In the early 2010s, the federal Labor government made the fateful decision to allow liquefied natural gas (LNG) exports from Queensland without requiring gas companies to first supply Australians.

Gary Gray, the then-Federal Resources Minister in the Gillard/Rudd Labor governments, claimed that domestic gas reserve regulations cause uncertainty and discourage investment. This pitted the government against Australia’s struggling manufacturing sector, which hoped for cheaper gas.

“The Australian Government does not agree that domestic gas reservation would keep gas prices down or put more gas into the market”, Gray said in his opening address to the Australian Petroleum Production and Exploration Association conference in Brisbane on 27 May 2013.

“In our view, it would create uncertainty and deter investment in new gas supply”.

Gary Grey restated his objection to the East Coast domestic gas reservation in July 2013.

“Let me say very clearly, a reservation policy could not lead to lower gas prices or more gas”, Gray said.

“Calls for intervention in the market only serve to dampen any appetite for the very investment that’s needed to bring on new gas supplies”.

“We must allow our markets to respond as they are intended to do”.

Federal Labor’s anti-reservation stance pitted them against then-Western Australian Premier Colin Barnett, whose state government has implemented a domestic reservation scheme that requires big offshore gas projects to reserve some of their gas for the domestic market.

“As a result, the Chevron-led Gorgon and Wheatstone projects are building domestic gas plants in conjunction with the bigger and more lucrative LNG operations while Woodside Petroleum is under pressure to build a domestic operation alongside its Pluto LNG plant near Karratha”, reported The West Australian in May 2013.

“Local manufacturers led by Alcoa have been instrumental in driving the WA Government to implement the domestic gas policy as a way of trying to ensure lower gas prices, and a similar push is under way in eastern Australia”.

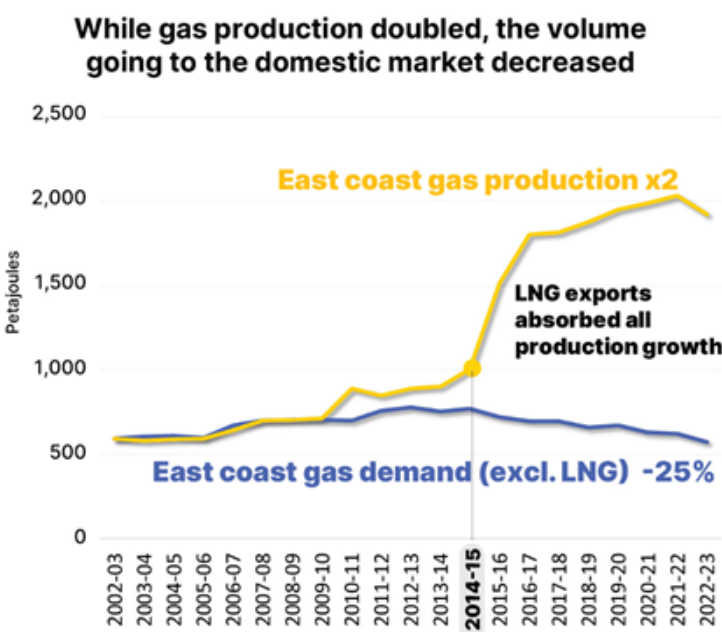

The rest is history. Gladstone LNG export terminals became operational, and East Coast Australia currently exports nearly three-quarters of its gas, mostly to China.

Gary Grey retired from politics in 2016 to become the general manager of external affairs for Mineral Resources, a Western Australian mining business. Grey had served as an advisor for Woodside Petroleum before entering federal politics.

While East Coast gas output has doubled since exports began, the domestic market now receives 25% less gas.

