The Australian Bureau of Statistics (ABS) has released the Q3 2025 national accounts, which reported a 0.4% rise in headline GDP over the quarter and a 2.1% rise through the year.

The result disappointed analysts’ expectations, which had tipped a quarterly rise in GDP of 0.7% and an annual increase of 2.2%.

The result was also below the RBA’s expectations, which had pencilled in around 0.55% quarterly growth in the November Statement of Monetary Policy.

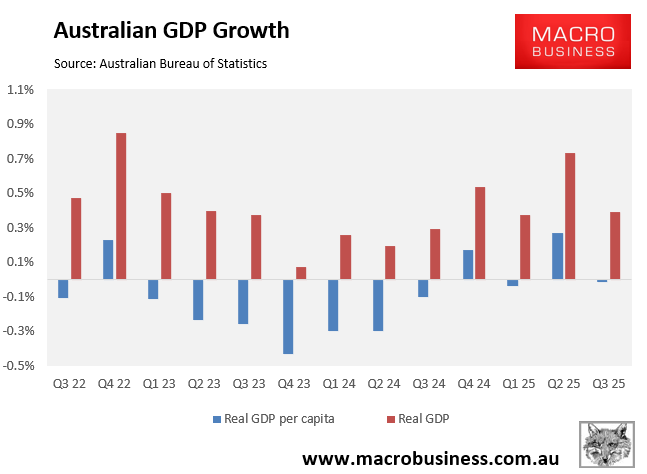

In real per capita terms, GDP fell ever so slightly (-0.01%) and has fallen for 10 out of the past 13 quarters (albeit the last two quarterly falls were very small):

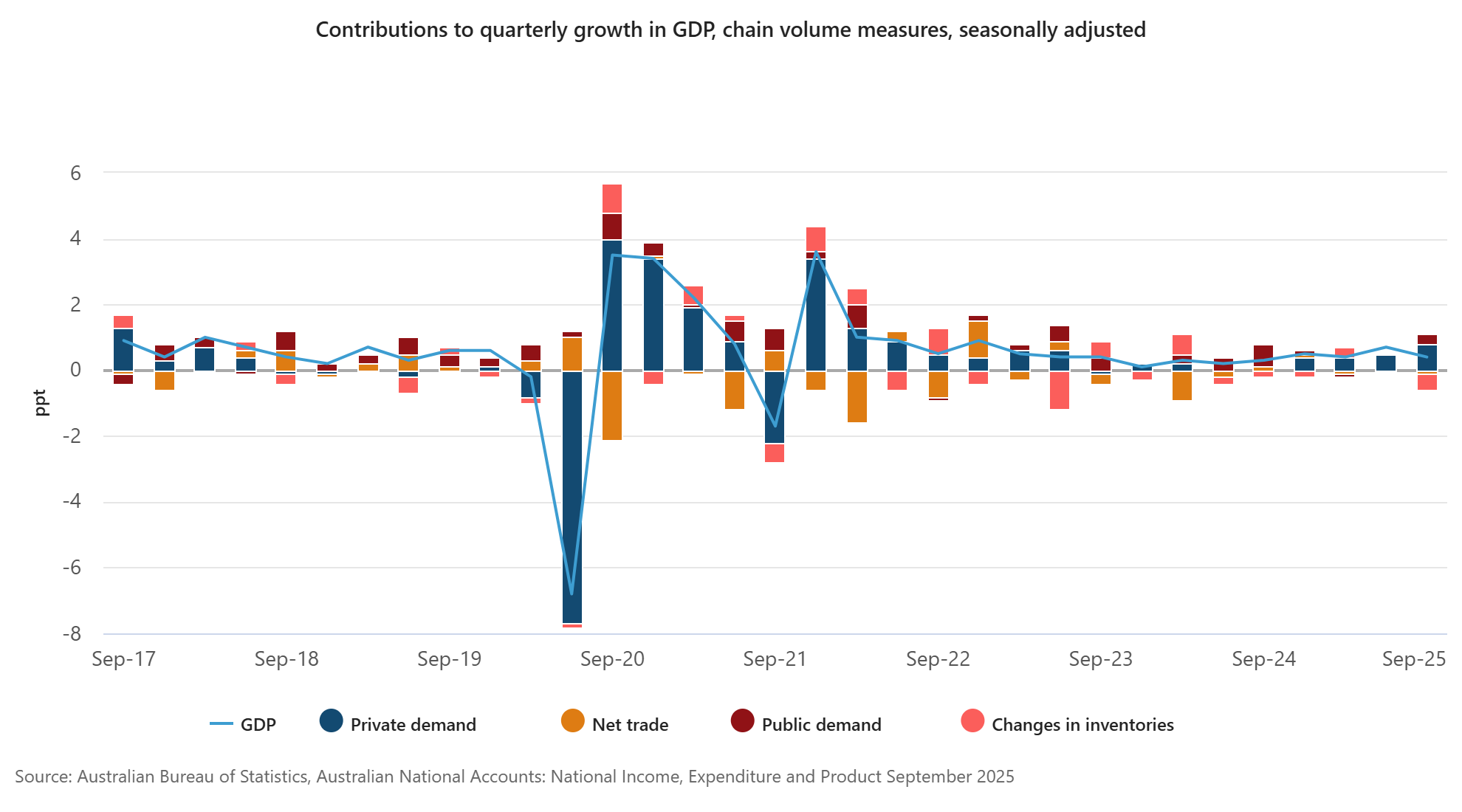

Domestic final demand contributed 1.1 percentage points to GDP growth.

Private demand led the contributions to growth through private investment (+0.5ppt) and household consumption (+0.3ppt). Public demand continued to support growth through government expenditure (+0.2ppt) and investment (+0.2ppt).

Net trade detracted 0.1 percentage points from GDP growth, as the rise in imports of goods and services (+1.5%) outpaced exports (+1.0%).

Changes in inventories detracted 0.5 percentage points from GDP growth.

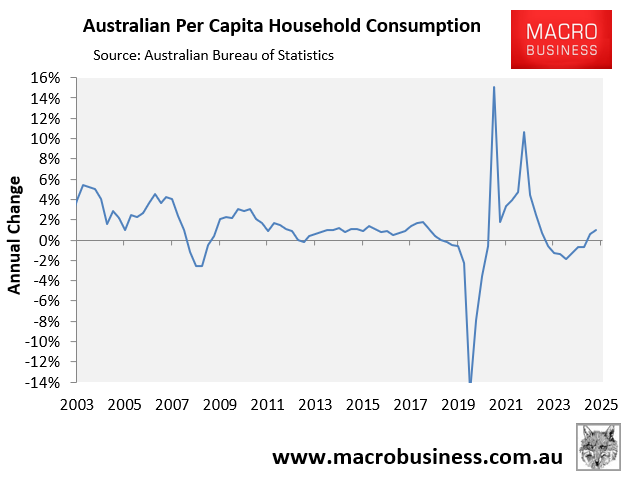

For mine, the most important reading was the soft rebound in real per capita household consumption, which rose by only 0.1% in Q3 2025 and was only 1% higher year-on-year:

The soft result should quell some of the howling from interest rate hawks demanding that the RBA hike rates.