Cotality has released alarming data illustrating the sharp deterioration of rental affordability over recent years following record net overseas migration.

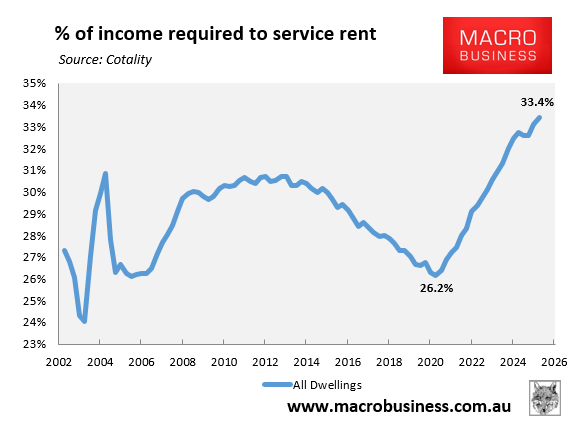

The following chart plots the percentage of median household income spent on renting the median dwelling at the national level:

Rental affordability nationally was tracking at its most favourable level in 15 years in Q4 2020, with the median tenant household spending 26.2% of their income on rent.

However, as of Q3 2025, the latest reading, Australia’s rental affordability was tracking at its worst level in recorded history, with the median tenant household spending 33.4% of their income on rent.

Cotality notes that in the five years to Q3 2025, the median rent in Australia rose by 53.3%.

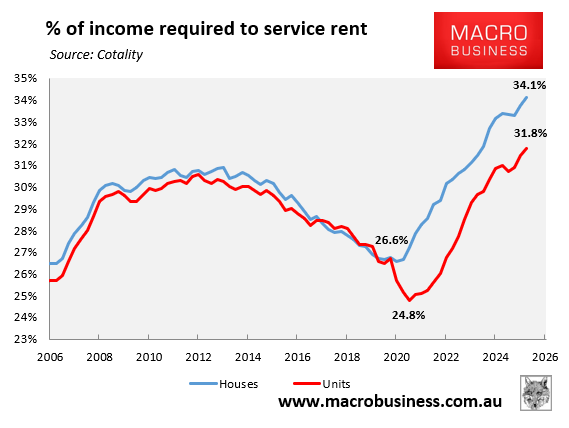

As illustrated in the following chart, rental costs relative to incomes have soared for both detached houses and units:

The percentage of income spent by tenants on house rent has surged from a cyclical low of 26.6% in Q2 2020 to a record high of 34.1% in Q3 2025.

In a similar vein, the percentage of income spent by tenants on unit rents has risen from a cyclical low of 24.8% in Q4 2000 to a record high of 31.8% as of Q3 2025.

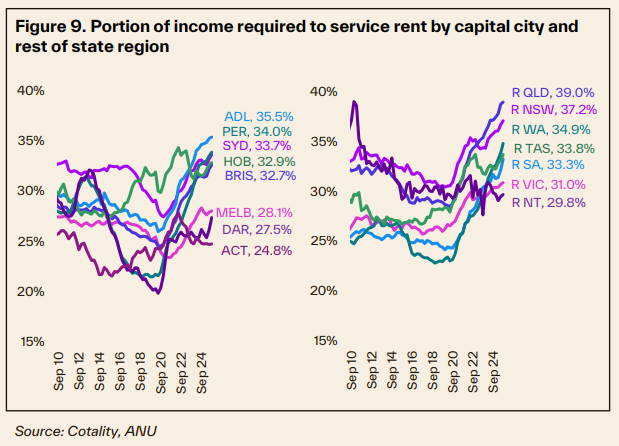

Finally, the following chart from Cotality shows that rental affordability has soared to a record low across most markets, both capital city and regional:

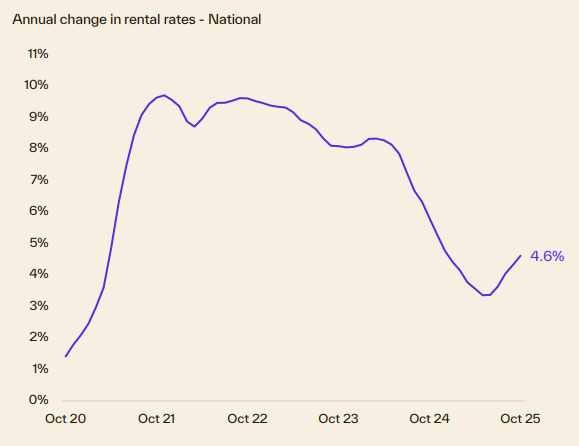

The outlook for rental affordability remains poor, with Cotality reporting that advertised rents have reaccelerated:

