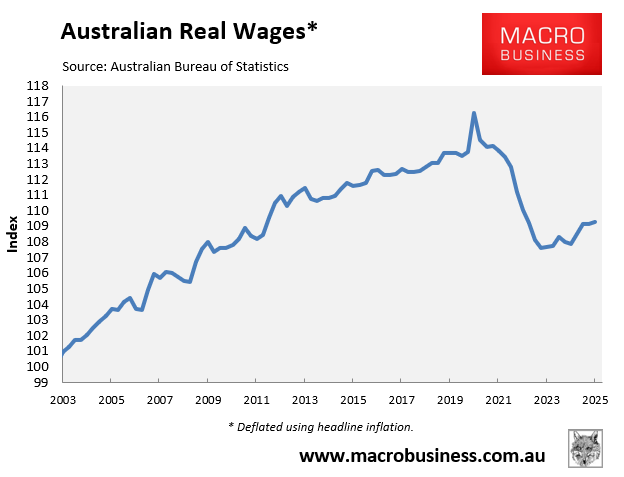

Australians have suffered the deepest decline in real wages in recorded history.

As of the June quarter of 2025, Australian real wages were tracking 6.0% below their June 2020 peak, at roughly the same level as December 2011.

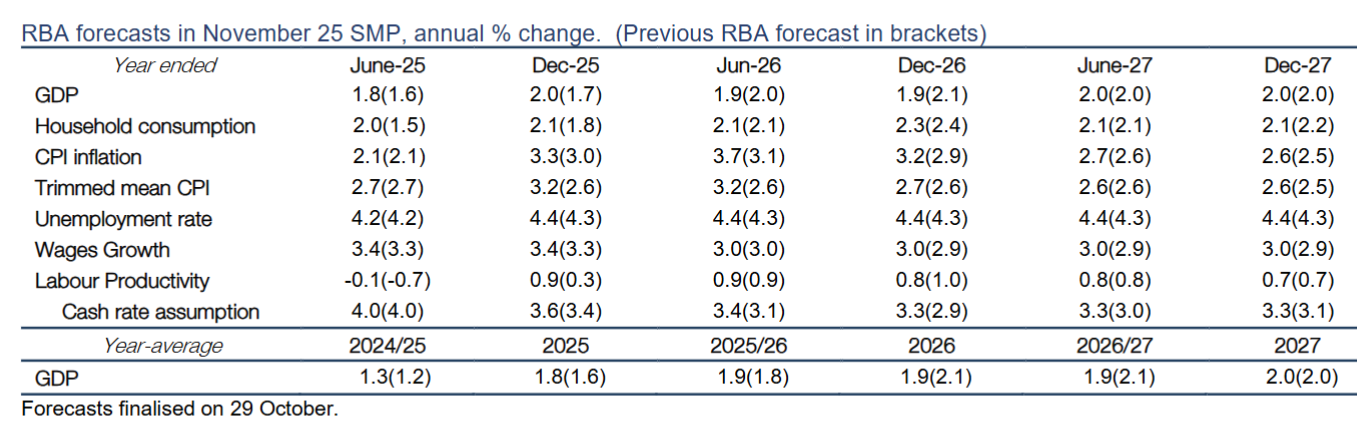

The Reserve Bank of Australia (RBA) released its Statement of Monetary Policy (SoMP) this week, which contains the following economic forecasts:

As you can see, CPI inflation has been revised up significantly, whereas wage growth has only been revised up marginally.

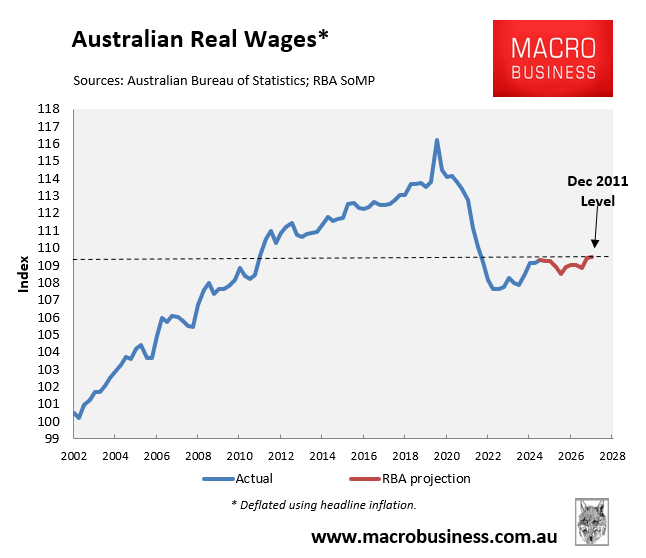

The result is that real wages are not expected to recover over the forecast period to the end of 2027, as illustrated below:

By the end of 2027, Australian real wages are forecast by the RBA to remain 5.8% below their peak, still tracking at the same level as December 2011.

