The Australian Bureau of Statistics (ABS) has debuted its highly anticipated “complete” monthly consumer price index.

This new monthly CPI indicator is a major upgrade—covering nearly the entire consumption basket, using richer data sources, and giving policymakers and the public a real-time view of inflation rather than waiting for quarterly updates.

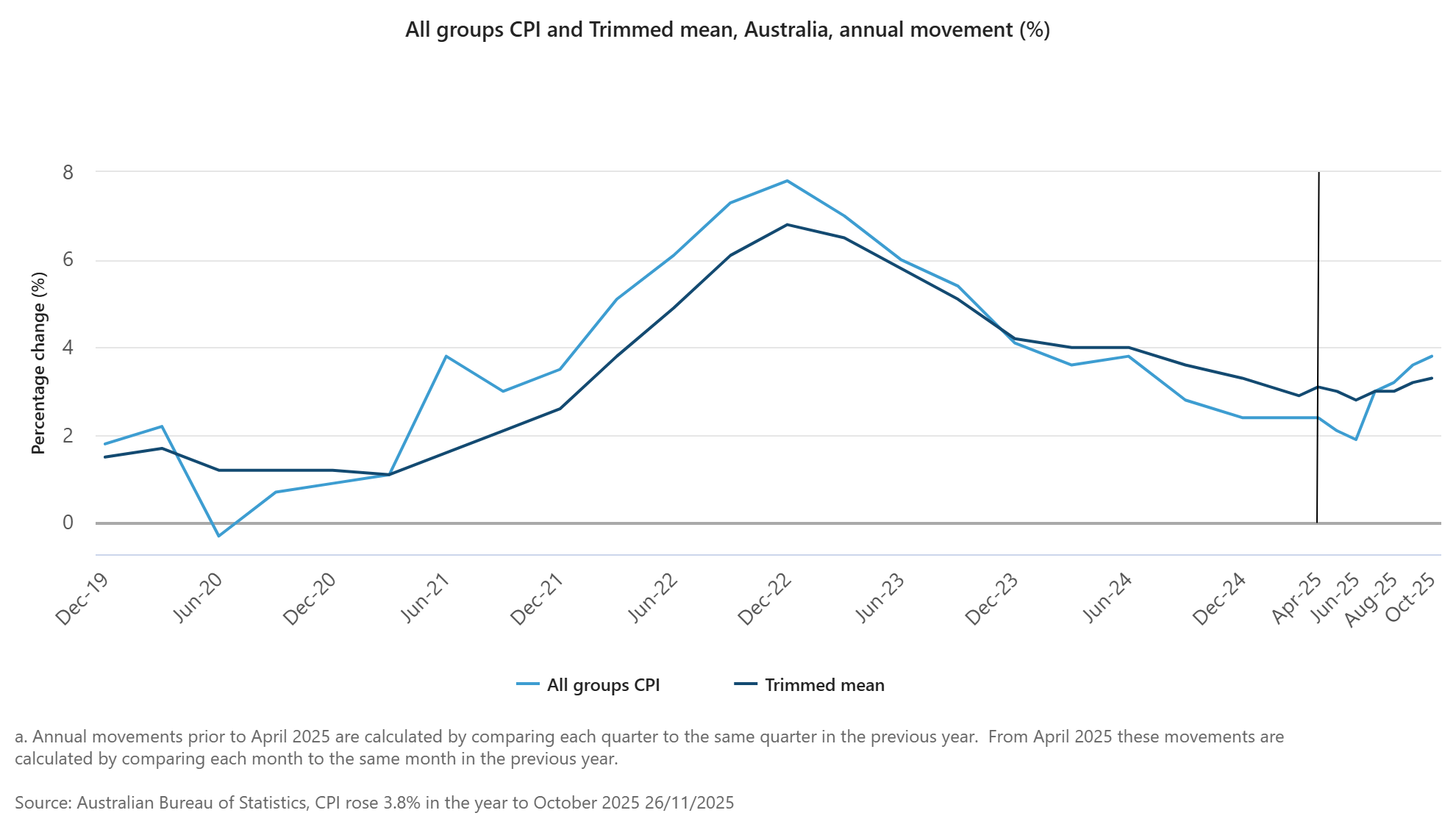

The results for October are out and show that headline CPI inflation rose by 3.8% in the year to October 2025, up from 3.6% in the year to September:

The policy-relevant trimmed mean inflation rose by 3.3% in the year to October, up from 3.2% in the year to September:

Commenting on the result, ABS head of prices statistics Michelle Marquardt noted:

‘Today’s release marks the transition from the quarterly CPI to the complete Monthly CPI as Australia’s primary measure of headline inflation. The time series for the complete Monthly CPI goes back to April 2024, which is when the ABS began collecting prices for a number of Expenditure Classes more frequently’

The annual increase in the complete Monthly CPI of 3.8% to October was up from 3.6% to September.

