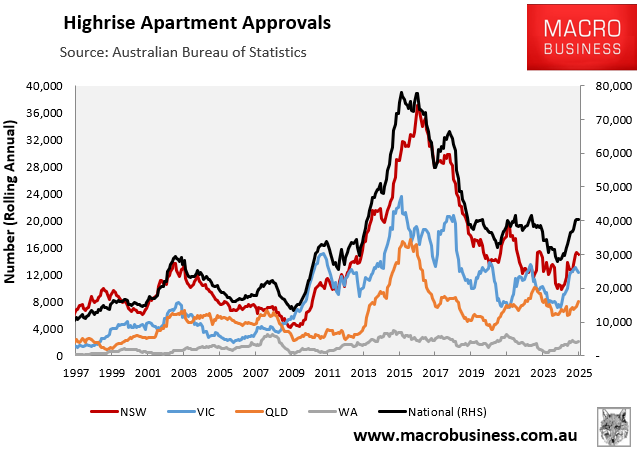

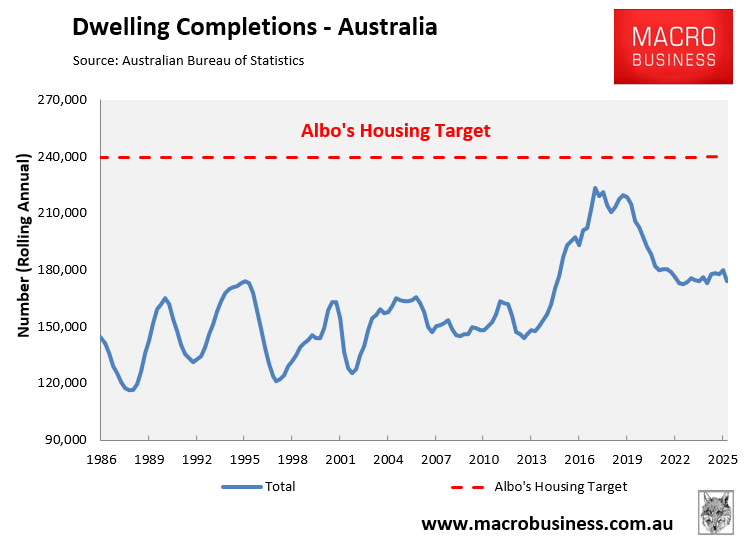

The Albanese government’s fantastical target of building 1.2 million dwellings over five years, or 240,000 homes a year, is based on delivering another boom in high-rise apartment towers, even greater than the one experienced between 2015 and 2020.

To meet the federal government’s lofty housing construction target, Australia would need to build more homes than ever before, given that the record single year of new home construction was only 223,600 in 2017 amid the aforementioned apartment construction boom.

Policymakers conveniently overlook the fact that the last decade’s unprecedented boom in high-rise apartment towers resulted in an increase in construction defects and quality issues, such as fractured foundations, water leaks, balcony defects, and flammable cladding.

Sydney’s Opal and Mascot Towers, for instance, required evacuation due to extensive cracking.

These faults have cost owners and taxpayers millions in rectification works.

According to a 2023 NSW government strata study, more than half of newly registered structures since 2016 had at least one severe problem, with repair costs averaging $331,829 per building.

The Strata Community Association NSW found that waterproofing was the most common major problem, followed by fire safety.

These flaws were highlighted in the Four Corners Report “Cracking Up,” which revealed a systemic failure to control and safeguard the purchasing public from subpar workmanship.

Engineer Leith Dawes cautioned that buying an off-the-plan apartment in Australia has become “Russian Roulette” due to the numerous undetected building flaws.

Four Corners and A Current Affair also reported on the hefty strata fees levied on high-rise apartment owners.

As Mark Twain famously said, “History doesn’t repeat, but it often rhymes”. The SMH has published a report on numerous new apartment projects that have experienced serious defects and have been issued prohibition and stop-work orders across Greater Sydney.

