China plays the West for fools on energy and climate change

Eric Reguly, the European Bureau Chief of The Globe & Mail, has a timely article that explains how China is deceiving Europe on climate and energy policy.

Reguly argues that China’s continued reliance on cheap coal power gives it a decisive industrial advantage over Europe, where high electricity prices and strict climate policies are driving deindustrialisation.

While China promotes its green credentials through electric vehicles, solar panels, and wind technology, much of this production is still powered by coal, allowing it to dominate global trade while Europe struggles to balance decarbonisation with competitiveness.

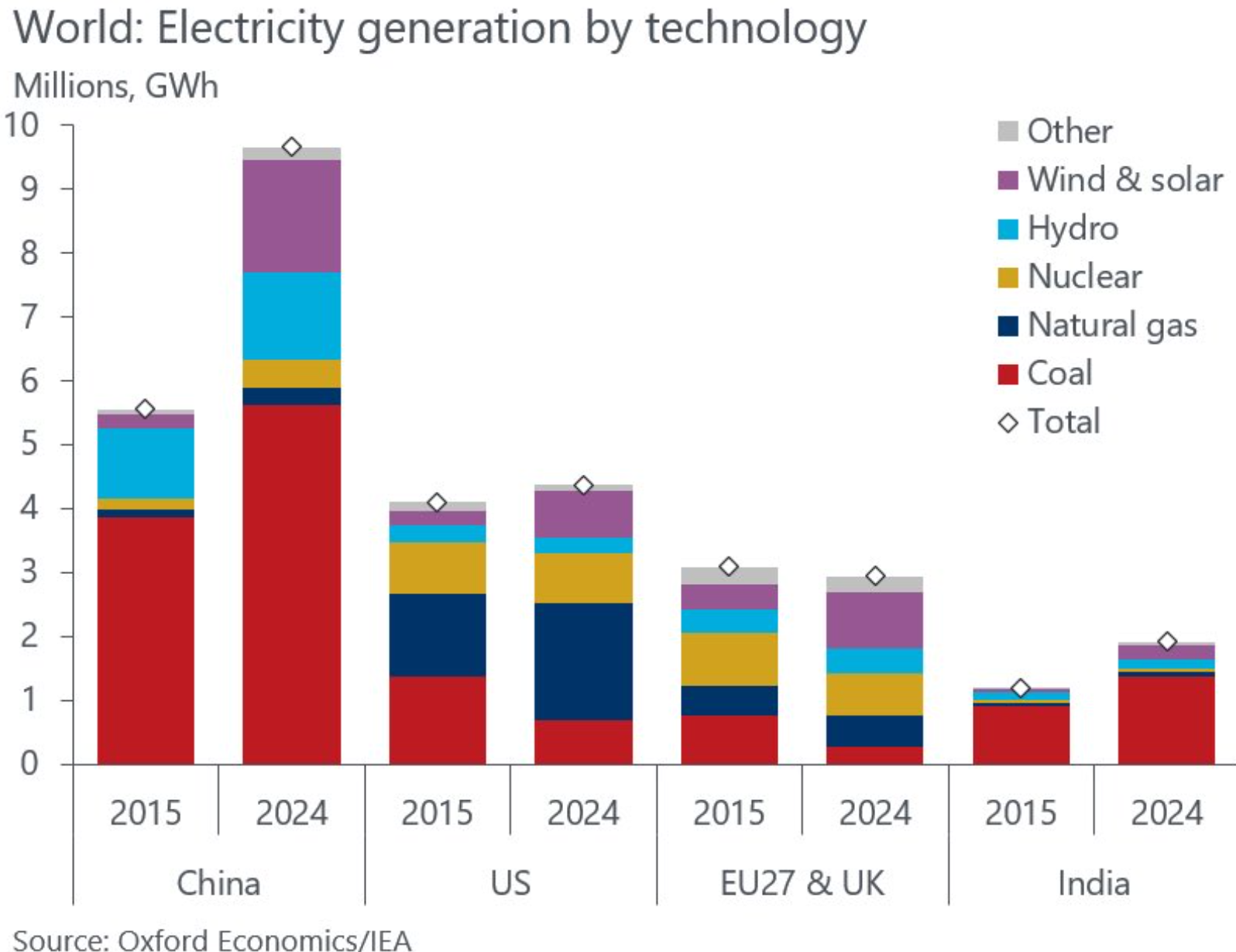

Reguly notes that coal still generates more than half of China’s electricity.

