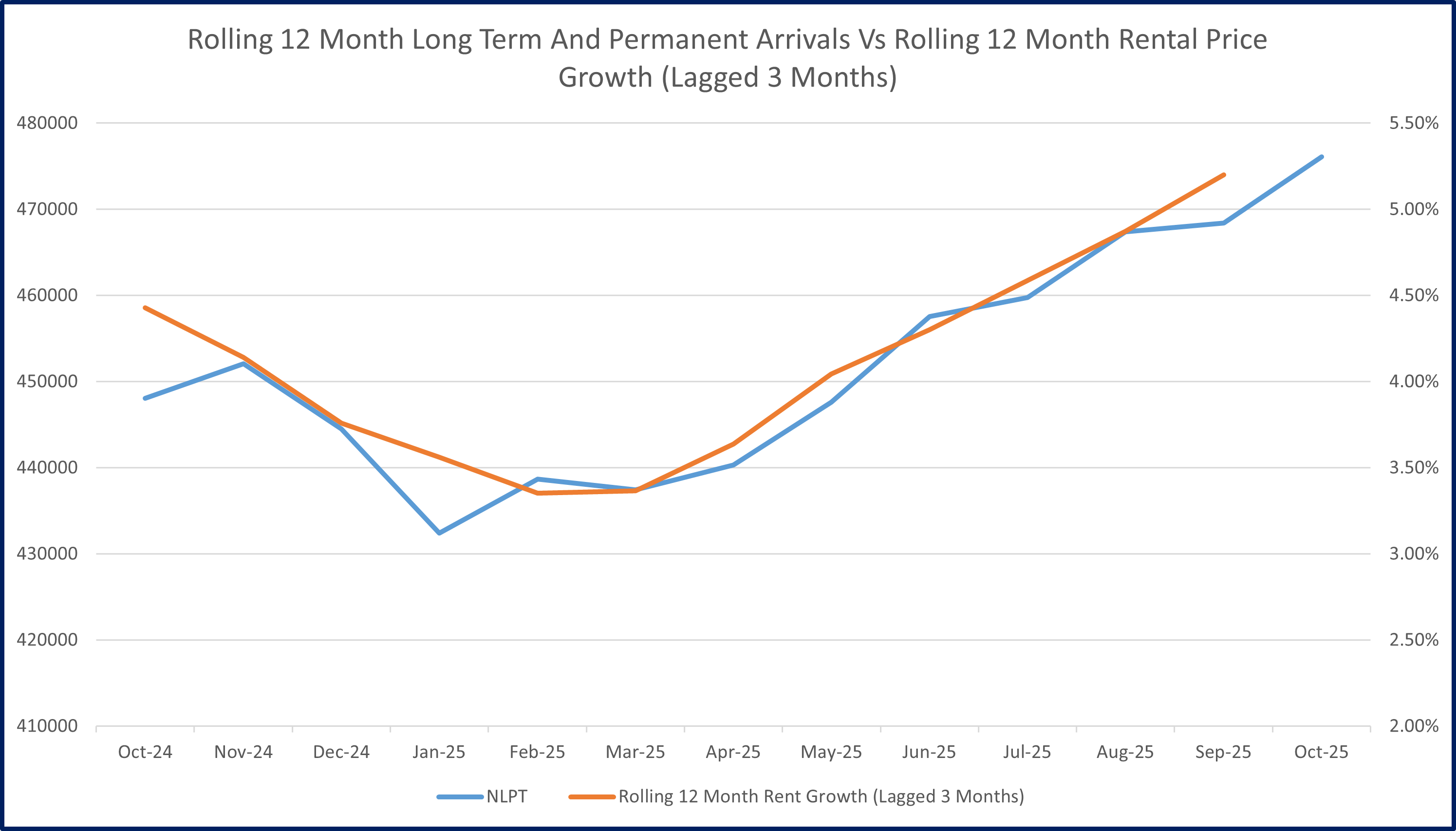

This strong rise in NPLT arrivals has correlated strongly with the tightening of the rental market and the resurgence in asking rents:

Chart by Tarric Brooker

While actual net overseas migration has continued to trend lower (but remains high historically), this moderation in NOM is arguably less relevant to the housing market than people arriving in Australia requiring housing.

Thus, the upswing in NPLT arrivals looks to be largely responsible for the tightening of the nation’s rental market and accelerating rental growth.

It is difficult to see how the rental situation will improve given that dwelling construction remains sluggish at the same time as demand remains strong.

I discussed these issues in my latest Treasury of Common Sense on Radio 2GB/4BC: