New Zealand is experiencing an unprecedented house price crash after experiencing one of the developed world’s largest price booms over the pandemic.

As Justin Fabo of Antipodean Macro illustrates below, the Real Estate Institute of New Zealand’s House Price Index (HPI) shows that national home values have declined by more than 17% over the last 45 months to be only 3.4% higher than they were five years earlier.

Adjusting for inflation, New Zealand’s HPI is back to where it was in late 2019, erasing all of the pandemic gains.

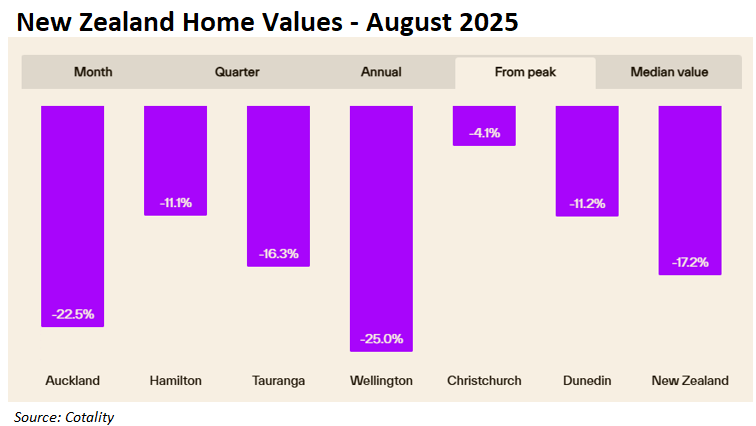

Cotality has released its New Zealand dwelling values index for August, which recorded the fifth consecutive monthly decline.

The nationwide median value now stands at $809,113, down 17.2% compared to the January 2022 peak and the lowest level since August 2023.

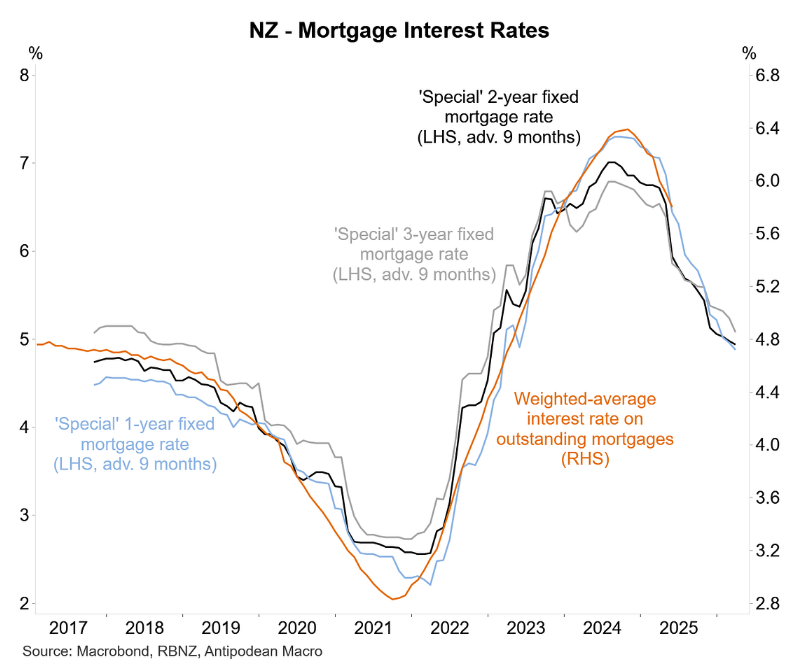

Cotality NZ Chief Property Economist Kelvin Davidson noted that “continued economic weakness, further increases in unemployment, and subdued confidence” are behind the decline in values, despite falling mortgage rates.

“Caution is the dominant theme, and with unemployment not expected to be at its peak just yet, it’s unlikely that many people will be rushing out to bid up house prices aggressively over the rest of 2025”, Davidson said.

