Retirement Essentials has released a report, produced on behalf of industry super fund HESTA, showing that Australians who receive the age pension but continue to work can incur effective marginal tax rates of between 60% and 80%.

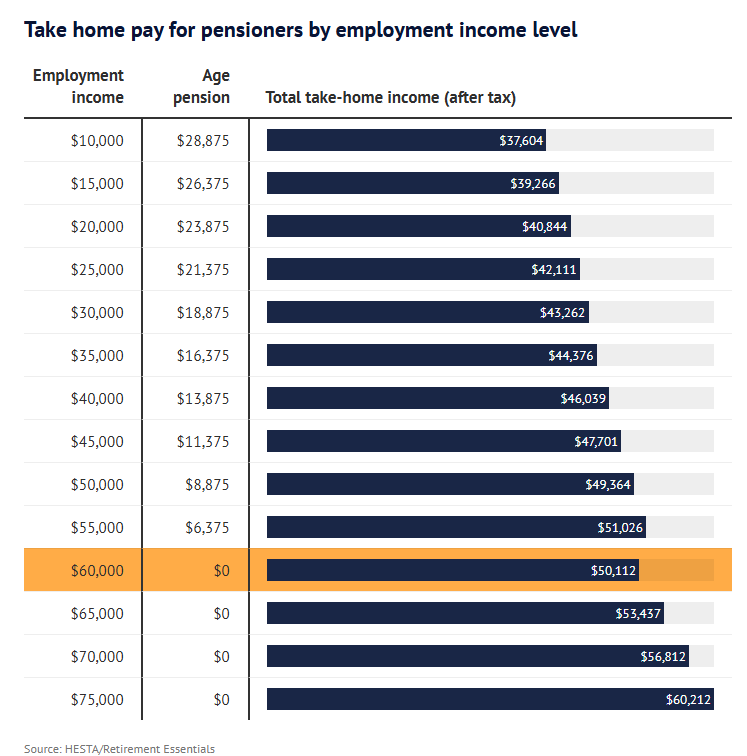

Retirement Essentials found, among other things, that the effective marginal tax rate for a single pensioner will be 78% if their employment income rises from $30,000 to $35,000.

Likewise, the effective marginal tax rate will be 118% for a single pensioner whose income rises from $55,000 to $60,000.

Meanwhile, the effective tax rate for a couple where only one partner works can be as high as 122% if their employment income rises from $85,000 to $90,000.

HESTA CEO Debby Blakey says the high marginal tax rates faced by pensioners are a huge disincentive to workforce participation among retirees, many of whom want to work at least part-time, especially as Australia continues to experience labour shortages in crucial areas such as health.

“Retirement is changing, but the system hasn’t aligned well with that”, she said. “Many of our retirees are keen to work, not just for financial reasons, but for connection or their mental well-being. Part-time or casual work in retirement helps people retain a sense of purpose and fulfilment, while addressing critical workforce demand and boosting the broader economy”.

“Age pensioners can continue to make significant contributions to the workforce”, Blakey said. “But there’s no incentive for them to increase their work”.

As a counterpoint, over-65s in New Zealand participate in the labour force at a staggering 25%, compared to around 14% in Australia. Only around 3% of aged pension recipients in Australia work.

The reason New Zealand’s seniors’ participation rate is so high is that the pension is not means-tested and is available to everyone above the age of 65. As a result, older Kiwis do not forfeit their pension if they work more; instead, they pay tax on their additional earnings.

Two other top pension systems, the Netherlands and Denmark, have defined benefit programs, or universal basic pensions, and have significantly higher labour force participation rates among seniors than Australia.

According to research from National Seniors Australia (NSA):

- Fewer than 76,000 pensioners (3%) currently work, but many would work (or work more) if they did not lose half their earnings when they work more than one day a week.

- Exempting work income from the Age Pension income test could benefit two million pensioners with limited wealth, alleviating pensioner poverty.

- The policy could see up to 400,000 pensioners available to fill critical labour shortages across the country.

In addition to the participation benefits, a universal pension would reduce complexity and administrative expenses by eliminating the need for means tests, taper rates, deeming rates, and so on.

A universal pension would also abolish the game-playing and manipulation that older citizens engage in to maximise their Age Pension benefits.

Instead of importing hundreds of thousands of migrants into Australia every year to address labour shortages, which puts undue strain on infrastructure, housing, and the environment, Australia should make greater use of retirees who want to work by modifying pension rules to alleviate punitive effective marginal tax rates.

It is an obvious policy solution that would boost the economy and alleviate poverty without the many downsides that come from immigration-driven population growth.