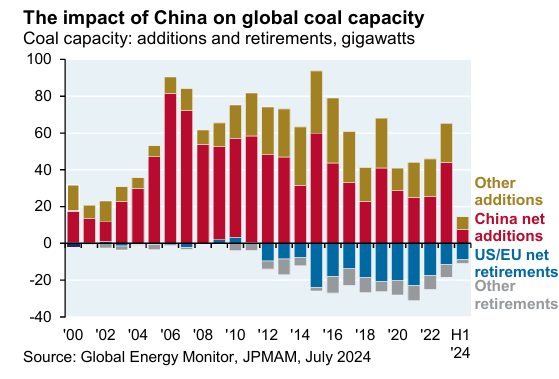

In 2024, China accounted for 93% of all new coal plant construction worldwide, adding nearly 95 GW of capacity. These coal plants are cheap, quick to build, and flexible in output, making them central to China’s energy security.

Cheap energy underpins China’s massive trade surplus, projected to exceed US$1 trillion in 2025. China dominates global production of EVs, batteries, solar panels, and wind components, but much of this is powered by fossil fuels.

Meanwhile, the EU has spent decades winding down coal, with Poland the last major holdout (coal mines are set to close by 2049). Electricity prices in Europe are roughly twice those of the U.S. and 50% higher than China, crippling energy-intensive industries.

China presents itself as a green leader, with EVs making up nearly half of domestic car sales in 2024. Yet China’s carbon emissions continue to rise, overshadowing Europe’s climate gains.

Eric Reguly’s arguments are spot on.

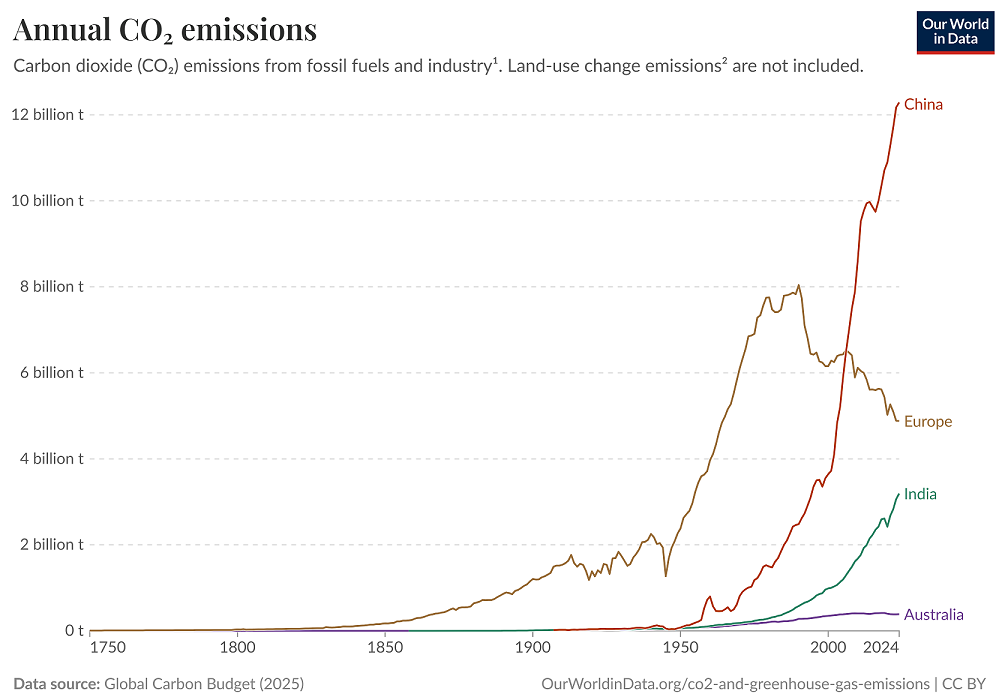

China accounted for nearly one-third (31.8%) of global carbon emissions in 2024. China alone also accounted for 63.5% of the rise in the world’s carbon emissions between 1999 and 2024.

The chart below from Oxford Economics shows the various sources of electricity generation across major economies.

