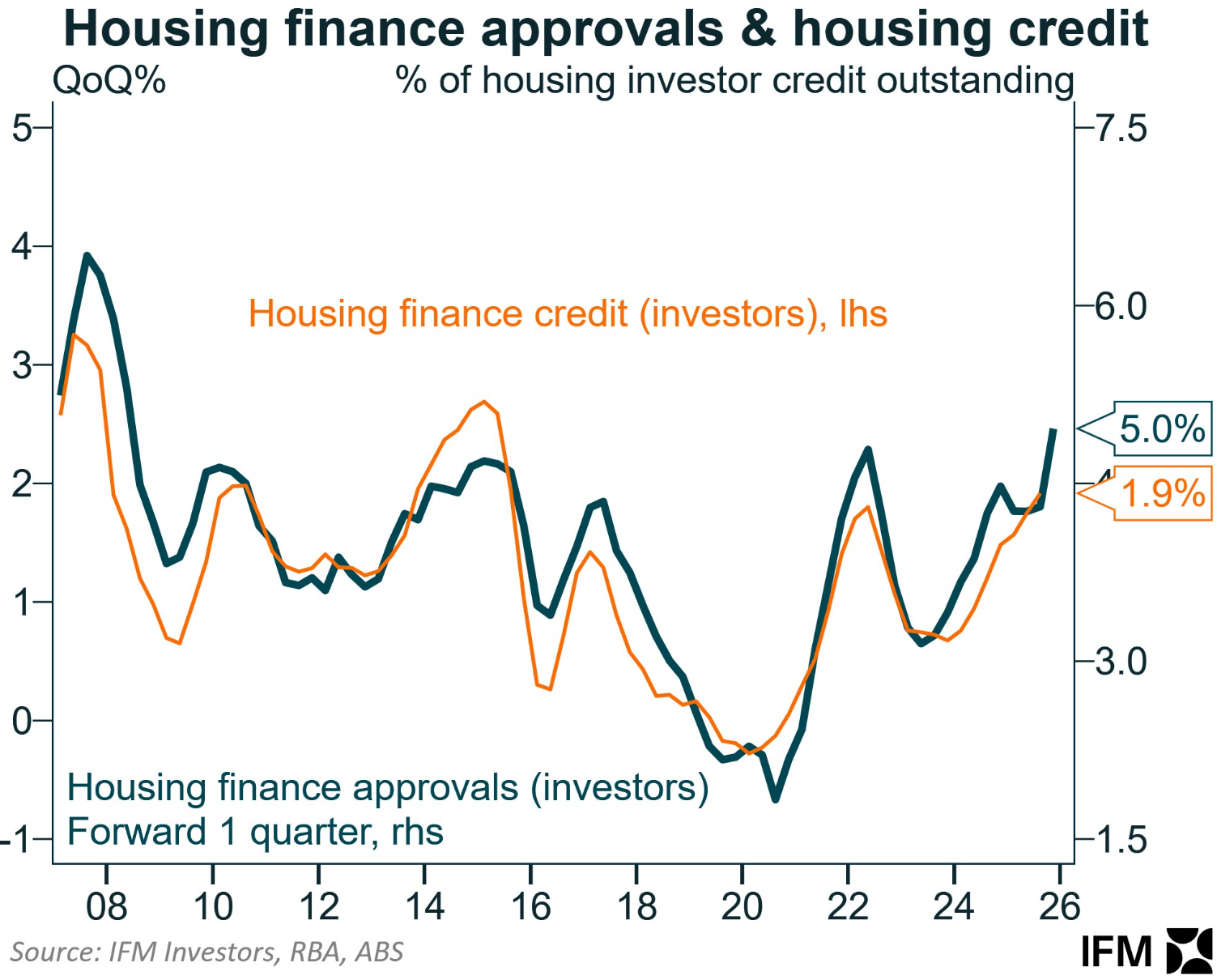

The latest batch of lending data from the Reserve Bank of Australia and the Australian Bureau of Statistics showed that investor mortgage lending has surged to decade highs.

