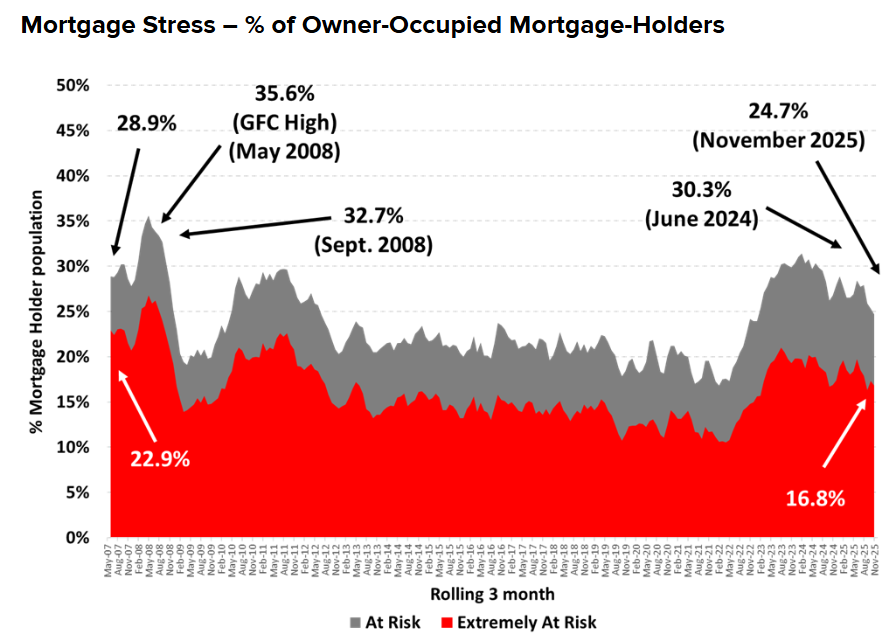

Roy Morgan reports that mortgage stress has fallen to its lowest level since January 2023, following the Reserve Bank of Australia’s (RBA) three 25 bp rate cuts.

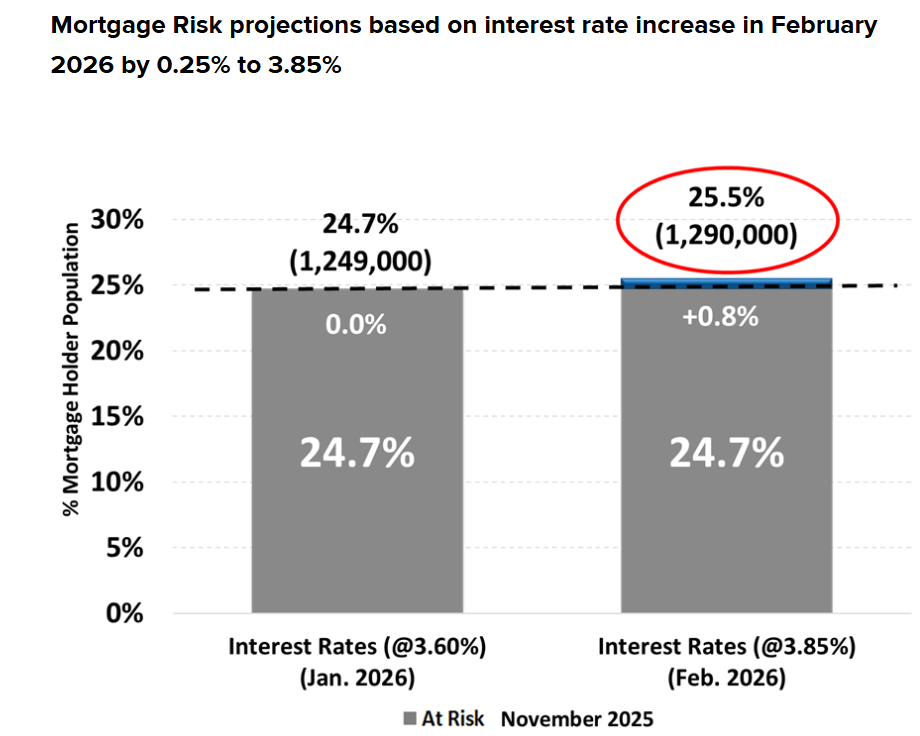

Roy Morgan classified 24.7% of mortgage holders as ‘At Risk’ of’ mortgage stress’ in the three months ending November 2025, a 3.2% decrease from August 2025 and significantly below the recent peak of 30.3% in June 2024.

Even so, 442,000 more Australians were classified as ‘At Risk’ of mortgage stress three years after interest rate hikes began, which saw the official cash rate rise from 0.1% to 4.35% between November 2023 and February 2025.

