Wednesday’s CPI shocker, which saw annual trimmed mean inflation jump by 1.0% and 3.0% year-on-year, has shut the door on near-term interest rate cuts.

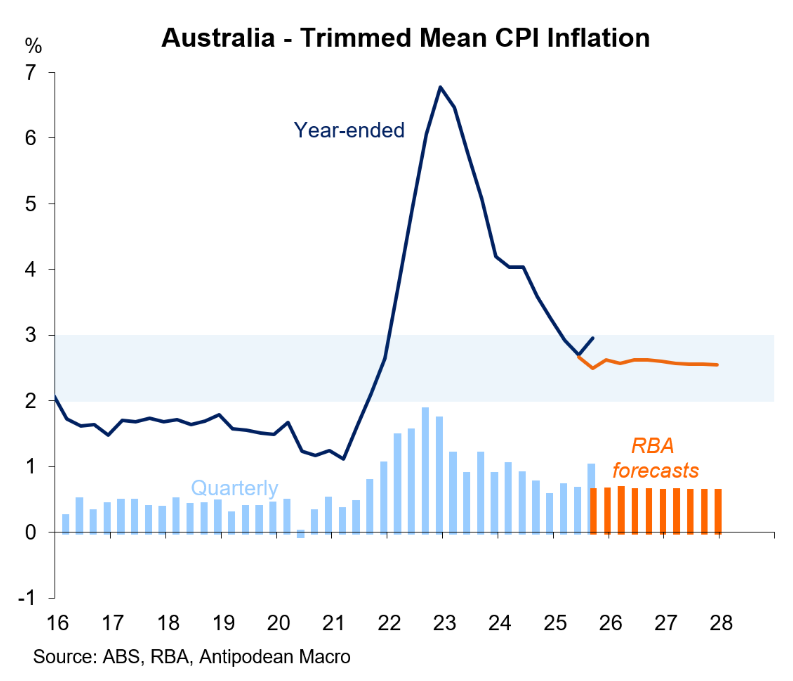

As illustrated below by Justin Fabo from Antipodean Macro, the Reserve Bank of Australia (RBA) was looking for trimmed mean inflation of 2.6% at the end of 2025. To achieve this now, the trimmed mean would need to print 0.2% in the December quarter, an impossibility.

As a result, the RBA will lift its end-of-year estimate of underlying inflation when its revised forecasts are released next week as part of the November Statement of Monetary Policy.