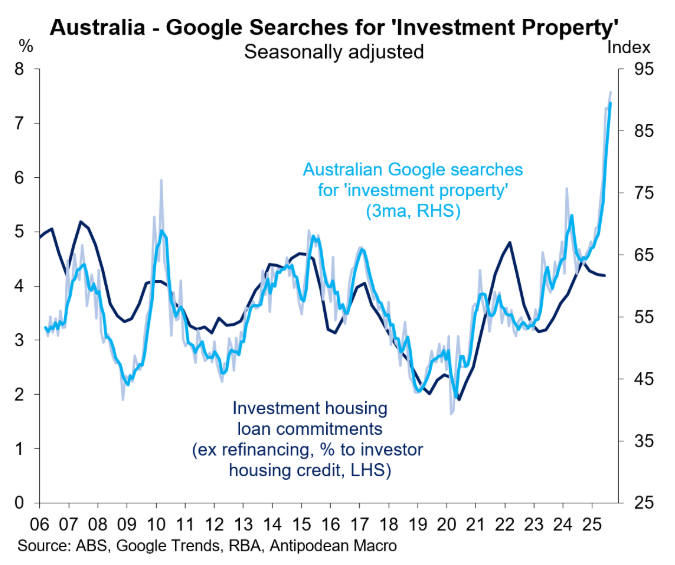

Recently, Justin Fabo from Antipodean Macro posted the following chart showing that Google searches for “investment property” had surged to their highest level in at least two decades:

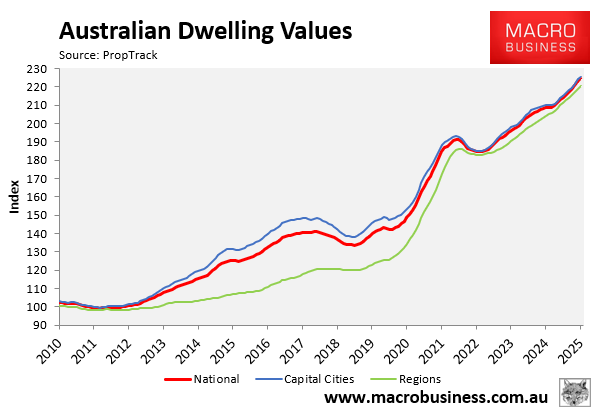

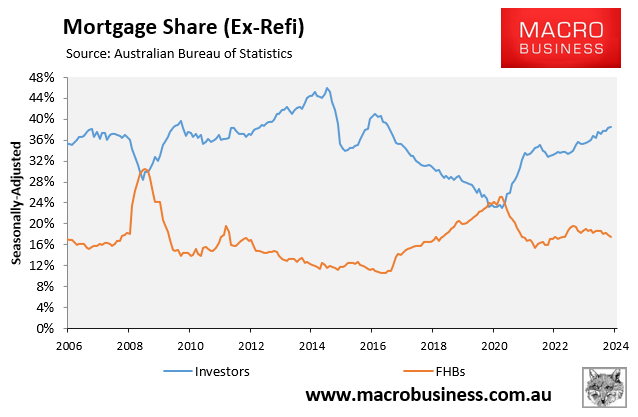

The surging demand from property investors is one of the reasons why Australian home values are surging. The situation has been worsened by the Albanese government’s 5% deposit scheme for first home buyers, which has also expanded demand, especially for homes priced at more affordable price points.

The Australian Prudential Regulation Authority (APRA) last week warned the banks that it may need to impose strict new lending rules as soon as December due to strong growth in both household debt and investor home loans.

The new restrictions for residential mortgage lending could include limits on high debt-to-income and investor or interest-only loans.

APRA highlighted that with housing prices rising, household debt-to-income ratios are increasing. This was in part a side effect of the Albanese government’s 5% first home buyer scheme.

“The expansion of the Australian government’s 5% deposit scheme is expected to boost demand from first-home buyers”, APRA stated.

“Given that housing supply takes some time to respond to increases in demand, momentum in housing prices is likely to continue in the near term”.

“APRA also makes it clear Labor’s scheme is pushing banks to take on more risk”, Coalition housing spokesman Andrew Bragg said. “Allowing people to buy a home with a tiny deposit means borrowers are taking on bigger and more expensive mortgages, which leaves families, lenders and the taxpayer exposed if something goes wrong”.

However, with investor lending also surging, APRA warned that competition between banks for mortgages was heating up, which could “result in higher default levels and credit losses”.

“It is a question about whether there are risks that need to be managed differently”, said APRA official Marion Kohler. “We will be talking about that in an update that’s coming before the end of the year and I don’t want to really elaborate further on that”.

Tightening macroprudential rules on investor lending is a no-brainer, since it would help curb demand, speculative lending, and house price appreciation, thereby improving affordability and financial stability.

Moreover, one of the best ways to help first home buyers enter the market is to reduce competition from investors.

Victoria, which implemented a raft of taxes targeted at property investors, highlights this point well. Fewer property investors in Victoria have kept a lid on prices and driven a large boost in first home buyer purchases.