The largest contributor to annual inflation was Housing, up 5.9%. This was followed by Food and non-alcoholic beverages and Recreation and culture, which both rose 3.2%.

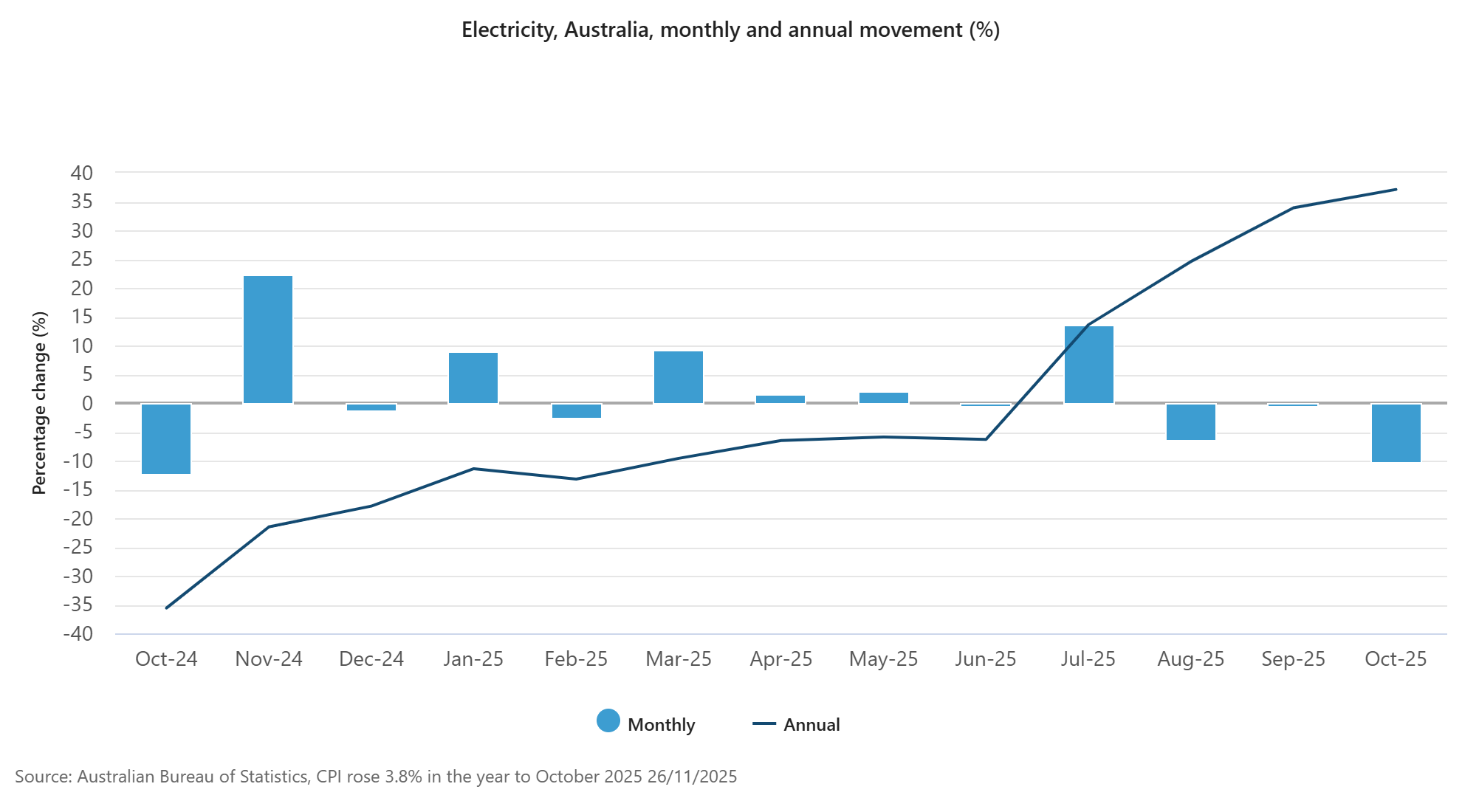

Soaring electricity costs following the expiry of subsidies continue to drive inflation higher:

According to the ABS:

Electricity costs rose 37.1% in the 12 months to October, up from 33.9% to September. The annual rise in electricity costs is primarily related to State Government electricity rebates being used up by households. The timing of the rollout of the Commonwealth Energy Bill Relief Fund (EBRF) rebates also impacted electricity costs.

In October 2024, State Government electricity rebates were in place for Queensland and Western Australia. Over the year to October 2025, those rebates have ended.

Excluding the impact of the Commonwealth and State Government electricity rebates over the last year, electricity prices rose 5.0%. This reflects annual price reviews from energy retailers in July 2025.

With trimmed mean inflation running above the RBA’s 2% to 3% target, there is no way that it will cut rates until inflation moderates or unemployment spikes higher.

As a result, rates will remain on hold for the foreseeable future.