I reported last week on how increases in tobacco excise have resulted in a significant decline in Australia’s tobacco excise revenue.

While illegal cigarettes are easily accessible and cost about $15 a pack, a legal packet of cigarettes now costs about $50 (tax and excise account for about $34).

The Australian Bureau of Statistics (ABS) has announced that it is investigating ways to quantify the use of unlawful nicotine-related items in response to the rise in contraband cigarettes.

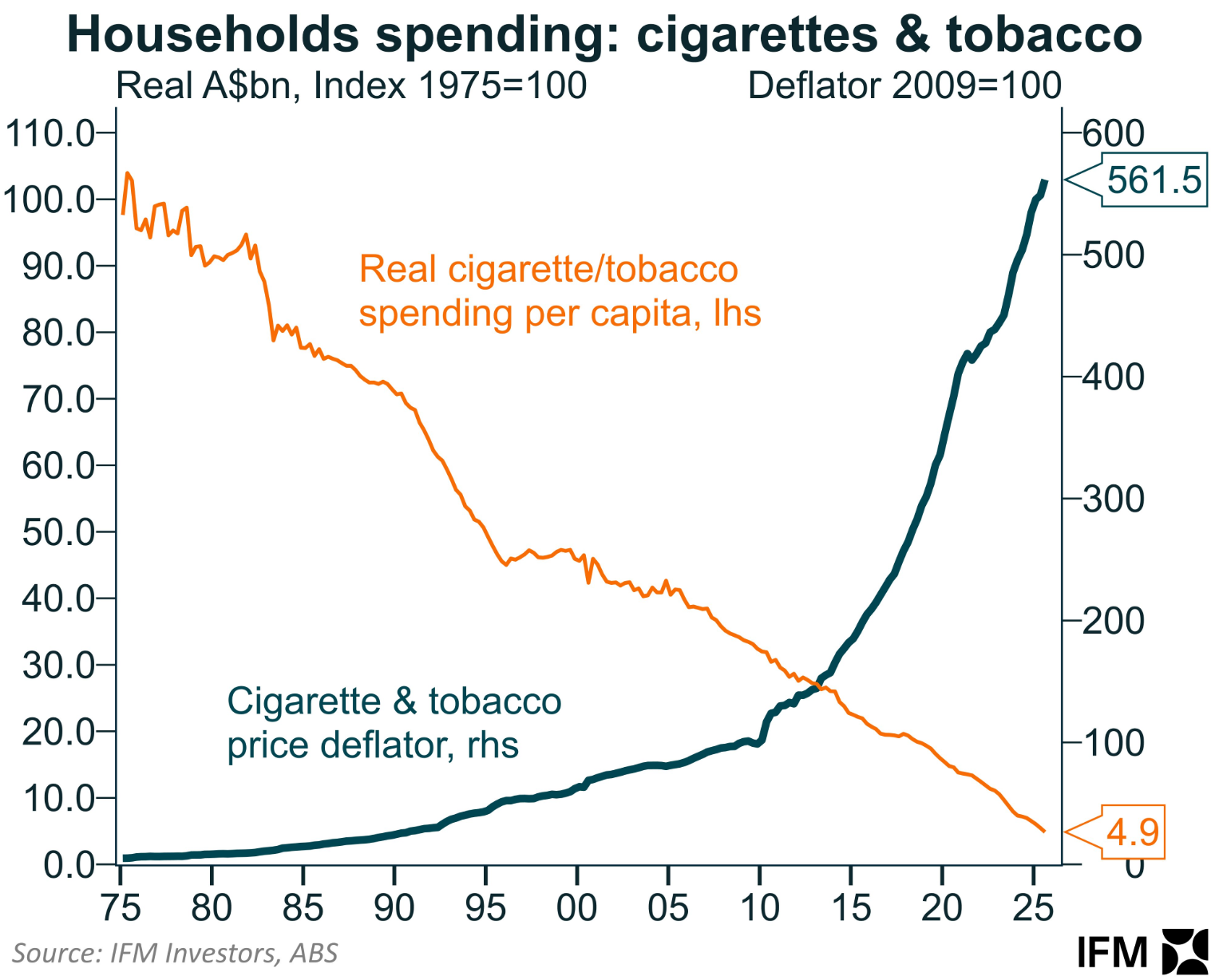

Alex Joiner of IFM Investors illustrates the situation in the following chart:

Cigarette and tobacco spending fell by 11%, according to the ABS’s Q3 national accounts release.