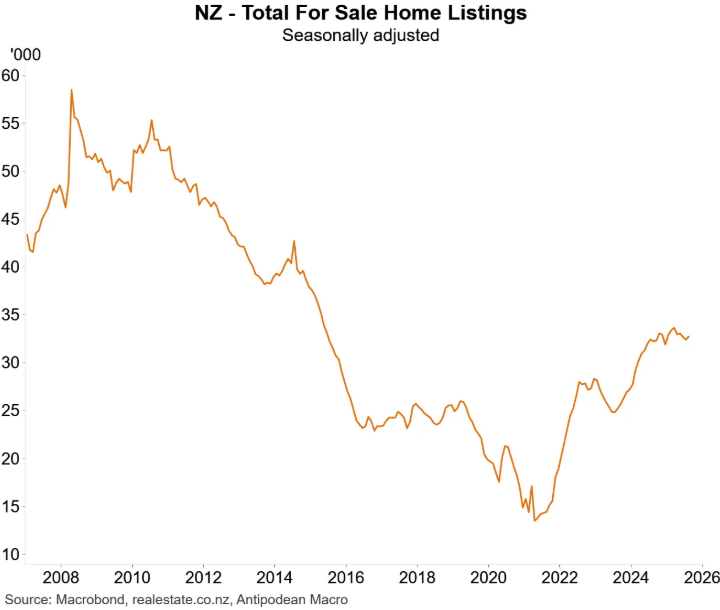

The other issue weighing down prices is the swelling number of for-sale listings, which has meant that the supply of homes is greater than demand.

However, Kelvin Davidson noted that while the weak conditions “might be discouraging for property owners and sellers”, it “is beneficial for those buyers on the other side of the coin”.

“In particular, we’re seeing continued strength from first home buyers”, he said.

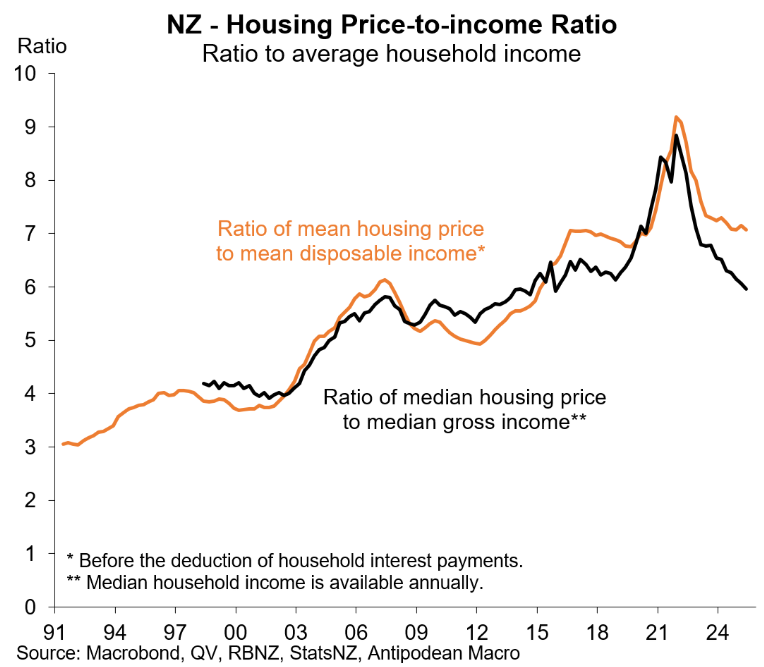

Indeed, New Zealand’s median house-price-to-income ratio has fallen to a decade low:

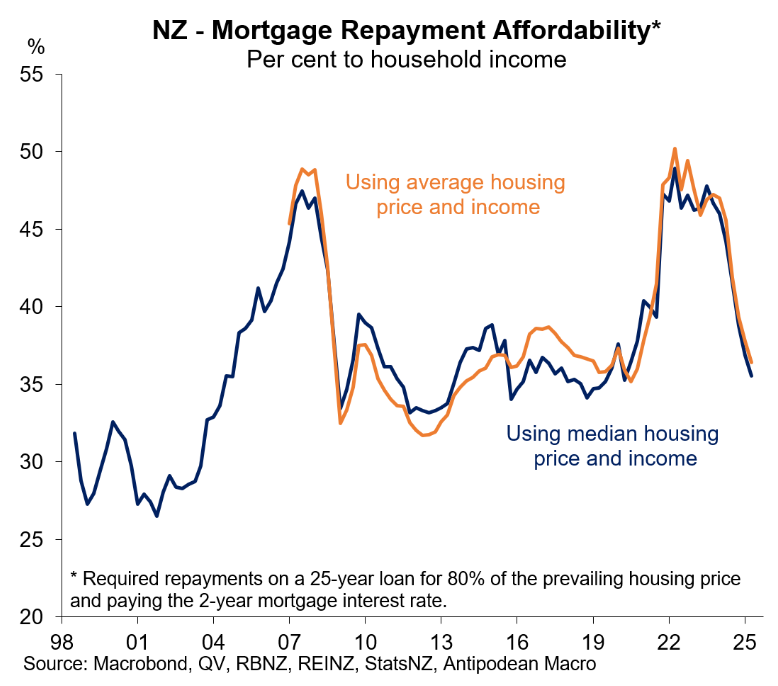

Mortgage repayment affordability is also tracking at its best level in around a decade:

In other words, New Zealand’s house price crash is fantastic news if you care about intergenerational equity.

Ultimately, the only way to make housing more affordable is for values to fall.