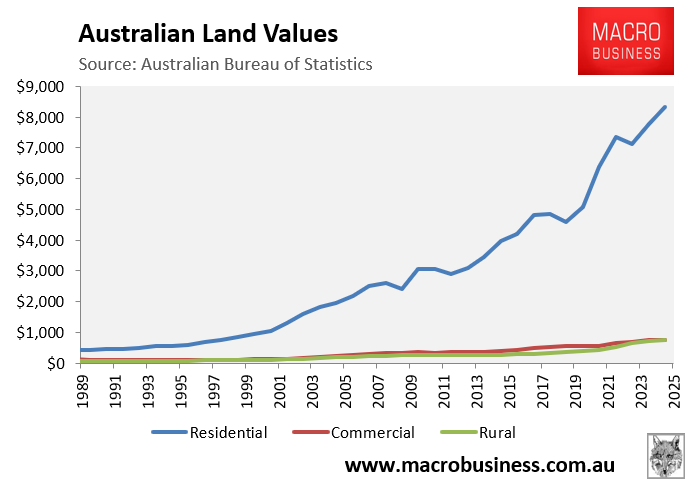

The Australian Bureau of Statistics (ABS) has released its annual national accounts for the 2024-25 financial year, which includes extensive data on land values.

Land values underpinning the Australian housing market increased by 7.0% during the 2024-25 financial year.

In 2024-25, Australia’s land was valued at $9.8 trillion, with residential land accounting for 85% ($8.3 trillion).

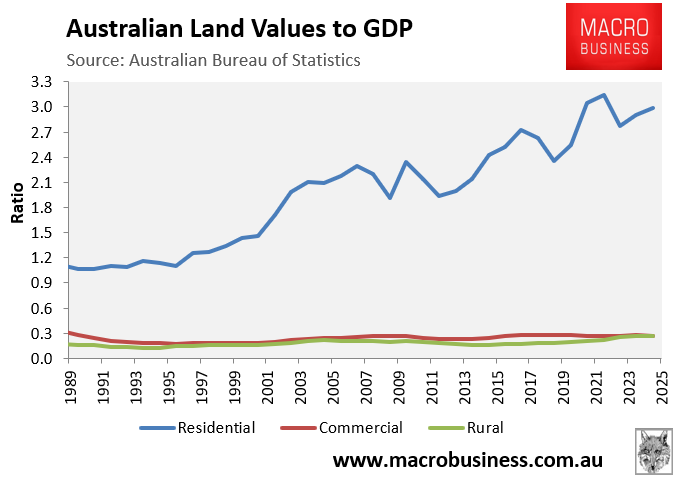

The chart below shows Australia’s aggregate land values categorised by use, compared to the country’s GDP since 1989, which is the oldest available data.

While aggregate Australian commercial and rural land values have remained relatively stable in relation to GDP over the last 36 years, residential land values have skyrocketed, rising from 1.1 to 3.0 times GDP by 2024-25.

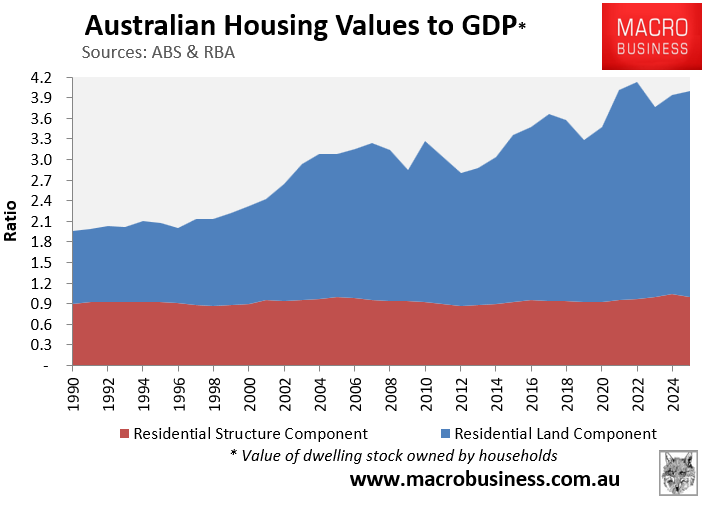

When the aggregate residential land values data is combined with the Reserve Bank of Australia’s (RBA) dwelling values data, which includes both residential land values and structures (buildings), it is clear that rising land costs have driven the increase in Australia’s housing values over the last 26 years.

Aggregate structure values, which are calculated by subtracting the ABS’ residential land value estimates from the RBA’s dwelling asset figures, were 0.88 times GDP in 1988-89 and have increased marginally to 1.0 times GDP as of 2024-25.

In contrast, the total value of Australia’s housing stock (land and structures) doubled from 2.0 times GDP in 1988-89 to 4.0 times GDP in 2024-25, owing to strong inflation in land values.

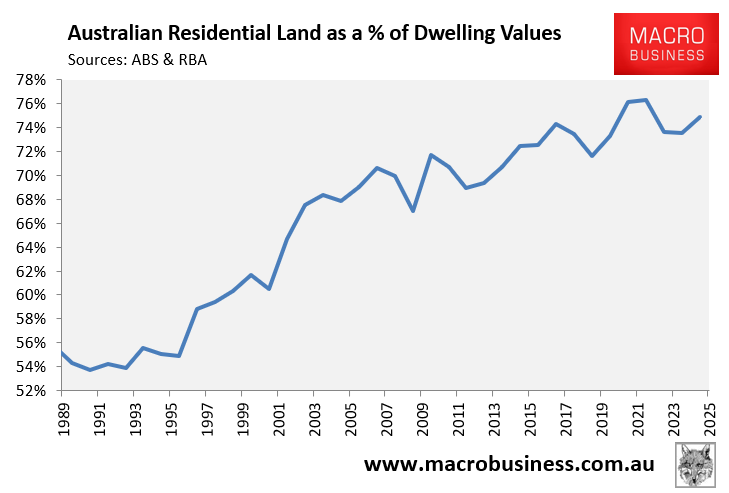

Reflecting the fact that residential land has increased in value compared to structures, the land share of Australia’s housing stock has increased from 54% in 1990-91 to 75% in 2024-25.