“Last week, this masthead reported that Observatory Place, a 24-storey apartment tower in Parramatta, was sitting empty after its now-bankrupt developers abandoned it following a prohibition order on the site in 2022”, The SMH reported.

“Since then, readers from across Sydney have reached out about other apartment buildings that remain vacant due to defects and subsequent stop-work orders placed on the sites by Building Commission NSW”.

Two years ago, Bronwyn Weir, a construction lawyer, cautioned that accelerating the construction of high-rise apartment towers would inevitably lead to cost-cutting and quality issues.

“Australia’s chronically undersupplied housing market is heading for another development boom and apartments will lead the way”, wrote The AFR’s Michael Bleby.

“On current estimates, 50% of what will be built will have serious defects”, Weir told The AFR.

Australia should avoid repeating past mistakes by rapidly increasing construction rates in response to unsustainable population growth driven by immigration.

The federal government should limit the nation’s immigration intake to a level that aligns with its capacity to provide high-quality housing and infrastructure, as well as the natural environment’s carrying capacity, particularly regarding water resources.

Significantly lower, sustainable immigration demand would encourage the building industry to prioritise quality over quantity in construction while also relieving the country’s rental crisis.

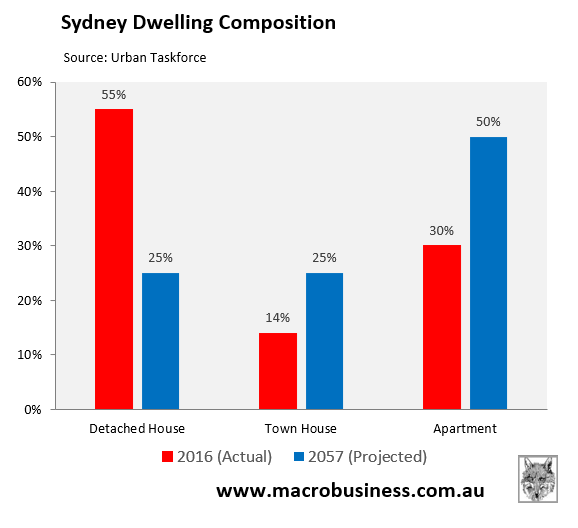

Lower immigration would also mitigate the need to transform our major cities into high-rise slums full of low-quality, expensive shoebox apartments.

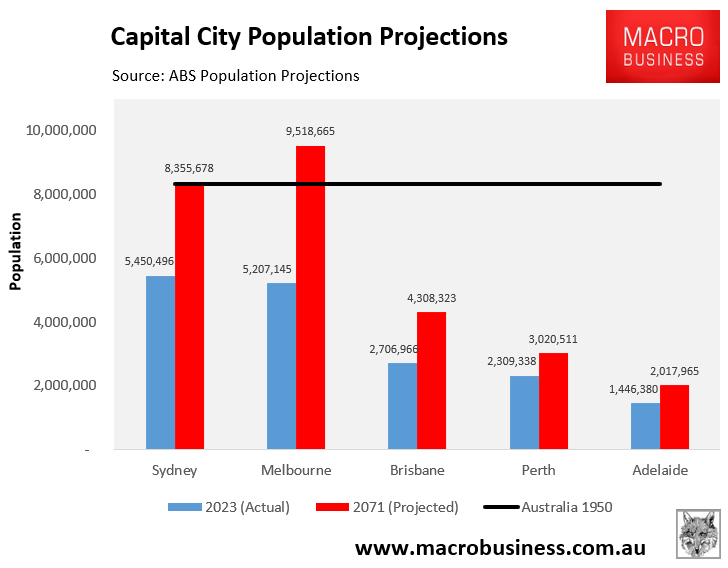

After all, who voted for Sydney and Melbourne to grow to cities of 8 and 9 million people? How will such rampant population growth improve living standards? Answer: nobody did, and it won’t.