The Victorian government’s recent tax changes—including higher land taxes, expanded levies, and reduced thresholds—have discouraged property investment by significantly increasing holding costs, reducing returns, and prompting thousands of investors to sell or avoid new purchases.

In particular, the tax‑free threshold was cut from $300,000 to $50,000, meaning far more investors are now liable for land tax. Marginal rates for owners with multiple properties were also raised, hitting portfolio investors hardest.

The property industry has argued that this exodus of investors has reduced rental supply, driving up rents for tenants.

However, the latest Victorian Government rental report challenges this view.

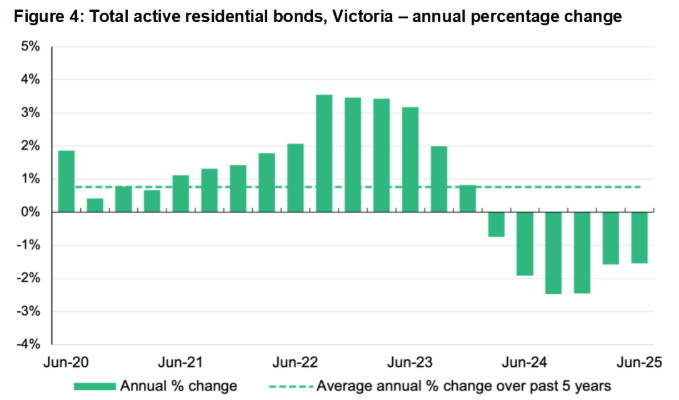

As illustrated below, the number of rental bonds in Victoria has declined for six consecutive quarters, meaning the overall number of homes available for rent has shrunk:

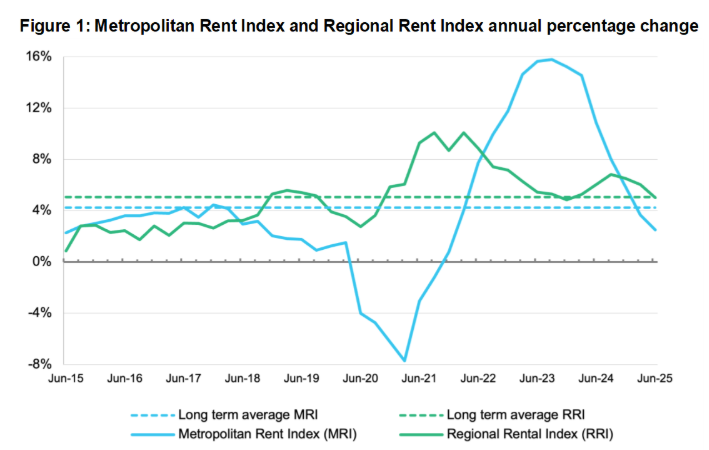

However, despite the decline in the supply of rental bonds, annual rental inflation has slowed to below the long-term average in Melbourne (2.5% annually) and the long-term average in the regions (5.0%):

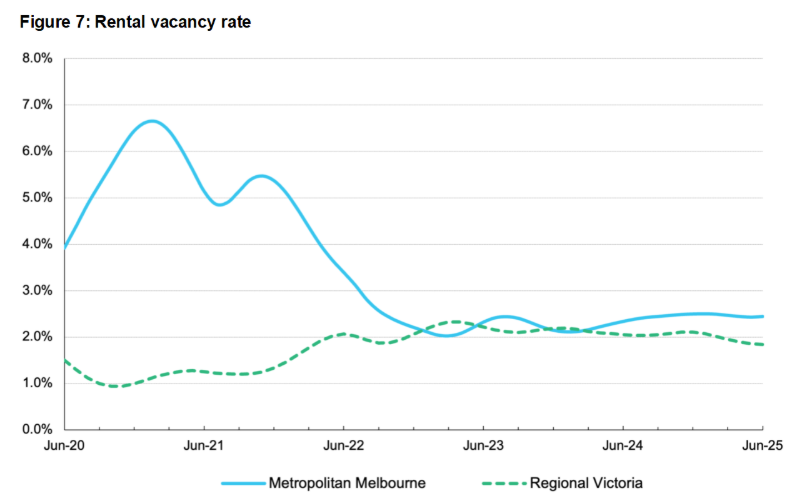

Victoria’s rental vacancy rate has also trended higher in Melbourne but slightly lower in the regions:

