The likelihood of a near-term rate cut has been shattered with Wednesday’s Q3 CPI release from the Australian Bureau of Statistics (ABS).

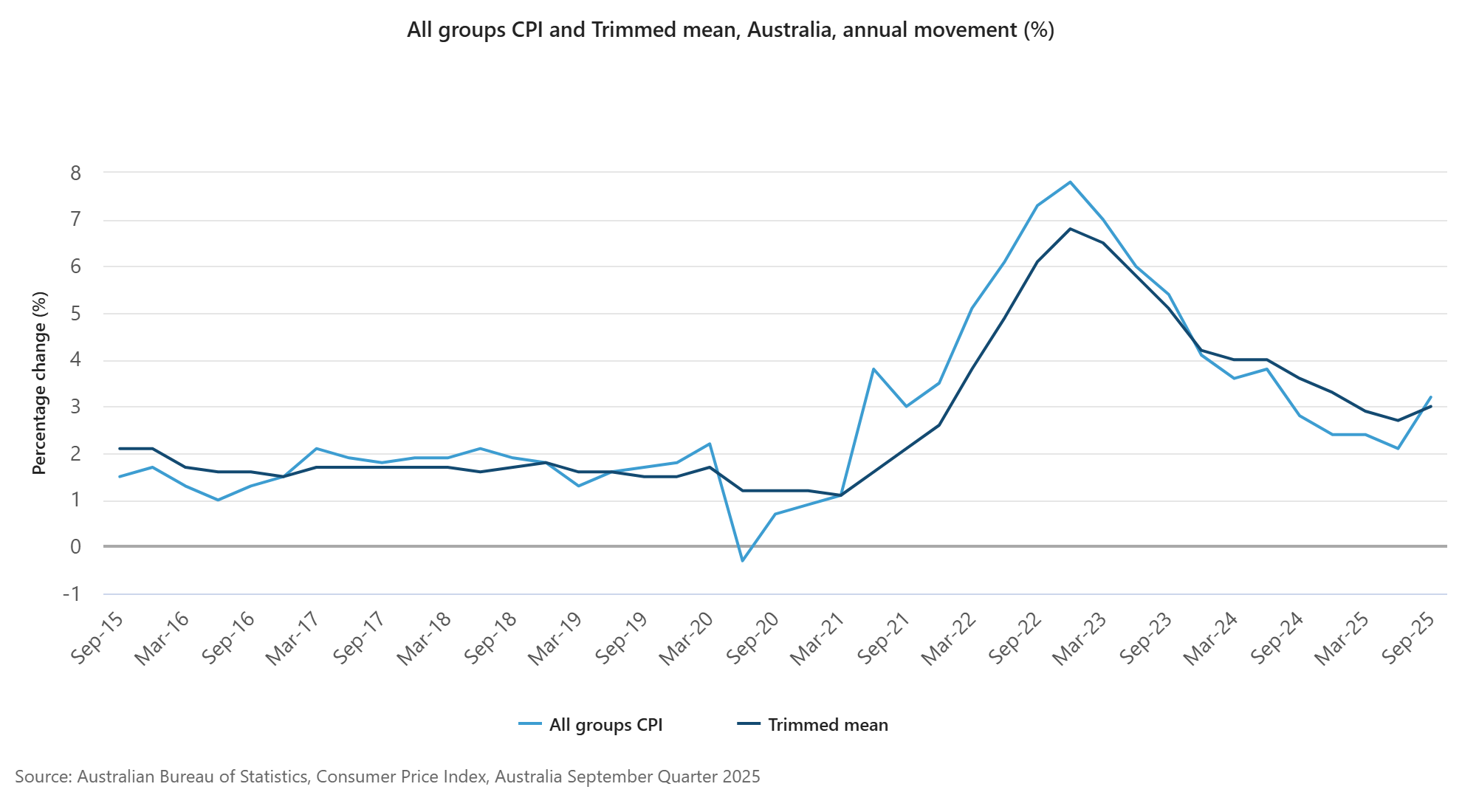

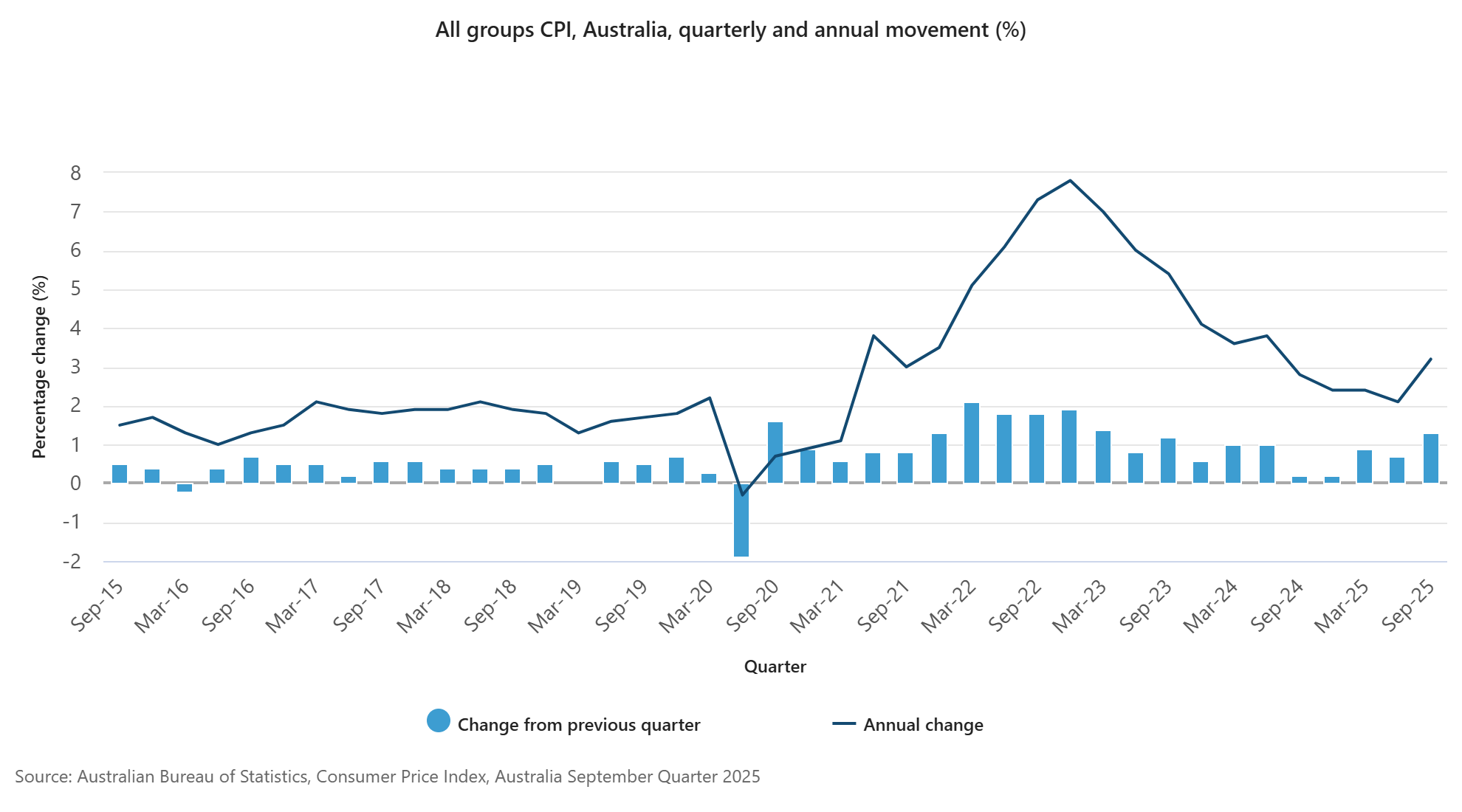

The policy-relevant trimmed mean inflation spiked by 1.0% in Q3, well above the median economists’ forecast of a 0.8% rise. This took the annual trimmed mean CPI to 3.0% – the very top of the RBA’s target band.

This is the first time annual trimmed mean inflation has increased since Q4 2022.

Headline CPI also jumped by 1.3% in Q3 to be 3.2% higher year-over-year. This was the highest quarterly rise in headline CPI since Q1 2023 and the highest annual inflation rate since Q2 2024.

