Drive.com.au published interesting data showing the decline in battery electric vehicle (BEV) sales in Australia despite massive subsidies from governments.

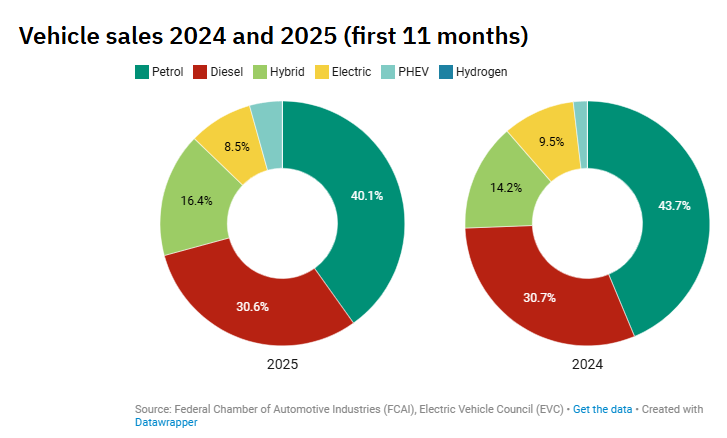

Over the first 11 months of this year, only 8.5% of vehicles sold were BEVs, down from 9.5% over the same period in 2024:

Internal combustion engine (ICE) vehicles accounted for 70.7% of vehicle sales in 2025, down from 74.4% in 2024. In contrast, the share of hybrid vehicles, including both standard and plug-in models, increased to 20.7% in 2025 from 16.1% in 2024.

The decline in BEV share is extraordinary given that Australia’s governments have spent literally billions of dollars to subsidise their purchase and running costs, with most of the benefits flowing to higher-income earners.

Introduced in 2022, the fringe benefits tax (FBT) exemption is aimed at making BEVs more affordable for employees through salary packaging and novated leases.

The Australian Treasury initially expected the FBT exemption for BEVs to cost the federal budget around $200 million annually. However, now the Treasury estimates the scheme to cost over $1 billion a year in forgone revenue.

Nearly half of the tax benefits have gone to those earning more than $150,000, raising equity concerns.

The total cost of the FBT exemption for BEVs is now forecast by the Treasury to increase to $9.7 billion between 2026-27 and 2029-30 as the number of BEVs grows.

BEVs are eligible for a higher luxury car tax threshold than ICE vehicles.

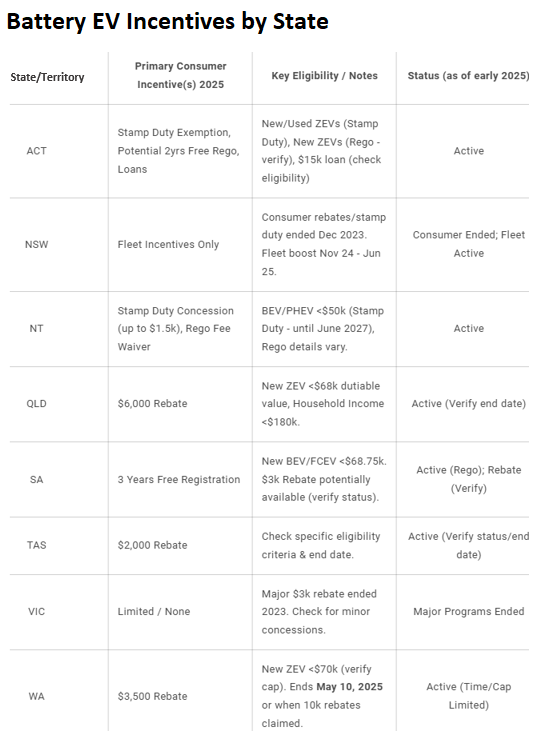

Several Australian states and territories also offer direct subsidies, stamp duty exemptions, and registration discounts for battery BEVs.

BEVs are exempt from road user fees, including the 51.6 cents per litre fuel excise.

With over 300,000 BEVs now on Australian roads, the cumulative loss in excise revenue is substantial—estimated to be in the hundreds of millions of dollars annually. This loss of excise revenue will only grow in tandem with the number of BEVs on Australian roads.

Finally, the federal government’s New Vehicle Efficiency Standard (NVES) is designed to force Australians into buying BEVs by taxing new ICE cars out of existence.

Given the enormous carrots and sticks deployed by governments, it is hard to believe that BEV demand remains so low.

Australia’s governments ought to quit wasting limited public funds on subsidising private vehicle purchases.

Wealthy inner-city residents receive the majority of these subsidies, exacerbating inequality and costing the federal and state governments billions in lost tax revenue as they grapple with mounting debt.

Furthermore, if BEVs were superior to ICE and hybrid cars, buyers would prefer them because they are a better product.

Since BEVs cannot compete with ICE or hybrid automobiles on an equal basis, car leasing companies and EV advocates have consistently called for more subsidies, incentives, tax breaks, and outright bans on ICE vehicles in an effort to “encourage” people to switch to BEVs.

It’s time for the government to stop providing subsidies and let the market and customer preferences determine which vehicles are bought.