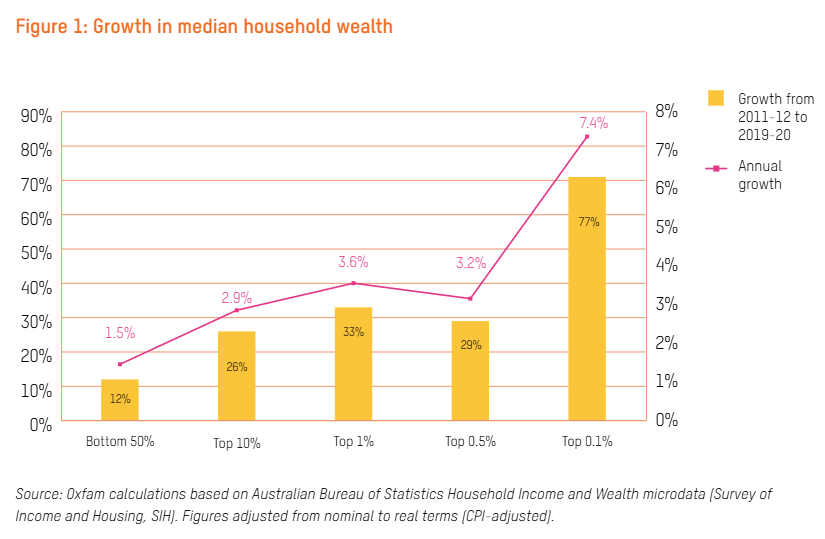

A new report from Oxfam claims that the capital gains tax (CGT) discount and negative gearing are “disproportionately” benefiting Australia’s wealthiest, fuelling the housing affordability crisis and inequality, and harming the federal budget.

Accordingly, Oxfam has called on the government to “properly tax wealth and restore a progressive tax system that works for working people”.

“Today, billions of dollars in budget revenue are given away to the wealthiest in the form of tax discounts and because Australia’s tax system does not effectively tax the super-rich”, Oxfam argues.

“Instead it allows them to amass wealth and fund lavish lifestyles through untaxed growth in assets and investments. This harms our economic resilience and our society. It deepens the inequality divide, allowing unbridled wealth growth at the top, while starving the budget of revenue needed for public services and poverty alleviation for people living on low incomes”.

“For long-term budget sustainability, the government must properly tax wealth and restore a progressive tax system that works for working people”.

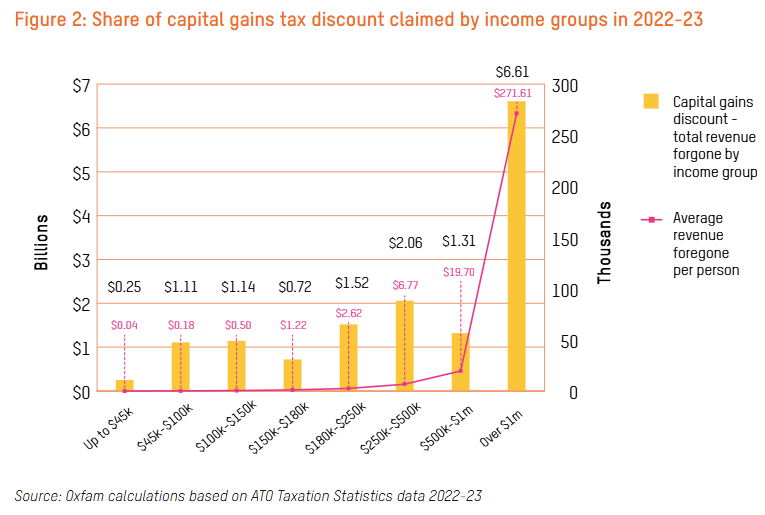

Oxfam adds that the CGT discount overwhelmingly benefits the wealthiest Australians:

“The benefit of the capital gains tax discount to people earning over $1 million is almost 1,500 times more than someone making between $45,000 and $100,000. This is a key driver of rising inequality and it must come to an end. By scrapping the capital gains tax discount alone, the government could have restored around $22.7 billion to the budget in 2024-2025”.

Among other suggested reforms, Oxfam has called on the federal government to “end the capital gains discount for individuals and trusts, and tax capital gains like income from work”, as well as “phasing out negative gearing over five years”.

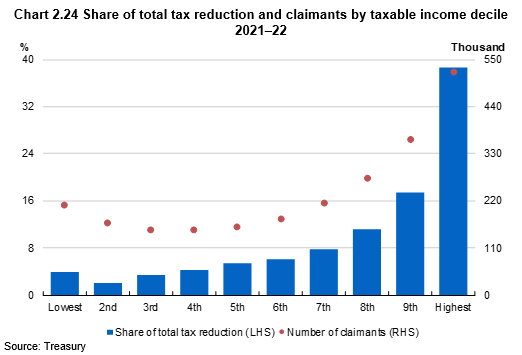

The Australian Treasury’s analysis of the 2021-22 tax year revealed that those with above-median income received 81% of the overall tax benefit from rental deductions, with 39% going to people in the highest taxable income decile (Chart 2.24).

According to the Treasury, those with higher taxable incomes are more likely to claim rental losses, with those in the top 30% receiving 75% of the overall benefit.

