Last week, the Australian Prudential Regulatory Authority (APRA) released its new prudential standard, effective February 2026, which caps high-risk mortgages (debt-to-income ratio over 6x) at 20% of new lending.

APRA’s announcement aims to manage housing vulnerabilities preemptively amid rising prices but excludes new housing builds and applies portfolio-wide, allowing banks flexibility while aligning with government goals to boost affordability through supply incentives.

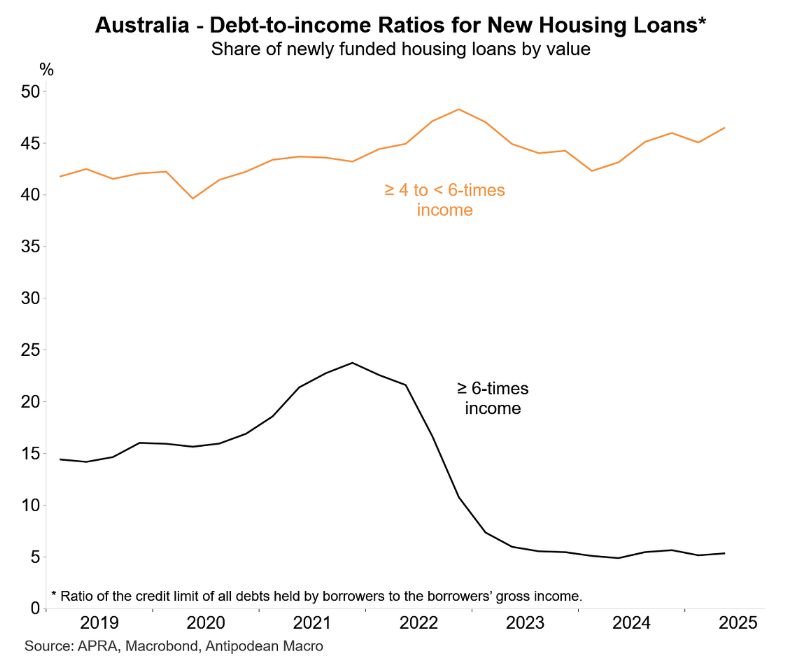

As illustrated below by Justin Fabo from Antipodean Macro, only around 6% of current loans exceed this threshold. Therefore, it is possible for high DTI exposures to triple before they surpass the regulatory speed limit.

As a result, critics have labelled APRA’s intervention as a symbolic gesture that has effectively greenlit more than three times the existing volume of high DTI loans in the market.

It is a policy aimed at giving the impression that APRA is “doing something” about rising mortgage risks, while actually doing the bare minimum.

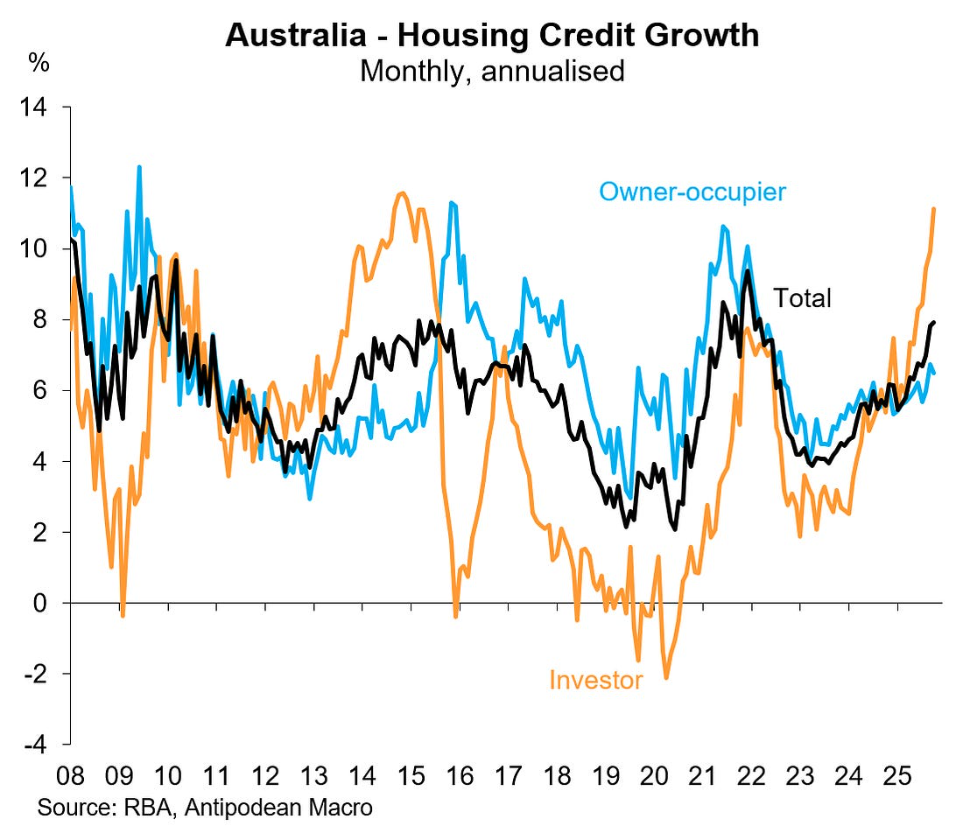

In any event, Friday’s housing credit data from the Reserve Bank of Australia (RBA) showed that investors are piling into the housing market.

