Australia’s energy demand will soar over the coming decades due to a combination of rapid population growth, the mass build-out of data centres, and the likely need for a fleet of energy-hungry water desalination plants.

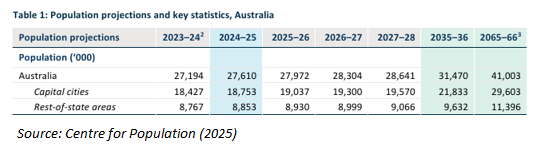

The latest projections from the Centre for Population, released this month, show that the nation’s population will balloon by 13.4 million (nearly 50%) by 2065–66, equivalent to adding another Sydney, Melbourne, and Perth to the current population.

As a result, household demand for energy (let alone extra industrial and commercial demand) will also increase by around 50%.

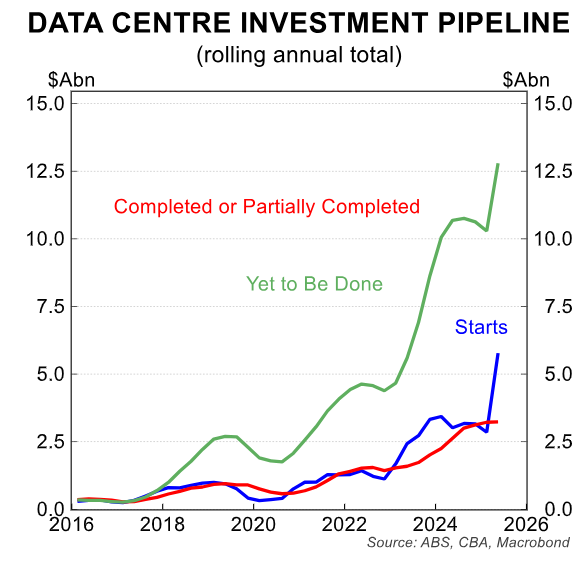

Over the same period, Australia is expected to build hundreds of data centres, requiring substantial power and water.

As explained in a recent note from CBA:

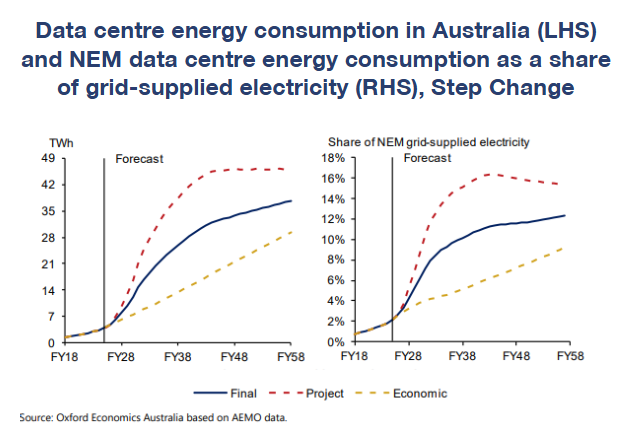

“In 2024-25, Australian data centres are estimated to have consumed 4TWh of electricity, equating to 2.2% of total NEM consumption. This is forecast to grow to 12TWh by 2029-30 and reach 34TWh by 2049-50, representing up to 12% of grid supplied electricity (chart 11)”:

“In addition, data centres consume decent amounts of water. In Sydney and Melbourne, data centres account for 0.7% and 0.2% of yearly local water usage, respectively. As data centre capacity grows, nationwide data centre water usage is forecast to rise to 17GL by 2030”.

Finally, the growth in population and data centres, alongside potential reduced rainfall, will require the construction of water desalination plants near our major cities to augment supplies, requiring more energy.

Thus, no matter how you cut it, Australia will require a massive amount of new energy supplies.

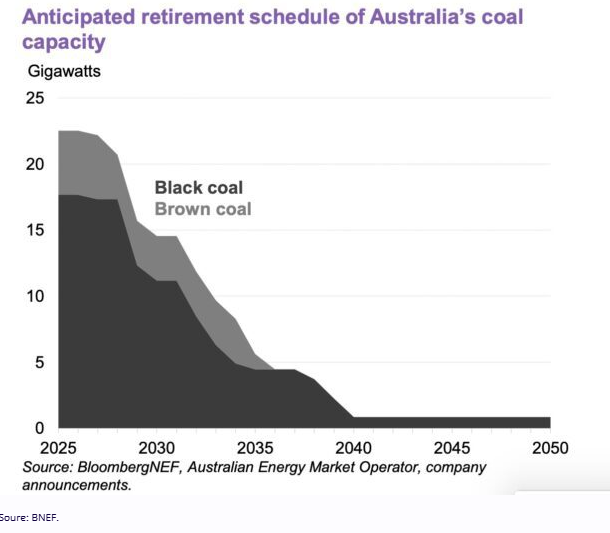

However, the government’s plan is to shut down baseload coal generation in favour of weather-dependent solar and wind, backed by batteries, pumped hydro, and gas.

