The only thing that may have prompted the Reserve Bank of Australia (RBA) to cut rates at its next monetary policy meeting is a sharp deterioration in the labour market.

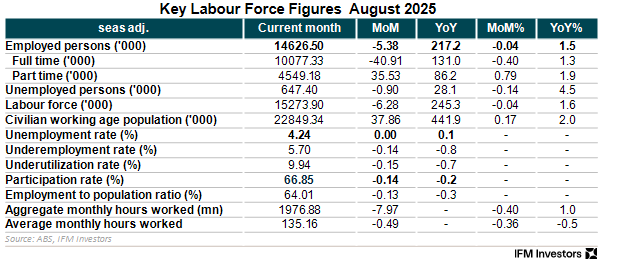

Alas, Thursday’s official labour force survey for August from the Australian Bureau of Statistics (ABS) extinguished any hope of a rate cut, with the unemployment rate remaining stable at 4.2% and the underemployment rate falling by 0.1% to 5.7%.

The internals were weak, however, with the number of people employed falling by 5,400 and hours worked falling by 0.4%.

The 0.1% decline in the participation rate prevented the unemployment rate from rising.

Other indicators released this week suggest that the labour market has weakened.

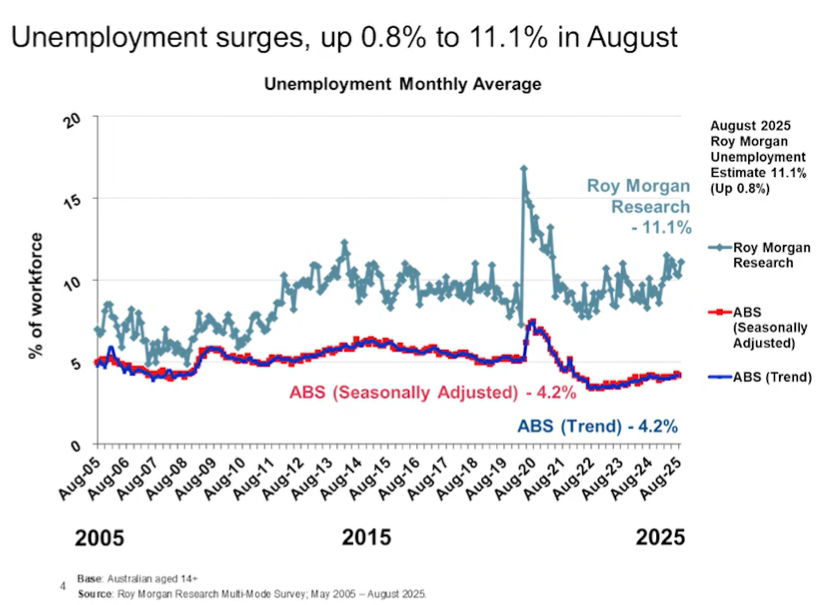

Roy Morgan’s shadow labour force report posted a large 0.8% jump in unemployment in August to 11.1%. Roy Morgan unemployment was also up a hefty 2.0% year-on-year.

