New Zealand provides a textbook example of why lowering immigration below the nation’s home building capacity lowers rents, benefiting tenant households.

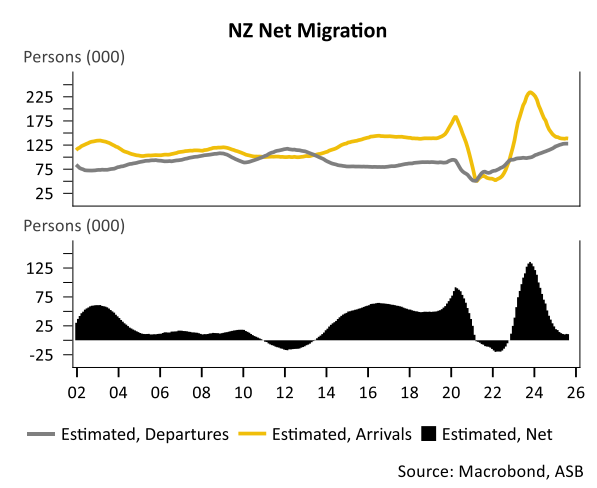

As illustrated in the following chart, New Zealand’s net overseas migration slowed to only 10,628 in the year ending August 2025, well below the decade average of 49,000 and around 120,000 fewer than the late 2023 peak.

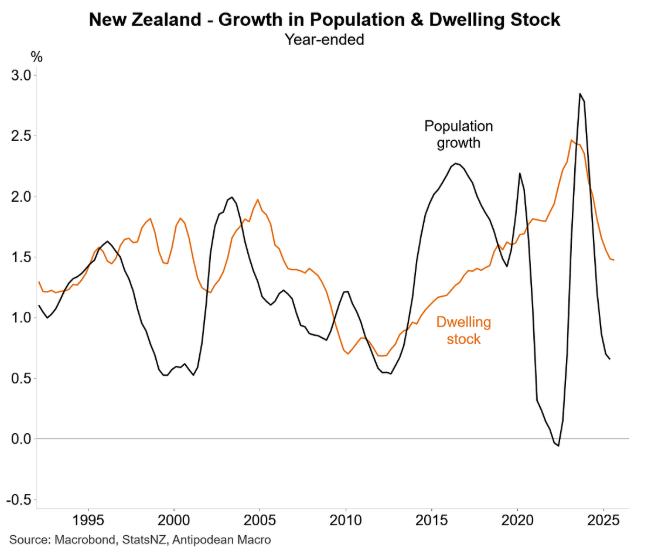

As a result, the growth in New Zealand’s dwelling stock is now easily exceeding the growth in New Zealand’s population growth:

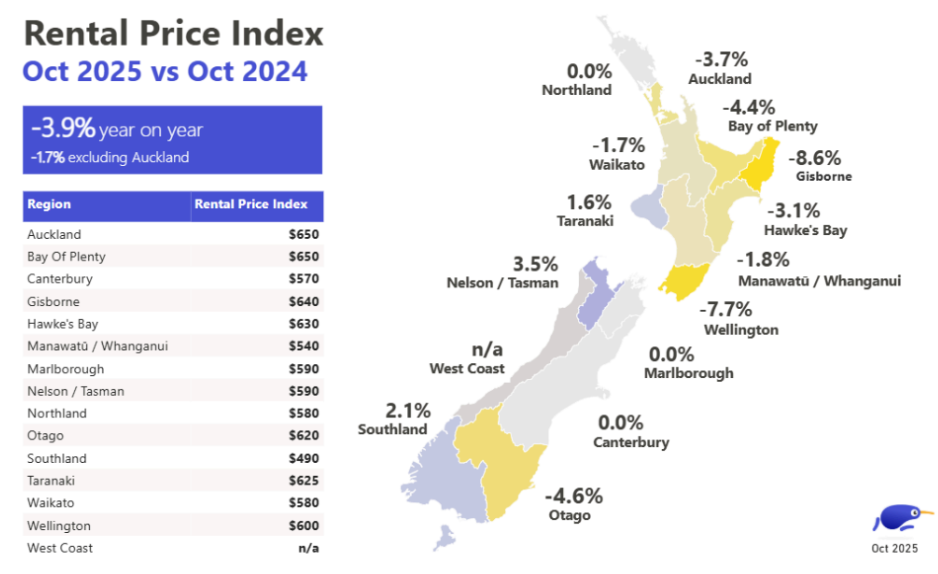

The impact on the rental market has been stunning. With fewer new renters chasing an expanding number of homes, the TradeMe rental price index fell by 3.9% in the year to October 2025, taking asking rents May 2023 levels.

