Last week, I reported an AFR analysis of 16 financial reports from federal agencies, which revealed that 14 had unbudgeted increases in staff expenses totaling $841 million.

Budget watcher Chris Richardson warned that the wage blowout could threaten the federal budget’s March forecast of a $42 billion deficit for this financial year, as could the billions of dollars in ‘funding cliffs’, which are government programs that have expired or are due to expire this year.

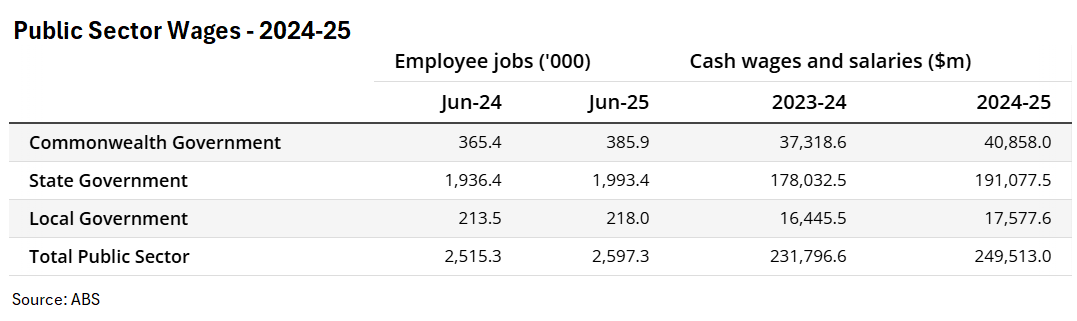

The Australian Bureau of Statistics (ABS) released data on public sector wages, which grew by 3.3% across all levels of government between June 2024 and June 2025, while wages paid surged by 7.6%

“The rise in the public sector wage bill reflected a combination of underlying wage growth driven by new enterprise agreements and growth in employment”, Sean Crick, ABS head of labour statistics, said.