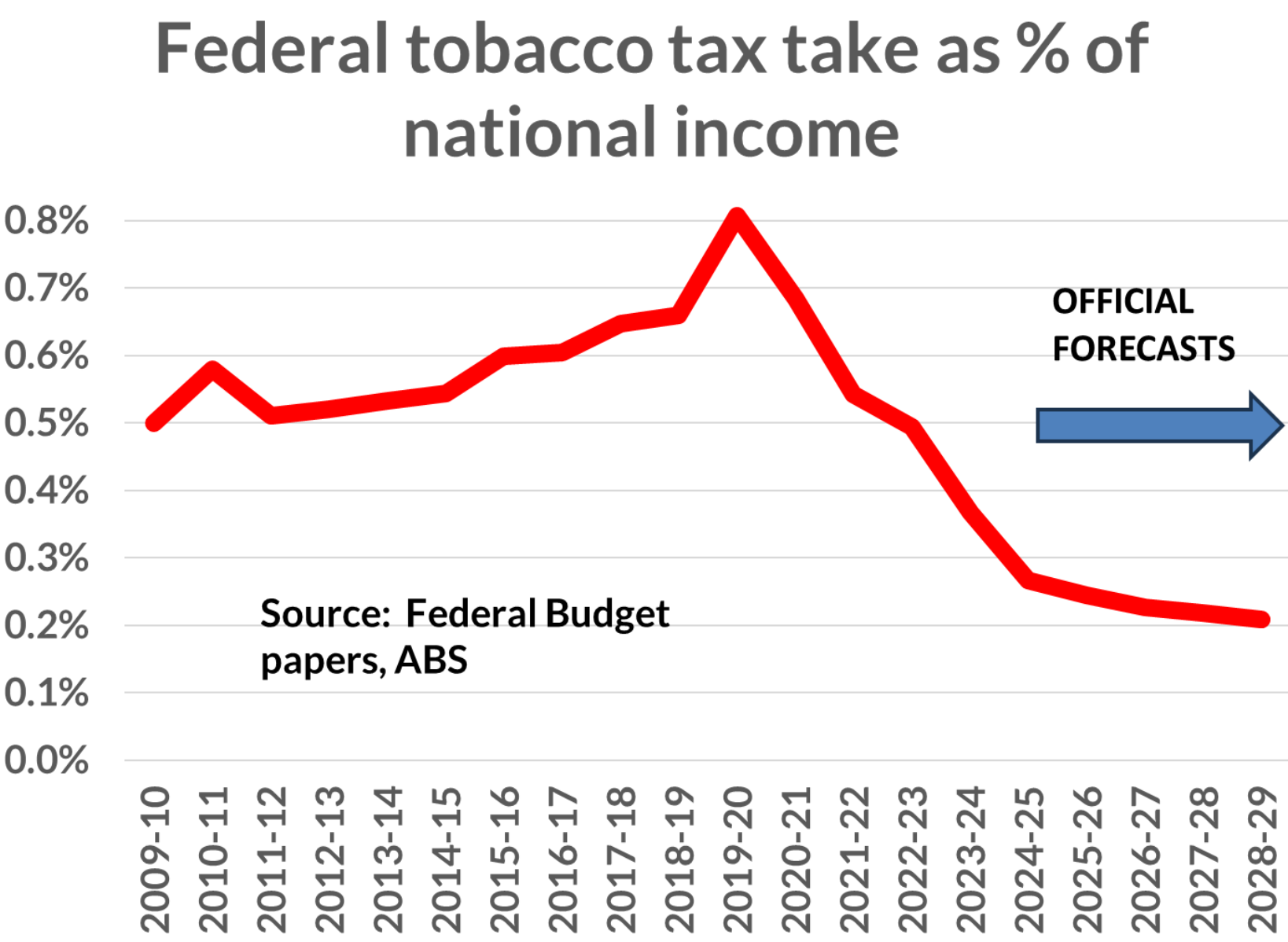

This is the Laffer curve in full effect, which illustrates the relationship between tax rates and government revenue. An ideal tax rate is one that maximises revenue.

Australia has passed the stage where increasing tobacco excise rates lowers revenue because consumers divert their cigarette purchases to the black market in order to avoid paying taxes.