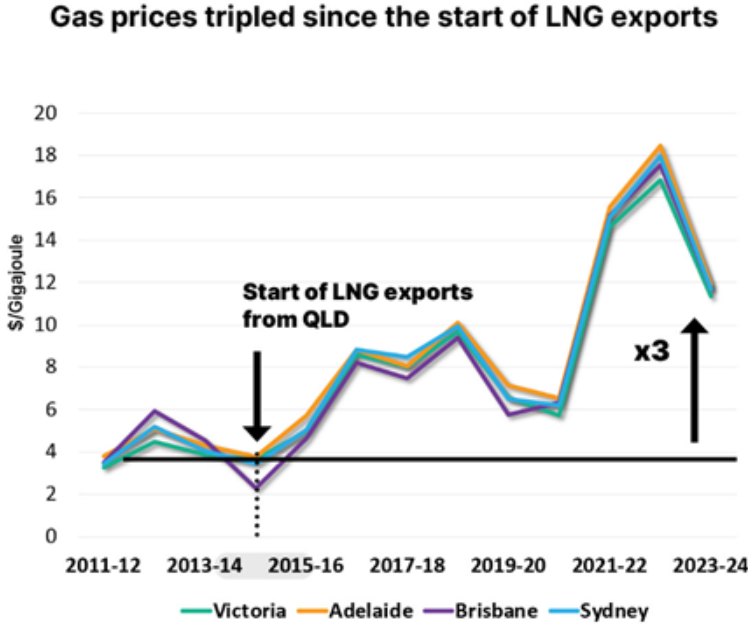

The consequent domestic scarcity has roughly tripled East Coast gas prices:

Given gas’s critical role in firming and setting marginal prices in the wholesale electricity market, the tripling of gas prices has also raised electricity costs.

Despite being a significant LNG supplier, East Coast Australia is now facing the frightening prospect of having to import gas. Importing LNG would result in considerably higher gas and electricity prices, as the East Coast gas price would reach import-parity levels (export pricing plus liquefaction, transportation, and regasification).

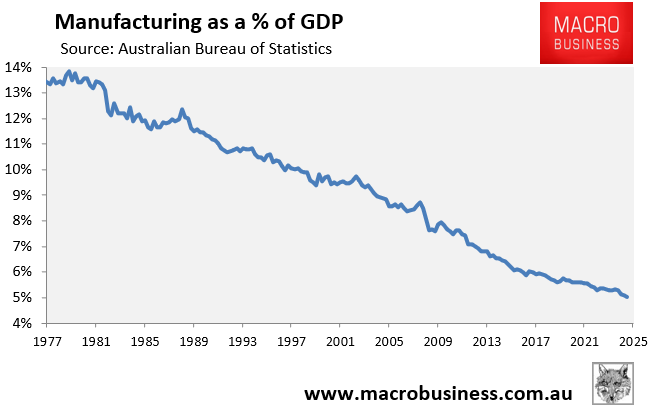

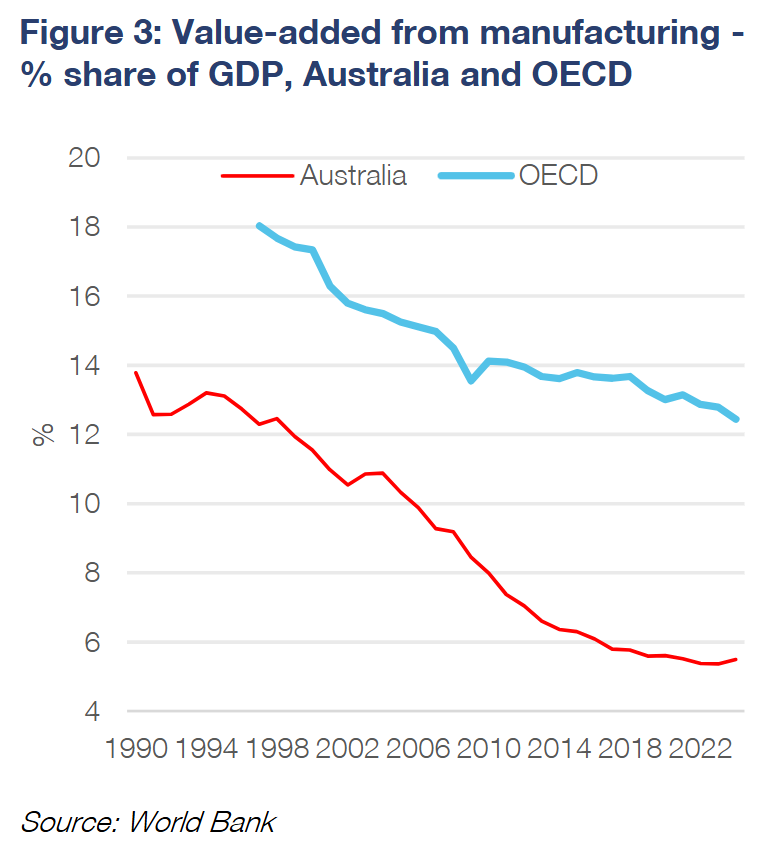

Rising energy costs have had the most detrimental impact on Australia’s manufacturing sector.