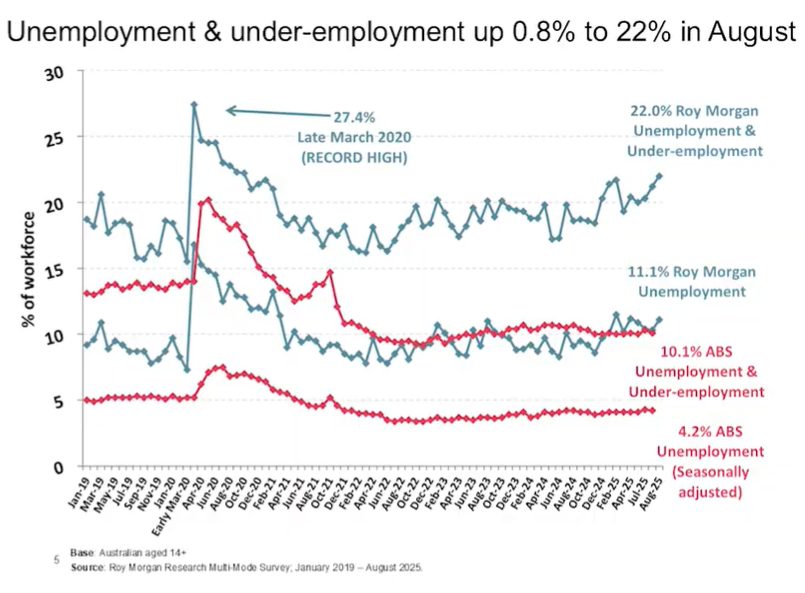

Roy Morgan’s measure of total labor underutilisation—i.e., unemployment and underemployment combined—also rose by 0.8% in August to 22.0% and was 3.4% higher over the year:

Roy Morgan effectively counts someone as unemployed if they want a job but are unable to get one. Therefore, it is a broader definition than the ABS’ stricter unemployment measure.

As you can see, Roy Morgan’s shadow labour force survey has broken away from the ABS series over the past nine months.