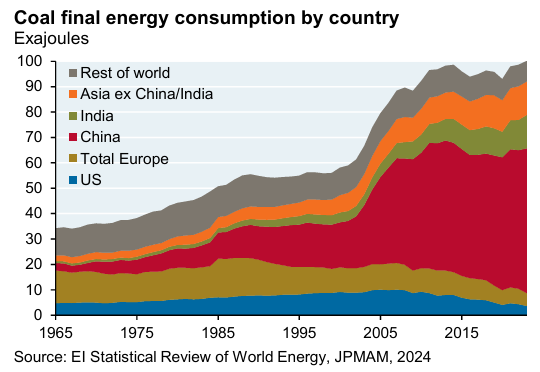

While the developed world has moved away from coal over the last decade, China has massively increased its coal consumption.

China alone has added more coal-fired generation than the rest of the world has decommissioned.

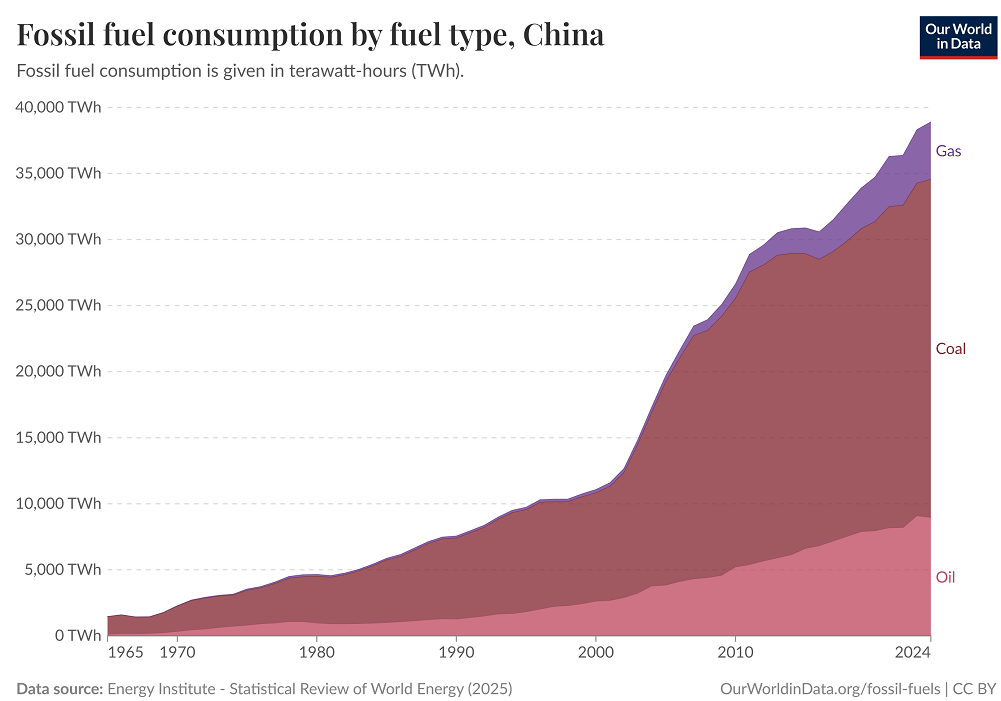

Despite its green claims, China’s coal consumption has soared:

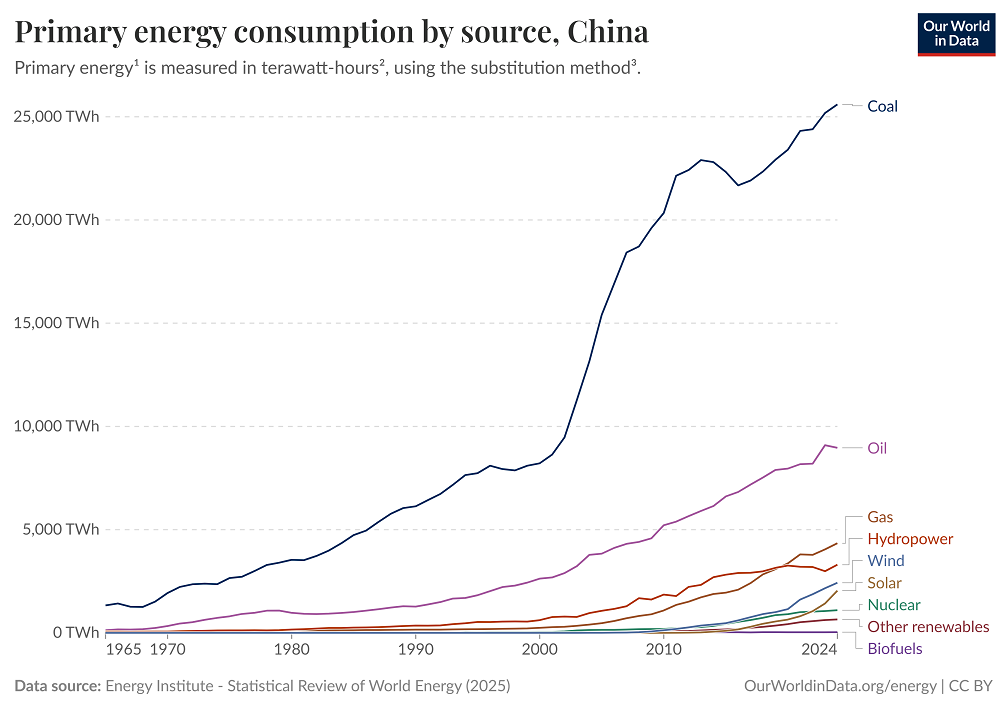

China’s electricity grid is dominated by coal, dwarfing renewables in both absolute terms:

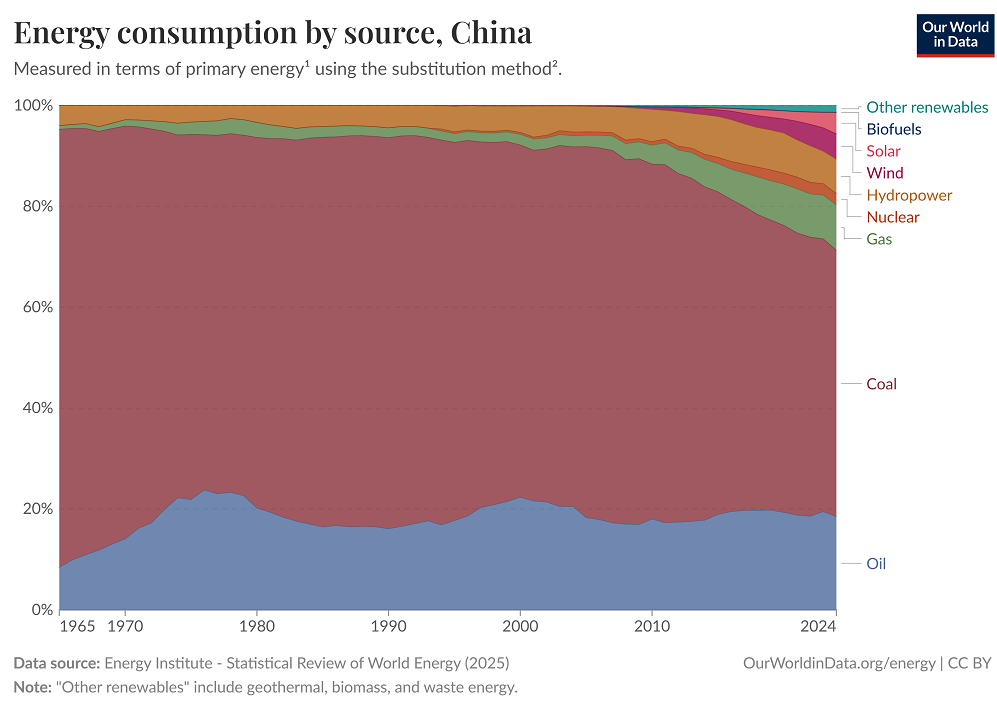

As well as by share:

China is also playing Australia for a fool.