In the second quarter of 2025, the manufacturing sector’s output as a share of GDP fell to a historic low of 5.0%, down from 8.9% two decades before and 15% in the mid-1970s.

According to CBA economist Vivek Dhar, “the decline in the share of manufacturing in Australia’s economy has been faster than advanced economies, reflecting the overall challenges of keeping labour, materials, and energy prices low enough for Australia’s manufacturing sector to remain competitive”.

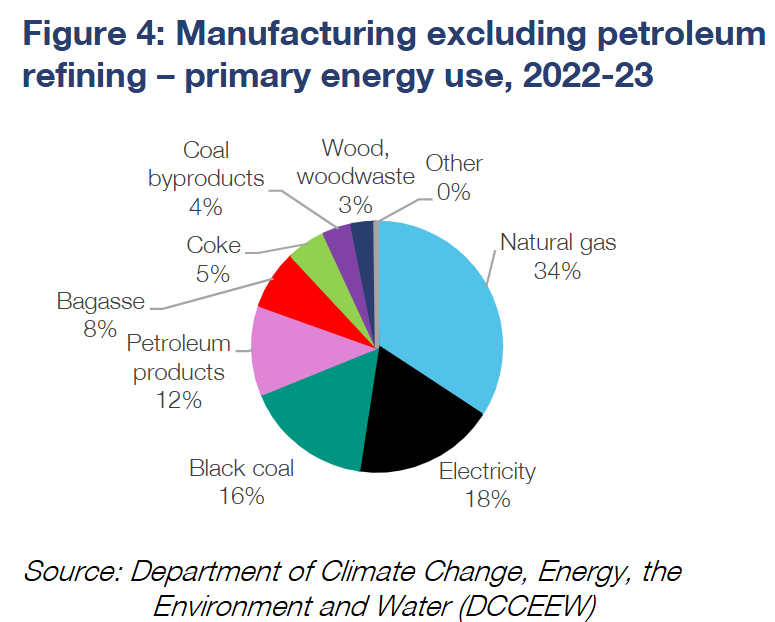

“Manufacturing, excluding the petroleum refining sector, primarily uses natural gas for its energy consumption”, noted Dhar. “Electricity is the second largest energy source, followed by black coal, petroleum products and then more fossil fuels”.

