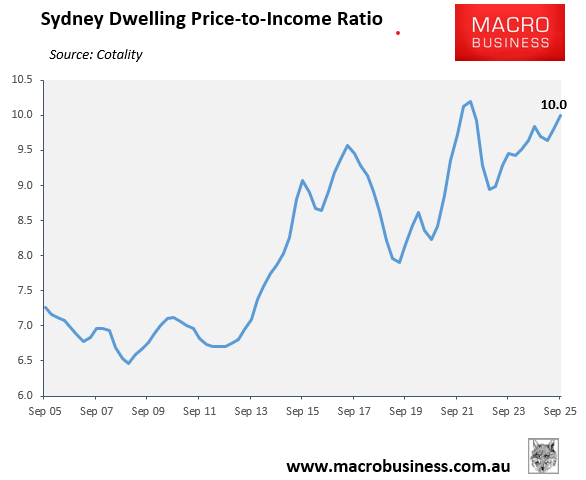

Cotality’s September housing affordability report showed that Sydney’s housing market was easily the most expensive in the nation, with a dwelling price-to-income ratio of 10.0.

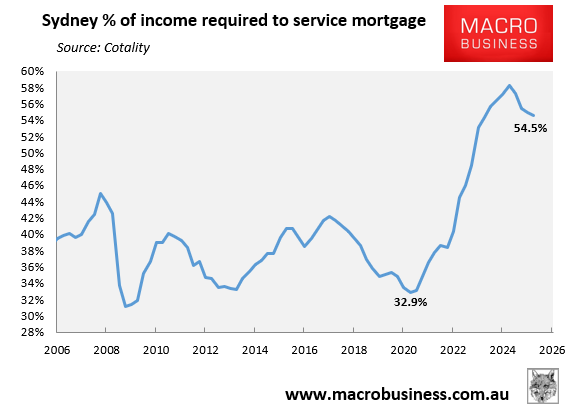

The percentage of median household income needed to service a mortgage on the median-priced Sydney home was also tracking at a historically high 54.5% in the September quarter, making Sydney housing extremely unaffordable.

With the Reserve Bank of Australia (RBA) now expected to keep interest rates on hold for the foreseeable future, Sydney home prices have begun to hit affordability constraints.

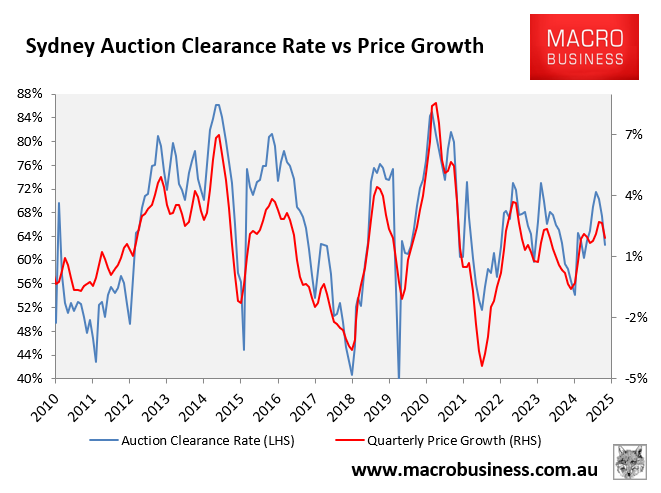

Sydney’s final auction clearance rates have fallen significantly from their recent peak, which has corresponded with a shift lower in price growth.

Sydney’s average monthly clearance rate peaked at 72% in August and fell sharply to 63% in November.

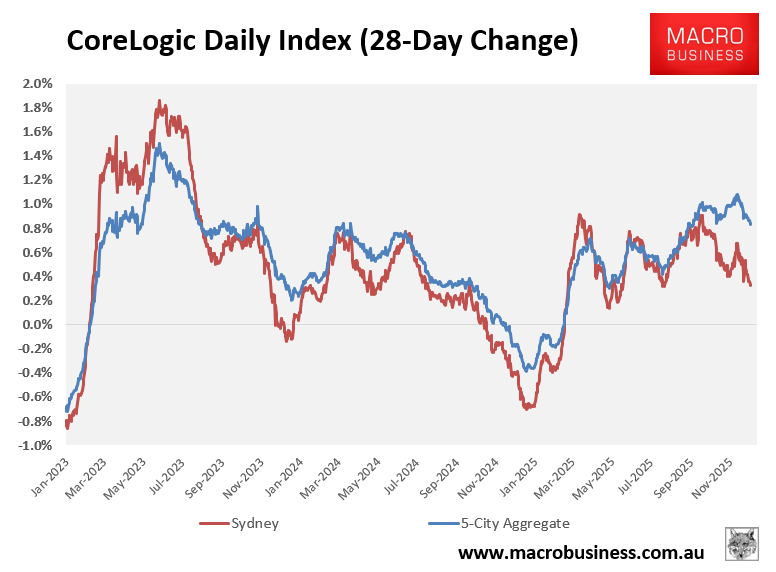

Growth in Cotality’s daily dwelling values index for Sydney has also slowed significantly, falling from a recent peak of 0.9% on a rolling 28-day basis to only 0.3% currently.

As illustrated above, Sydney’s dwelling value growth (0.3%) has diverged widely from growth at the aggregate 5-city level (0.8%).

Sydney’s slowdown was explained by leading Sydney auctioneer Tom Panos in last weekend’s market wrap:

“The real estate market that I operate in has changed. It has become easier for the buyer. There is less fear of missing out than what there was in September, August, even July”.

“Buyers are walking away. Why has there been a change in the market? Sentiment has changed because people are thinking interest rates are not going down”.

“The second reason is the stock supply increased dramatically. So those two things have meant that things aren’t blowing out and we are not having a crazy boom”…

“I’ve done a ring around to a lot of the auctioneers, including the chief auctioneer of the biggest group in Australia. It’s not just me. Overall, the last two weeks have been absolutely harder”.

The bottom line is that Sydney housing is too expensive. And without the prospect of further rate cuts, the ‘fear of missing’ (FOMO) that was powering the market has evaporated.