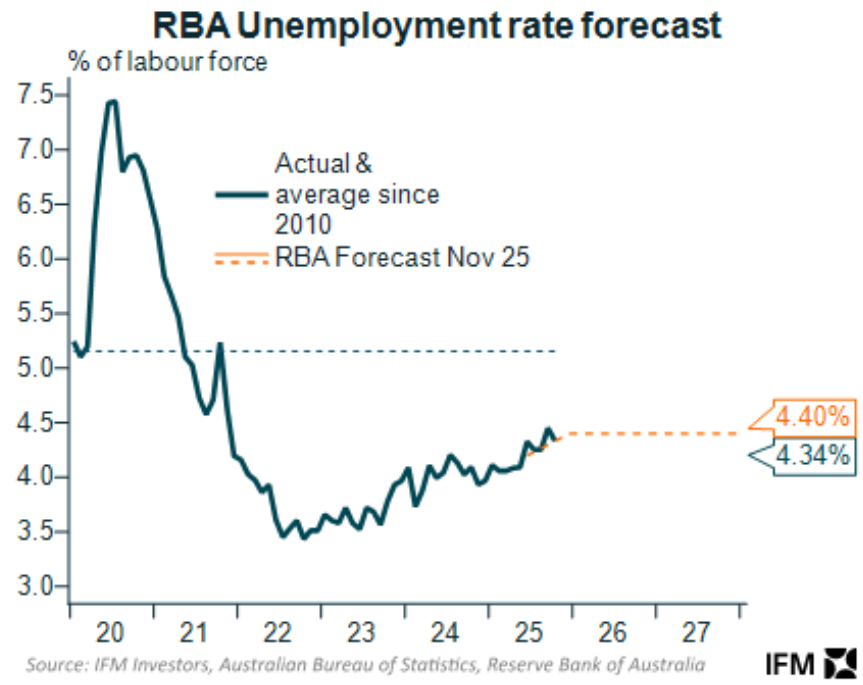

The latest Statement of Monetary Policy from the Reserve Bank of Australia (RBA) forecast that the official unemployment rate would remain around its current level until the end of 2027:

With “full employment” being one of the RBA’s mandates (the other being “price stability”), an increase in unemployment significantly above the forecast implies an increased chance of interest rate cuts.

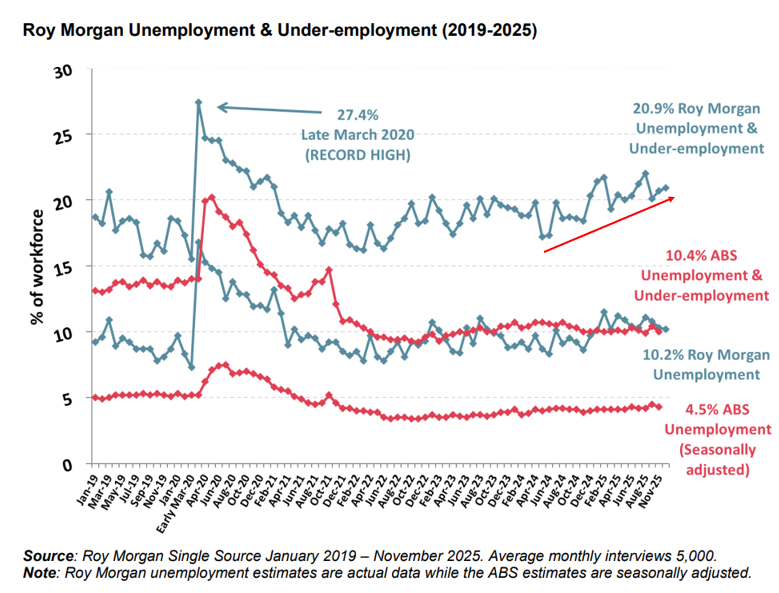

Roy Morgan released its shadow labour force report for November, which suggested the jobs market continues to soften.

While the unemployment rate fell marginally to 10.2% (down 0.1%), underemployment rose by 0.3% to 10.7%.

Both unemployment and underemployment have increased significantly from a year ago, with unemployment up by 1.6% and underemployment up by 0.9%. This means that overall labour underutilisation rose by 2.5% through the year, according to Roy Morgan.

Commenting on the results, Roy Morgan CEO Michelle Levine noted that combined unemployment and underemployment have remained at a high level above 3 million for 12 straight months and no net jobs created.

“Both unemployment and under-employment have increased markedly from a year ago with unemployment up 165,000 to 1,709,000 (10.7% of the workforce, up 0.9%) and under-employment is up 266,000 to 1,628,000 (10.2% of the workforce, up 1.6%)”.

“This means overall unemployment and under-employment has increased significantly by 431,000 to 3,337,000 (20.9%, up 2.5%)”.

“The sluggish labor market—with no net jobs created compared to a year ago—shows the low level of productivity in the Australian economy is stifling growth and leading to labour market stagnation”.

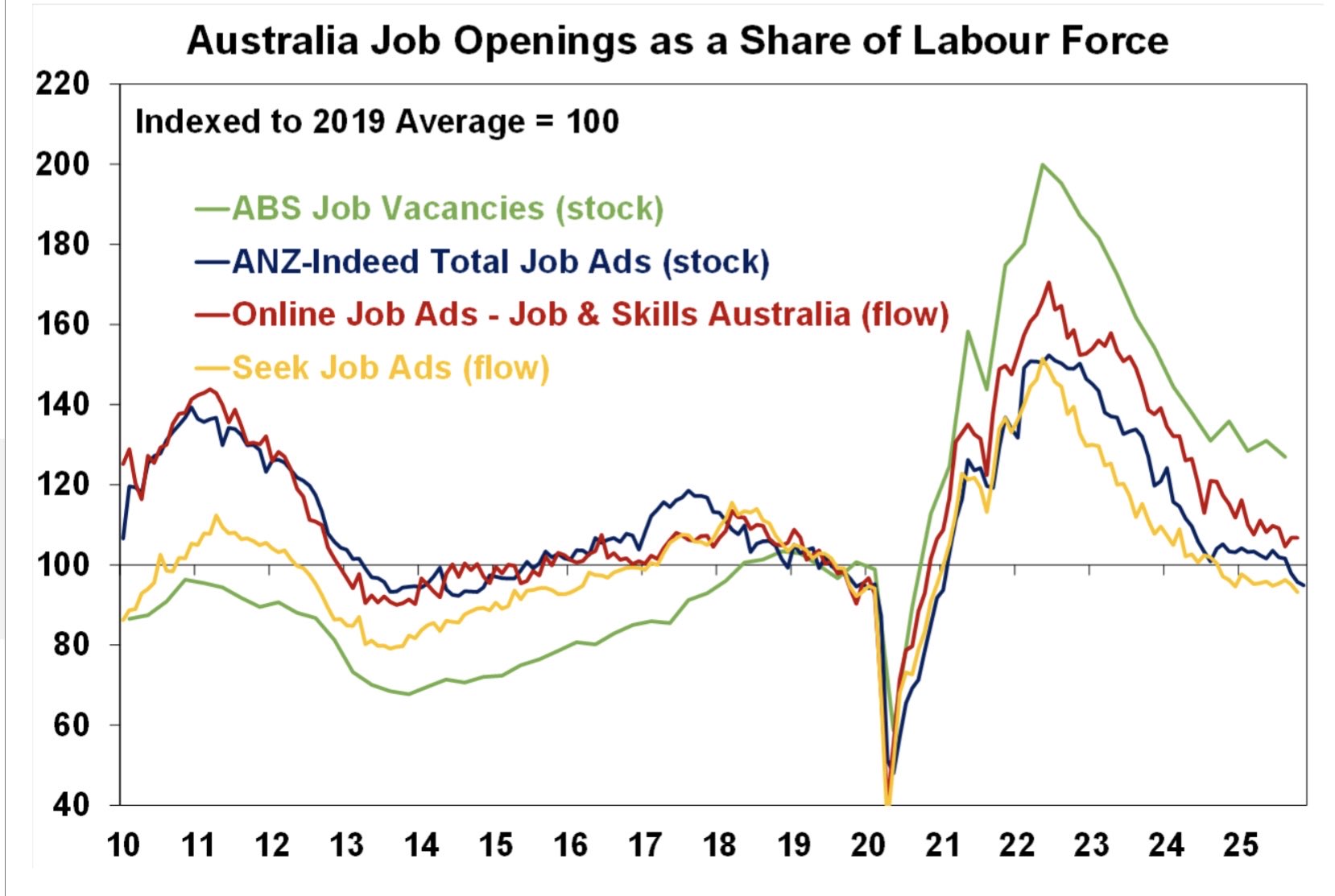

The soft picture painted by Roy Morgan is supported by job vacancies/ads data, which have fallen back toward pre-pandemic levels:

Source: Shane Oliver (AMP)

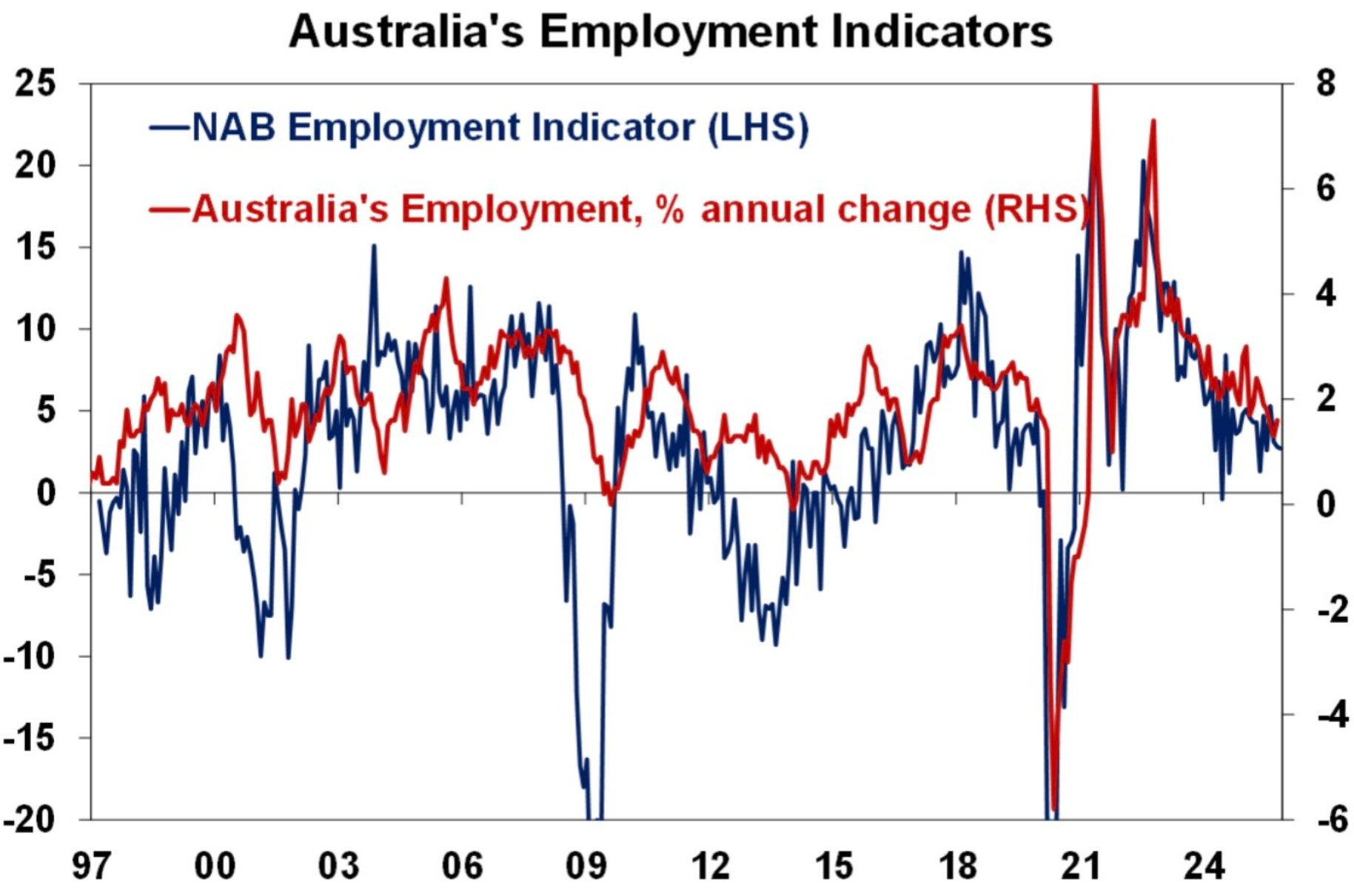

NAB’s latest monthly business survey, released on Tuesday, also pointed to sluggish job growth:

Source: Shane Oliver (AMP)

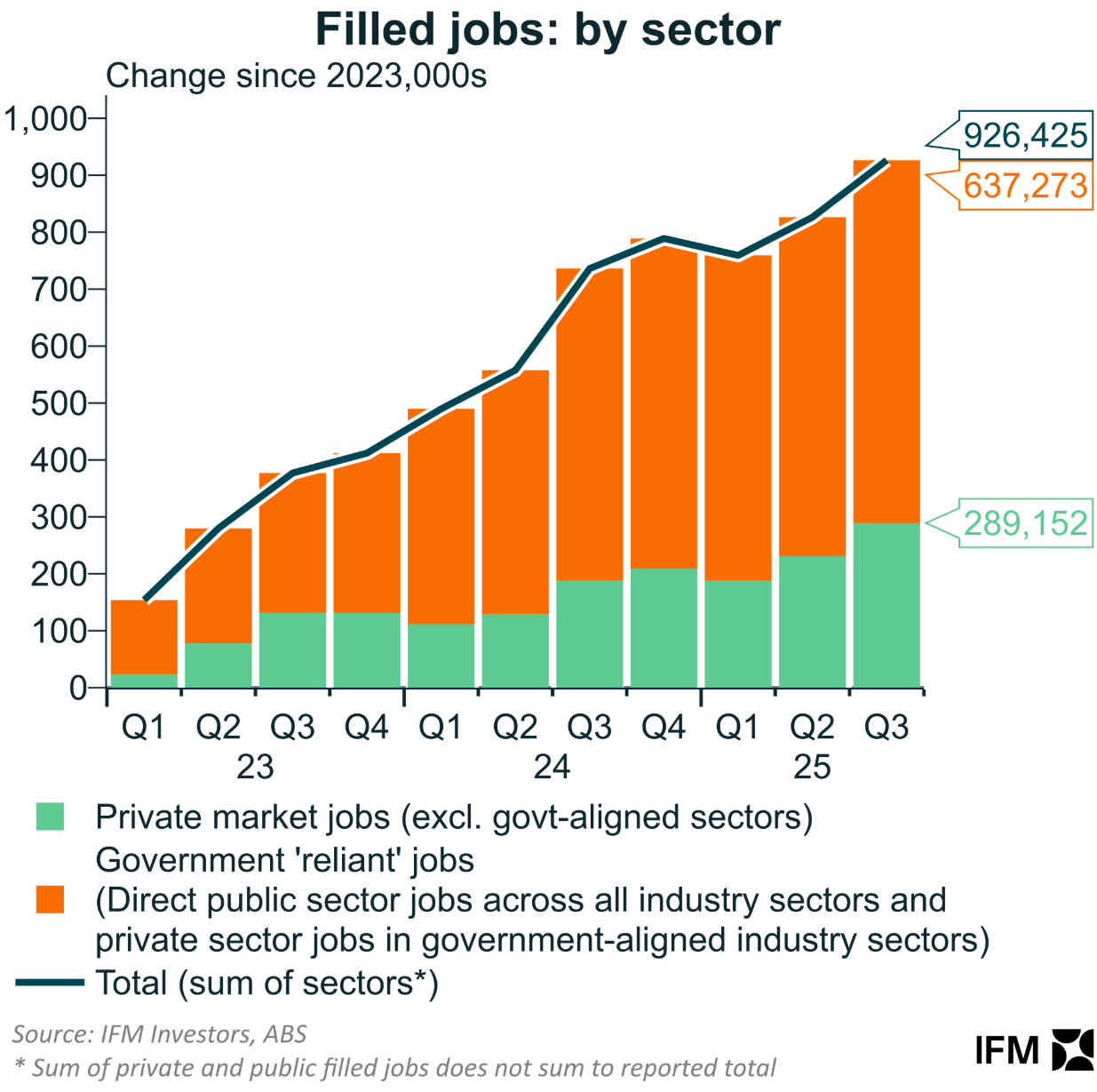

Meanwhile, the latest data from the ABS on filled jobs showed that nearly two-thirds of jobs created since the beginning of 2023 have been government-funded in the non-market sector of public administration and safety, healthcare and social assistance, and education:

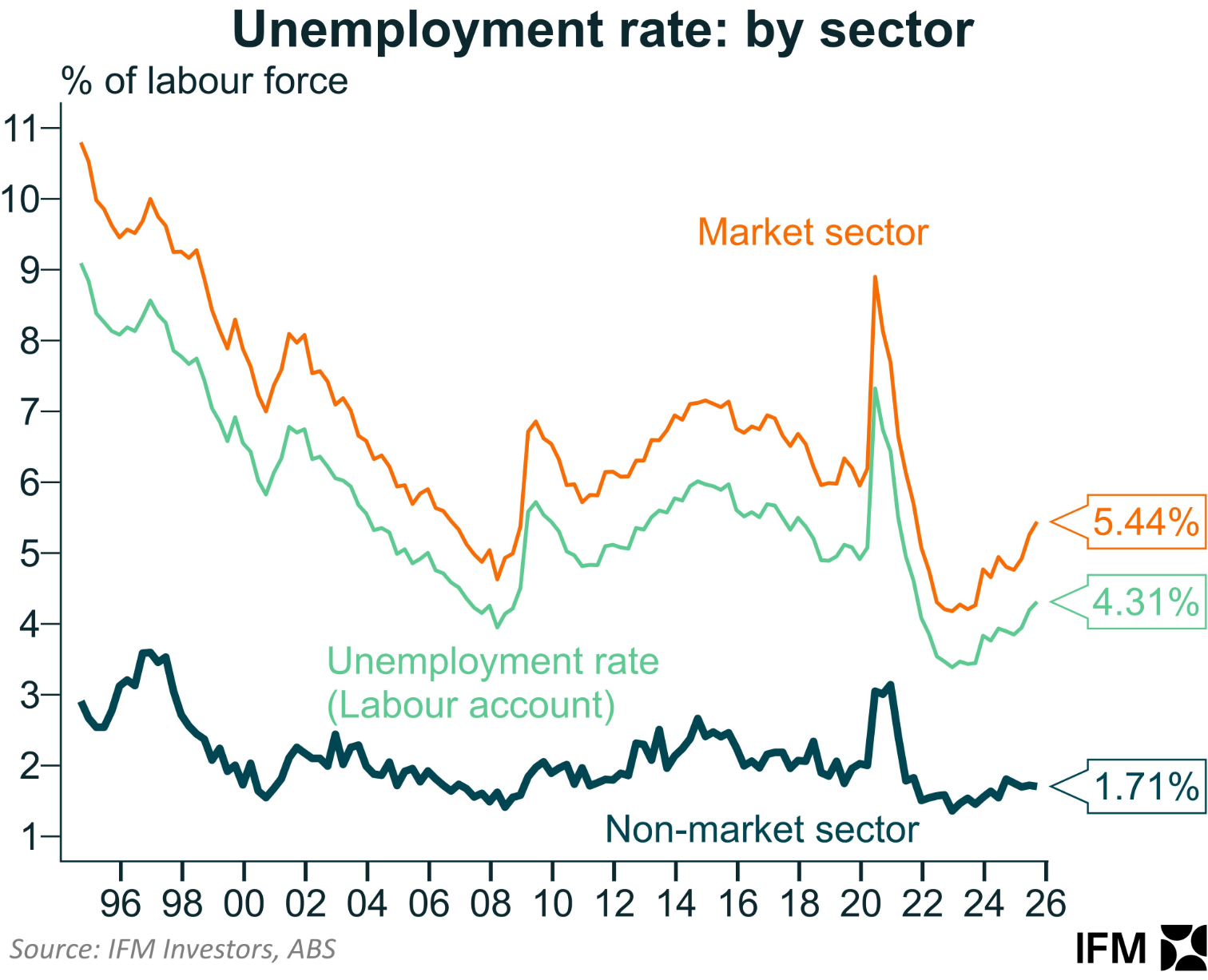

The upshot is that Australia’s labour market is not nearly as strong as suggested by the ABS’ headline unemployment rate of 4.3%, which has been driven by unsustainable government spending.

At some point, the labour market will officially crack.