Late last month, Cotality and Proptrack published two critical housing affordability reports.

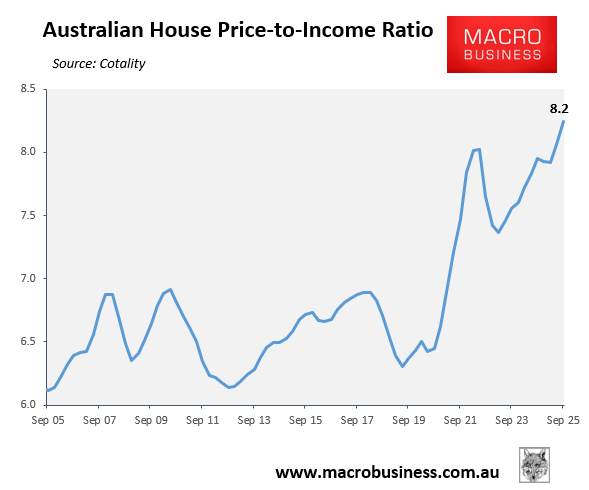

Cotality’s research revealed that the national median home price relative to median household income reached a new high of 8.2 in Q3 2025, up from 6.4 five years earlier in Q3 2020.

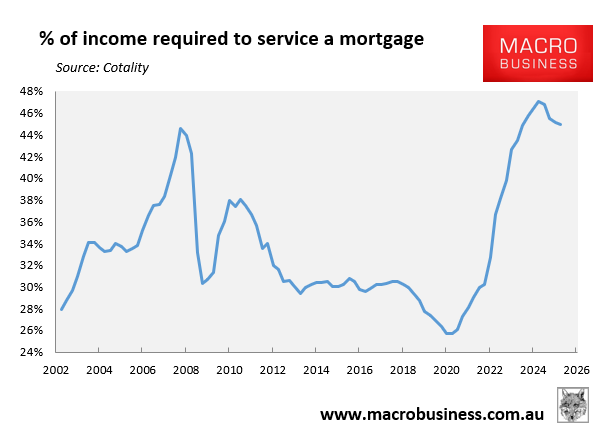

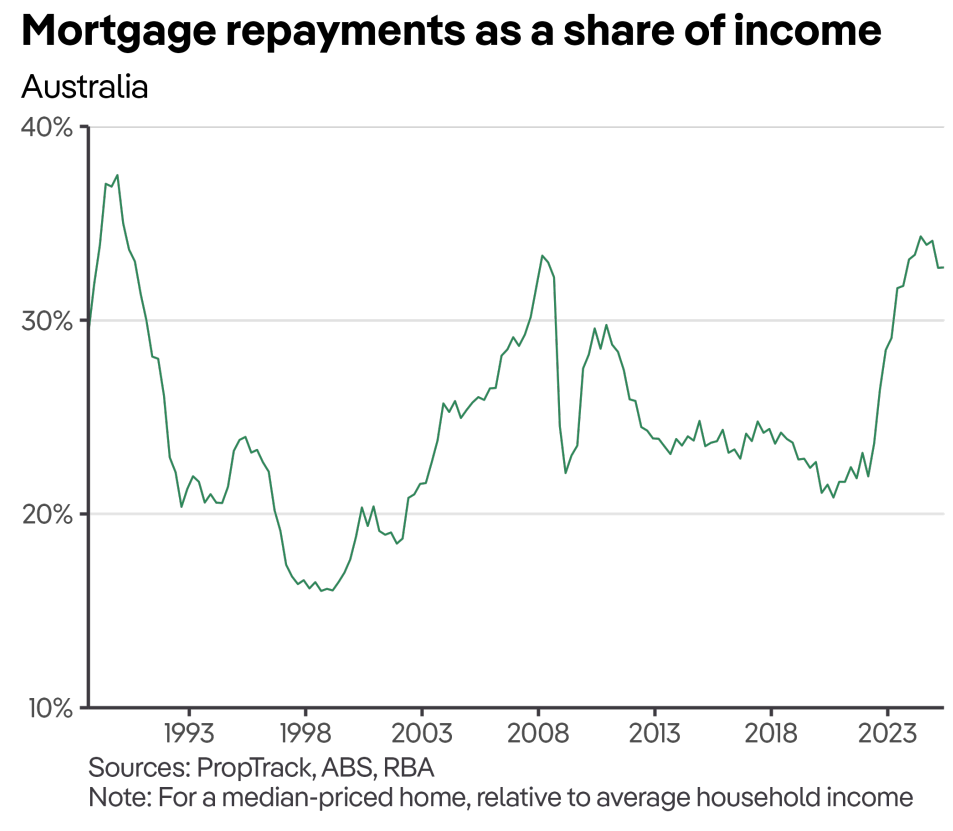

The amount of income required to service a new mortgage on a median-priced property has also increased, reflecting growing prices and interest rates.

