Last week, I reported on The Australian Youth Barometer 2025, which painted a bleak picture of the financial challenges facing younger Australians.

The report notes that 85% of young people report financial difficulties, while 18% face food insecurity.

Housing affordability is a major concern, with only 30% believing they’ll be able to afford a comfortable rental in the next 12 months. Only 42% believe they’ll ever own property.

Among young people aged 13–28 who rented a property, 73% reported being in rent stress, spending more than 30% of their income on rent.

Meanwhile, many feel the employment system is “stacked” against them, with 44% of young people reporting unemployment in the past year.

Overall cost of living pressures are squeezing younger Australians, with many believing they will be worse off than their parents (79%).

Distrust in political institutions is also growing, with many younger Australians feeling unrepresented or unheard.

SEEK’s second Workplace Happiness Index paints a similar picture, with the youngest workers reporting the lowest workplace satisfaction in Australia.

47% reported burnout and exhaustion from their jobs and 41% often dread going to work.

“It’s clear that many Australians are struggling to find fulfilment in their roles”, Transitioning Well organisational psychologist Justine Alter said.

Younger Australians are facing a mountain of barriers across the job and housing markets.

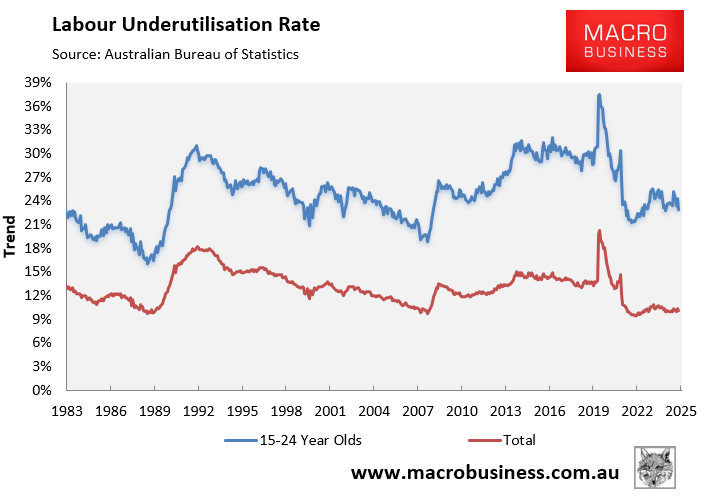

The youth underutilisation rate (i.e., unemployment and underemployment combined) at 22.9% is significantly higher than the broader labour market at 10.0%:

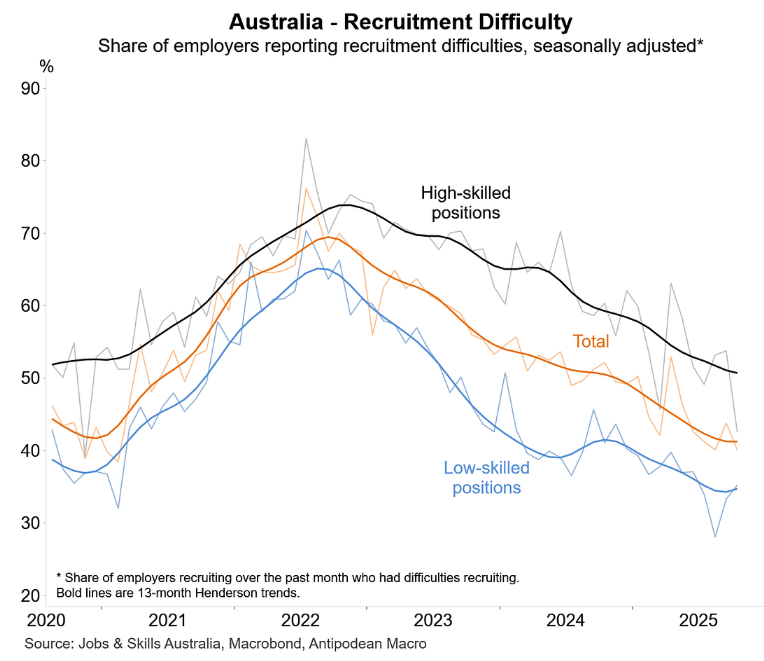

Younger Australians are also contending with an oversupply of low-skilled workers, driven by historically high immigration:

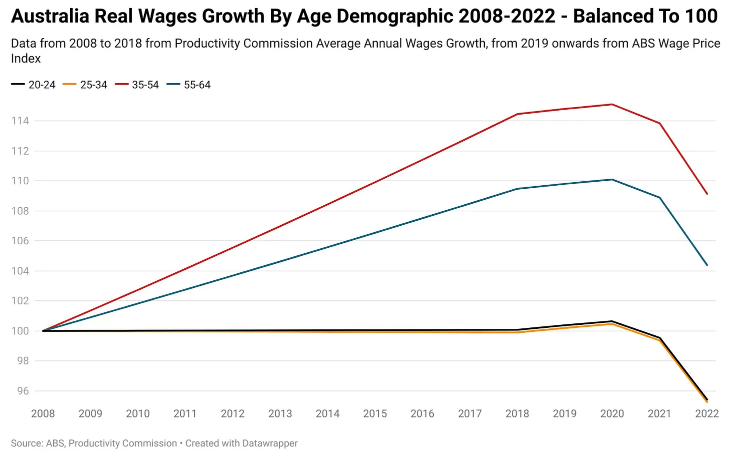

For decades, the real wages of younger Australians have also lagged behind other cohorts:

Chart by Tarric Brooker

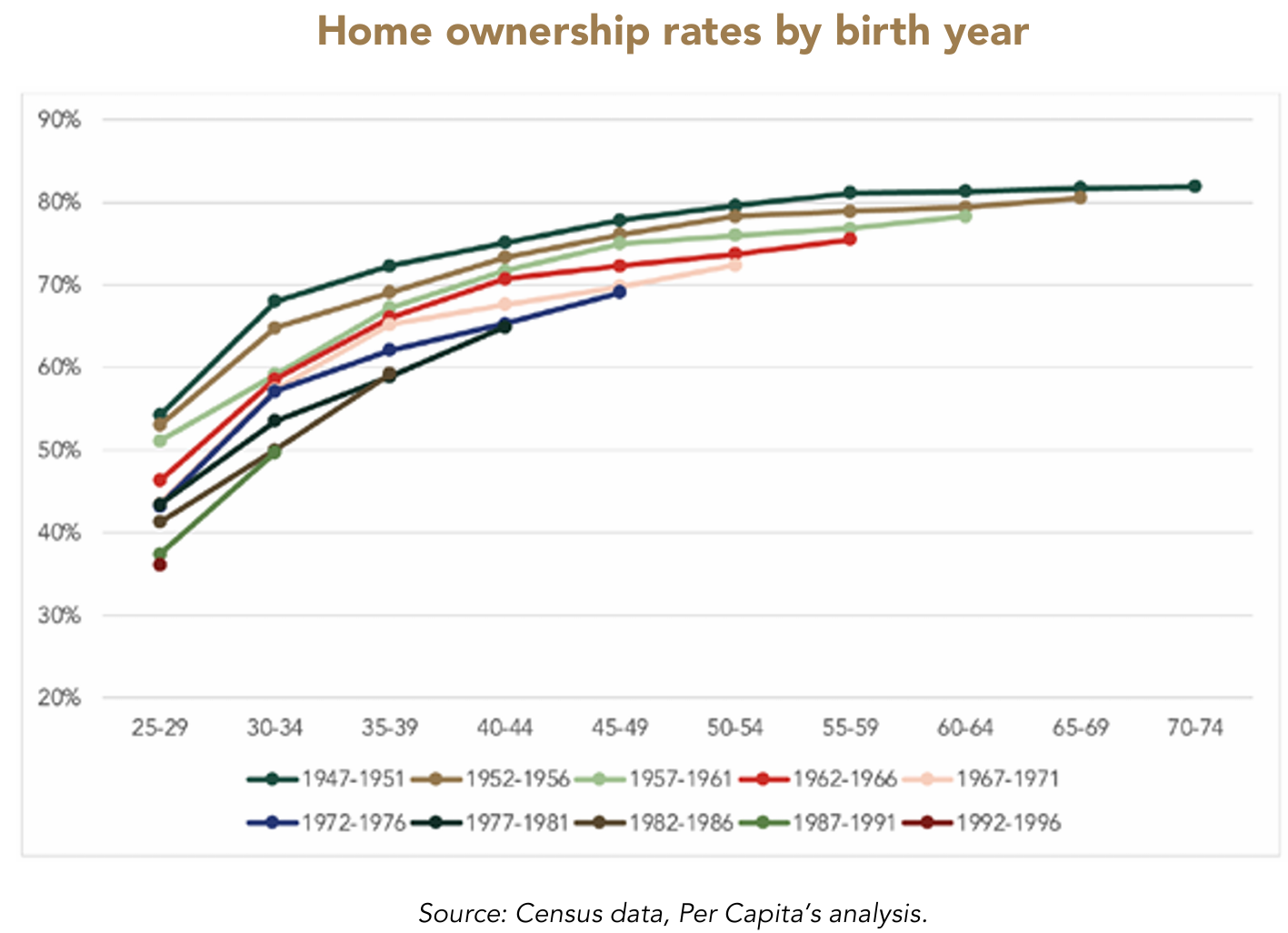

Meanwhile, secure and affordable housing has never been less attainable.

Younger Australians have suffered the biggest decline in homeownership rates, while older Australian homeownership rates have remained relatively constant.

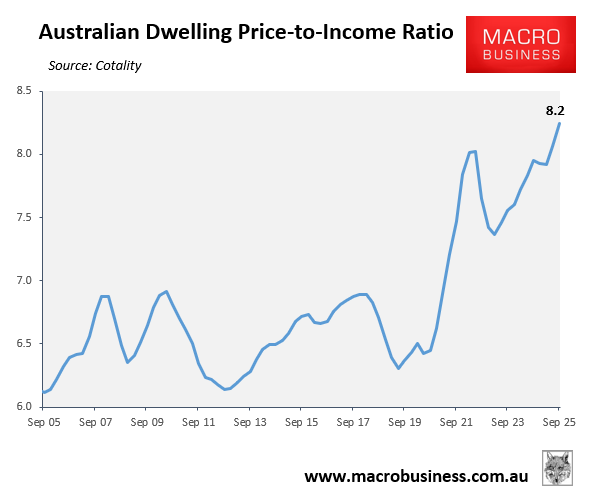

The latest housing affordability data from Cotality showed that the median home value nationally relative to incomes hit an all-time high in the September quarter of 2025:

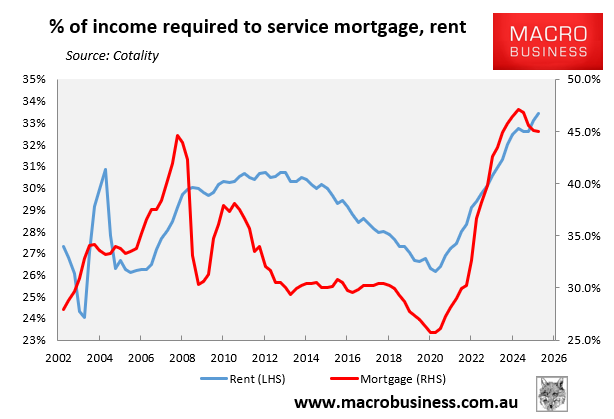

The share of median household income required to be spent on rent also hit a record high in the September quarter. And despite three rate cuts from the RBA, the share of median household income required to be spent on mortgage repayments on a new loan was tracking just below its all-time high in the September quarter, still above the GFC peak:

The above data helps explain why younger Australians are so miserable and angry. They are facing a depressing housing and economic future.