Source: Cotality

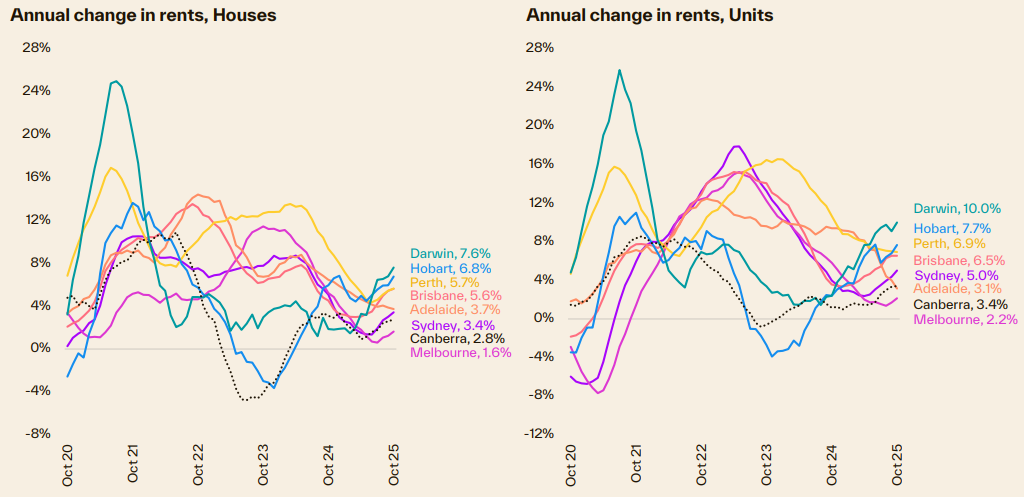

The acceleration of rents has occurred across most cities:

Source: Cotality

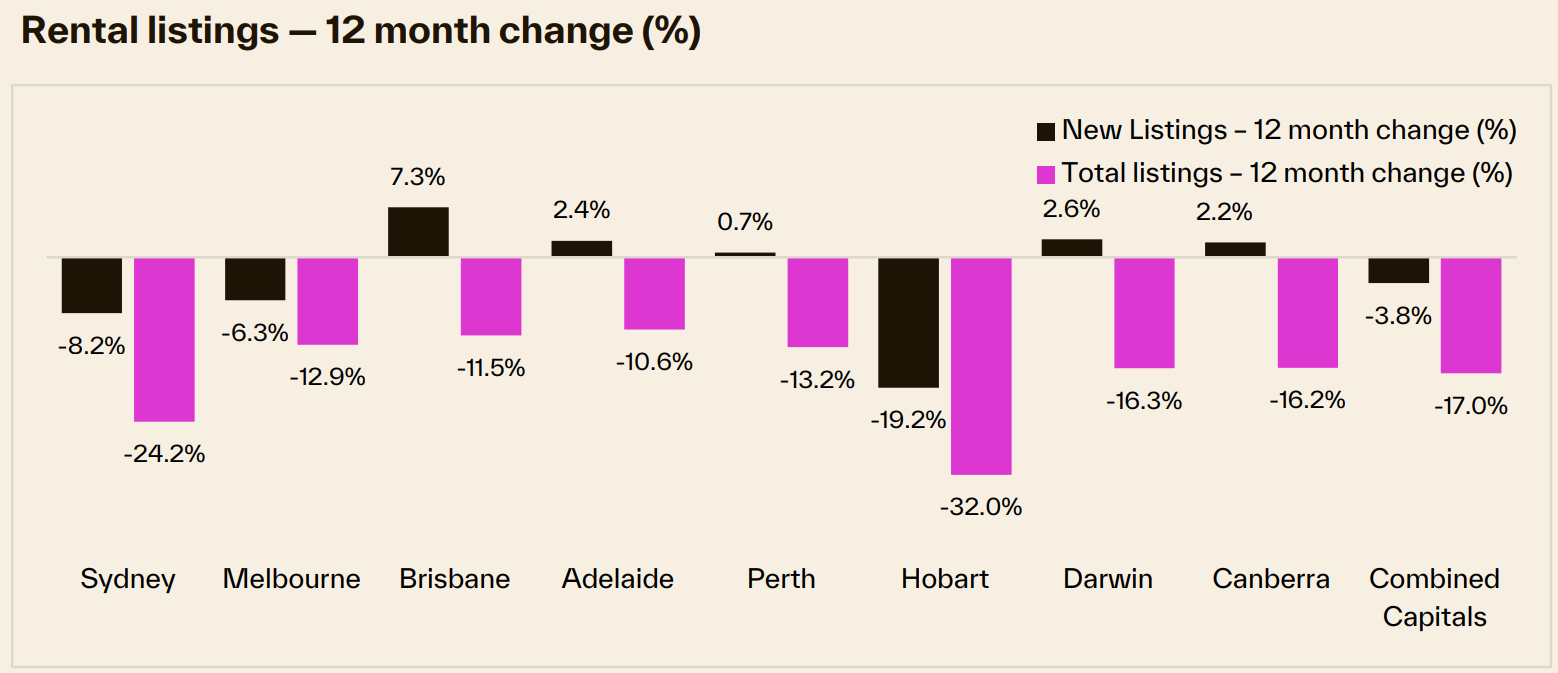

This reacceleration of rents has followed a collapse in rental listings:

Source: Cotality

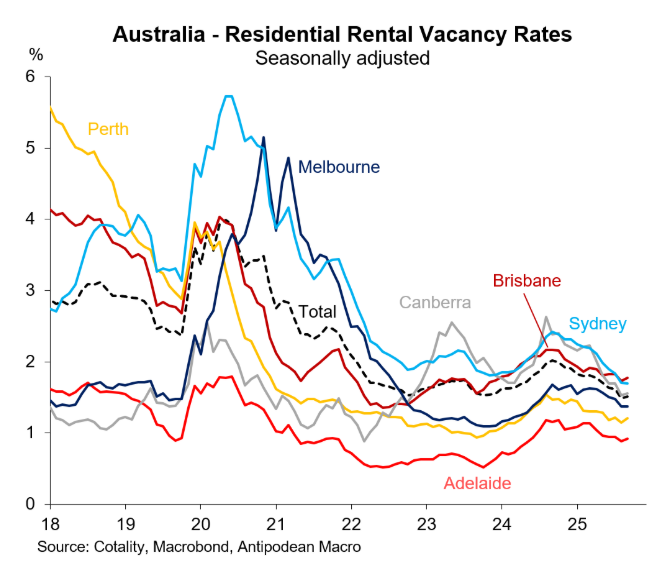

As a result, rental vacancy rates have collapsed to a record low at the national level:

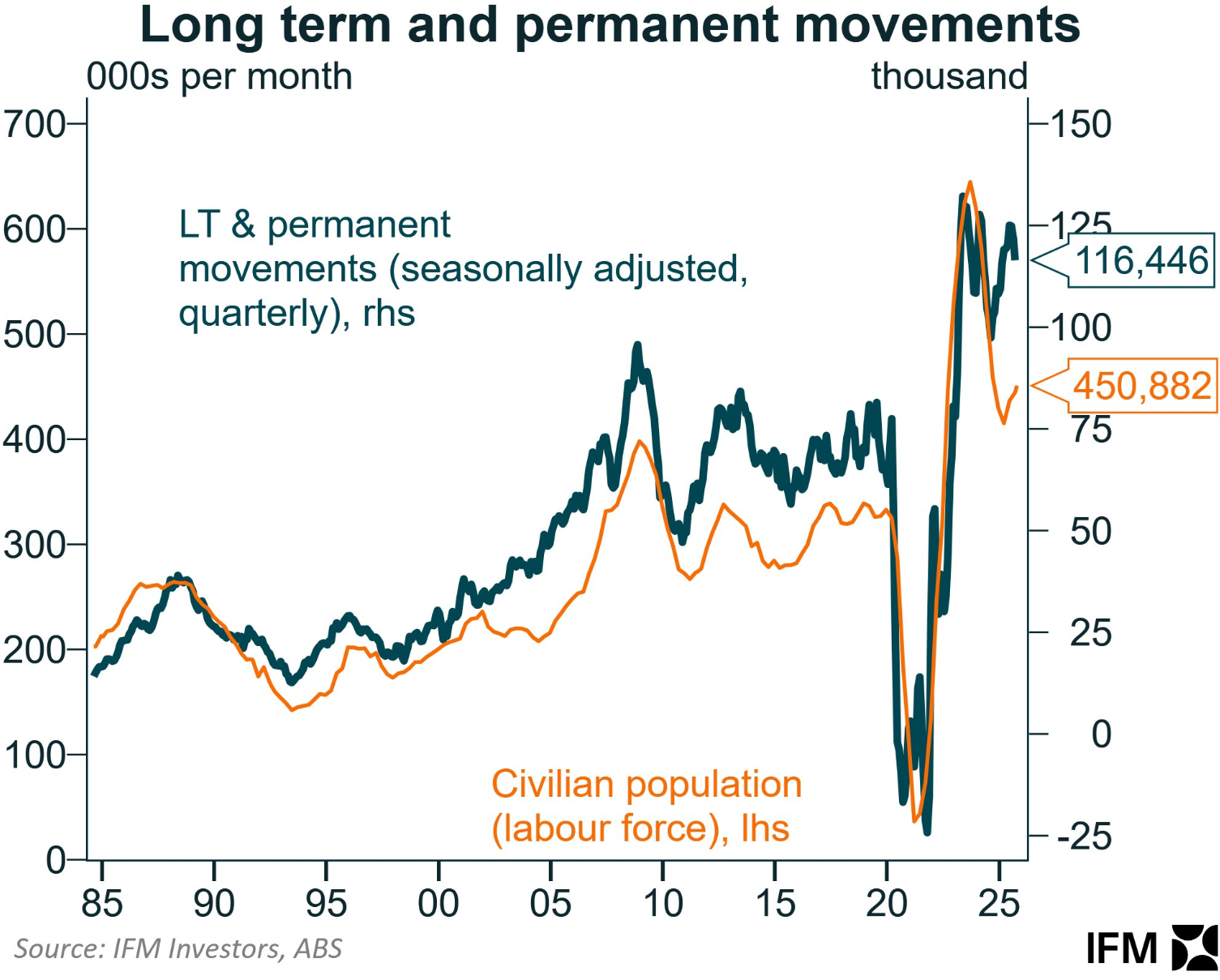

The situation is unlikely to improve given that population growth has rebounded into a heavily supply-constrained housing market.

As a result, the rental market will continue to tighten, punishing tenant households.