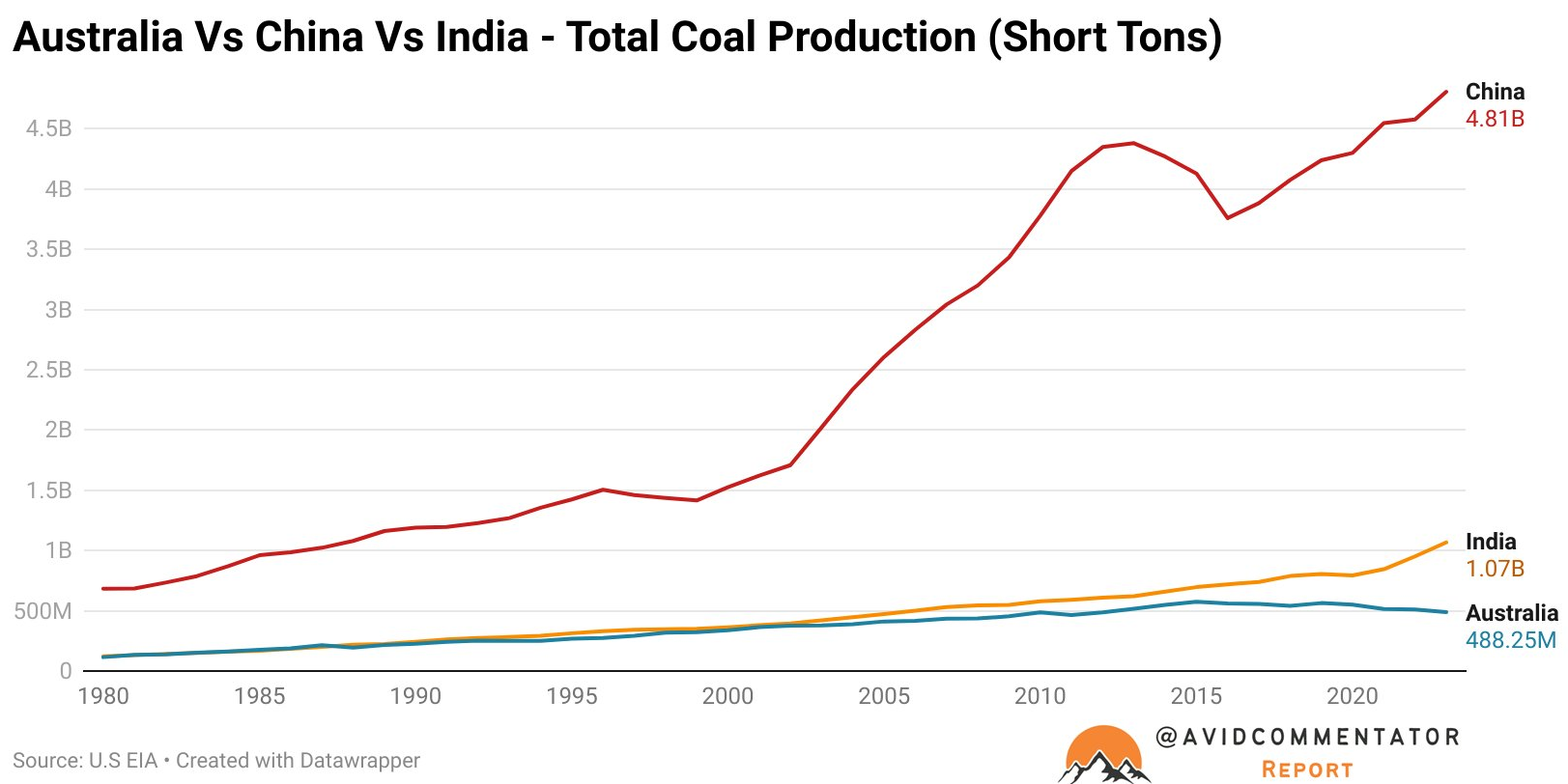

China produces around ten times more coal than Australia.

Australia exports seven times more coal than it consumes, a significant share of which goes to China, which is increasing its energy use and growing its emissions.

Australia also exports four times more gas than it consumes, much of which goes to China.

Australia should abandon its ‘net zero’ commitment, provide itself reliable and affordable power, and use more coal and gas at home rather than exporting it to China to burn.

Global carbon emissions would remain stable if Australia used more coal and gas itself and exported less. Our economy and living standards would not suffer as a result of unreliable and expensive energy.

The costs of climate change will arrive regardless of what Australia does.

The alternative is to pursue the ‘net zero’ fantasy, drive up power bills, increase costs and inflation across the supply chain, and watch as Australia’s remaining manufacturing industries close and move offshore to places like China.

Rationing energy use ultimately rations growth and living standards and will result in the complete deindustrialisation of Australia.

China’s leaders understand this fact. Australia’s policymakers do not. We need to wake up to this reality.