Total rental listings on Trade Me Property in October were 2% higher than October last year, while searches for rental properties on the website were down 6%.

“We haven’t seen the national median this low since early on in 2023, which is good news for renters who are looking at moving ahead of the summer months”, Trade Me Property spokesperson Casey Wylde said.

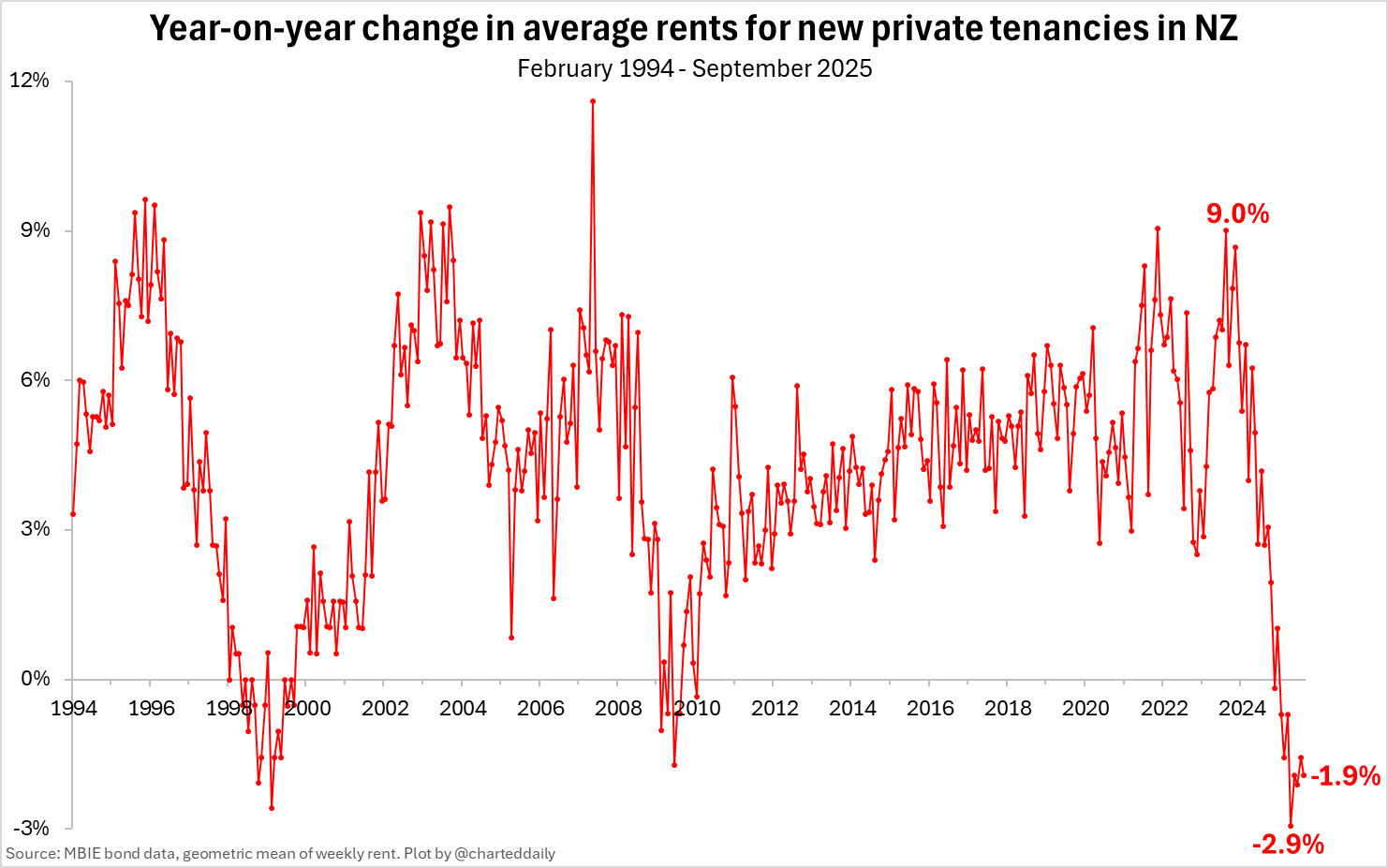

New Zealand rental bond data tells a similar story, experiencing the sharpest decline in rents in around 30 years:

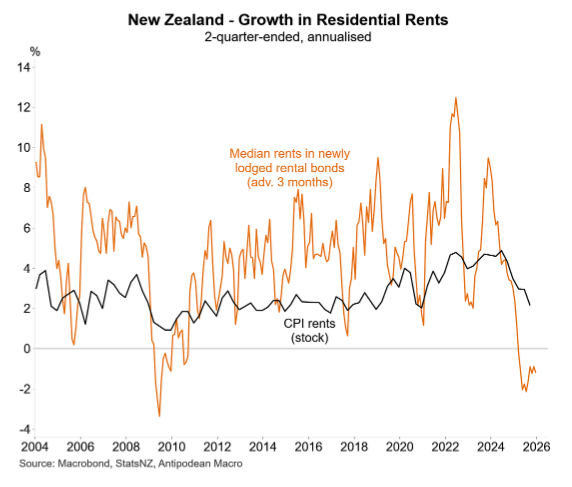

Justin Fabo from Antipodean Macro published the same data on a quarterly basis against CPI rents, as shown below:

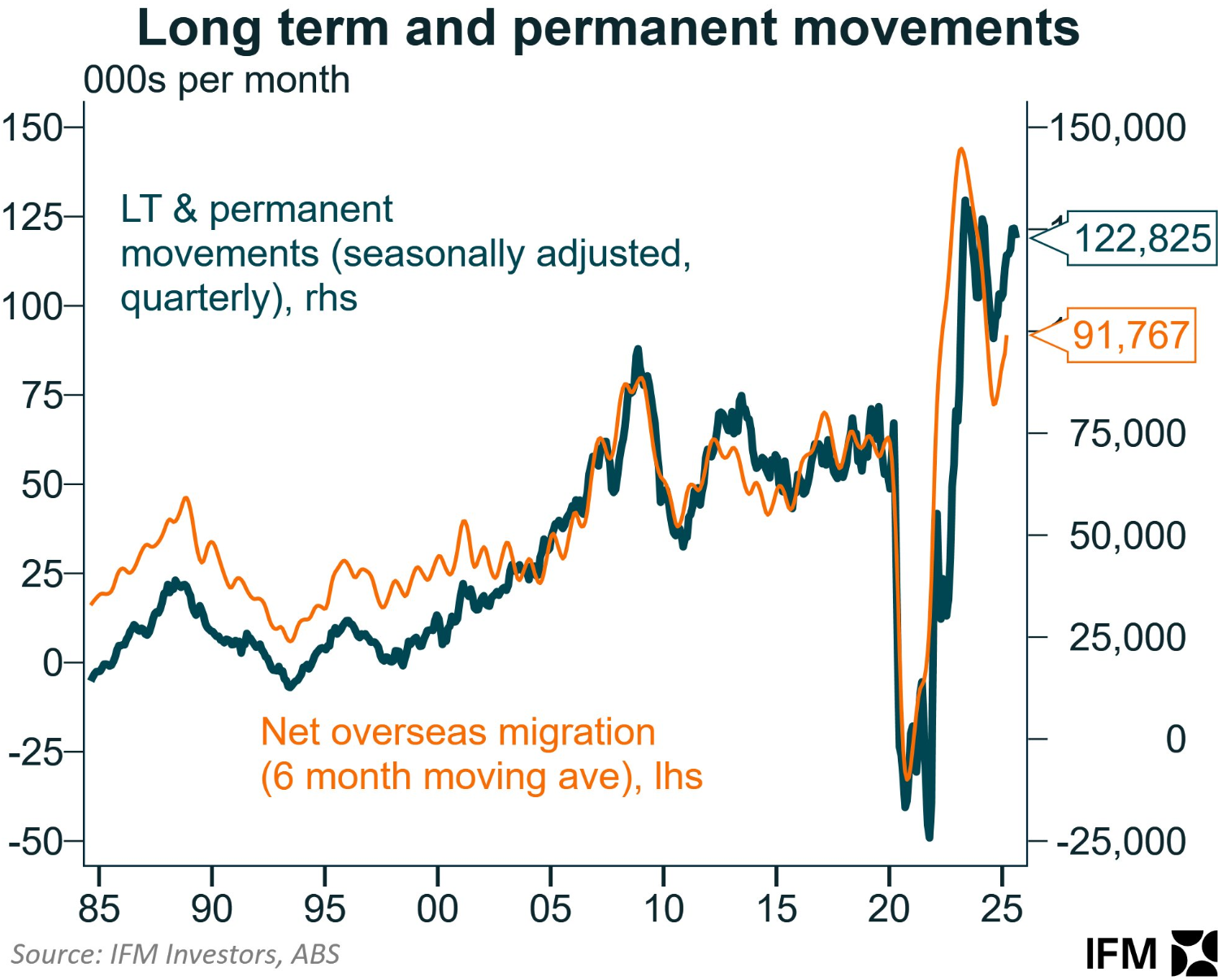

Sadly for Australian tenants, the opposite situation has taken place. Net permanent and long-term (NPLT) arrivals have rebounded, adding to rental demand.

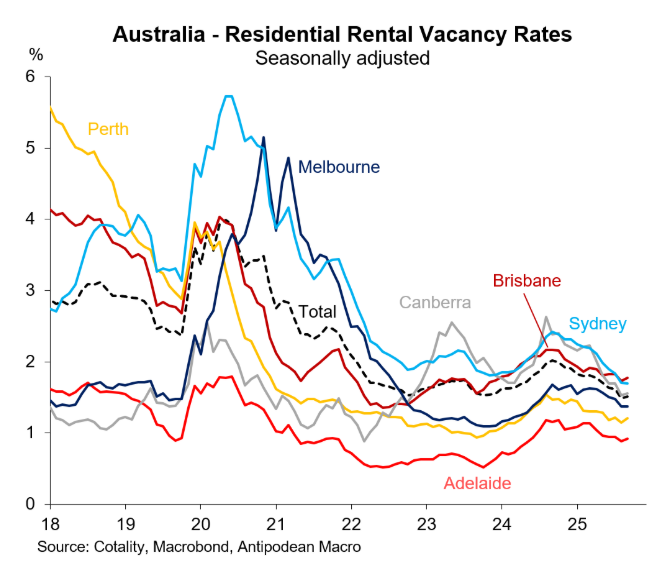