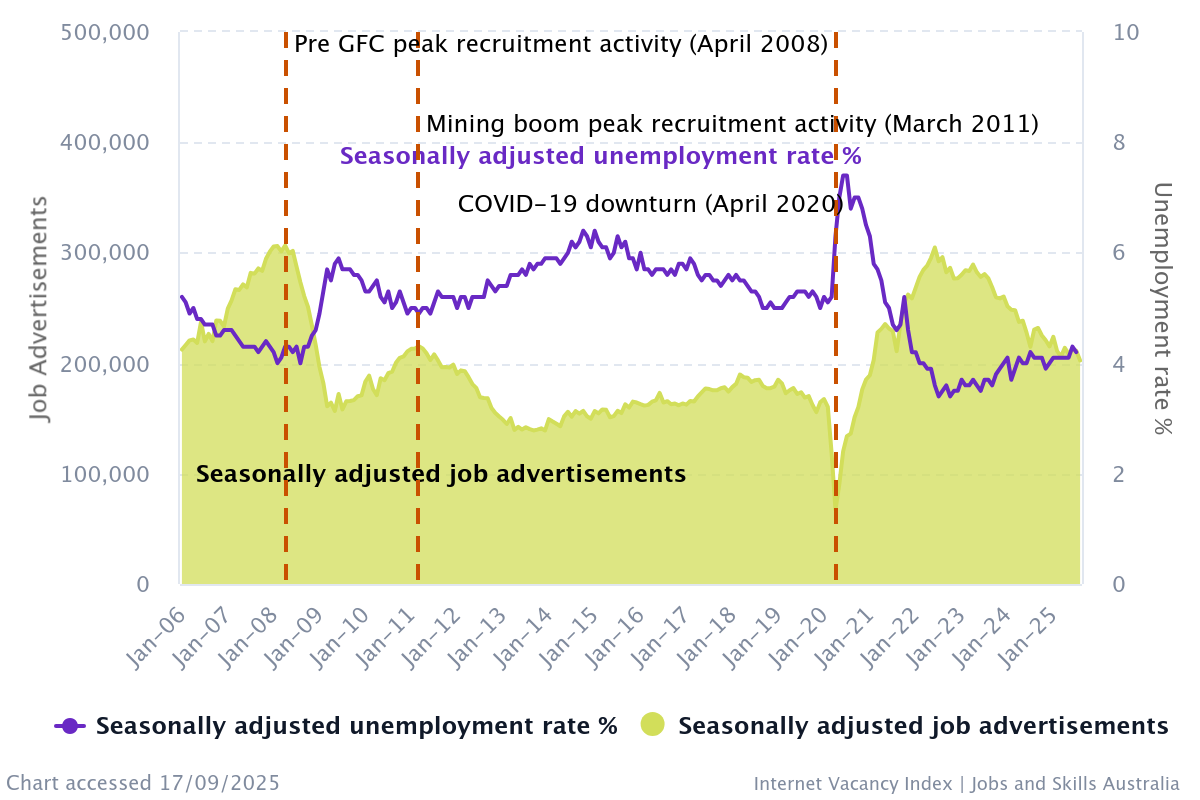

Jobs & Skills Australia (JSA) Internet Vacancies Index (IVI), which captures de-duplicated job ads on SEEK, CareerOne and Workforce Australia, also reached a new cyclical low in August following a 4.2% (8,900 job) decline in job advertisements:

Over the year to August 2025, online job advertisements decreased by 12.2% (or 28,000).

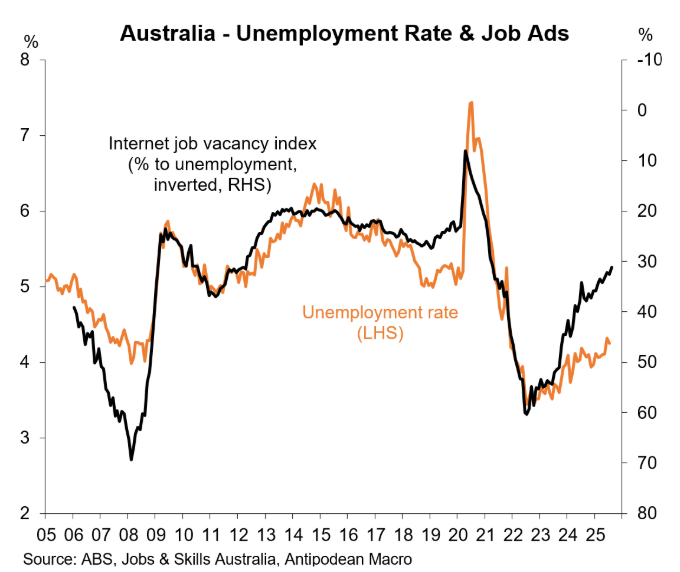

The following chart from Justin Fabo from Antipodean Macro plots JSA’s IVI against the official unemployment rate and continues to point to rising unemployment.

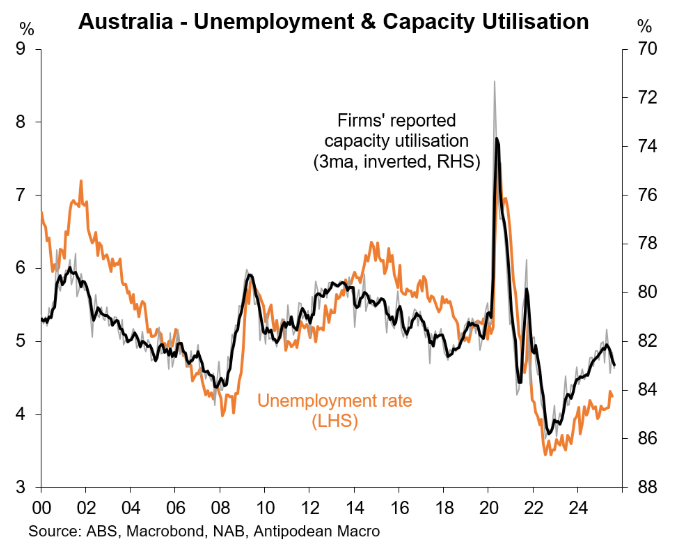

On the other hand, the latest NAB employment survey reported sharply falling capital utilisation in August, which points to lower unemployment:

Therefore, the signals are mixed.

Either way, today’s result from the ABS has extinguished hopes of imminent rate cuts from the RBA.

