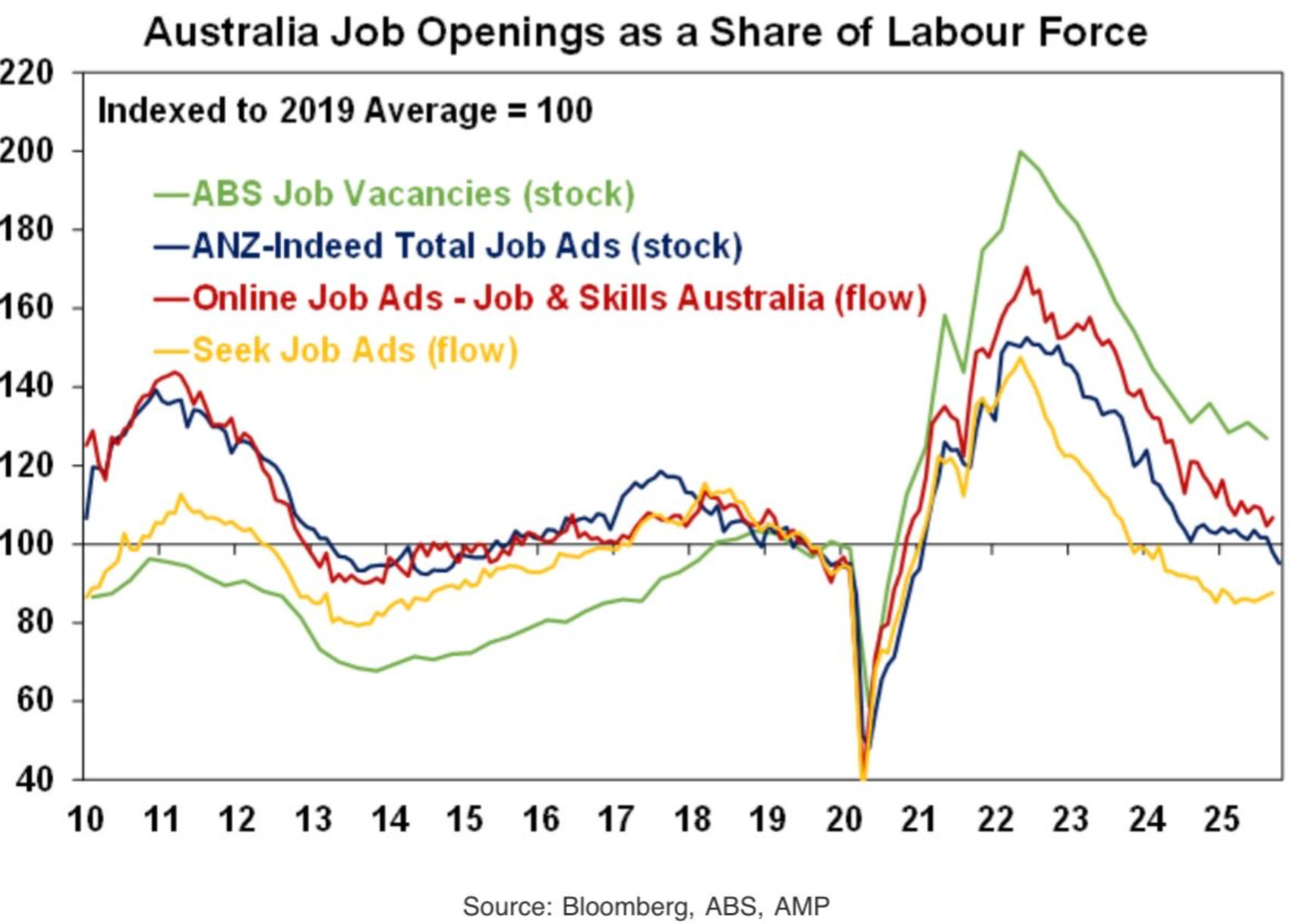

Recent job advertisements and vacancy data, presented below by Shane Oliver from AMP, suggest that Australia’s labour market is gradually softening.

