I have argued repeatedly that rising unemployment is the key condition that must be met for the Reserve Bank of Australia (RBA) to deliver another interest rate cut.

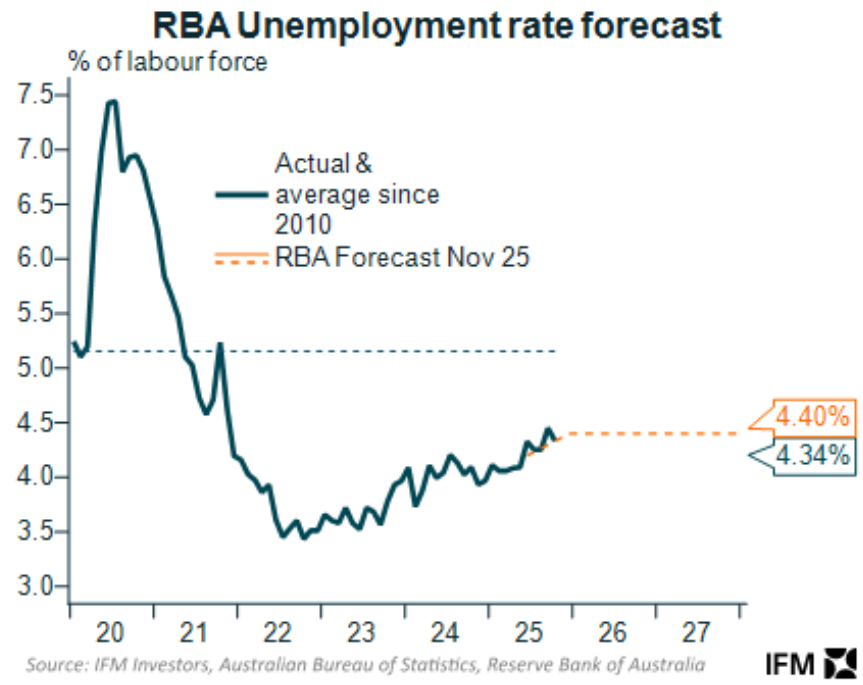

As illustrated below by Alex Joiner from IFM Investors, the latest Statement of Monetary Policy (SoMP) from the RBA forecasts that the headline unemployment rate will remain essentially at its current level until the end of 2027, indicating the labour market won’t deteriorate.

By extension, if the unemployment rate were to rise materially above its forecast, the RBA will be compelled to cut the official cash rate in a bid to boost demand in the economy.

Advertisement