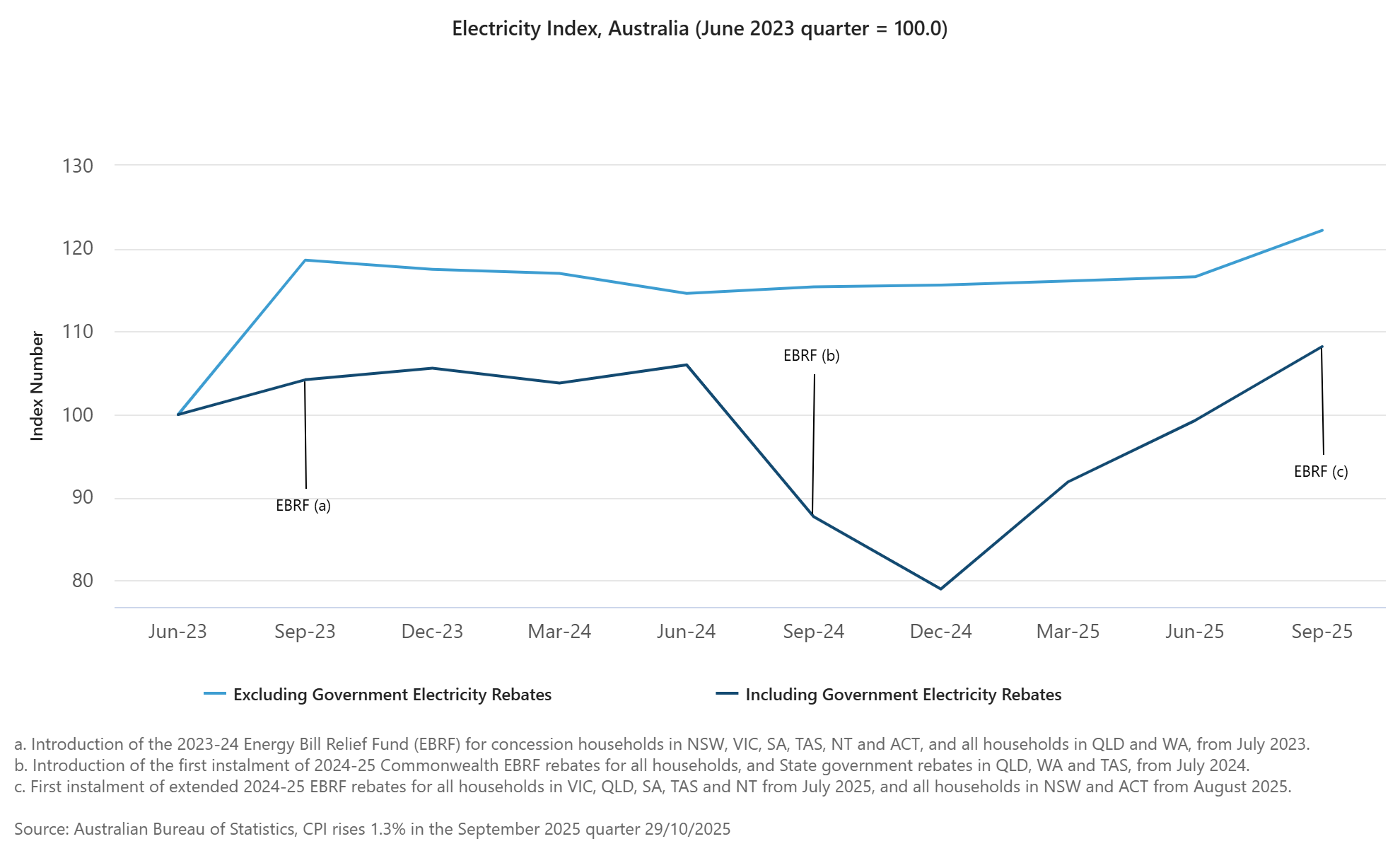

The largest contributor to this quarterly increase was electricity costs, which rose by 9.0%. Over the year, electricity costs jumped by 23.6% amid the expiry of rebates.

Alex Joiner, chief economist at IFM Investors, summarised the result as follows on Twitter (X):

“No rate cut coming for the foreseeable future. The only thing that would make the RBA’s predicament worse would be a continued rise in the unemployment rate”.

It appears that Australia is headed for a prolonged period of stagflation, driven in part by soaring energy costs.