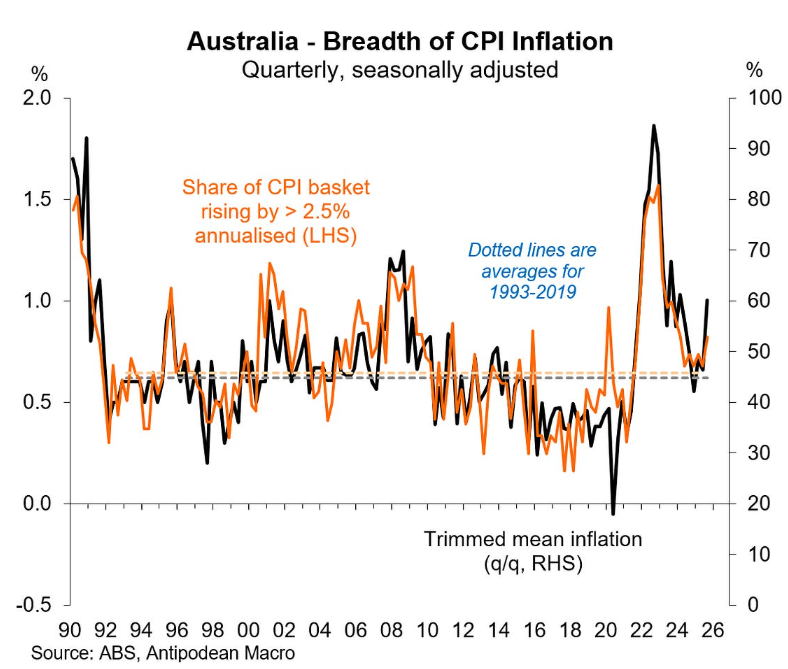

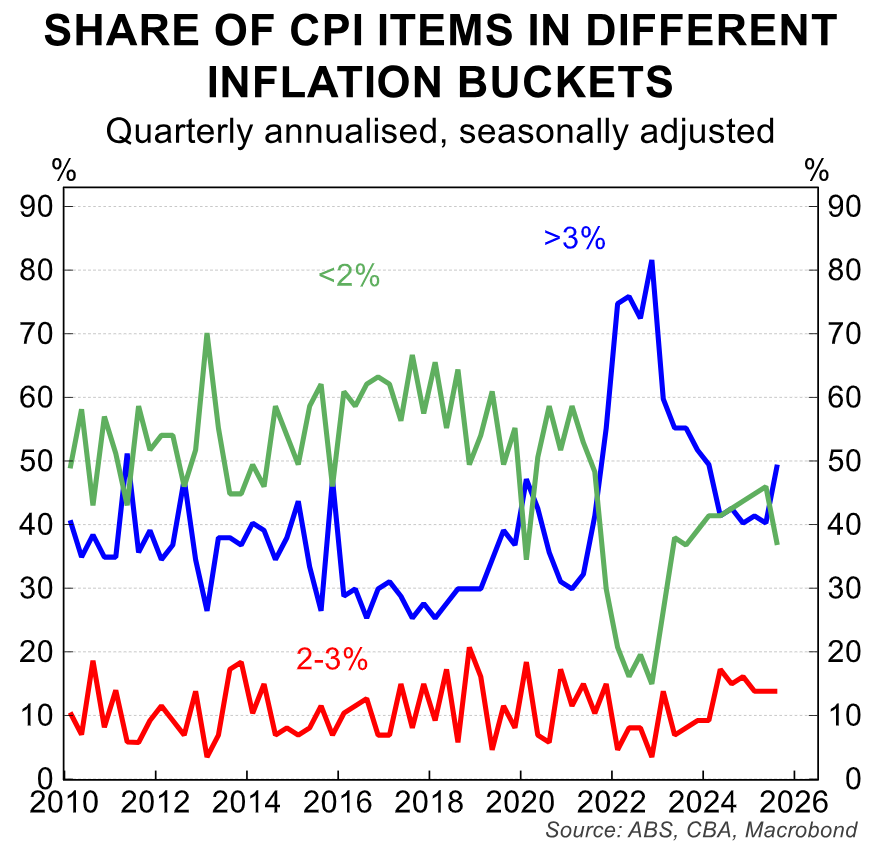

The following chart from Fabo shows that the breadth of inflation has lifted:

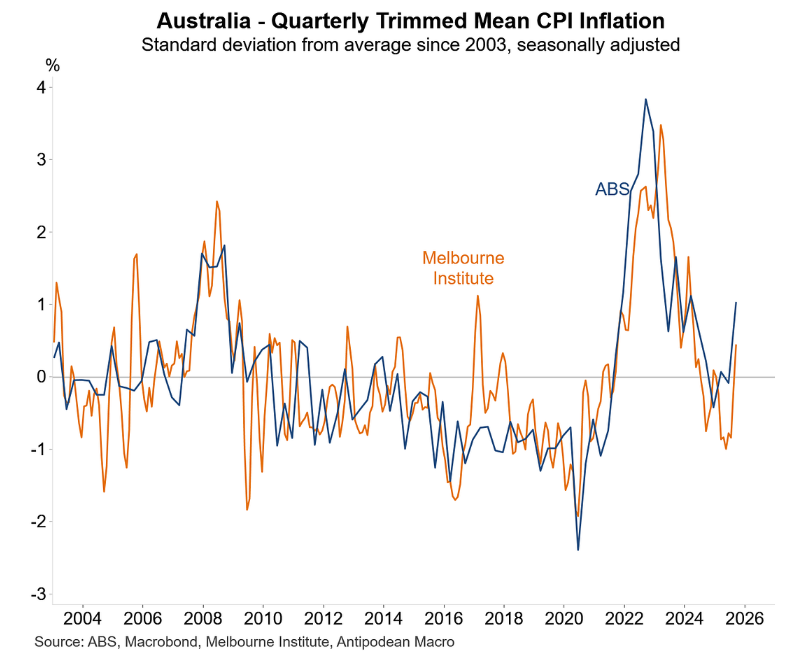

Both the official quarterly ABS trimmed mean and the unofficial Melbourne Institute measures are showing an inflationary pulse:

In short, the RBA is almost certain to keep interest rates on hold for the foreseeable future. There is no chance that the RBA will cut the cash rate until:

- Trimmed mean inflation falls back toward the middle of the target band (i.e., closer to 2.5%); or

- The unemployment rate rises significantly above its current level of 4.5%.

Following the CPI release, CBA’s head of Australian economics, Belinda Allen, released a note declaring “no more cuts to come”:

“The material upside surprise to Q3 25 trimmed mean CPI, and its broad-based nature, mean we now expect the RBA to remain on hold at 3.60% for a prolonged period”, Allen wrote.

“It would take a material upside move in the unemployment rate and more moderate inflation prints to bring the RBA back to the easing table”.

“Instead, the RBA will now turn more hawkish and look to prevent a return to higher inflation”, Allen said.

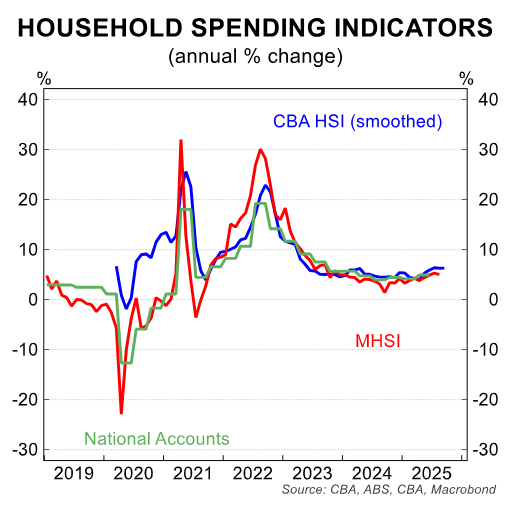

Allen noted a “stronger consumer back drop”, with “our CBA spending data picking up steam since March”.

CBA also reported that the share of CPI items growing above 3% rose to 50% in Q3, up from 37% in Q2:

As a result, Allen expects “the RBA to pivot to a much more hawkish tone at the November Board meeting”, with RBA’s statement “to revert to concern over inflation and the outlook”.

Westpac was the most dovish of the major banks. However, in a note released following the CPI result, Westpac Chief Economist Luci Ellis said the door has been closed on a rate cut this year, with February also looking unlikely.

However, Ellis argued that a “delay now adds to the chances of more cuts next year” in response to “the gradual softening in the labour market, and the resulting benign wages growth”.