The latest batch of rental data from Cotality and SQM Research suggests that Australia’s rental market has tightened.

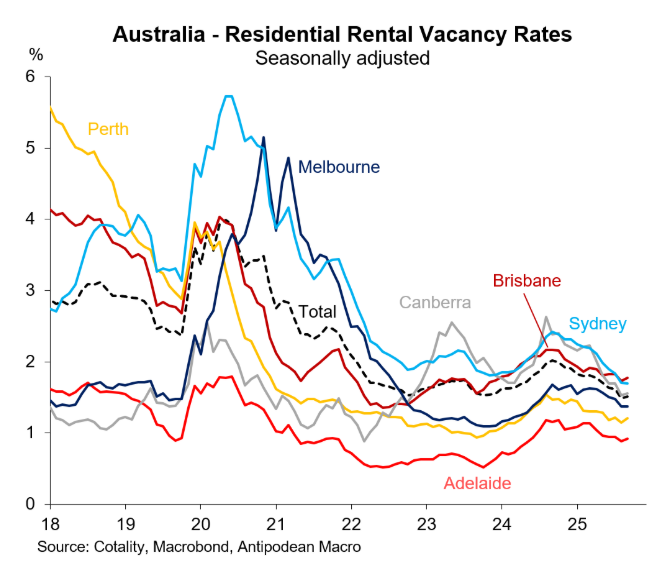

As illustrated below by Justin Fabo from Antipodean Macro, Cotality reported a capital city vacancy rate of 1.5% in September, which was 0.4% lower than a year ago and the lowest vacancy rate on record:

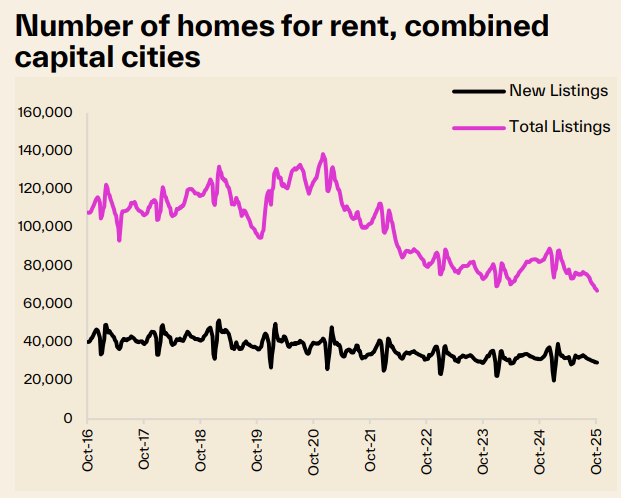

The number of homes listed for rent across the combined capital cities is also the lowest on record:

Source: Cotality

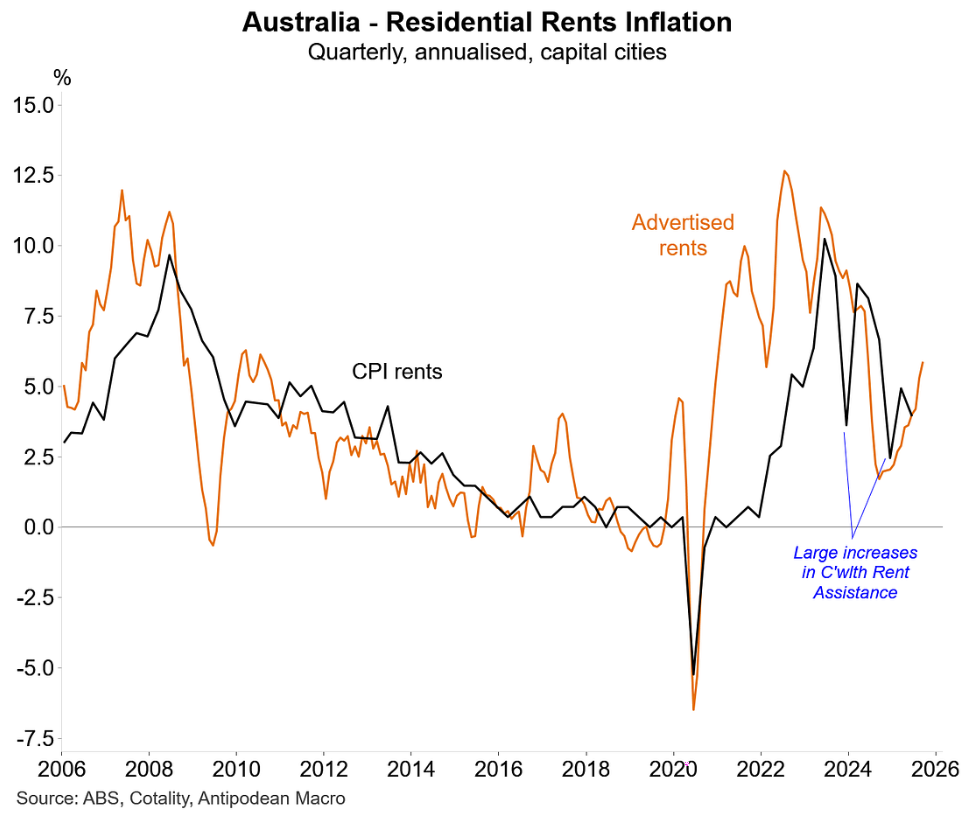

As a result, Cotality reports that capital city rental growth has reaccelerated, which follows a 43.8% increase over the previous five years:

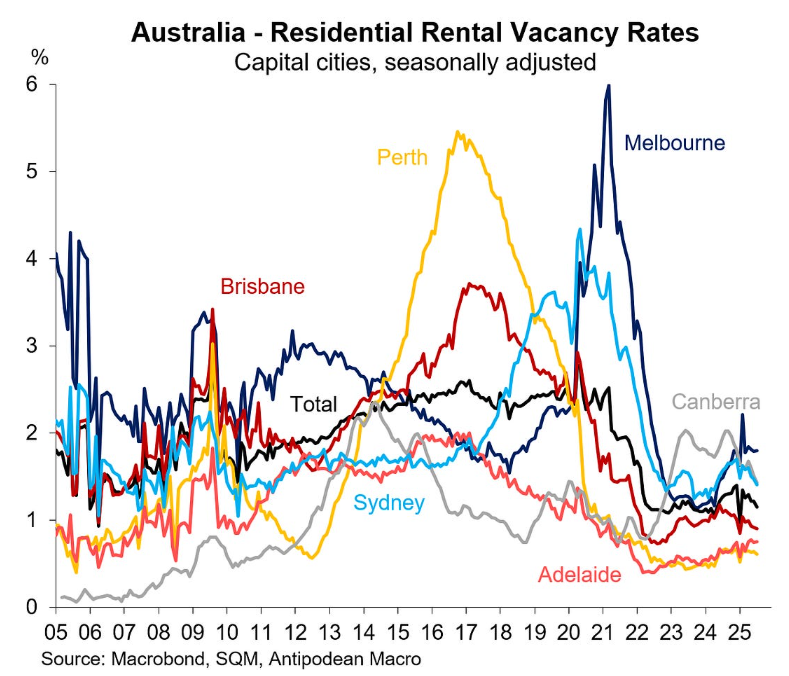

SQM’s research data tells a similar story, with the combined capital city rental vacancy rate collapsing back to just 1.2% in September:

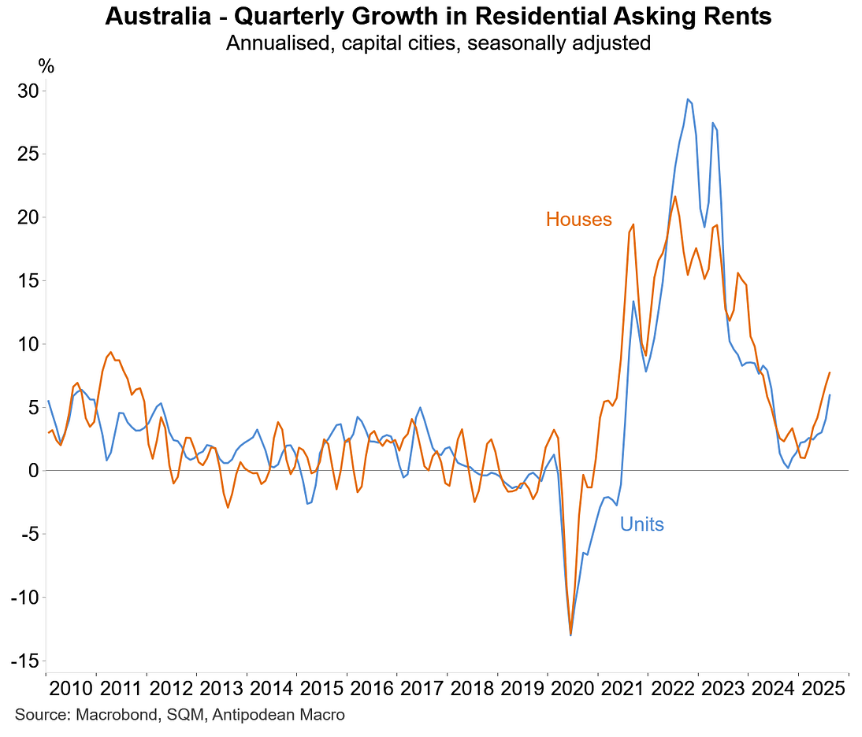

As a result, SQM also reports that rental growth has accelerated:

While I cannot be certain, Occam’s Razor suggests that a resurgence of net overseas migration is behind the collapse in vacancy rates and the rise in rents.

On Tuesday, the Australian Bureau of Statistics (ABS) released monthly net permanent & long-term (NPLT) arrivals data (i.e., border movements), which are officially considered by the Centre for Population as being a leading indicator for net overseas migration.

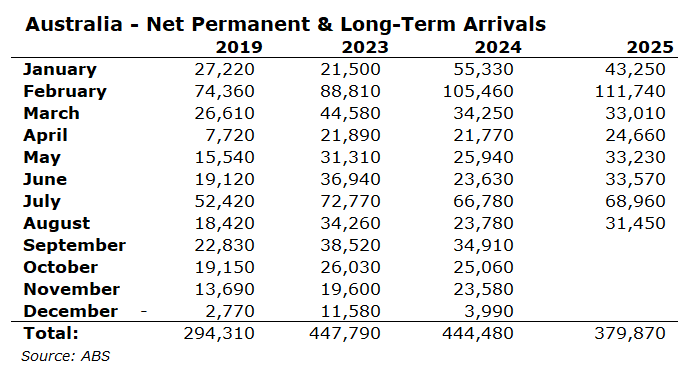

As illustrated in the table below, there were a record 379,870 net permanent and long-term arrivals in the first eight months of 2025, up 22,930 (6.4%) from the 356,940 net arrivals that landed last year and 138,460 (57.4%) higher than the same period in 2019, before the pandemic.

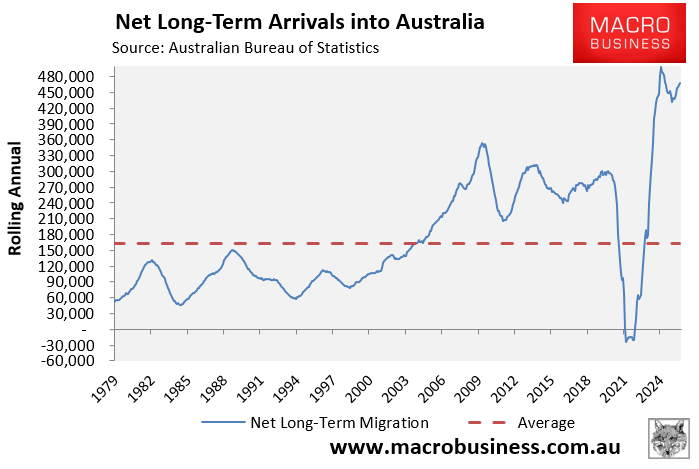

The following chart shows that there were 467,410 NPLT arrivals in the year to August 2025, with the annual rate of net arrivals rising since January.