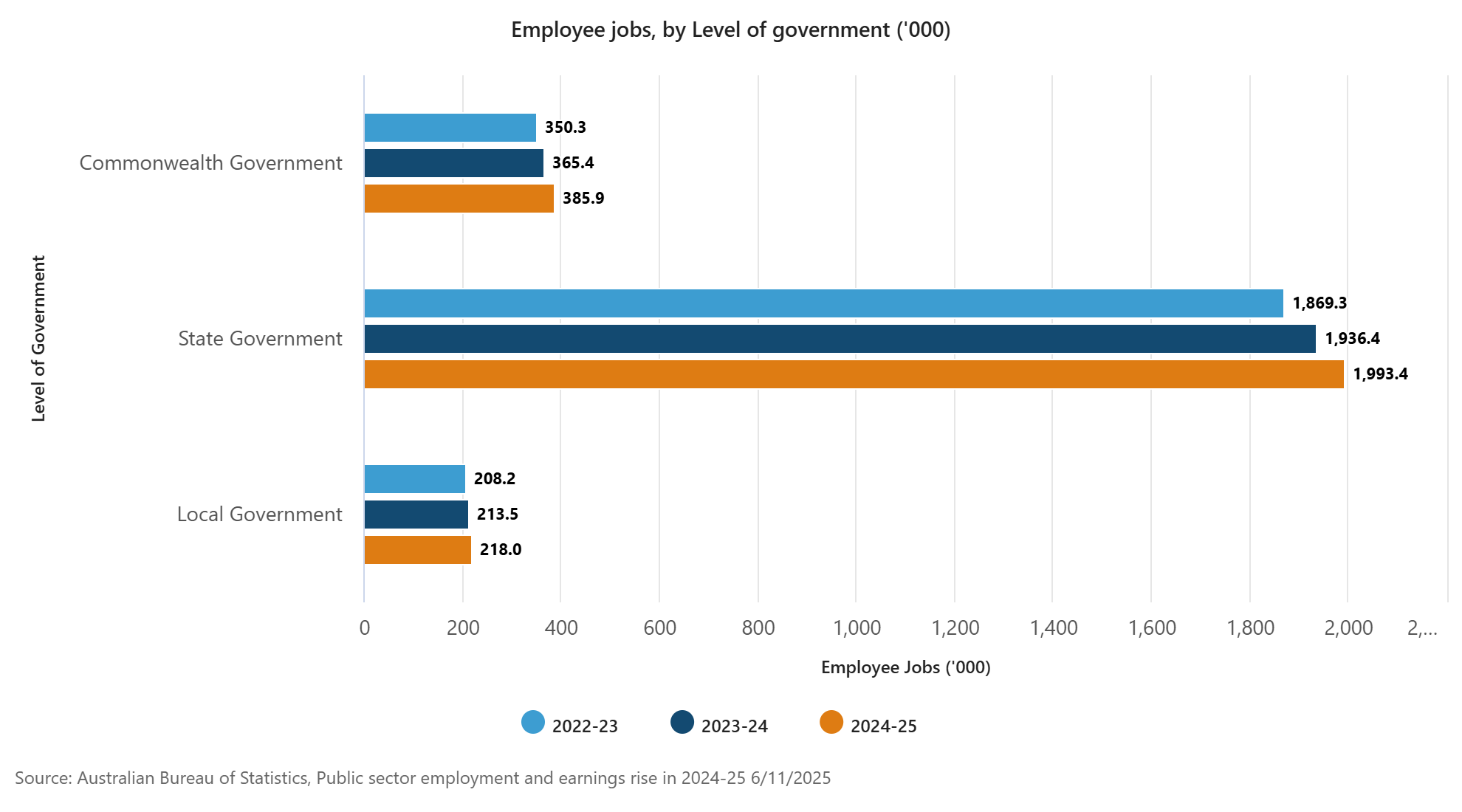

The growth in public sector employment in 2024-25 was strongest for the federal government.

Commonwealth government employee jobs rose 5.6% to 385,900 in 2024-25, while wages paid by the Commonwealth government in 2024-25 were $40.9 billion, a rise of 9.5% annually.

State government jobs rose by 2.9% in 2024–25, reaching almost 2.0 million positions. Wages paid by state and territory governments were $191.1 billion for 2024-25, up 7.3% annually.

Local government employee jobs rose by 2.1% to 218,000 in 2024-25, and wages paid rose to $17.6 billion (up 6.9% annually).

Tim Wilson, opposition spokesman for industrial relations and employment, estimated that eight in 10 jobs being created across Australia are attached to public spending, not private investment.

“That means wealth-creating jobs are collapsing, small business is collapsing, but Canberra is booming”, he said.

Kevin You, from the Institute of Public Affairs, said that the bloating of government jobs meant “the only boom sector of the Australian economy is the public service”, adding that public service workers now earned a 26% “public sector” premium to the average worker in the private sector—about $96,309 a year on average versus about $76,424 in the private sector.