Nationally, a median household purchasing a new median-priced home needs to spend 45.0% of its income on mortgage repayments in Q3 2025, up from 25.7% in Q3 2020.

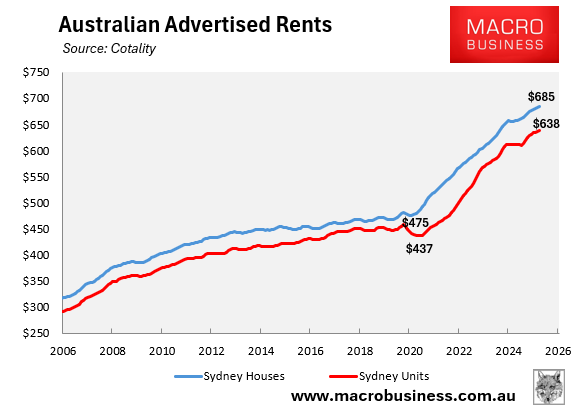

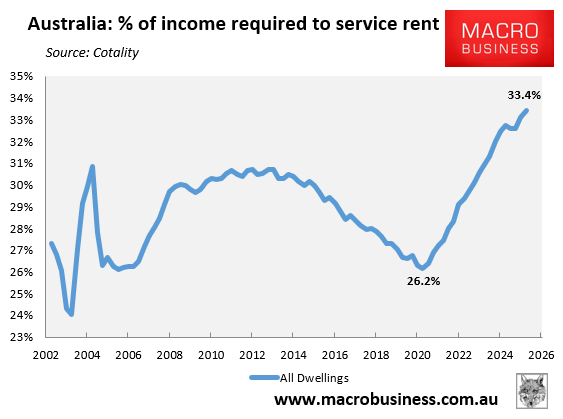

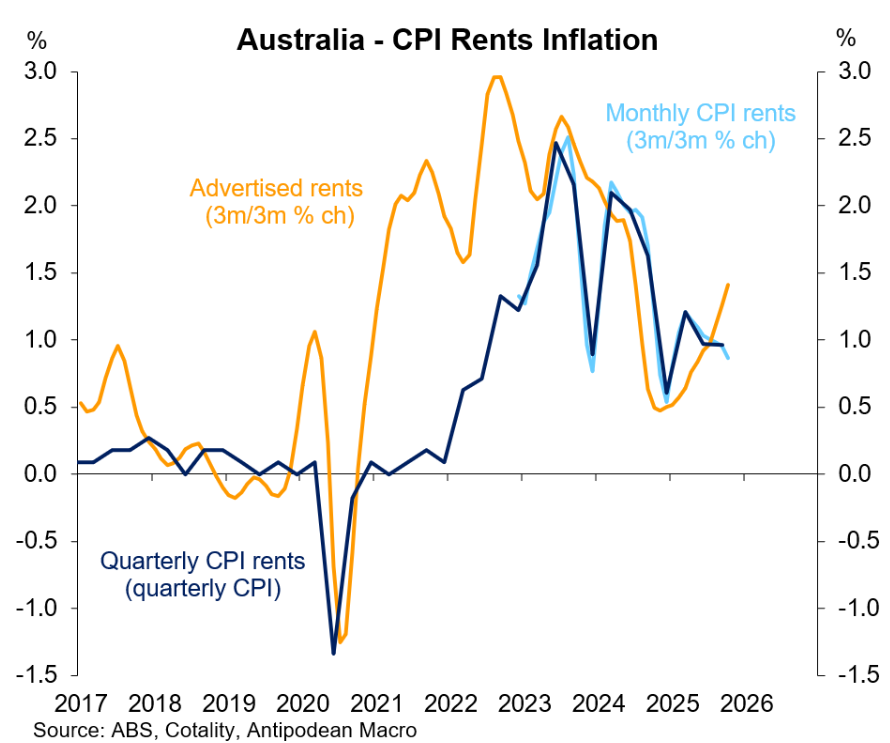

Rental affordability in Australia has also fallen to its lowest point on record.