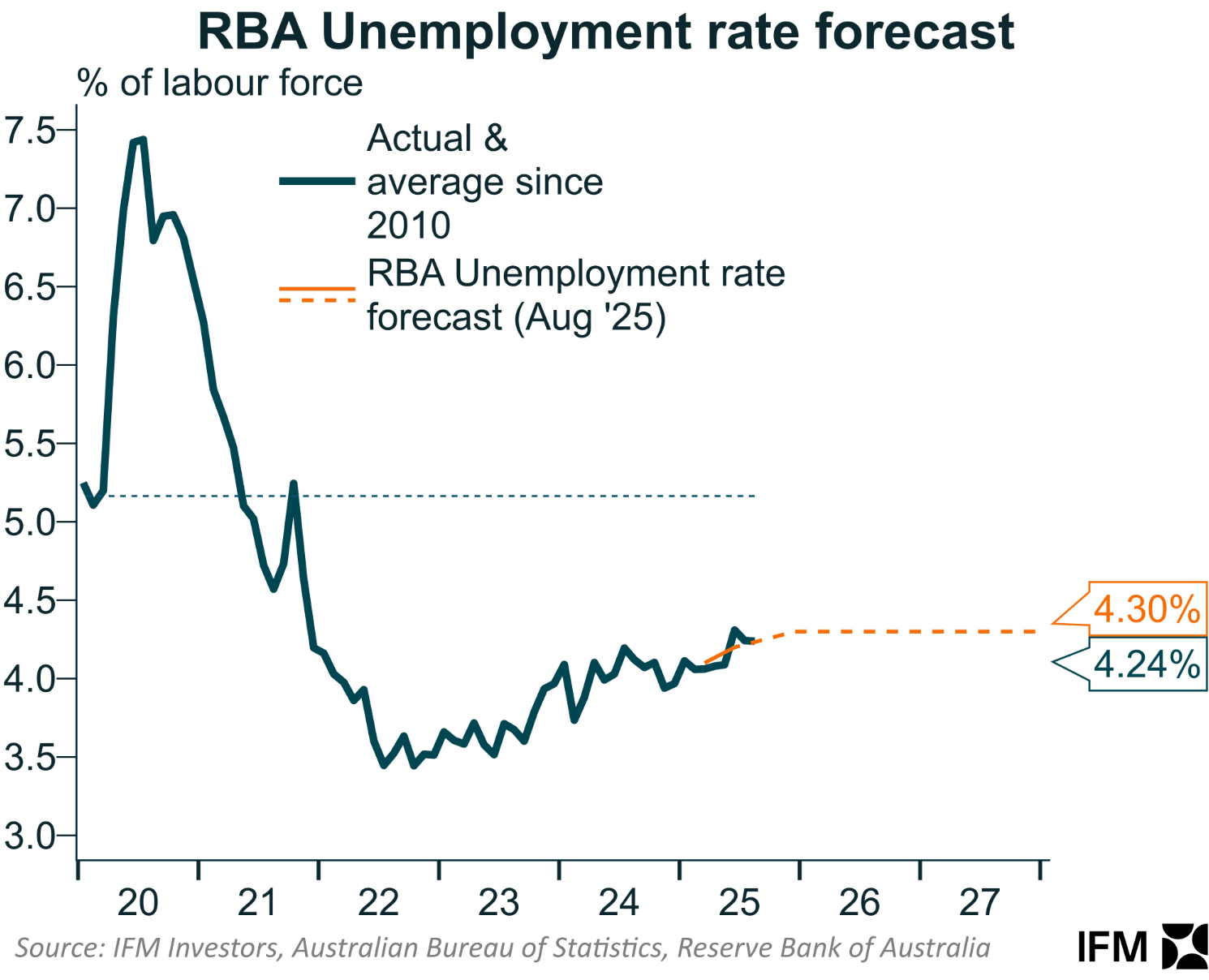

As illustrated below by Alex Joiner from IFM Investors, the unemployment rate is tracking slightly below the RBA’s forecast: