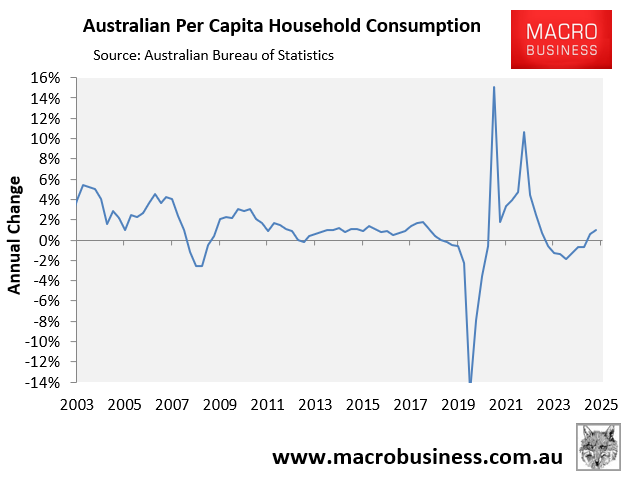

Wednesday’s Q3 national accounts release from the Australian Bureau of Statistics (ABS) reported fairly modest real per capita household consumption growth of only 0.1% for the quarter and 1.0% annually.

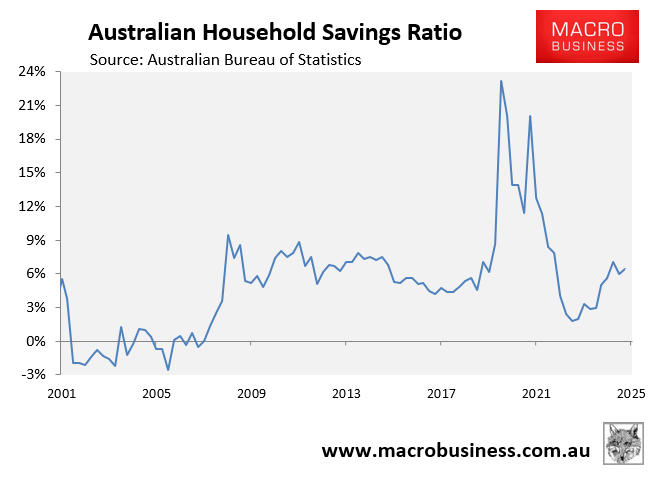

The national accounts also reported a lift in the household savings rate to 6.4%:

Viewed in isolation, this data would have soothed RBA concerns that consumers are lifting their spending excessively in response to the three rate cuts already delivered and rising asset prices.

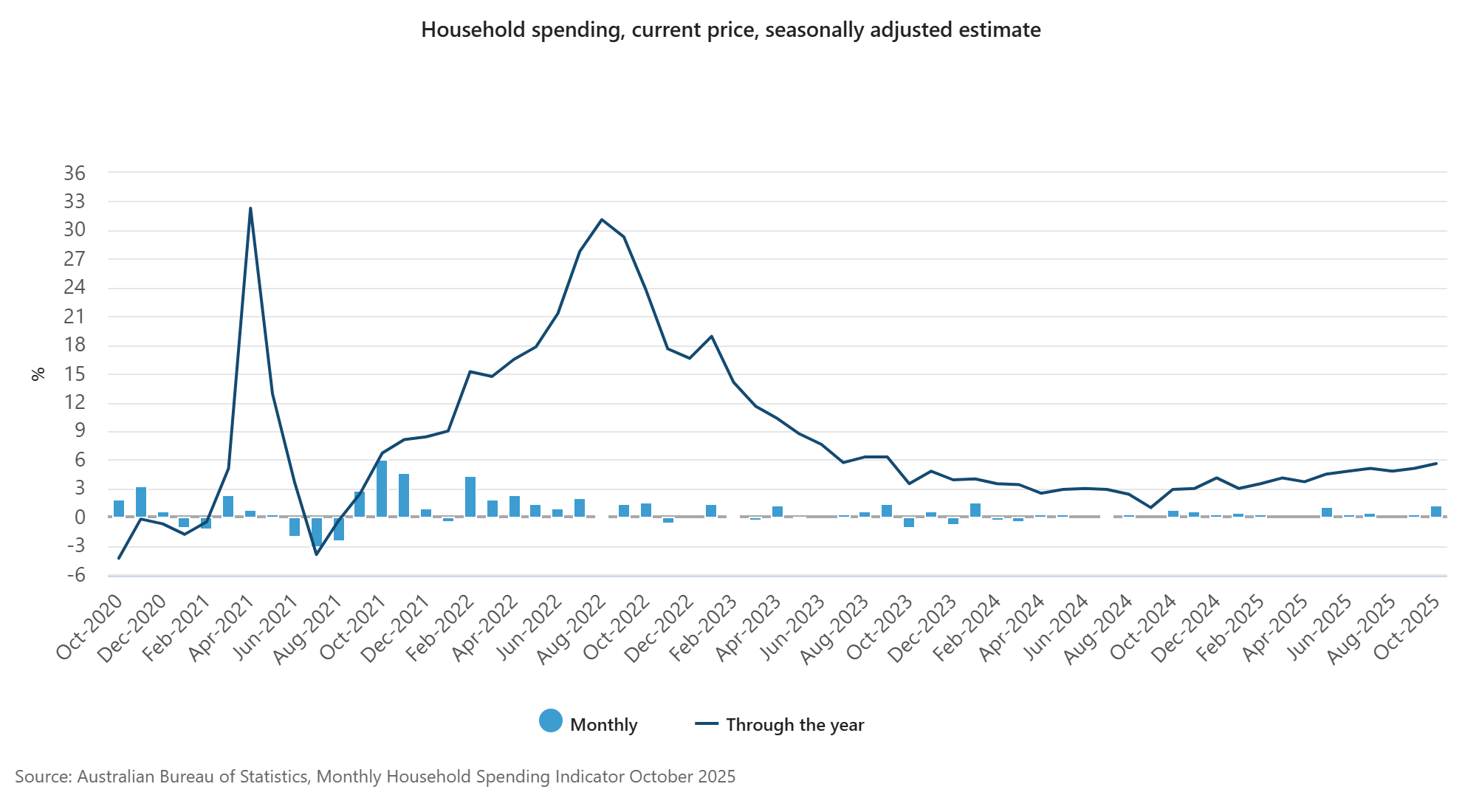

However, Thursday’s Household Spending Indicator (HSI) from the ABS showed that spending accelerated in October, recording its strongest monthly rise (1.3%) since January 2024, to be tracking 5.6% higher year-on-year.

However, the ABS noted that spending was boosted by promotional events (i.e., early sales). Services spending was also boosted by “Major concerts and cultural festivals”.

“Discretionary spending surged this month led by goods as promotional events saw households spend more on clothing, footwear, furnishings and electronics following months of weaker spending in these categories”, Tom Lay, ABS head of business statistics, said.

“Services spending also rose in October, as major concerts and cultural festivals drove up demand for catering, hospitality and hotel stays in major cities”.

Therefore, the jump in spending may be an aberration. Even so, it is another data point arguing against further rate cuts from the RBA.