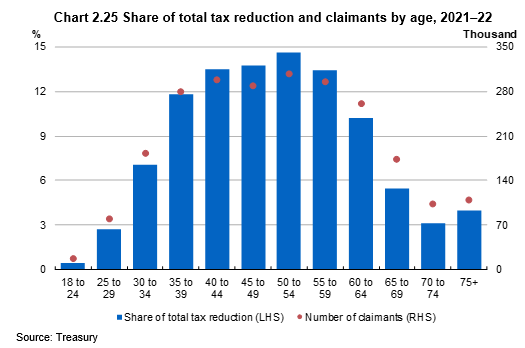

Generations X and Y also claimed the majority of deductions because baby boomers typically owned their rental properties outright or had retired.

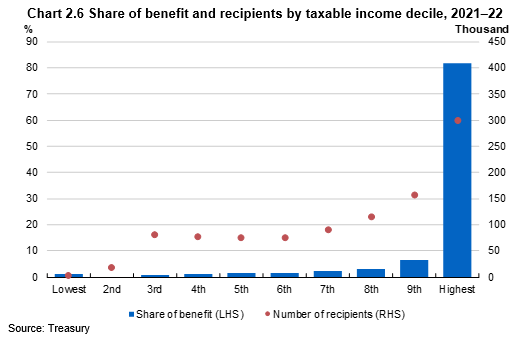

People in the highest income decile also received around 82% of the benefit from the CGT discount (Chart 2.6).

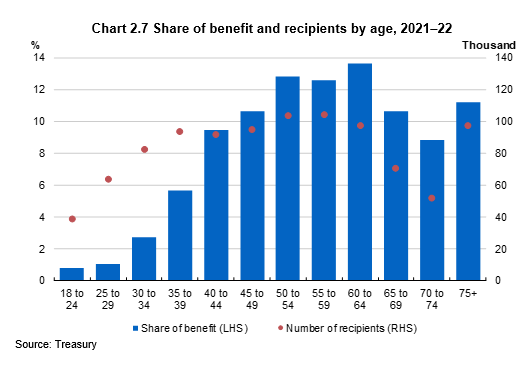

Older Australians reaped the largest benefits (Chart 2.7). Those aged 50 to 64 received the greatest share of the benefit, followed by those aged 60 to 64 (13.6%).

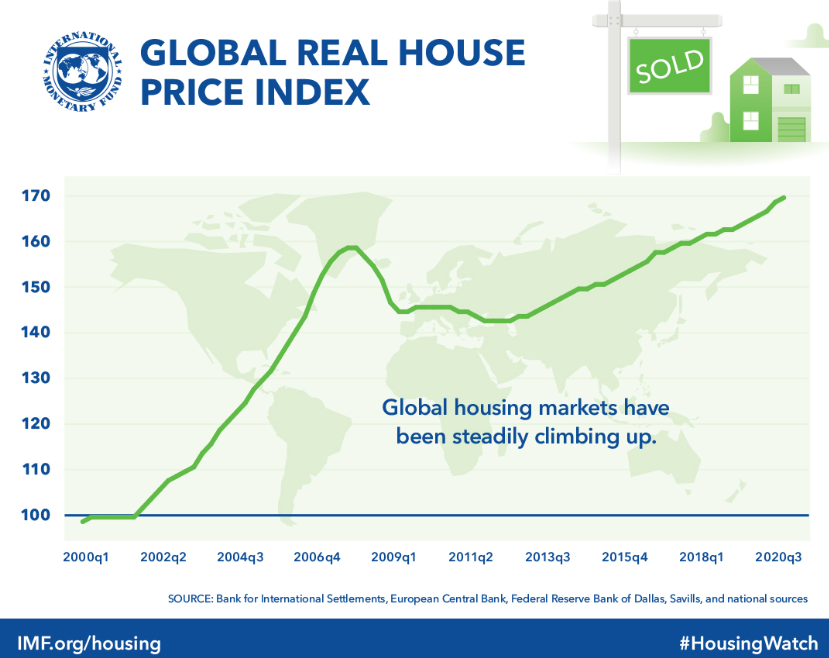

I don’t hold these tax breaks responsible for the absurd surge in housing prices since the turn of the century, given that prices have been rising globally (though they have undoubtedly contributed to the situation).

This suggests that global deregulation of mortgage financing played the biggest role.

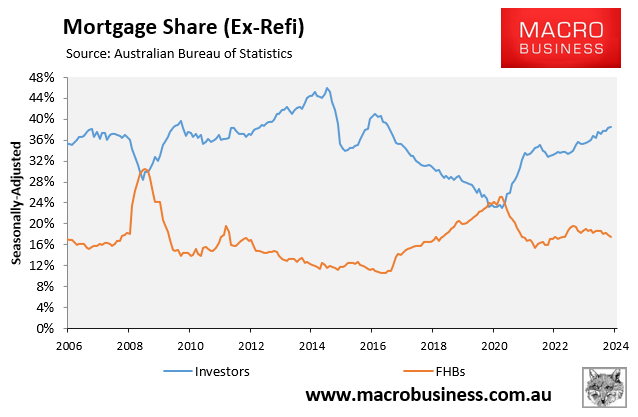

Nonetheless, Australia’s property tax breaks are costly to the federal budget, promote investor demand, crowd out first-home buyers, worsen inequality, and lower the country’s homeownership rate.

It is a statistical fact that if we want Australia’s homeownership rate to rise, we will need fewer investors in the market, squeezing out first-time buyers.

On budget sustainability and homeownership grounds alone, Australia’s property tax concessions should be unwound.