Nationally, advertised rentals increased by 44% in the five years leading up to the third quarter of 2025.

As a result, the percentage of income needed to cover rental payments on the median dwelling has risen to 33.4% as of Q3 2025, up from 26.2% five years before.

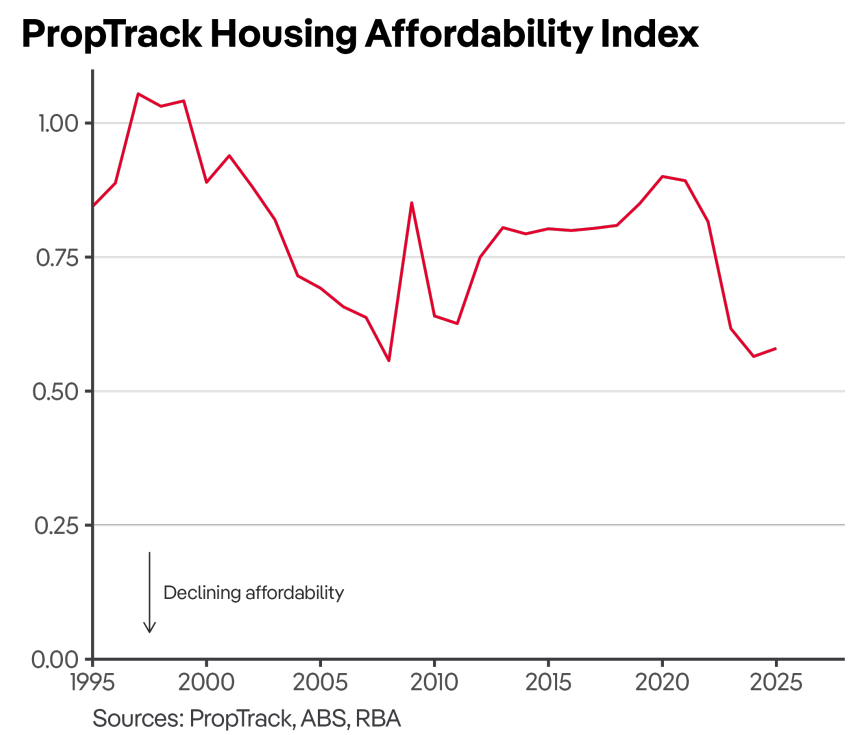

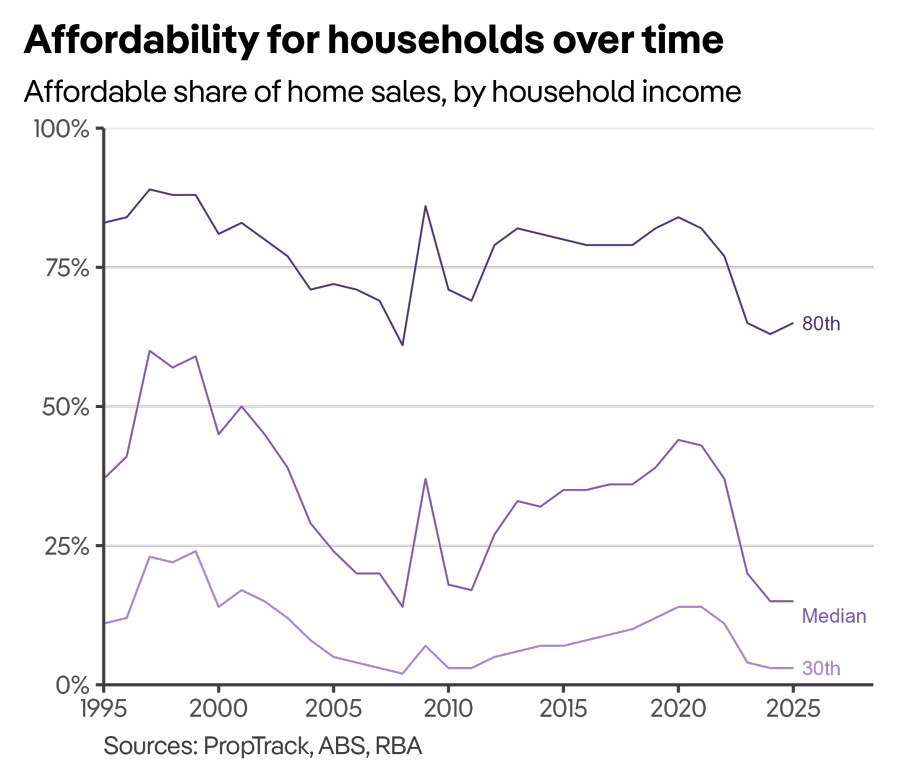

The PropTrack home affordability report shows a similar story.

