New Zealand’s house price crash has silver lining

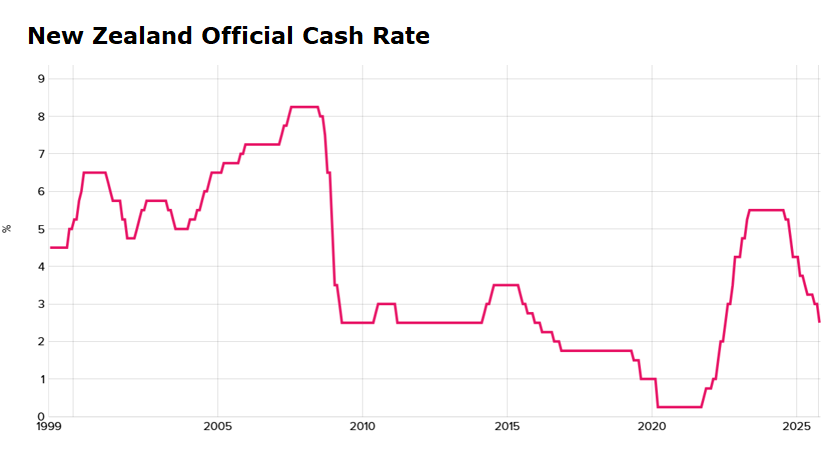

The Reserve Bank of New Zealand’s dovish shift, including the larger 50 bp cut at its October monetary policy meeting, saw the official cash rate fall to 2.5%, down 3.0% from its most recent peak:

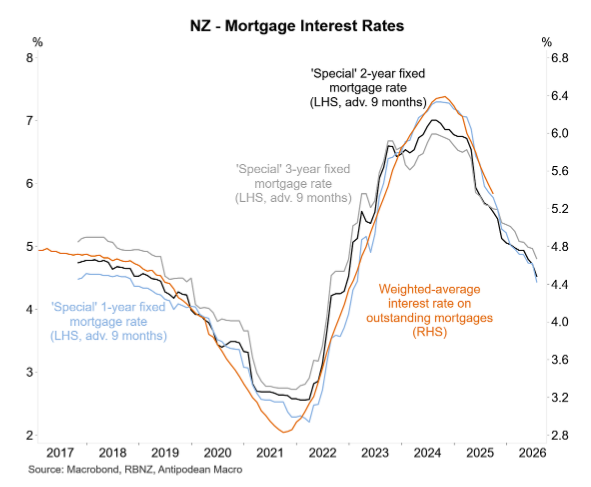

The sharp drop in the official cash rate has been matched in the mortgage market, where rates have fallen back to pre-pandemic levels:

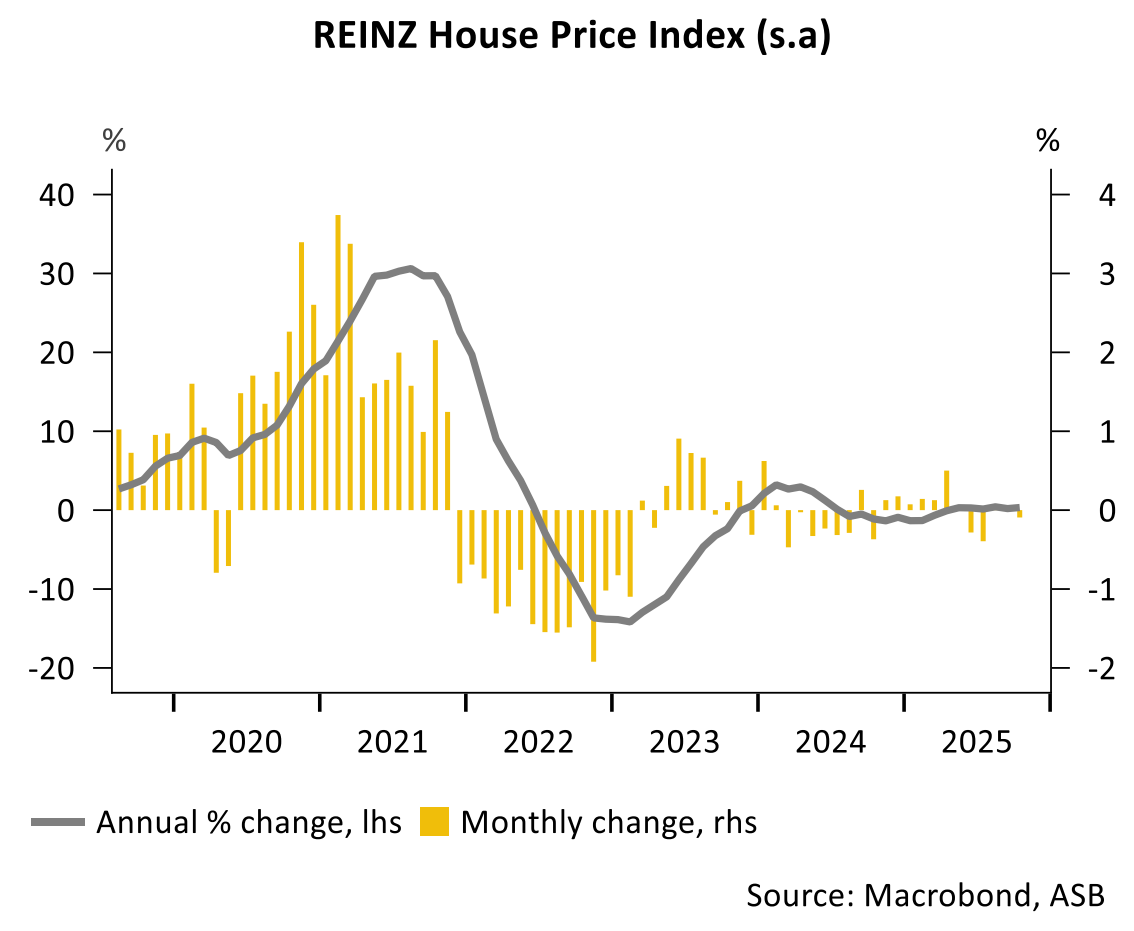

The Real Estate Institute of New Zealand (REINZ) House Price Index (HPI) was released on Monday and showed that the sharp reduction in mortgage rates has failed to stimulate the market.

Home values nationally declined by 0.1% in October, after flat readings in August and September.

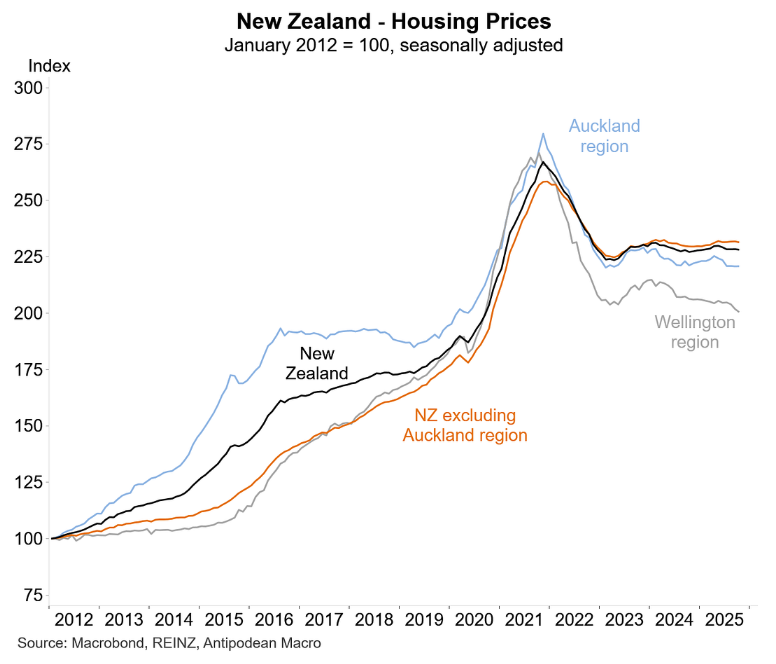

As illustrated below by Justin Fabo from Antipodean Macro, house prices have fallen sharply from their peak across all major markets:

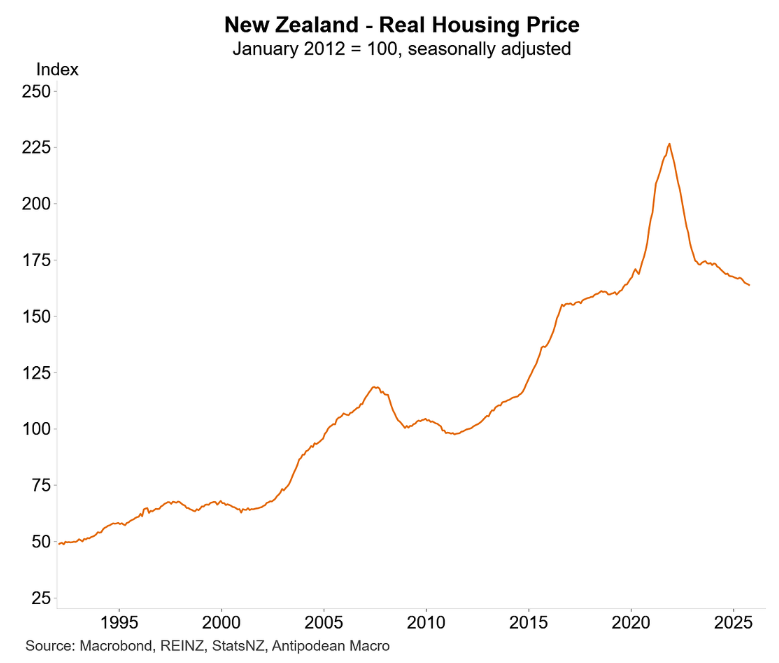

In real inflation-adjusted terms, New Zealand house prices continued to decline back to 2019 levels, completely surrendering their pandemic gains:

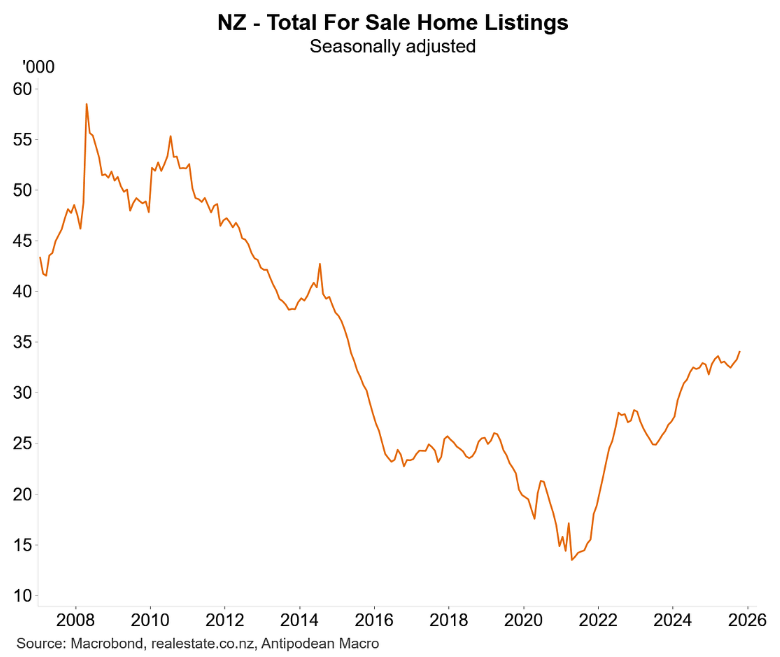

New Zealand’s housing market continues to be held down by an ample supply of homes available for sale, with the stock of unsold homes on the market picking up further in recent months to decade highs.

The median number of days to sell also edged higher in October and remains consistent with a buyers’ market.

As a result, there is little sign of upward pressure on sale prices.

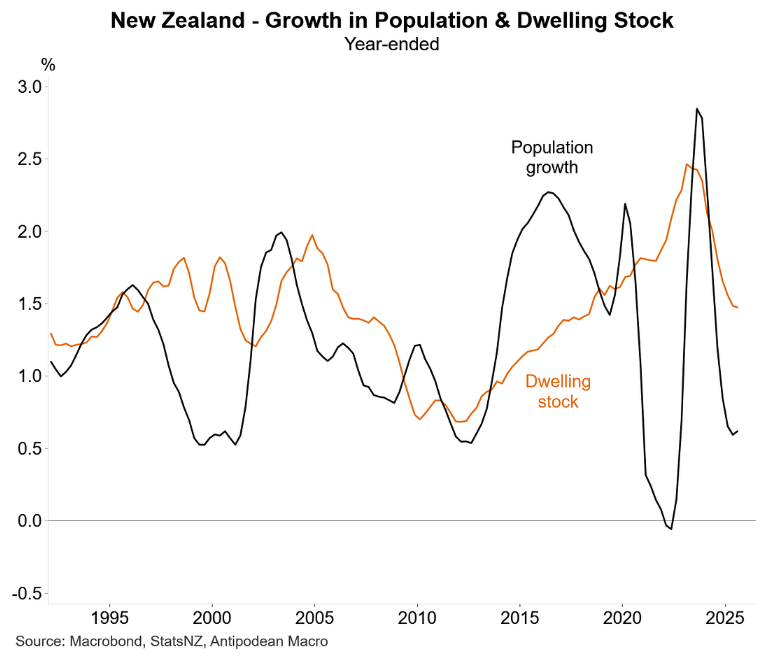

In addition, the collapse in net migration to New Zealand has meant that new housing supply is running well ahead of population demand, which is helping to lower both prices and rents.

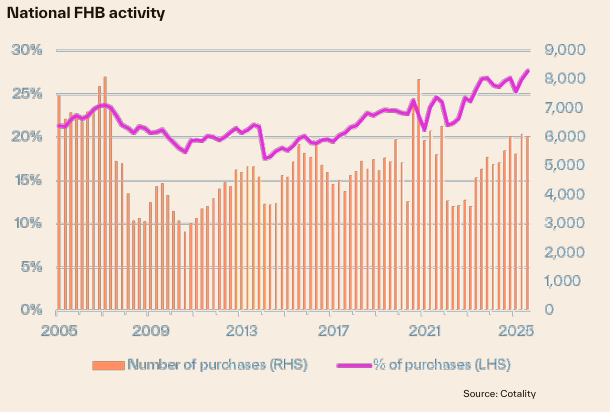

New Zealand first home buyers are clear beneficiaries of the weaker housing market conditions, with Cotality’s latest First Home Buyer Report noting that first home buyers’ market share is tracking at record highs.

In Q3 2025, first home buyers accounted for 27.7% of property purchases across New Zealand, beating the previous record of 26.9% in Q4 last year.

New Zealand is a testament to why the number one solution for housing affordability is lower prices, not self-defeating demand-side policies like Australia’s 5% deposit scheme for first home buyers.