As illustrated below by Justin Fabo, “the pick-up in housing price growth in Australia has gone hand-in-hand with a surge higher in investor housing credit growth which was running at a monthly annualised rate of 11.1% in October”:

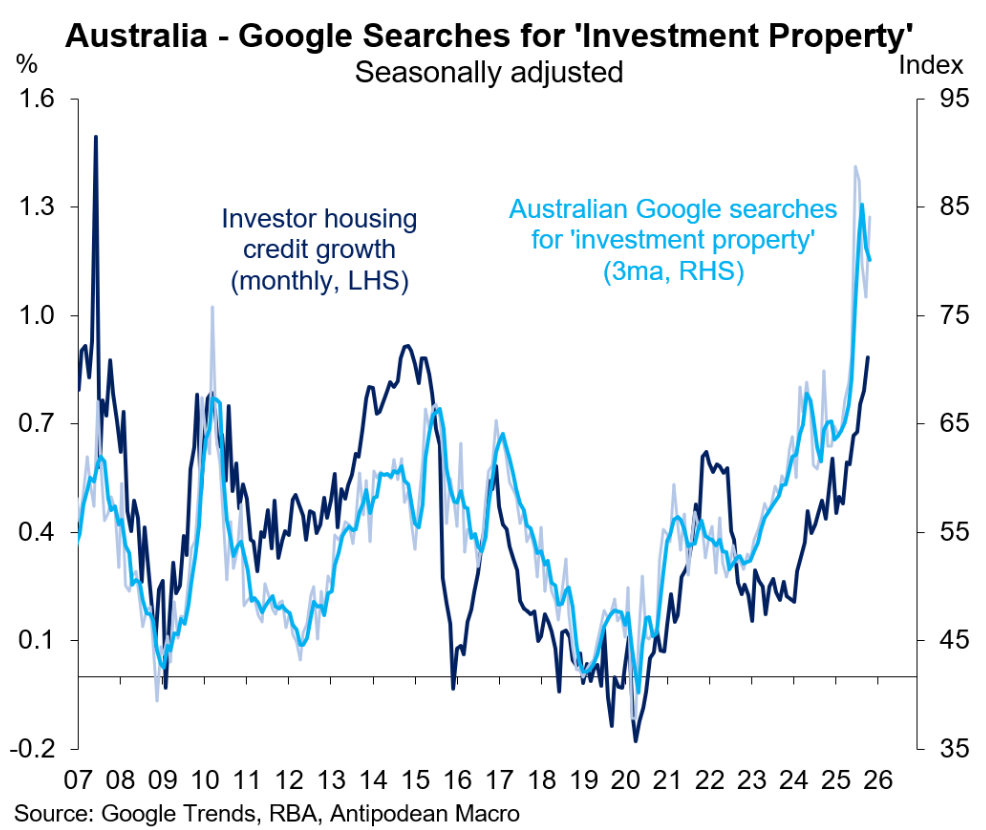

Fabo also showed that Google searches for “investment property” are tracking at historical highs:

The last time investor demand was this high was 2014-15, prompting Australia’s financial regulators to tighten the screws amid concerns that investor demand was fueling rapid house price growth, especially in Sydney and Melbourne.

In particular, APRA introduced macroprudential measures between 2014 and 2018 to slow investor mortgage growth. These included caps on investor lending growth, limits on interest-only loans, and tighter serviceability assessments to reduce risky borrowing.

As a result, investor mortgage growth slowed significantly after 2015. The share of interest-only loans also dropped from nearly 40% of new lending in 2015 to below 20% by 2018.

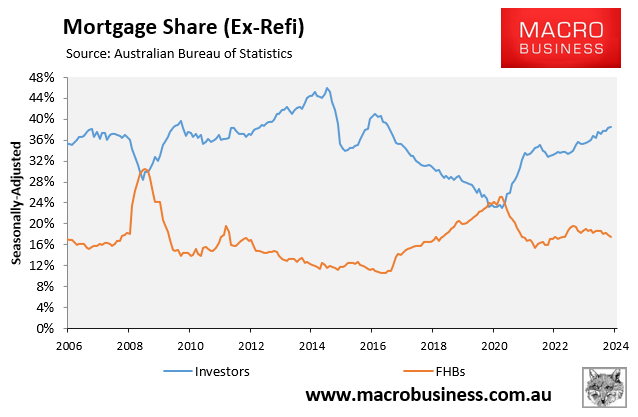

Why hasn’t APRA taken such decisive action to curb investor demand this time around?

Has the Albanese government got APRA on a tight leash, not wanting them to implement policies that could thwart the housing upswing?

The reality is that reducing investor demand is the easiest way to get more first home buyers into the market.

It is certainly preferable to driving prices and debt higher via Labor’s 5% deposit scheme for first home buyers.