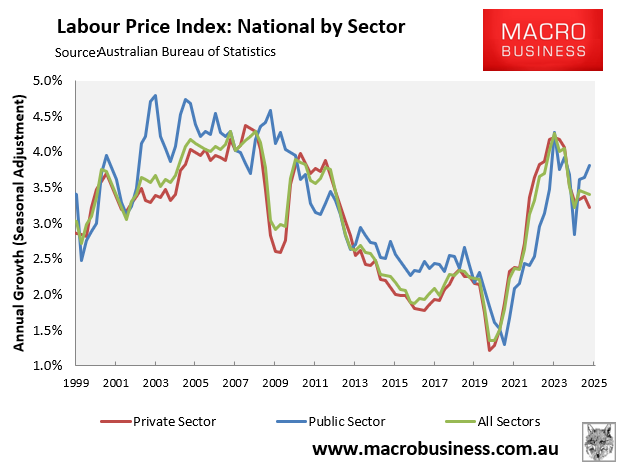

Last week’s Q3 wage data from the Australian Bureau of Statistics (ABS) also struck a soft tone, with private sector wage growth falling sharply, partly offset by strength in public sector wages:

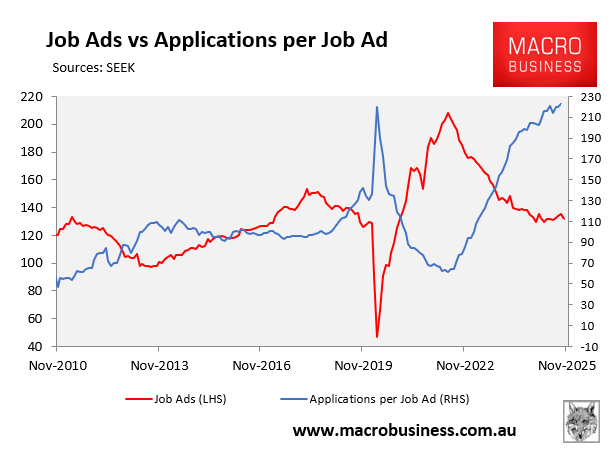

SEEK has released its latest employment report, which shows that job ads declined by 0.3% in October to be down 2.2% year-on-year.

The number of applications per job also rose by 1.3% in September (latest reading) to a new record high level that surpassed the pandemic peak. This marked “three years of uninterrupted growth”, according to SEEK Senior Economist Blair Chapman:

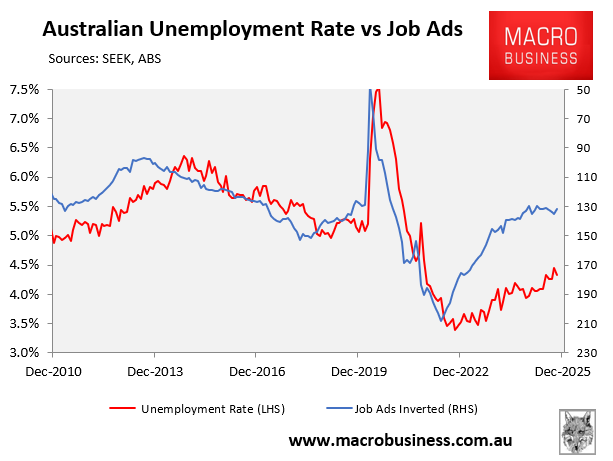

Like the other job ad measures, SEEK’s is pointing to a gradual lift in unemployment:

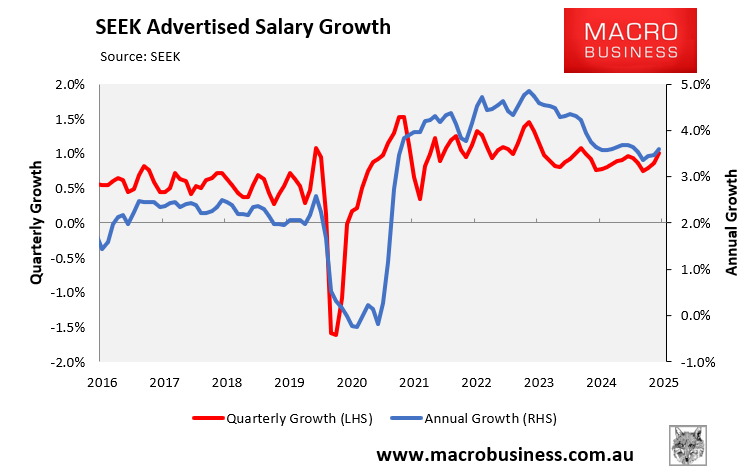

In slightly better news, SEEK’s advertised salaries index rebounded in October, rising by 1.0% over the quarter and by 3.6% annually:

Commenting on the uptick in advertised salaries, SEEK Senior Economist Blair Chapman noted:

“The slight acceleration in annual advertised salaries growth, returning to the pace last recorded in May, comes despite the labour market looking a little weaker than it did then, with annual employment growth slower and a higher unemployment rate”.