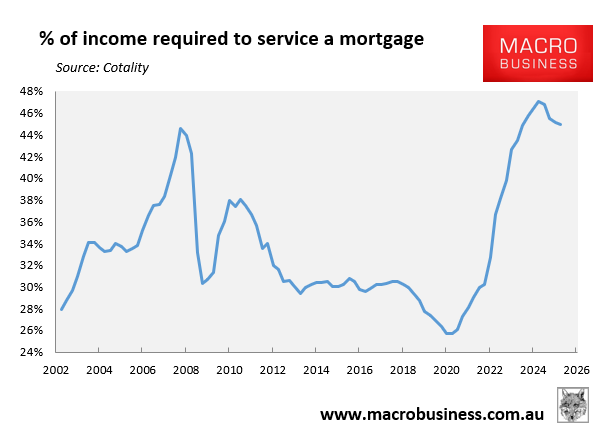

Roy Morgan’s results are supported by Cotality’s latest housing affordability report, which showed that median mortgage repayments as a share of median household income fell from a high of 47.1% in the September quarter of 2024 to 45.0% in the September quarter of 2025:

However, the good news for mortgage holders ends here.

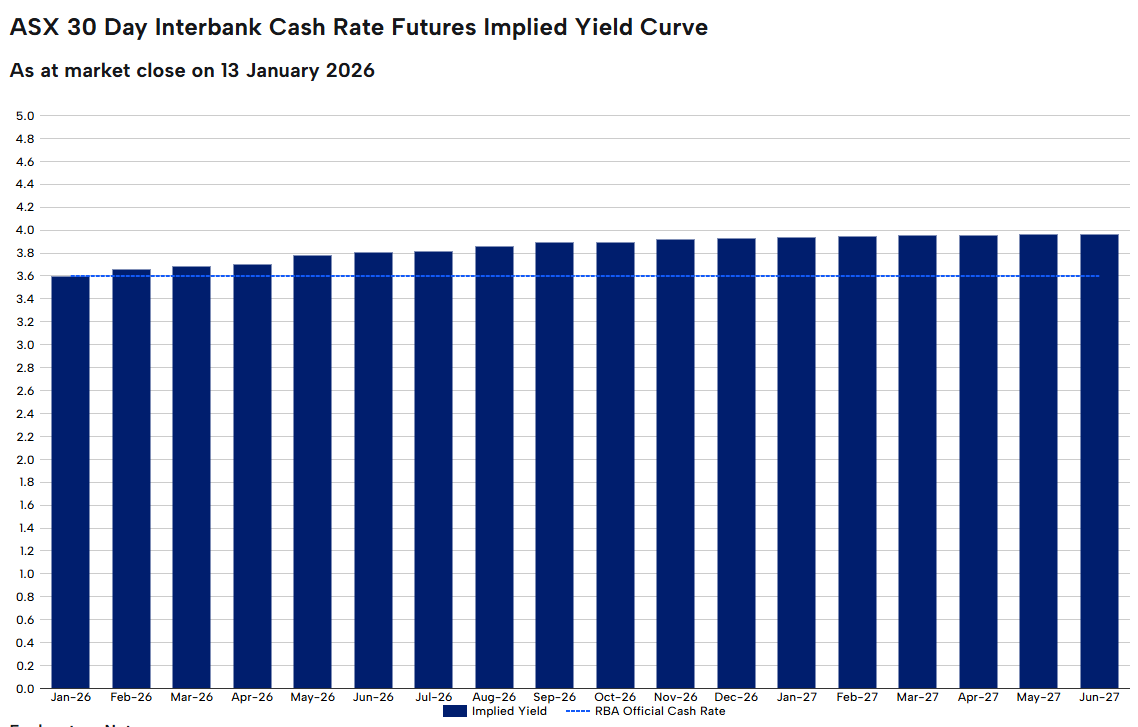

Most economists expect the RBA to lift the official cash rate one or two times in 2026, taking the cash rate to either 3.85% or 4.10%.