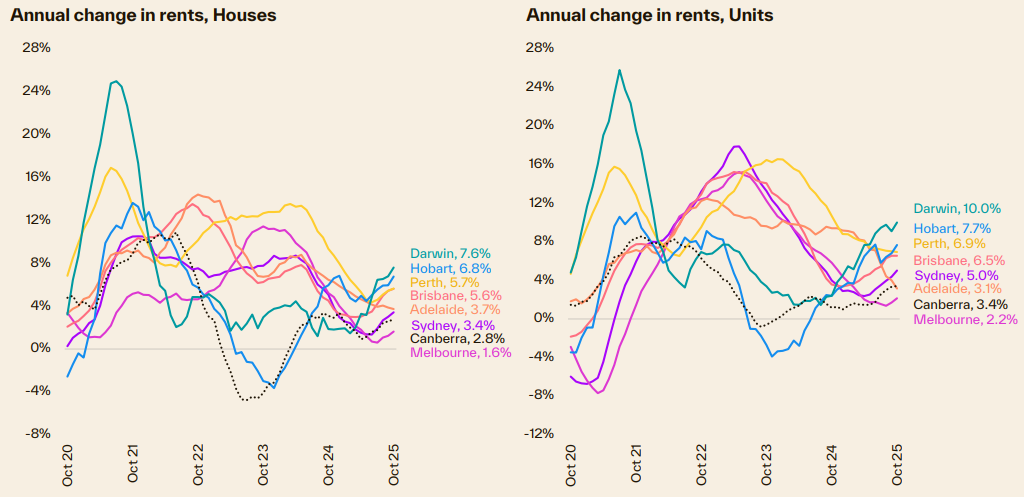

The national data also does not support the view that Victoria’s punitive taxes on property investors are punishing tenants.

According to Cotality, Melbourne has recorded the softest annual rental growth in the nation:

Source: Cotality

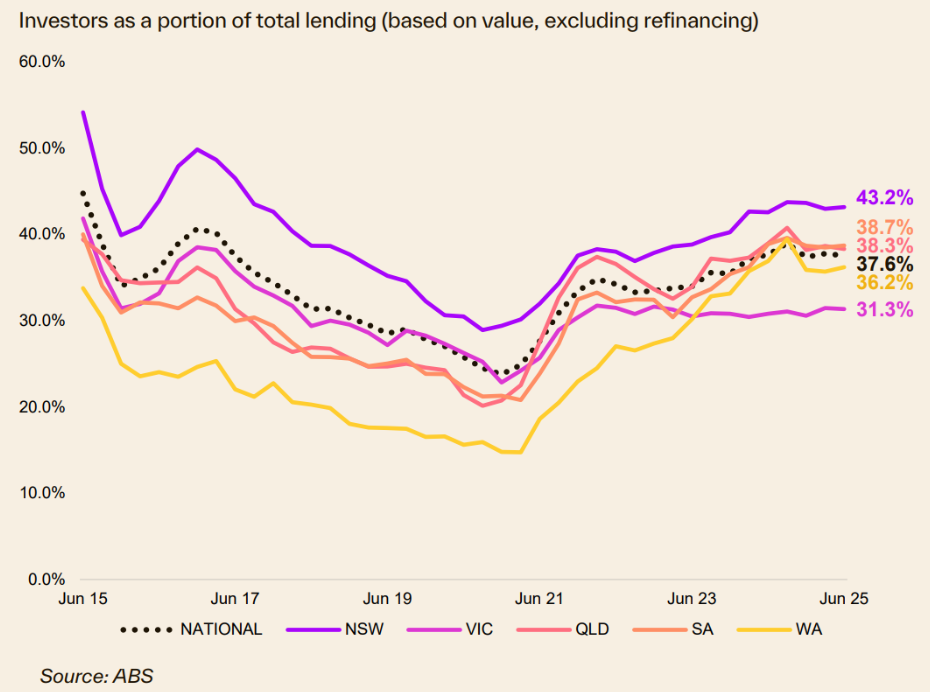

While Victoria has experienced a sharp decline in property investors, as evident by the decline in rental bonds and falling investor mortgages.

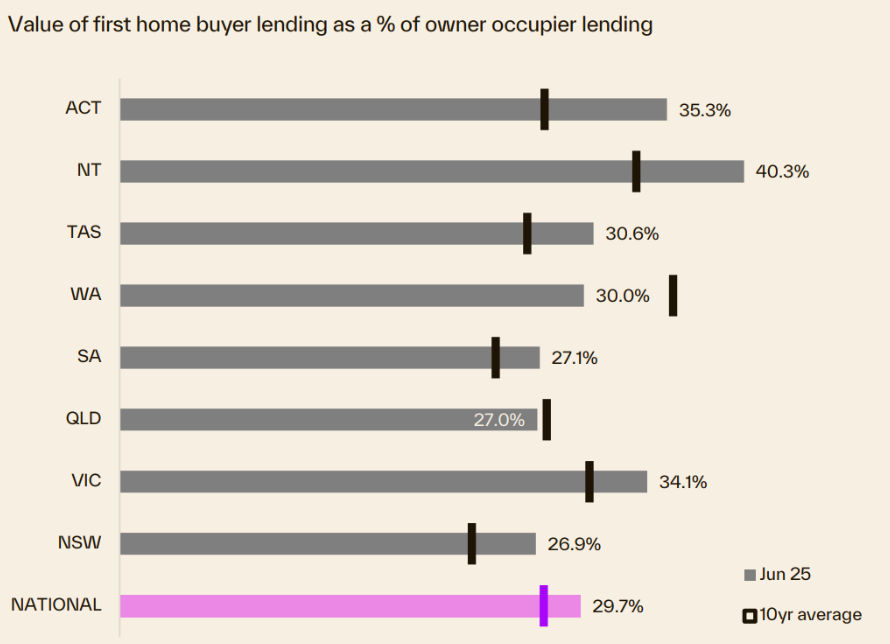

Victoria has also experienced a jump in first home buyer demand, which is tracking well above the decade average:

Source: Cotality

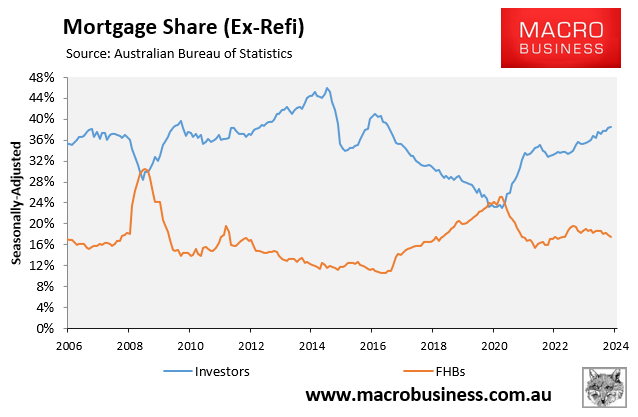

This above data reflects the historical inverse relationship between investor mortgage demand and first home buyer mortgage demand.

If Australian policymakers genuinely want to alleviate housing pressures and boost the homeownership rate, they should limit the number of investors in the market.

Policymakers should encourage investors to sell to first homebuyers, like Victoria does.