The rise in land costs is also evident in the off-the-plan market.

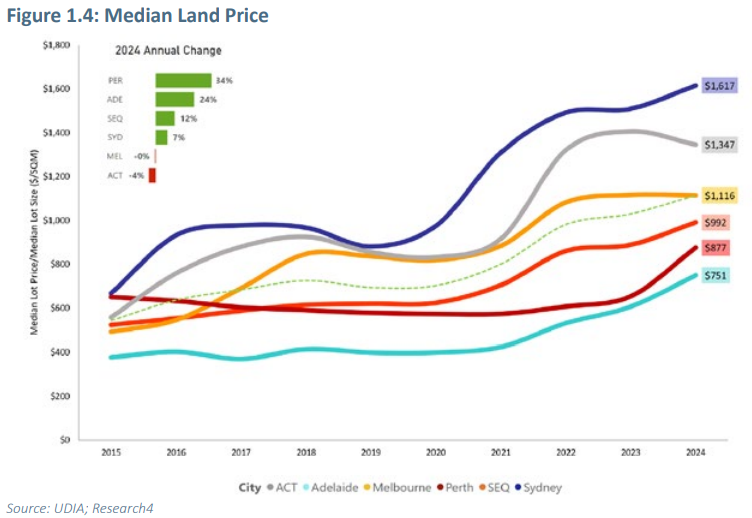

The UDIA’s 2025 State of the Lane Report showed that the combined capital city land price increased by 8% in 2024 to finish the year at $1,116 per sqm.

The rising cost of land in Australia is one of the impediments to developing new dwellings for its rapidly growing population.

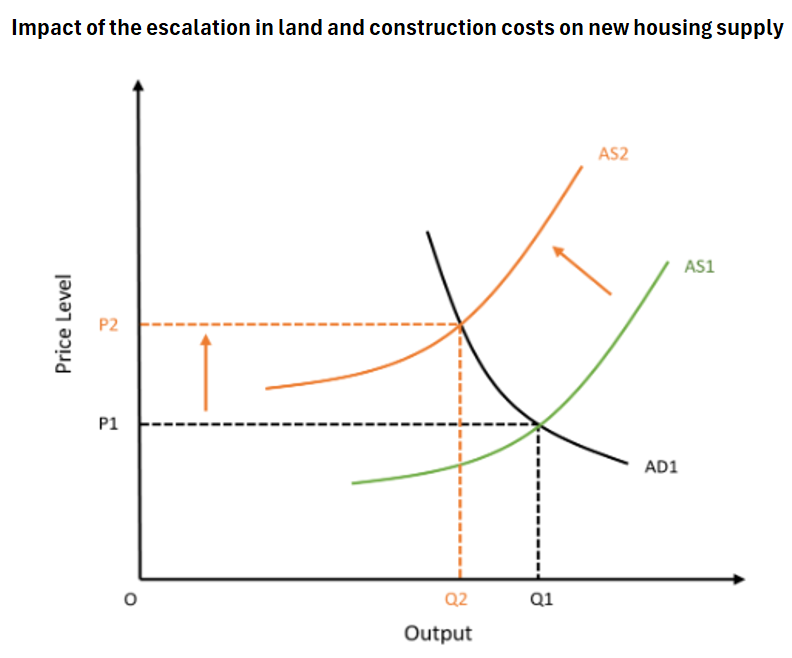

In economic terms, this land cost-push inflation has shifted the aggregate supply curve to the left, lowering total capacity to build dwellings at all price levels.

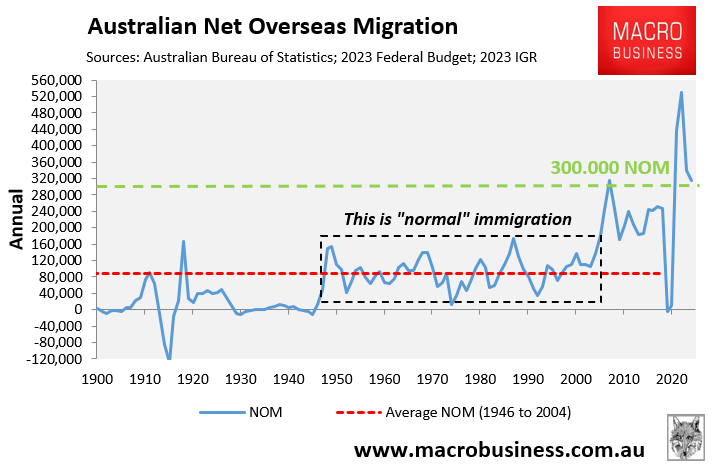

The federal government should have responded by reducing demand via lower immigration. Instead, it has chosen to ramp immigration once more, driven by international students.

Indeed, Abul Rizvi last week forecast that net overseas migration will average an extraordinary 300,000 under current immigration policies.

As a result, Australia’s structural shortage of housing will worsen.