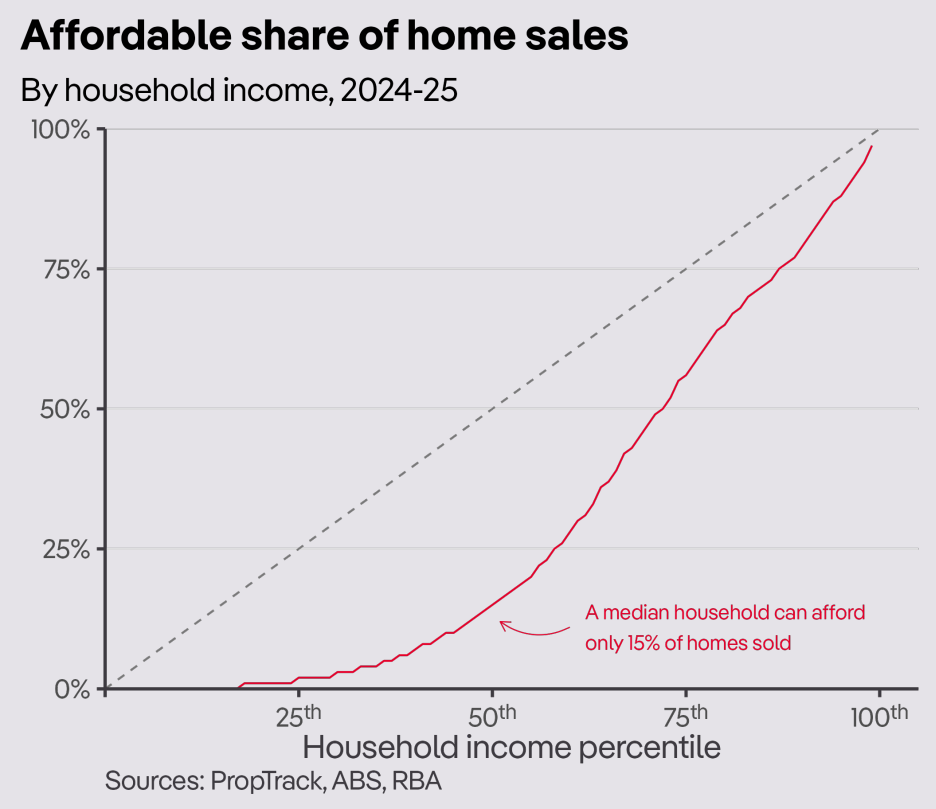

According to PropTrack, a median household could only afford 15% of homes sold in 2024-25, assuming a household spending 30% of their gross income on mortgage repayments, a 2.5% buffer for assessment above the most recent average new mortgage rate, and access to a 20% deposit and purchasing costs (such as stamp duty).

As a result, PropTrack’s home affordability index is hovering just above record low levels.

Lower-income households have the greatest affordability challenges, with a household at the 30th income percentile able to purchase only 3% of homes in 2024-25.

With property values rising, the RBA’s three interest rate decreases have contributed to a little improvement in purchase affordability.