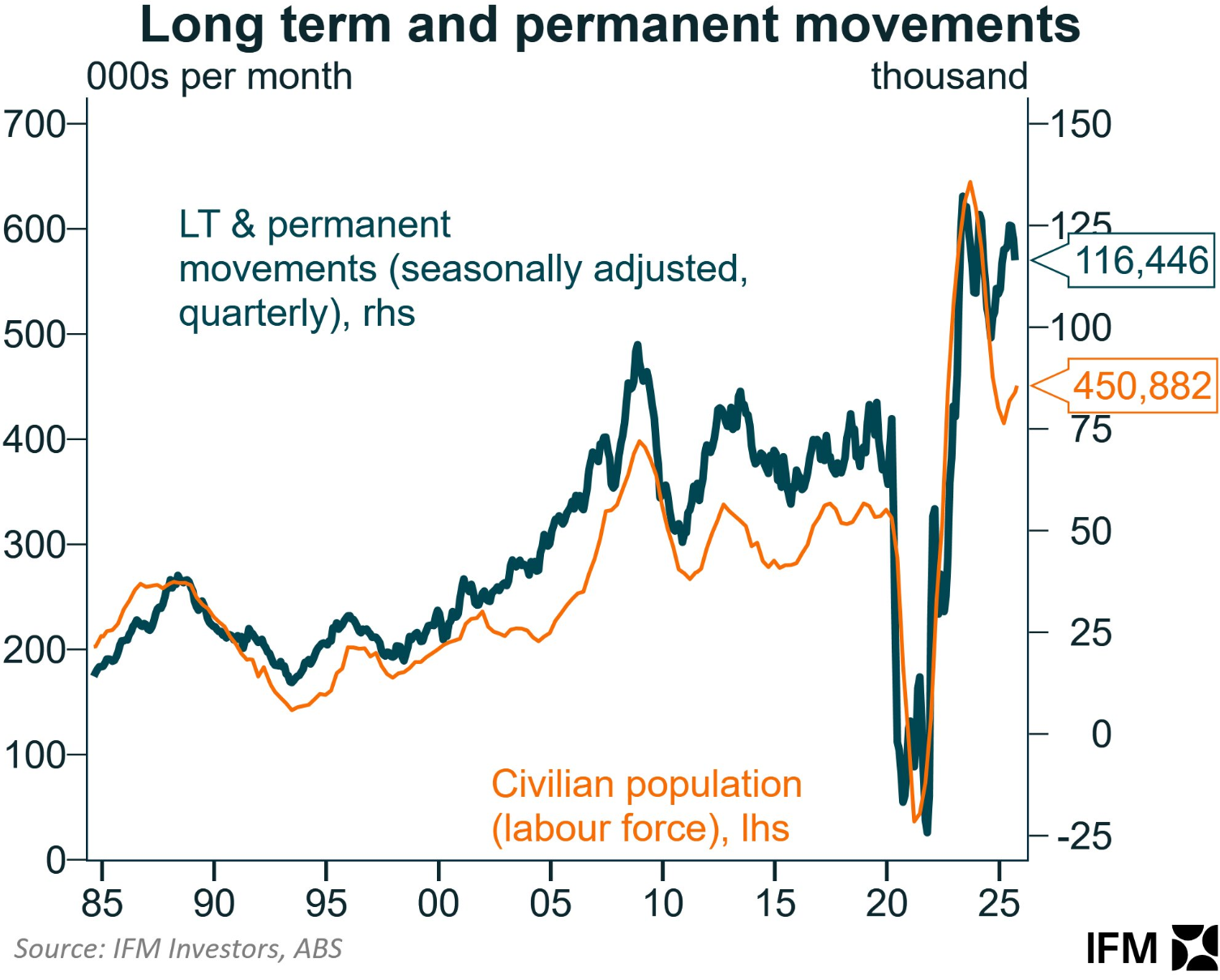

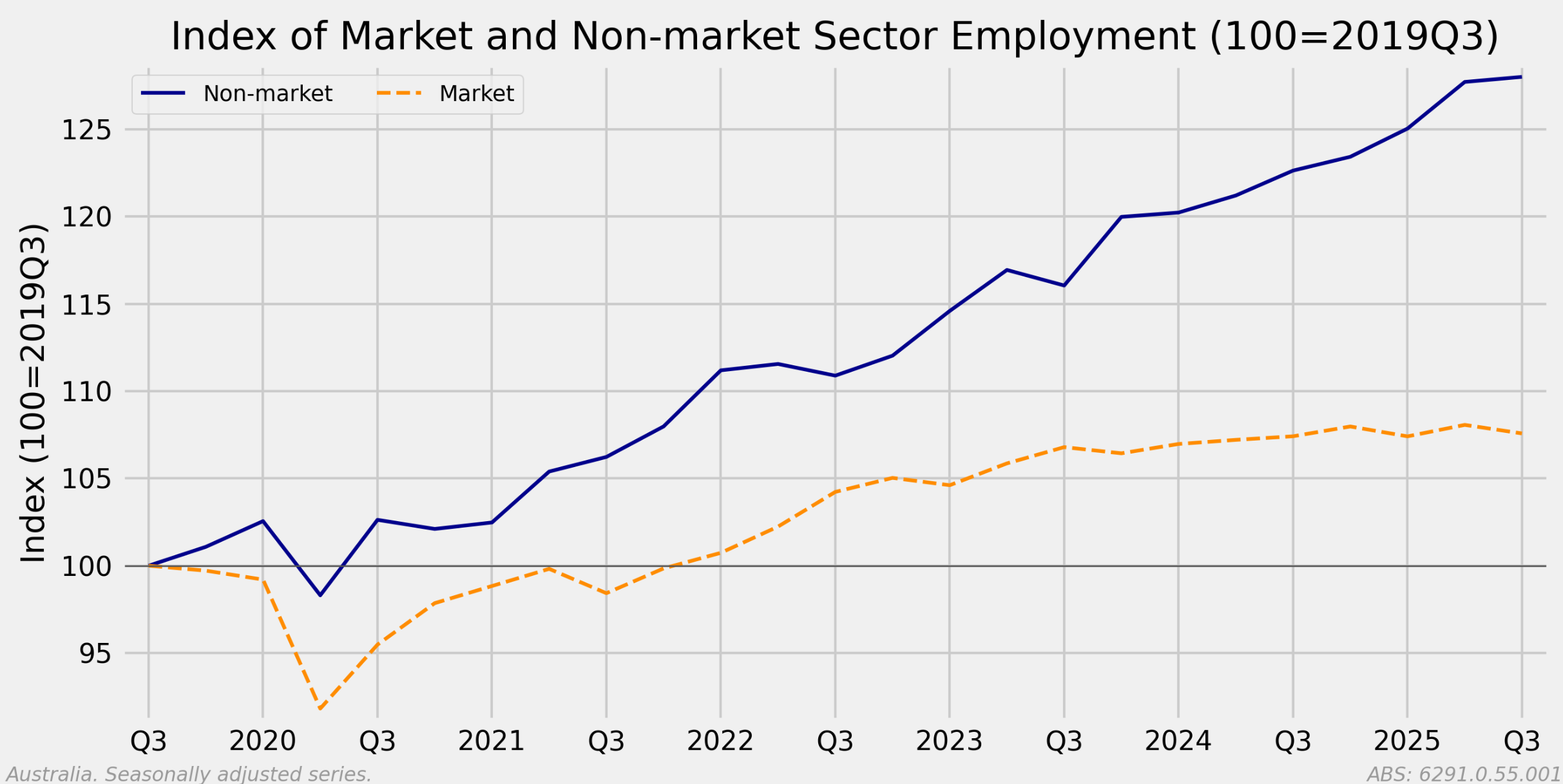

With Australia’s labour supply continuing to grow aggressively (i.e., by nearly 40,000 a month) owing to strong immigration, and the growth in non-market sector jobs also likely to moderate amid federal and state austerity measures to rein in costs, the ingredients are in place for rising unemployment.

