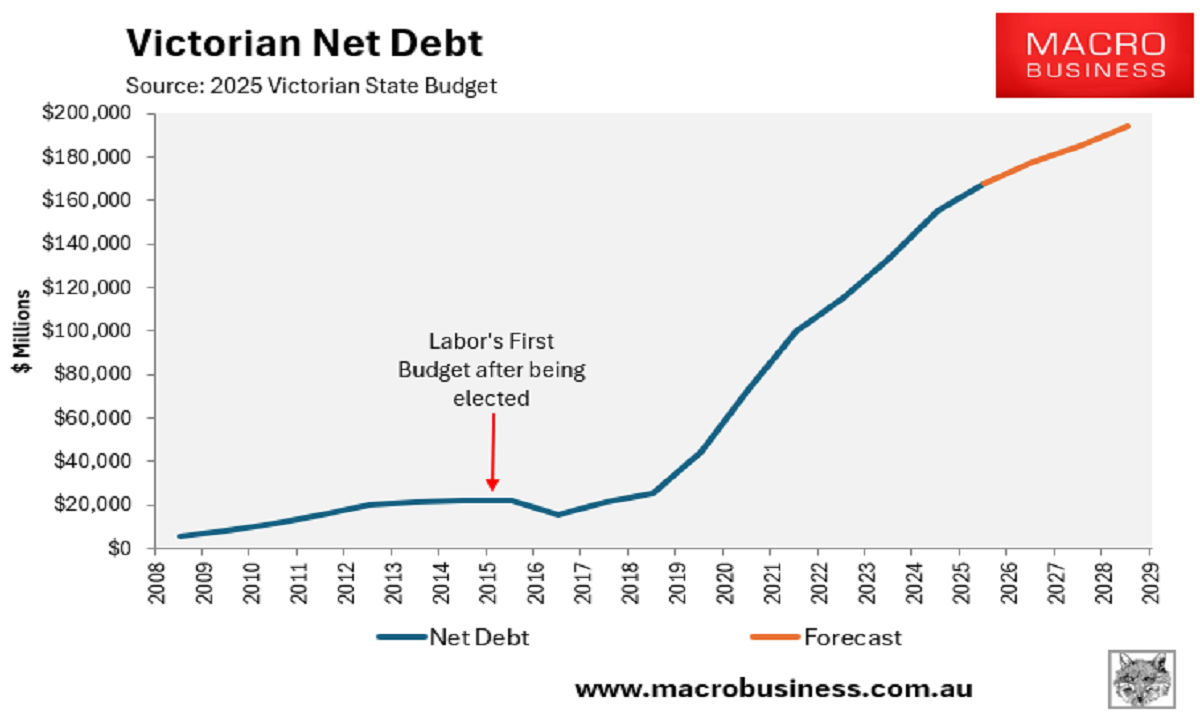

The state of Victoria already has the highest debt load and the nation’s poorest credit rating.

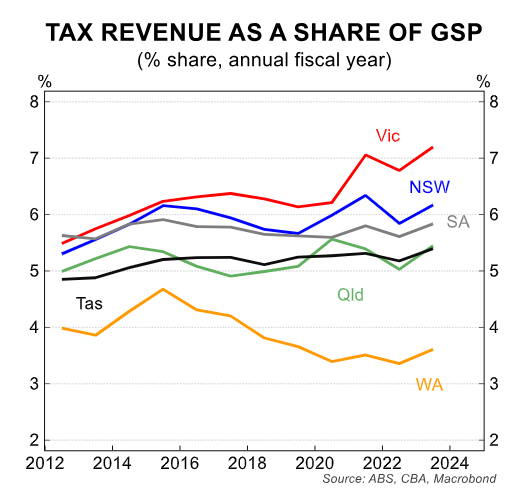

Victorians also pay the highest taxes in the nation.

The Allan Government last week unveiled a suite of new ‘value capture’ taxes and levies on developers, landowners, and car‑park operators to help fund the Suburban Rail Loop East (SRL East), the $34.5 billion first stage of Melbourne’s orbital rail line.

The measures include the following and are intended to raise around $10 billion to fund SRL East:

1. Developer Contribution Levy

- A new surcharge on developers building homes within the SRL East precincts.

- Expected to raise billions over coming decades.

- Industry groups warn it could increase housing costs and slow construction.

2. Car‑Park Levy

- A new annual levy on commercial car parks near SRL stations once the line opens.

- Similar to the existing Melbourne CBD congestion levy.

3. Land Tax Diversion

- Land tax revenue from SRL precincts will be redirected away from general state revenue and into the SRL project.

- Critics say this creates a budget shortfall for essential services.

4. Broader “value capture” tools

- Applies to landowners who benefit from rising land values due to the new rail line.

However, S&P Global Ratings criticised the value capture plan that the Victorian government intends to use to help fund the Suburban Rail Loop (SRL), stating it could put the state’s AA credit rating at risk.

“Given the government’s value capture plan appears to utilise $6 billion of existing land taxes to fund the SRL, it may need to find savings elsewhere to fund other priorities—or risk driving deficits and debt higher than we currently expect”, said Anthony Walker, an analyst at S&P Global Ratings.

“Any shortfall of revenues that requires the government to prolong its promised fiscal consolidation or materially increases its debt levels could become inconsistent with our AA rating”.

S&P’s criticism comes two weeks after it warned that the government’s pledge to cut 1,000 public servants and wind up 29 public entities would not help fix the state’s fiscal problems.

S&P had already identified the SRL as a major risk when it reaffirmed Victoria’s AA credit rating in July, saying there remained a danger its cost could blow out.

A Victorian government spokesman has responded to S&P’s criticism by claiming that value capture “has been used successfully to help fund major infrastructure projects across Australia and around the world”.

Obviously, earmarking existing land taxes to the SRL will also mean that there isn’t funding for other vital infrastructure projects and services.

Hence, the biggest losers from the SRL will be residents of Melbourne’s growth areas in the North and West who are badly starved of infrastructure and services and will now have to take a back seat to the SRL—an expensive boondoggle project that nobody asked for.