Yet, the rollout of renewables is stalling. Large‑scale solar and wind investment fell to 2.1GW in 2025, down from 4.3GW in 2024, and around one-third of the 6–7 GW per year required to meet Labor’s 82% renewable energy target by 2030.

Interestingly, some of the former proponents of an all-renewables future have come to the realisation that the world needs stable, non-weather-dependent baseload power, like coal and nuclear, for economies to function.

For several years, Larry Fink used his annual BlackRock CEO letters to push companies toward decarbonisation, arguing that climate risk is investment risk.

In 2021, he wrote that “No issue ranks higher than climate change”.

He argued that climate change would reshape global capital flows, and he urged companies to adopt net‑zero strategies.

Fink was historically a supporter of green energy initiatives and BlackRock pushed for ESG and renewable‑energy investment.

Now the mask has slipped, with Fink emphasising energy security and the continued need for fossil fuels.

Fink stated at the latest WEF meeting in Davos that solar and wind energy alone “can’t reliably keep the lights on”:

“The world is going to be short power. Short power”, Fink told the audience in Davos.

“And to power these these data companies, you cannot have just this intermittent power like wind and solar. You need dispatchable power because you can’t turn off and on these data centres”.

Indeed, Fink’s 2025 annual CEO letter drew attention because references to climate change were absent, signalling a shift toward energy pragmatism.

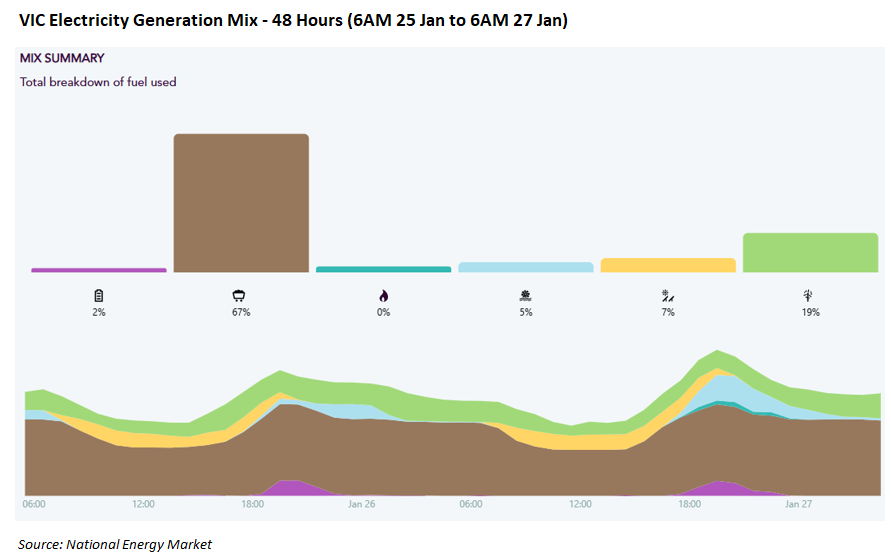

I will add that Australia’s East Coast only got through this week’s heatwave conditions (albeit with prices soaring in renewables-heavy South Australia) because of the stable generation from Victorian brown coal:

Frontier Economics chief Danny Price summed it up nicely on Tuesday:

“Coal generation was basically holding up the entire eastern seaboard yesterday (Monday) and probably today (Tuesday) as well. In fact at the moment (1.30pm Tuesday) Victoria is about 65% coal right now. Solar is obviously high, because it’s a cloudless day. But wind is actually pretty low”.

Price added that “we’ve been very, very lucky” that simultaneous heatwaves across multiple capital cities had happened in recent years only on weekends or public holidays.

“When the system is experiencing a high demand in three states—New South Wales, Victoria, South Australia—and that happens over a couple of days, then the system really is under strain”, he said.

“If that happens, then I’m pretty confident there’ll be some significant outages and high prices”.

“It is only a matter of time. It will happen. There’s no doubt that it will happen. Year by year the system becomes more fragile and that’s because people are spending less on coal”, he said.

How will Australia’s energy grid operate in a stable and cost-effective manner when coal exits and demand soars via the combination of massive population and data centre growth, alongside the build-out of water desalination plants?

I fail to see how the government’s renewables-dominant energy system can deliver affordable and reliable energy. Can somebody please explain how?