Source: Mark Graph

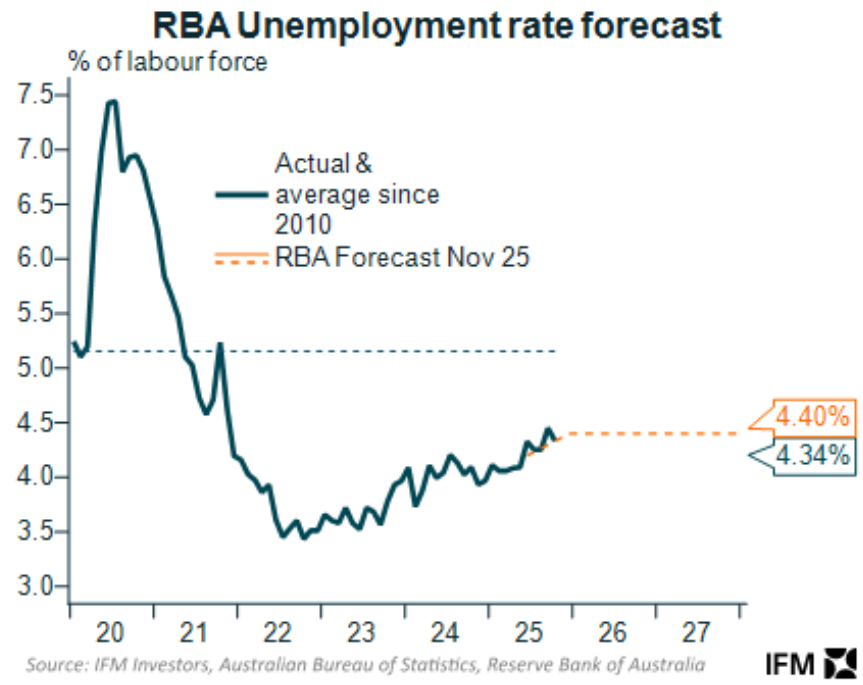

As a result, I expect the nation’s unemployment rate to rise above the Reserve Bank of Australia’s (RBA) forecast of 4.4% unemployment out to the end of 2027.

Rising unemployment will also be the catalyst for further interest rate cuts, although not until the second quarter of 2026 at the earliest.