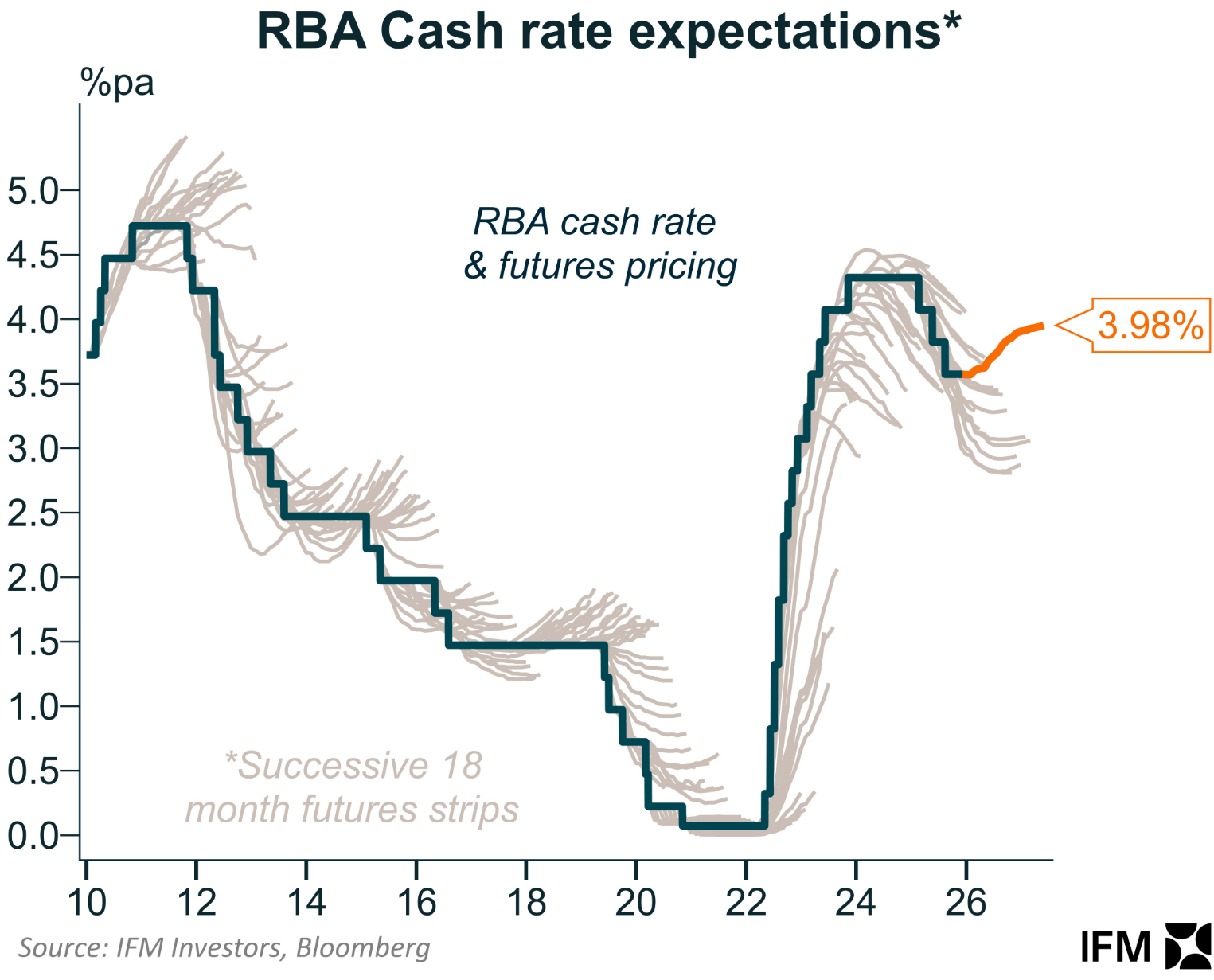

Before Tuesday’s interest rate decision, financial markets anticipated that the Reserve Bank of Australia (RBA) would deliver one more 25-bp rate hike in 2026 amid rising inflation concerns.

Tuesday’s NAB Business Survey for November suggested that Australia’s inflation is not as broad-based as thought and also pointed to a further softening of the labour market—both of which should comfort the RBA.

As illustrated below by Shane Oliver from AMP, both business confidence and conditions softened in November as rate cut hopes evaporated:

Source: Shane Oliver (AMP)

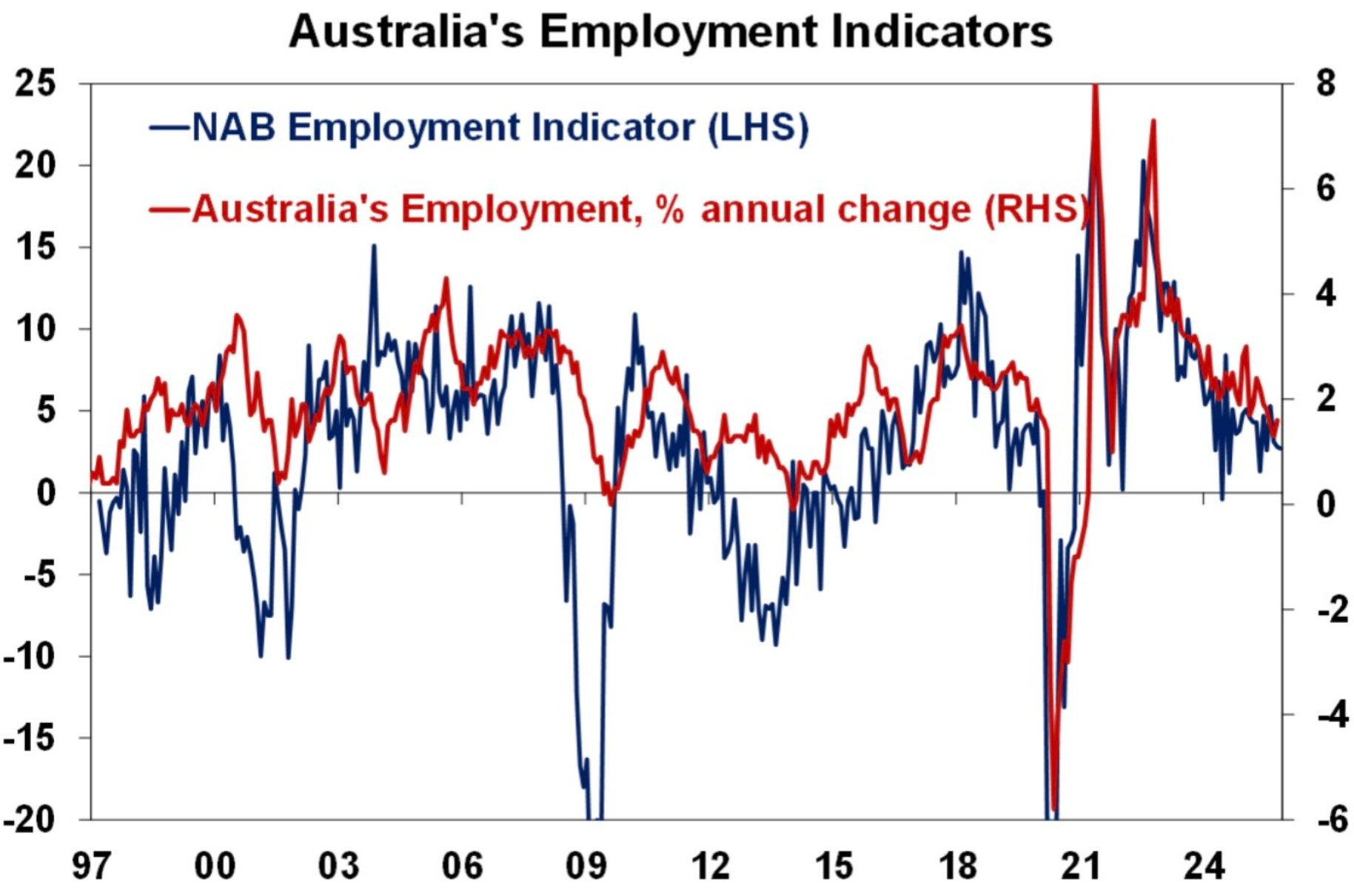

Employment continues to point to softer job growth:

Source: Shane Oliver (AMP)

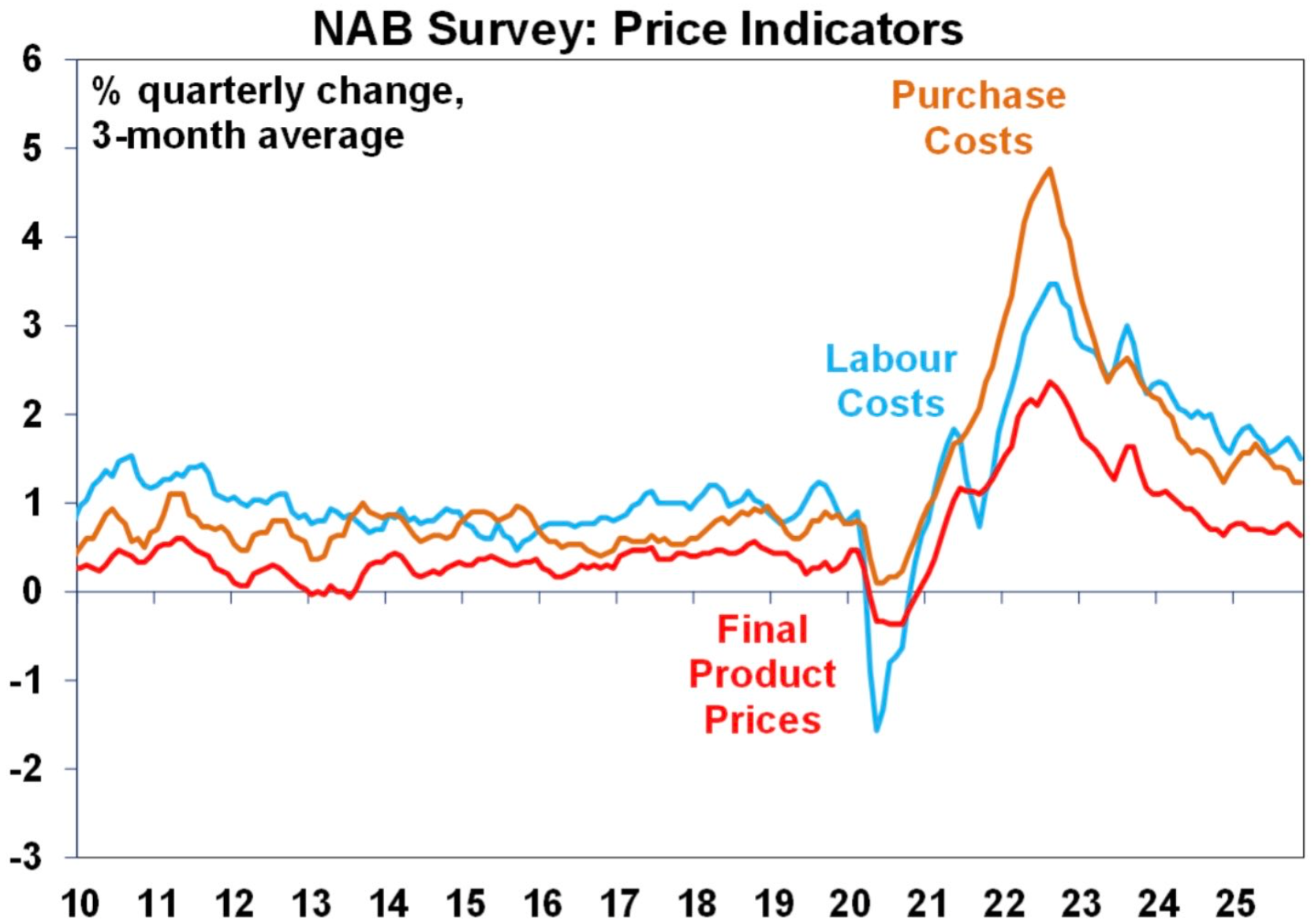

Cost pressures also continue to trend down, with final product prices at a benign 0.6% over the quarter, suggesting CPI inflation may slow:

Source: Shane Oliver (AMP)

Westpac economist Ryan Wells summarised the result as follows:

“Given the fact that a large portion of the recent lift in official inflation has been driven by administered prices, today’s data suggests that market-side demand-driven inflation is not as grave of a concern”.

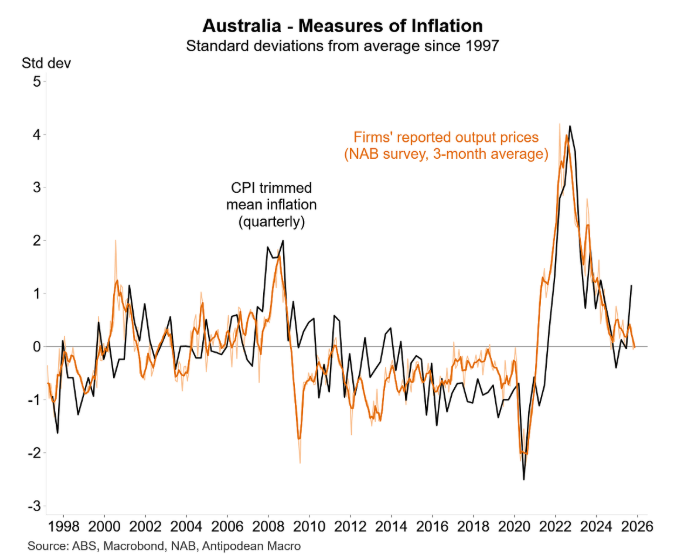

As illustrated below by Justin Fabo from Antipodean Macro, “surveys of firms’ output price inflation are giving quite different signals to the available information from the monthly CPI and the implications for Q4 trimmed mean inflation nowcasts”:

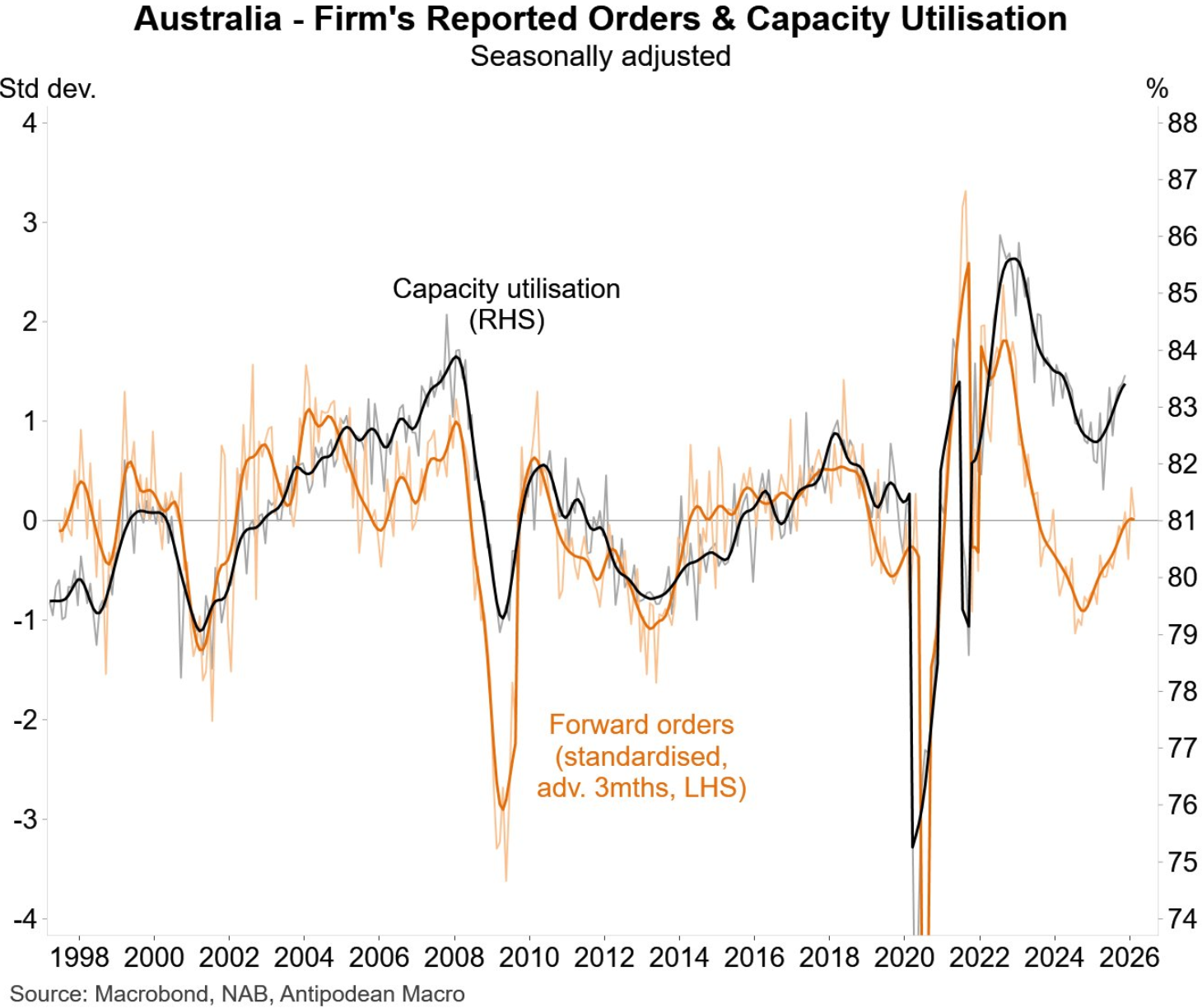

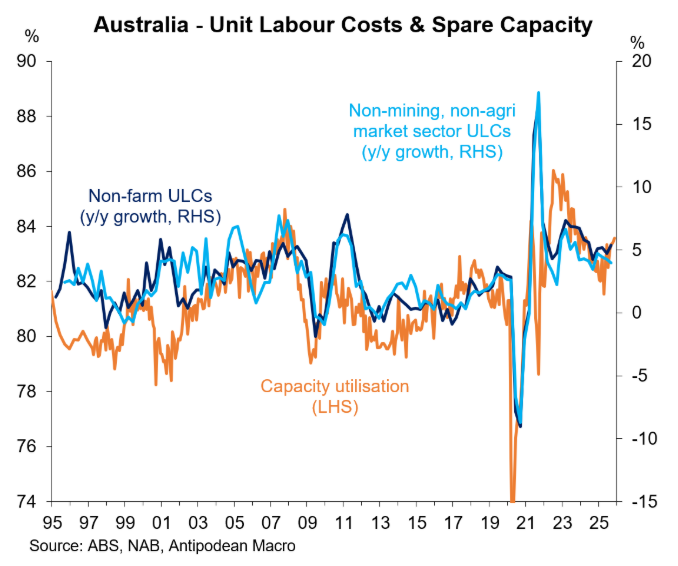

More alarmingly, the below chart from Fabo plotting forward orders and capacity utilisation suggests that “Australia’s potential growth rate has fallen a lot”:

“The increase in firms’ capacity utilisation is a warning that strong unit labour cost growth may be here to stay in at least the near-term”, argues Fabo.

The above charts from Fabo highlight why Australia desperately needs stronger productivity growth to boost the supply-side of the economy and expand the nation’s growth potential.

Without stronger productivity growth, the Australian economy risks being stuck in stagflation.