Like other advanced nations, Australia is facing pressures from an ageing population.

The federal government has tried to mitigate these ageing pressures by running a high immigration policy to mitigate labour shortages and increase the number of taxpayers.

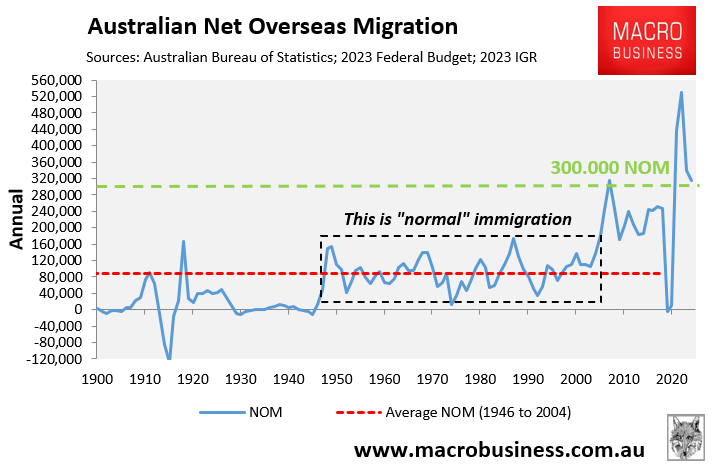

Former senior immigration department bureaucrat Abul Rizvi believes that Australia’s annual net overseas migration will average 300,000 under current immigration policy settings. Such an immigration level had only ever been achieved once in Australia’s history before the pandemic: in 2008-09 under “Big Australia” Kevin Rudd:

Australia’s high immigration policy has unambiguously failed. The wrong skills have been imported, making shortages worse. Housing and infrastructure have also been severely strained under the population surge, reducing liveability and productivity.

Rather than importing more people, a better solution to Australia’s ageing problem is to simply abolish the age pension income means test, which punishes pensioners with high effective marginal tax rates for undertaking paid employment.

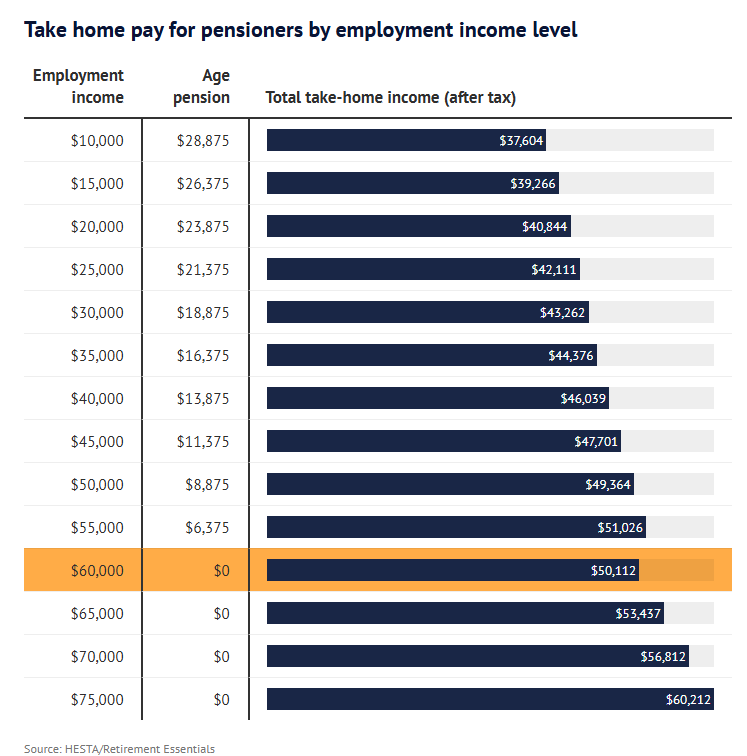

Research carried out by Retirement Essentials for industry super fund HESTA has found that people who are working and receiving the aged pension face effective marginal tax rates of as much as 77%.

Older Australians are being penalised for working later in life at a time when not only are there more people who want to keep working longer, but there is also a growing number of people who have to work longer because they need to. Such high tax rates primarily affect this second group.

“Nobody else is paying these rates”, Jeremy Duffield, a former managing director at Vanguard and director of Retirement Essentials, says.

“The situation creates a powerful disincentive for older Australians to supplement their retirement income and contribute to the workforce”.

“Older people need an incentive to work. With current arrangements, I struggle to see why some people even bother”.

New Zealand’s over-65s account for a stunning 25% of the labour force, compared to around 14% in Australia. Only about 3% of Australian age pensioners work.

The fact that the pension is not means-tested and is open to anybody over the age of 65 explains the high participation rate among New Zealand’s senior population. As a result, older Kiwis who work more don’t forfeit their pension; instead, they pay tax on their higher wages.

The Netherlands and Denmark, two other top pension systems, have defined benefit programs, or universal basic pensions, and seniors work at significantly higher rates than in Australia.

Australian policymakers should meet New Zealand halfway by maintaining the pension assets means test while eliminating the income means test. This would allow pensioners to work without incurring financial penalties.

According to research from National Seniors Australia:

- Fewer than 76,000 pensioners (3%) currently work, but many would work (or work more) if they did not lose half their earnings when they work more than one day a week.

- Exempting work income from the Age Pension income test could benefit two million pensioners with limited wealth, alleviating pensioner poverty.

- The policy could see up to 400,000 pensioners available to fill critical labour shortages across the country.

Rather than importing hundreds of thousands of migrants every year to address labour shortages, which puts undue strain on infrastructure, housing, and the environment, Australia should utilise its existing labour force more effectively by making better use of retirees who want to work. Changes in pension rules can achieve this by reducing punitive effective marginal tax rates.

This simple policy change would bolster the economy and alleviate poverty while avoiding the negative consequences of excessive immigration-driven population growth.