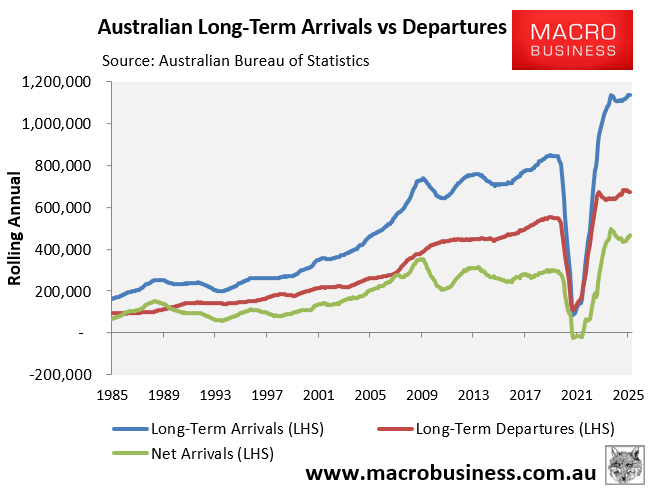

There were 1,137,850 permanent and long-term arrivals in the year to August 2025, the highest level in history, partly offset by 670,440 departures:

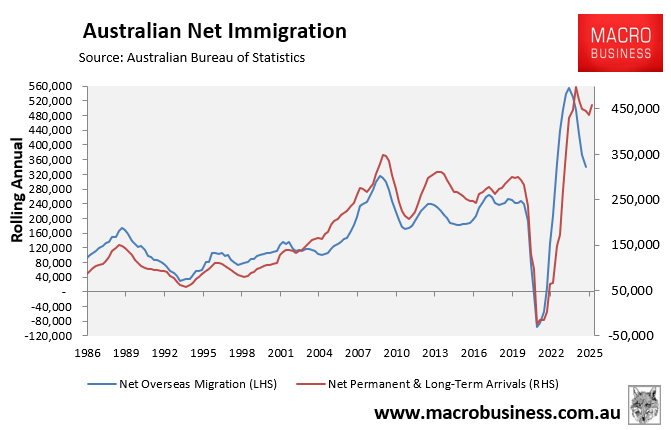

Historically, the monthly NPLT arrivals series has closely tracked the official quarterly net overseas migration (NOM) series, which runs on a six-to-nine-month delay.

As you can see below, the NPLT arrivals series has decoupled from the official NOM series, which is current to Q1 2025:

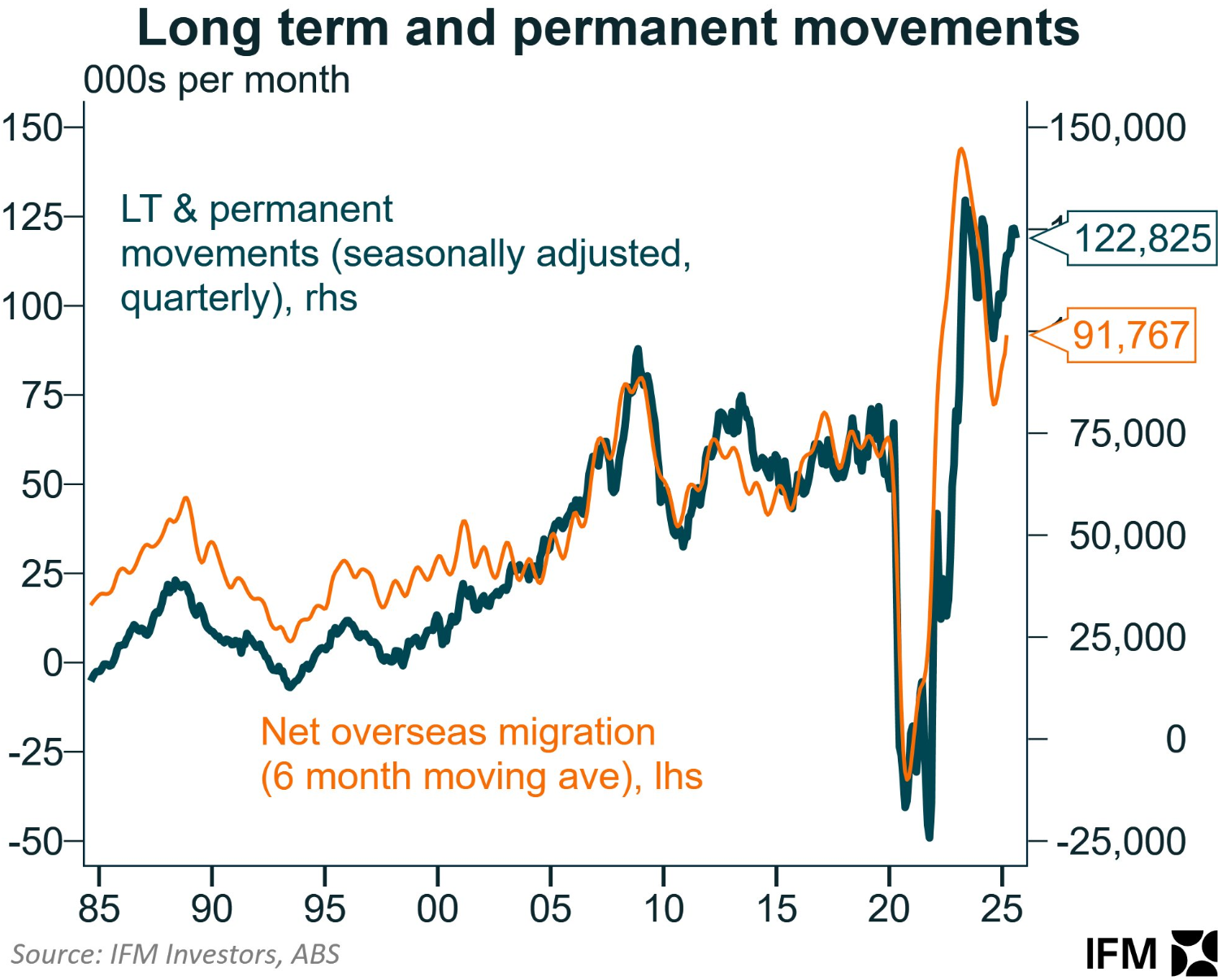

Alex Joiner from IFM Investors presents the same data on a seasonally adjusted basis:

Therefore, the evidence suggests that NOM is rising again.

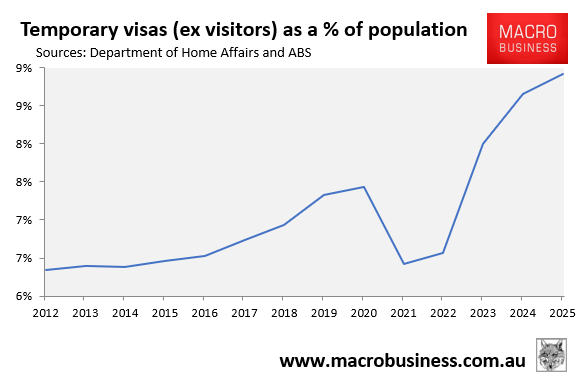

The Albanese government recently announced that it has raised the planning level for international students by 25,000 to 295,000 for 2026.

As a result, Australia’s international student and temporary visa numbers—which are already the highest in the advanced world relative to our population—will inevitably increase.

In the lead-up to the 2022 and 2025 federal elections, Prime Minister Anthony Albanese stated that Labor would run a smaller and less temporary migration program.

Instead, it has delivered a larger, lower-quality, and more temporary immigration program than ever before.

Australia’s rental crisis will intensify if population growth continues to outpace supply.