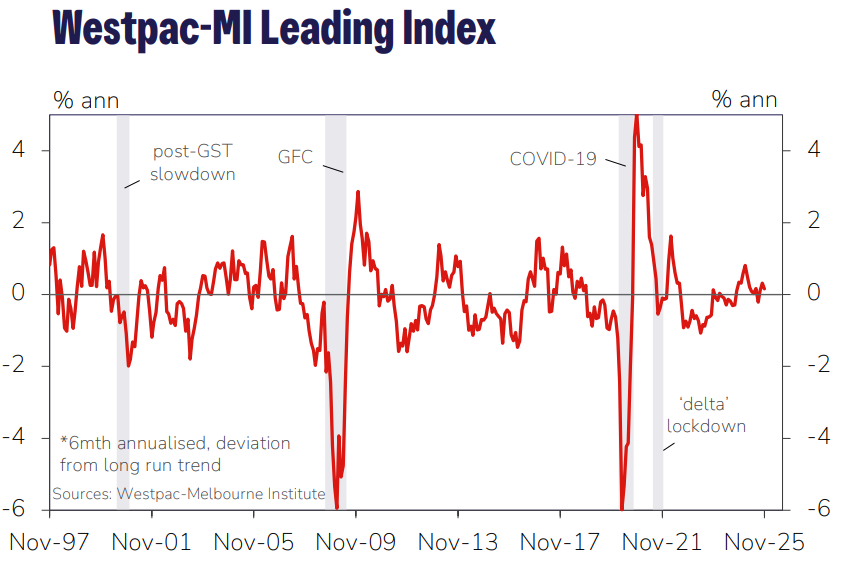

The Westpac–Melbourne Institute Leading Index has been released, showing that Australia’s forward-looking economic momentum has slowed, with the six‑month annualised growth rate easing to +0.16% in November from +0.32% in October.

While still positive, the index signals subdued growth over the next 3–9 months, reflecting share market volatility, weaker consumer expectations, and softening labour market indicators.

Westpac expects GDP growth to lift only marginally from 2.1% in 2025 to 2.4% in 2026, around trend.

Momentum remains “positive but subdued”, Westpac says.

The interest rate outlook remains the key risk to the growth outlook.

Westpac has revised its interest rate forecasts, now tipping no change next year (previously Westpac tipped two rate cuts).

“There are risks on both sides of our base case view”, chief economist Luci Ellis said. “We reserve the option to put rate cuts in 2026 back on the table if the labour market starts to unravel”.

“We think that rate hike talk is premature. We cannot rule out that more near-term bad news on inflation spooks the RBA and induces a near-term hike, but in our view, it is not the most likely outcome”.

“If it does happen, though, our forecasts for growth, the medium-term inflation outlook and the labour market would need to be revised down, and a subsequent reversal of that policy tightening would be in play in 2027”.