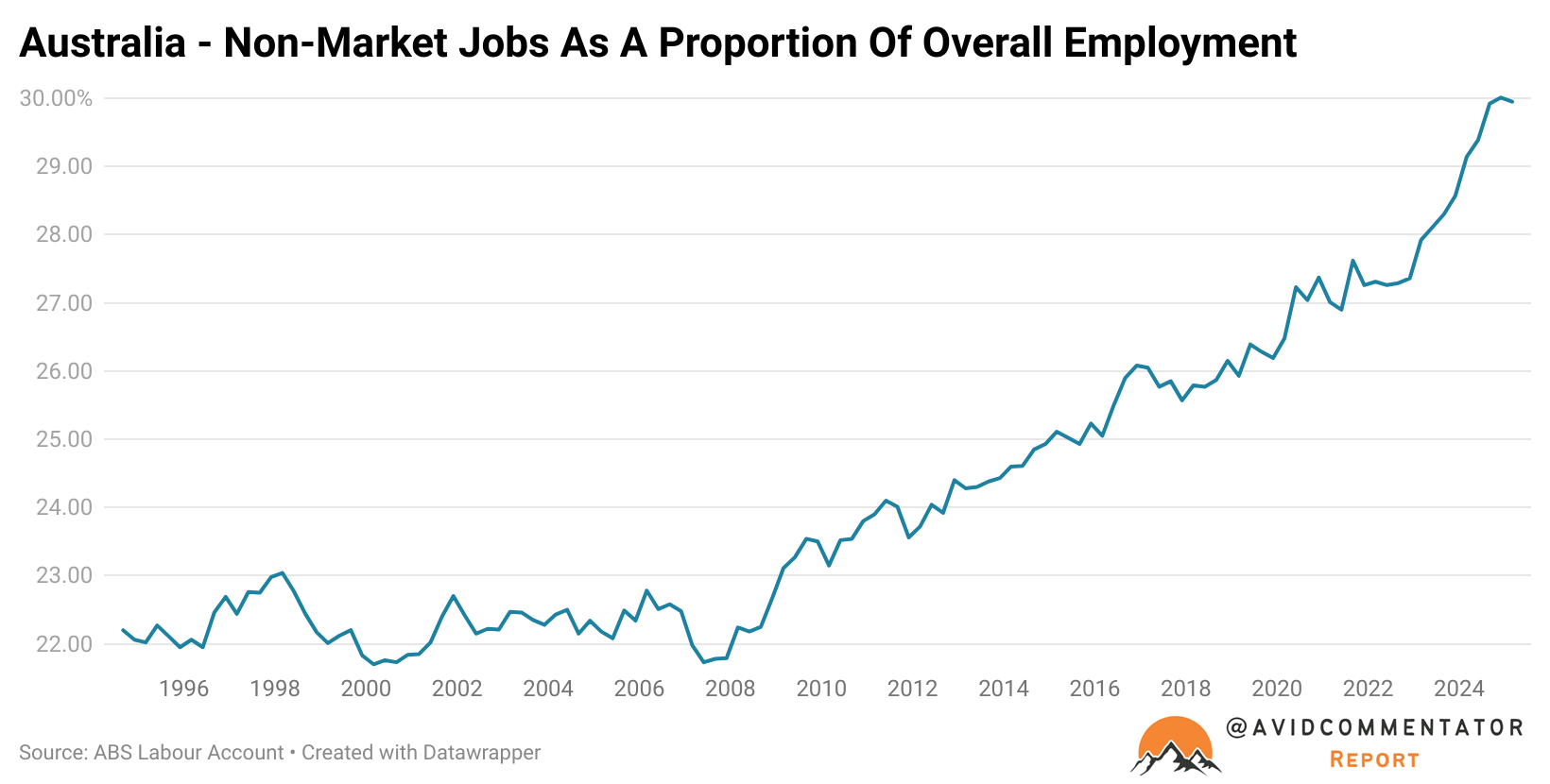

The surge in public servants only provides a partial picture. The bigger issue lies in the enormous growth in non-market sector jobs, which also includes roles in healthcare, social assistance, and education.

The government primarily funds these non-market sector jobs, which have increased dramatically in share since 2008, driven recently by the expansion of the NDIS.

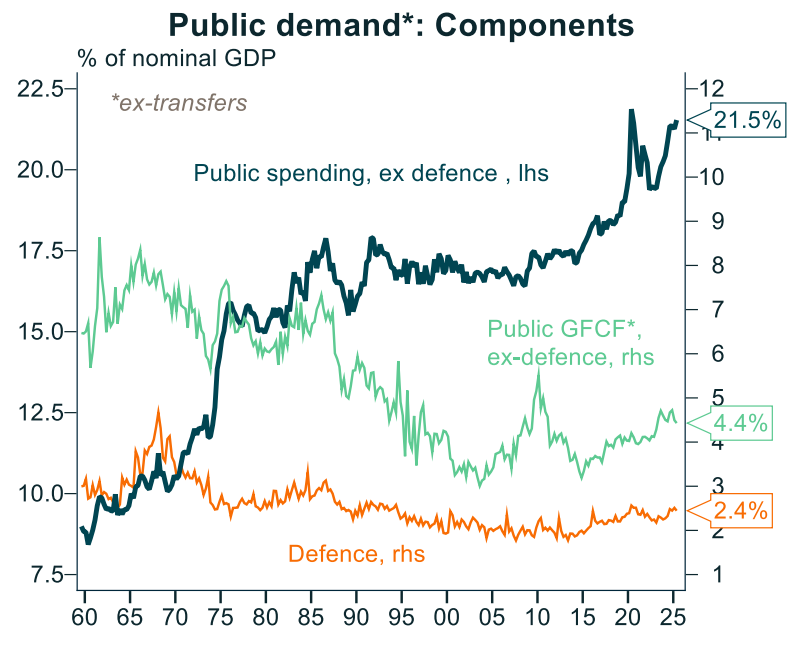

As a result, the role of the federal government in Australia’s labour market has become more pervasive over time, with spending on non-market jobs comprising a larger share of federal budget spending.