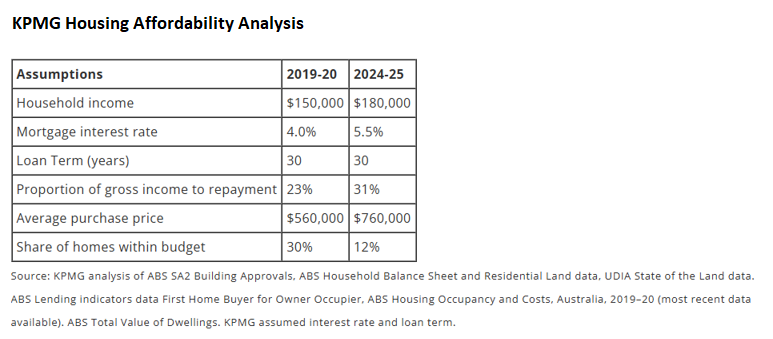

KPMG’s housing report tells a similar story

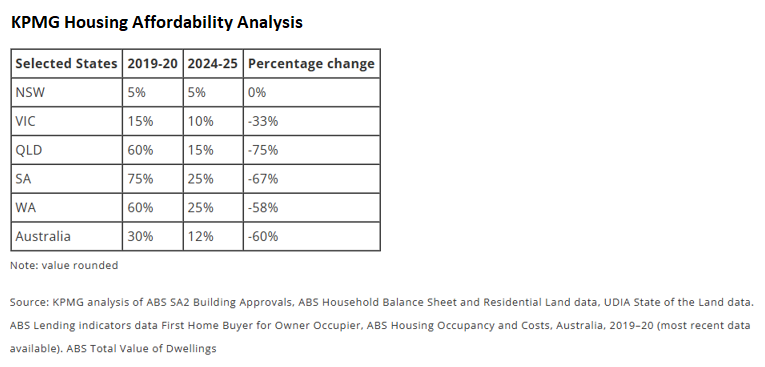

New research from KPMG shows that first-home buyers with an average household income of $180,000 can now afford to buy just 12% of homes that are for sale nationwide. This compares with 30% of homes in 2019-20, when the average household income was $150,000.

KPMG’s analysis also shows that the average price paid by first-home buyers has increased by $200,000 over the last five years, to $760,000.

“In just five years, the face of first-home buyers has changed dramatically. Median home prices continue to soar, but average first home buyers aren’t targeting median priced homes”, KPMG Urban Economist Terry Rawnsley said.

To nobody’s surprise, NSW has the most expensive housing in the nation, although affordability for first home buyers hasn’t worsened over the past five years.

“The fact the pool of affordable properties in NSW remains unchanged over 5 years despite house price increases suggests it may have reached the limit of unaffordability”, Rawnsley said.

Terry Rawnsley added that rising house prices may prompt young couples to economise by purchasing a home with fewer bedrooms, which in turn could make them decide to have fewer children than they had intended.

KPMG also noted that the amount of new housing supply priced at $800,000 or lower has steadily declined. In 2024-25, approximately 12% of new dwellings were within this price range, compared to about one-third in 2022-23.

“Rising construction costs and higher interest rates have reshaped the housing market. Since 2022, a wave of builder insolvencies has pushed developers to pivot toward premium, high-end projects. These dwellings may be fewer in number, but they’re easier to sell and carry lower financial risk, marking a clear shift away from affordable housing supply”, Rawnsley said.

Affordability outlook remains poor:

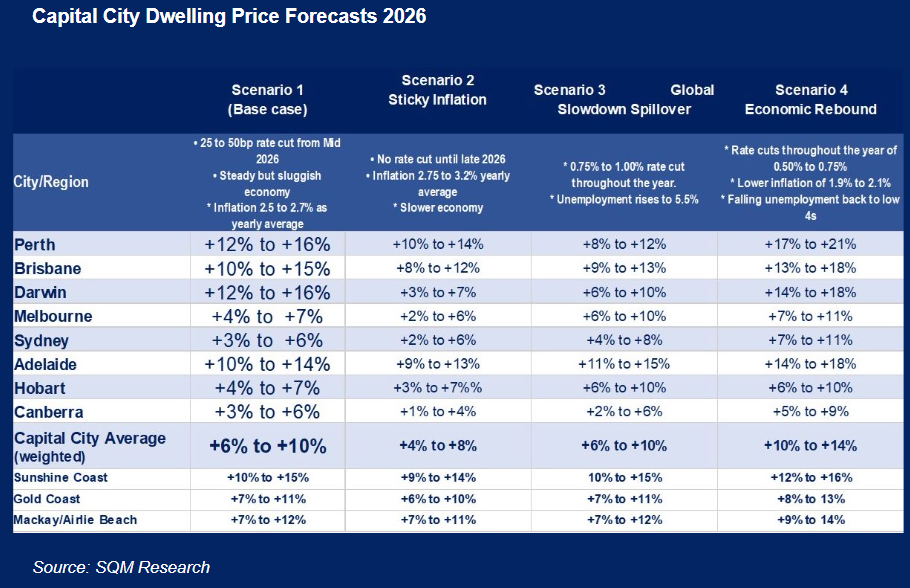

SQM Research forecasts that dwelling values will grow faster than incomes in 2026, whereas the RBA is expected to keep interest rates on hold for the foreseeable future.

As a result, purchase affordability will inevitably decline in 2026.

Cotality has also reported record low rental vacancy rates and rising advertised rents, which should worsen rental affordability in 2026.

In short, the housing affordability situation in Australia is set to worsen in 2026.