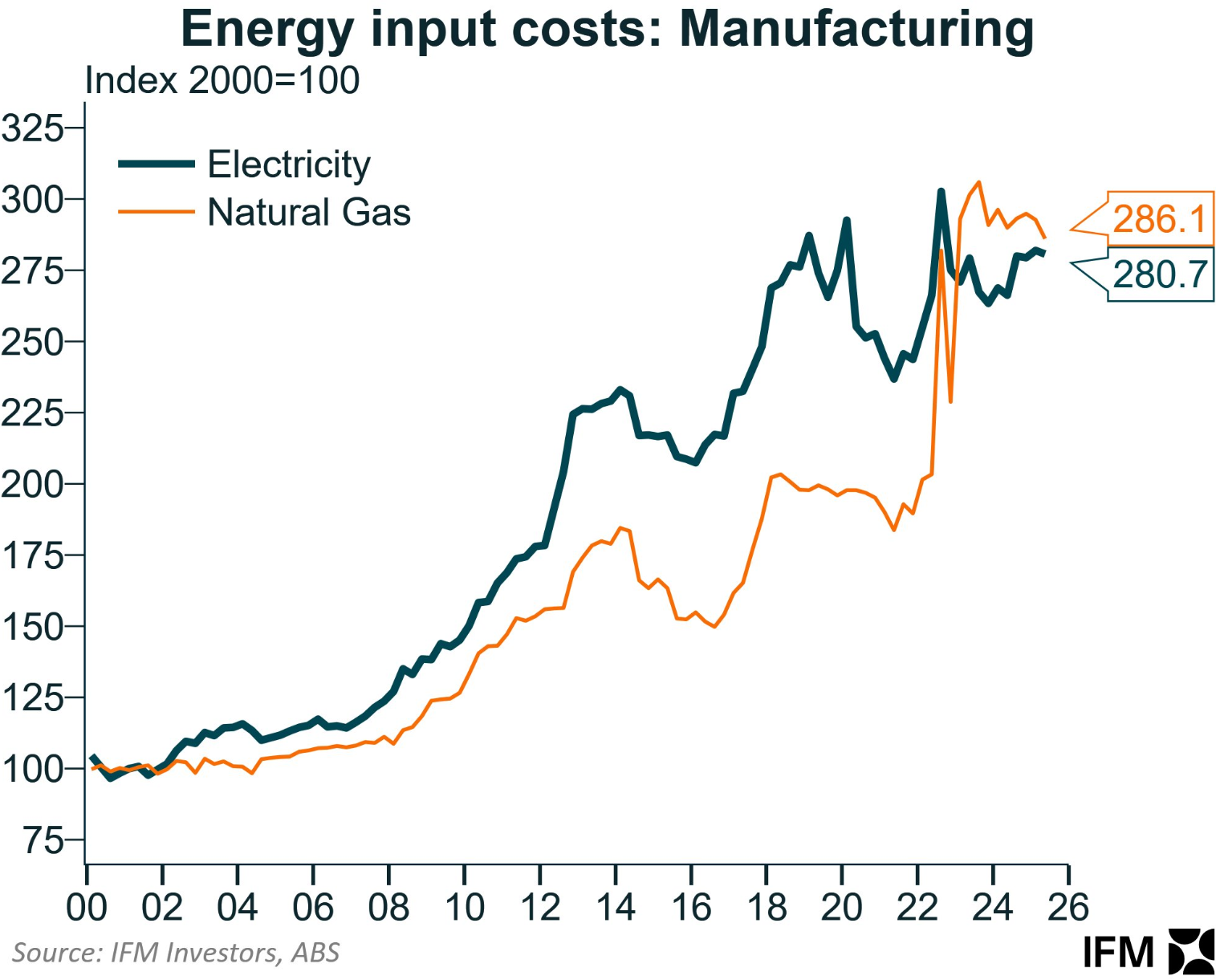

Alex Joiner, chief economist at IFM Investors, illustrates the manufacturing sector’s energy problem.

Natural gas input costs in manufacturing have risen by 186% since 2000, while electricity prices have risen by 181%.

The rise in natural gas costs has been especially dramatic since 2022, when Russia invaded Ukraine.

Earlier this month, Manufacturing Australia chief executive Ben Eade called for domestic reservation, claiming that the viability of industries was at stake:

“Australia’s gas market is failing domestic customers and putting strategic industries like steel, fertiliser, building materials and food production at risk”, Eade said.

“This has been getting worse for years, but the time for serious reform has come. The federal government’s review of the gas market must deliver structural reform that ensures Australian gas is available for Australian consumers at prices that allow us to compete, decarbonise, invest and grow”.

Speaking at the Financial Review Energy and Climate Summit this week, BlueScope Steel’s head of energy and carbon, Megan Wheeldon, said that the East Coast gas market is “broken” and demanded a domestic gas reservation scheme to ensure that gas was available for manufacturers.

“Over the last 10 to 15 years, we have seen new supply come into the market, we have seen demand destruction, we have seen manufacturers leave and fold, and we have seen domestic gas prices triple. That is fundamentally a broken market”, she said.

“That does not follow the textbooks of supply and demand. Something is required in order to bring pricing back to a balanced outcome in order for manufacturing to continue in this country”.

“We believe we do need some kind of pricing intervention. Regardless of how much supply is coming on, there is not enough to be able to get prices down to restore the competitive advantage that we need in a textbook supply and demand market”, Wheeldon said.

Brickworks’ general manager of energy, Melissa Perrow, also called for domestic reservation, adding that gas was required to achieve temperatures above 1000 degrees in its kilns—levels that could be very difficult to achieve via electrification.

East Coast Australia has the highest gas prices of any exporting jurisdiction in the world. These high gas prices have contributed to higher electricity prices, since gas is a major marginal price setter in the wholesale market.

The gas situation will only get worse if the East Coast begins importing LNG into New South Wales, Victoria, and possibly South Australia to alleviate artificial domestic shortages.

Implementing a domestic reserve on the East Coast and bolstering gas pipelines and infrastructure are, therefore, crucial for cutting prices and mitigating the negative effects of LNG imports.

The alternative is to do nothing and allow gas and electricity prices to soar. Doing so will result in further deindustrialisation, less economic sophistication and sovereignty, and falling living standards.