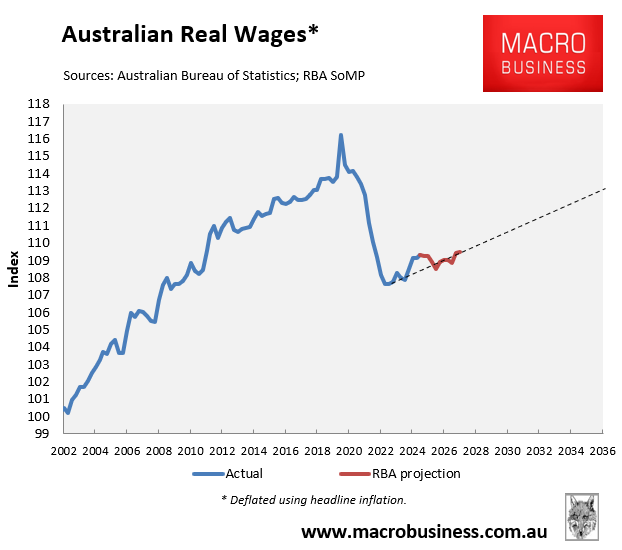

The next chart extrapolates the RBA’s forecasts on wage growth and CPI inflation:

As you can see, it could take another decade for Australian real wages to recover to their pre-pandemic level.

There are two factors underpinning Australia’s poor wage growth.

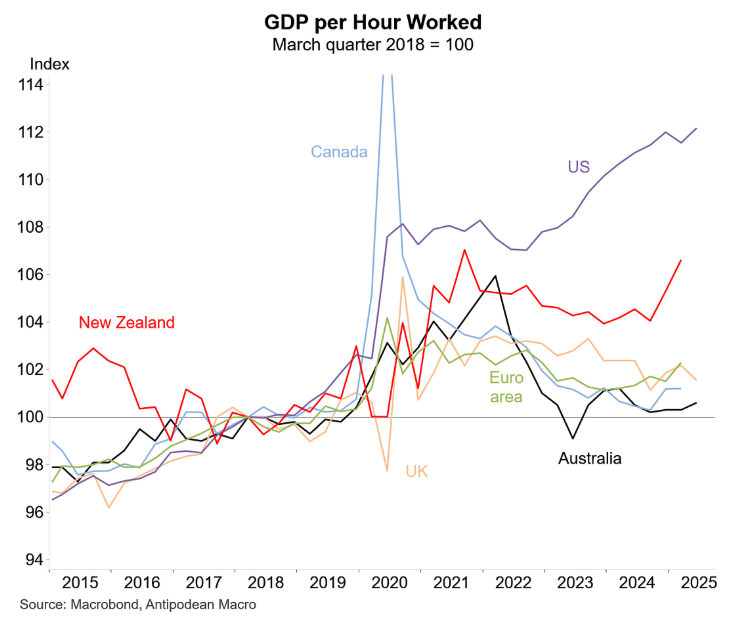

First, Australia’s labour productivity has collapsed to around the lowest level in the advanced world.

As noted by Gerard Minack this week:

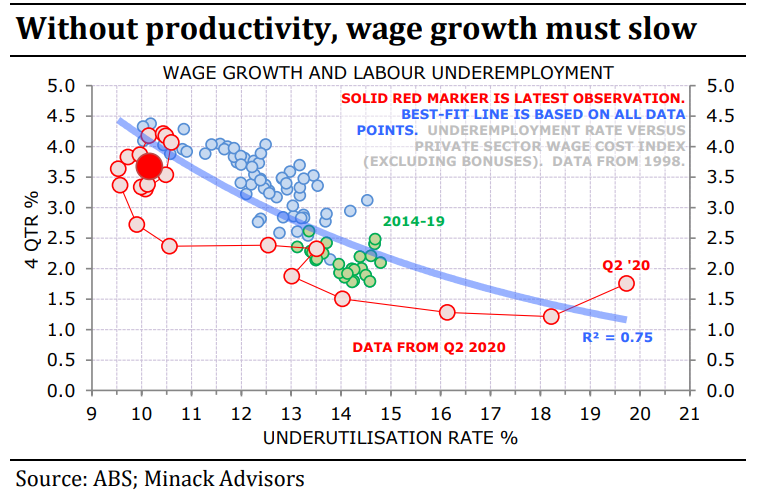

Without productivity growth—or a terms of trade windfall—income is a zero sum game: real wages, for example, can only grow at the expense of profits…

The nominal wage growth that is compatible with the RBA’s 2-3% inflation target falls as productivity growth slows. With zero productivity growth, nominal wage growth would need to be around 2½-3% to be consistent with 2½% inflation (allowing for the fact the price of goods–many imported—tends to fall in real terms).