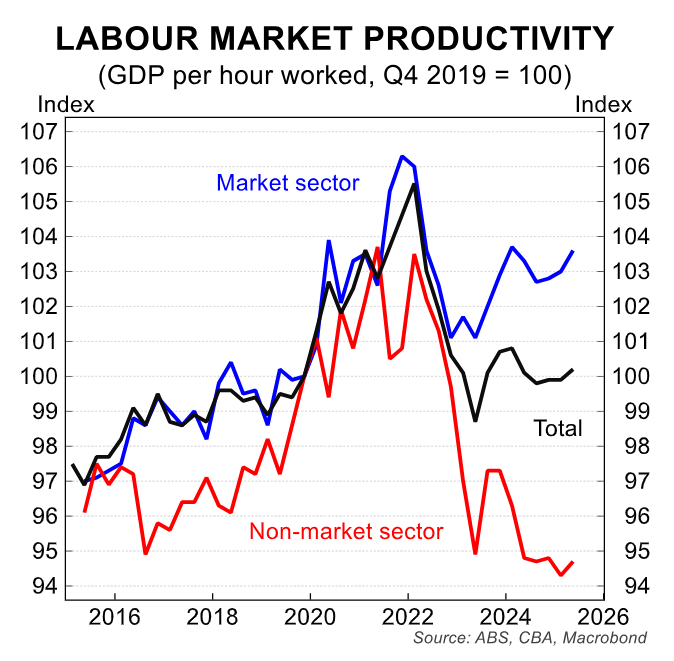

The bloating of non-market jobs is not only harming the federal budget bottom line but also the nation’s broader productivity growth.

Labour productivity in the non-market sector has collapsed, tracking at around 20-year lows:

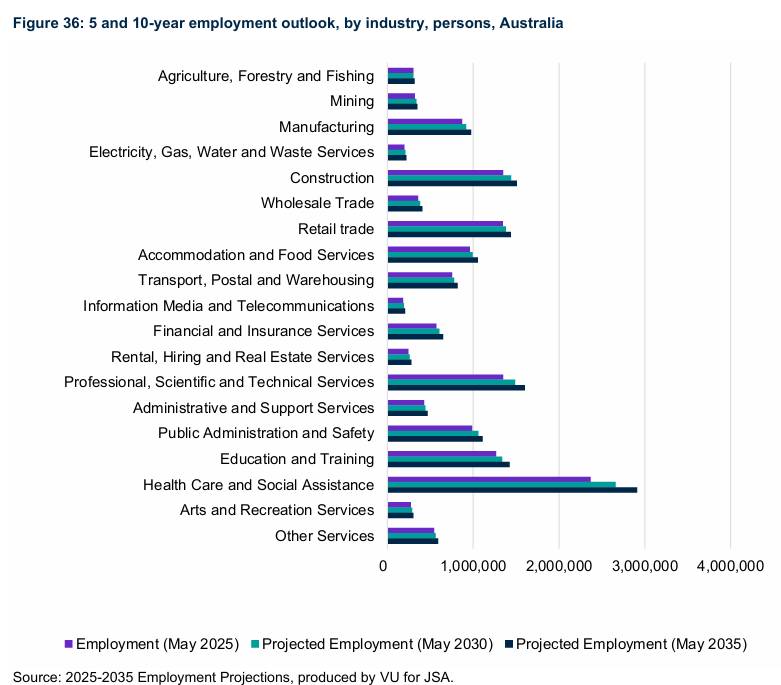

The situation is unlikely to change. Jobs & Skills Australia has forecast that more than 961,000 people will join the nation’s workforce over the next five years, increasing total employment by 6.5% to 15.7 million people.

Over the 10 years from May 2025 to May 2035, total employment is projected to increase by 13.3%, or nearly 2.0 million people, reaching over 16.6 million employed persons.

Non-market service industries are expected to account for around half (49%) of this growth, namely via healthcare, social assistance, professional and scientific services, and education and training.

In summary, Australia has transformed into a low-productivity growth economy fueled by unsustainable government-funded employment and excessive immigration.