Chart by Chris Richardson

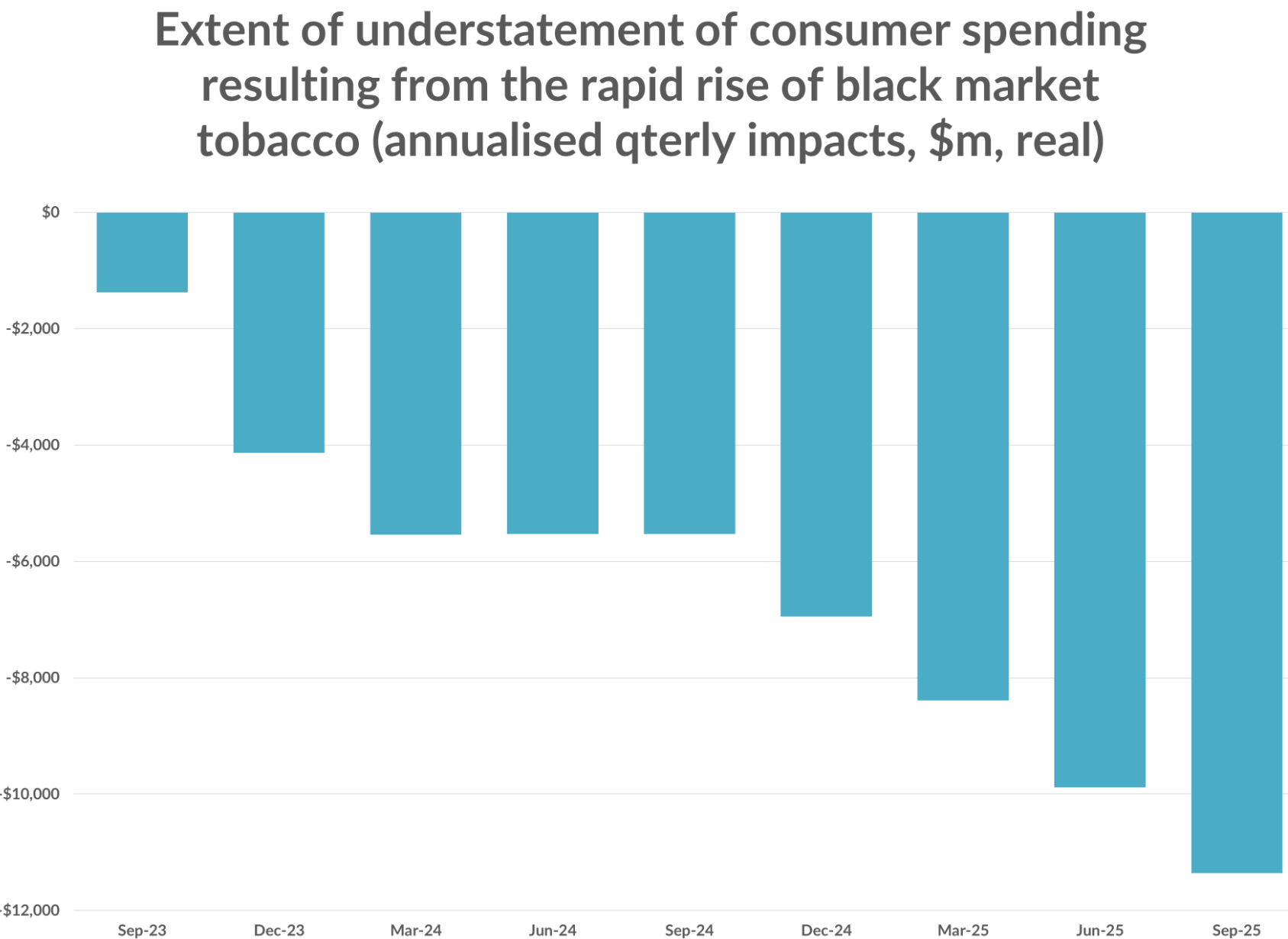

In fact, the illicit tobacco market in Australia has grown by almost $10 billion in the past two years, according to ABS estimates, with an ongoing (but rising) shortfall of close to $12 billion at annualised rates:

Chart by Chris Richardson

Richardson summed up the policy failure as follows, claiming it:

- indicates worsening health outcomes (we tried to make smoking more expensive, but it actually made it cheaper);

- is consistent with the collapse in the tax take (if everyone were paying the tax, we’d be raising an extra $15 billion a year);

- is an incredibly large gift to organised crime, which is currently the most subsidised industry in the country; and

- is increasingly detrimental to smokers and businesses that have continued to operate in the legal market.

The federal government’s budget is facing another hit following the revelation that multinational tobacco companies will be entitled to a tax rebate of more than $940 million.

They had paid the tax on tobacco products that were imported during 2024-25 but which cannot be sold in Australia due to new regulations that took effect on 1 July.

The tobacco companies are either in the process of re-exporting or have already re-exported the unsaleable product that has been sitting in their warehouses.

The government will have to either include the cost of the rebate in Wednesday’s Mid-Year Economic & Fiscal Outlook or delay it until the 2026 budget.

Treasury officials are worried the loophole could encourage further claims, creating ongoing fiscal risk.

Meanwhile, industry sources are frustrated with the government’s policy tinkering.

“This is a crisis of the government’s making, a textbook case of unintended consequences”, one source told The Australian on condition of anonymity.

“It’s a perverse outcome where people aren’t consuming less, yet the government is bleeding revenue. Rather than acknowledging the problem, they doubled down on policies that were already failing”.

“The result of which is the loss of billions of dollars flowing into the hands of organised crime. But the real cost isn’t just to government revenue; it’s to every taxpayer”.

“When Australians are being told to brace for spending cuts in the budget update, this is money that should be funding aged care, housing and essential services”.

Indeed, Chris Richardson previously estimated that had Australia earned from tobacco excise the same share of national income as in 2019-20, the federal budget would have received $69 billion more over the current four years of forward estimates—i.e., $16 billion this year, rising to $19 billion in 2028-29.

“The lost dollars are devastating”, Richardson concluded.

Thus, tobacco taxation ranks as one of Australia’s most significant public policy failures.

The obvious solution is to lower tobacco excise and properly police the illegal market.