The RBA may keep the current modestly restrictive policy on hold until the labour market loosens enough to reduce wage growth to 3% or below…

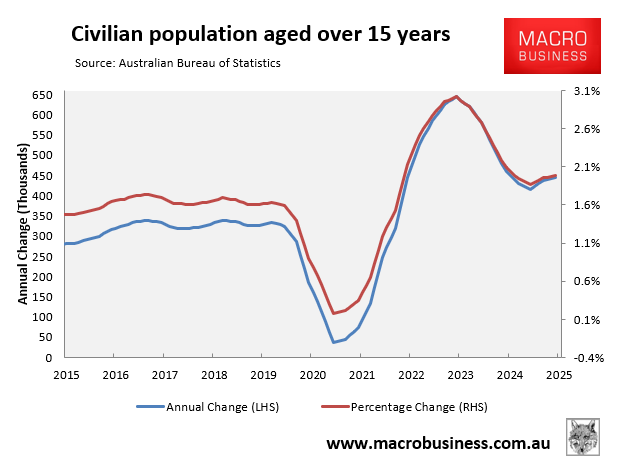

The other problem facing wages is that the federal government continues to grow the labour supply aggressively via immigration.

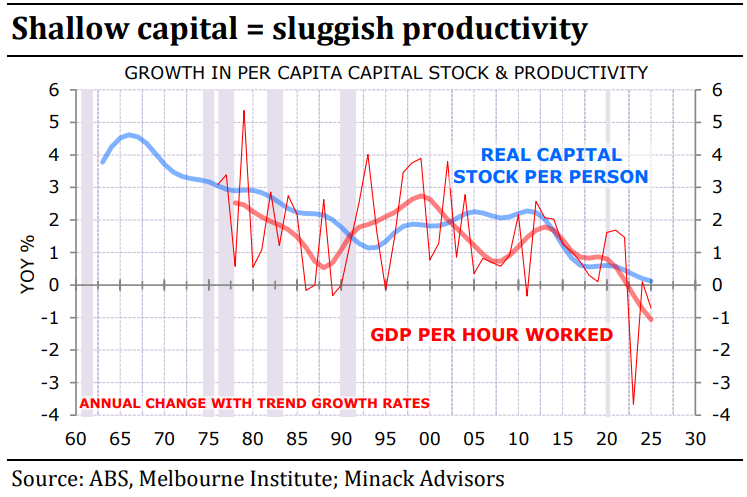

Doing so has helped to bid down wages as well as lowered the nation’s productivity growth via slowing the growth in capital stock per worker (so-called ‘capital shallowing’):

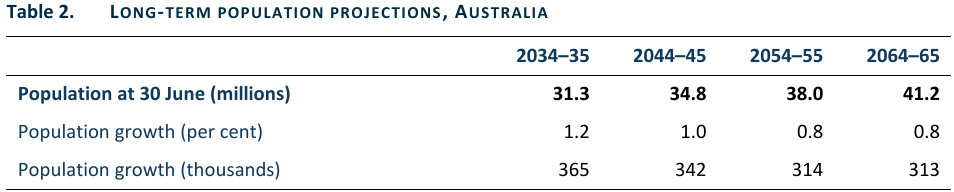

It is challenging to see how Australia can realistically increase the capital-to-labour ratio, i.e., experience ‘capital deepening’, and boost productivity growth when it has committed to expanding the nation’s population by 13.5 million over the next 40 years.

Source: Centre for population

Adding the equivalent of another Sydney, Melbourne, and Brisbane to Australia’s current population in just 40 years will require an unprecedented amount of investment in business, infrastructure, and housing to simply maintain the capital stock per person.

Achieving such extraordinary levels of investment is an impossible task, meaning that the Australian economy will inevitably suffer further ‘capital shallowing’, slower productivity growth, and poor real wage growth.