Rental vacancy rates have also collapsed to a record low nationally as population growth continues to outrun new dwelling construction.

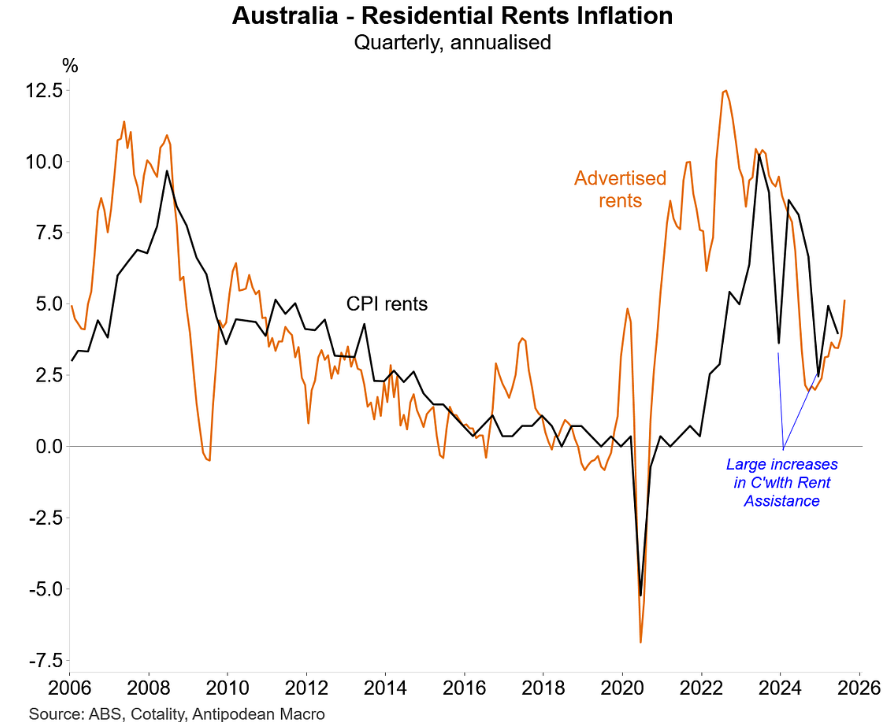

As a result, advertised rents—which have already jumped by 43% over the past five years—have reaccelerated, heaping more pressure on Australian tenants.

With the Albanese government reopening the international student floodgates, Australia’s rental market will continue to tighten, punishing tenants.