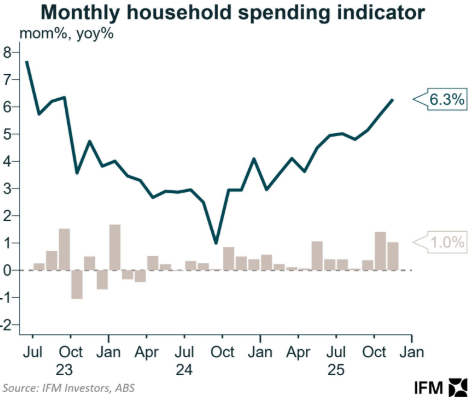

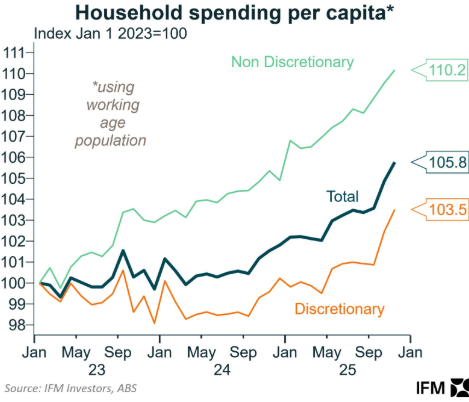

This view was supported by the release this week of the Australian Bureau of Statistics’ household spending indicator for November, which reported strong discretionary spending by consumers.

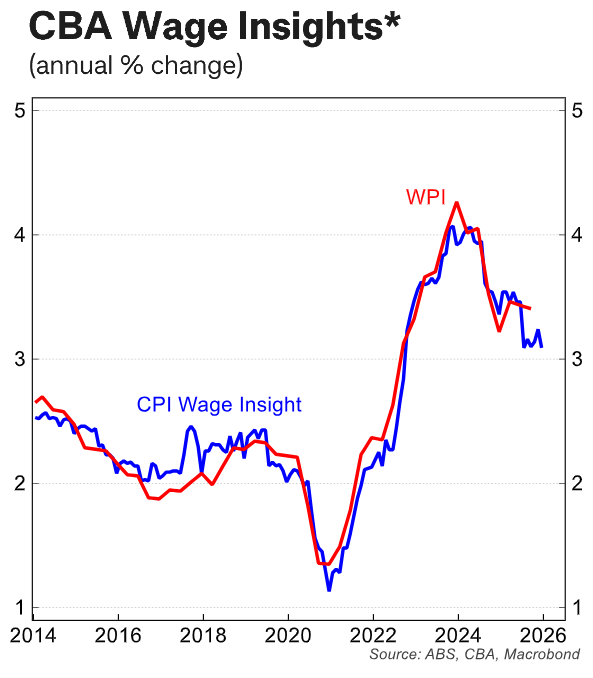

On the other hand, CBA reported that wage growth, as measured by customer accounts, has softened, suggesting that strong consumer demand is unlikely to be maintained:

Either way, the risks for interest rates are tilted to the upside, even though I lean toward the RBA keeping rates on hold.

Roy Morgan estimates that a single 25 bp rise in the official cash rate would push another 41,000 Australian households into potential mortgage stress and the percentage of “At risk” mortgage holders to 25.5%:

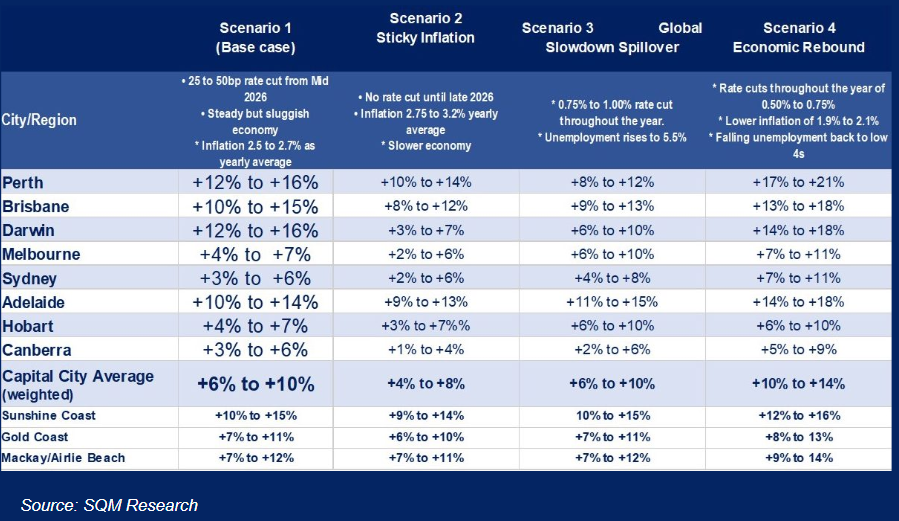

SQM Research, alongside other forecasters, also expects robust home prices to experience solid growth in 2026, even without further rate cuts:

If home values continue to climb faster than income growth without offsetting interest rate reductions, the ratio of mortgage payments to income will inevitably rise.

It also means that Australian mortgage stress will increase.

Mortgage stress would obviously rise further still if home prices and mortgage rates rose in tandem.