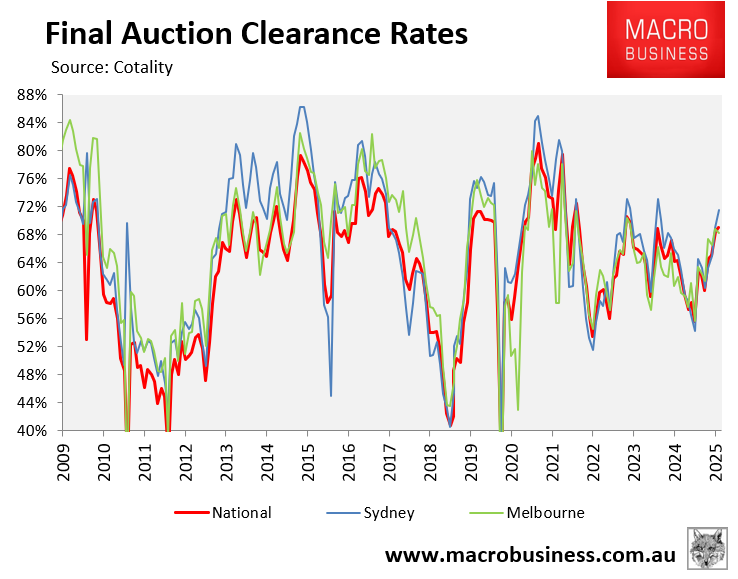

Cotality’s final auction clearance rates for August suggest that Sydney, in particular, is headed for another price boom.

Sydney’s final auction clearance rate averaged 72% in August, which was the city’s strongest result since February 2024 (73%).

Sydney’s final auction clearance rate in August was also the strongest in the nation, easily beating Melbourne’s (68%) and the combined capital city average (69%).

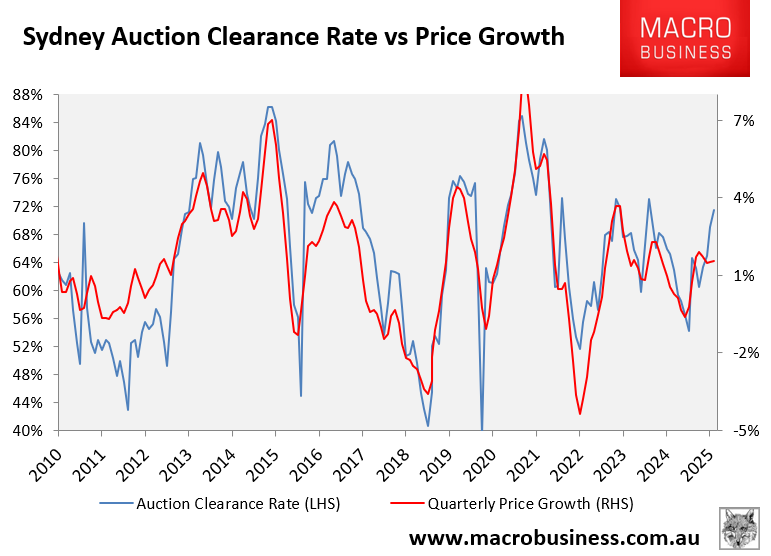

The following chart plots Sydney’s average monthly final auction clearance rate against PropTrack’s quarterly dwelling value growth series:

You can see that Sydney’s auction clearance rate has historically been highly correlated with price growth. The recent surge in auction clearances, therefore, suggests that Sydney home prices will accelerate.

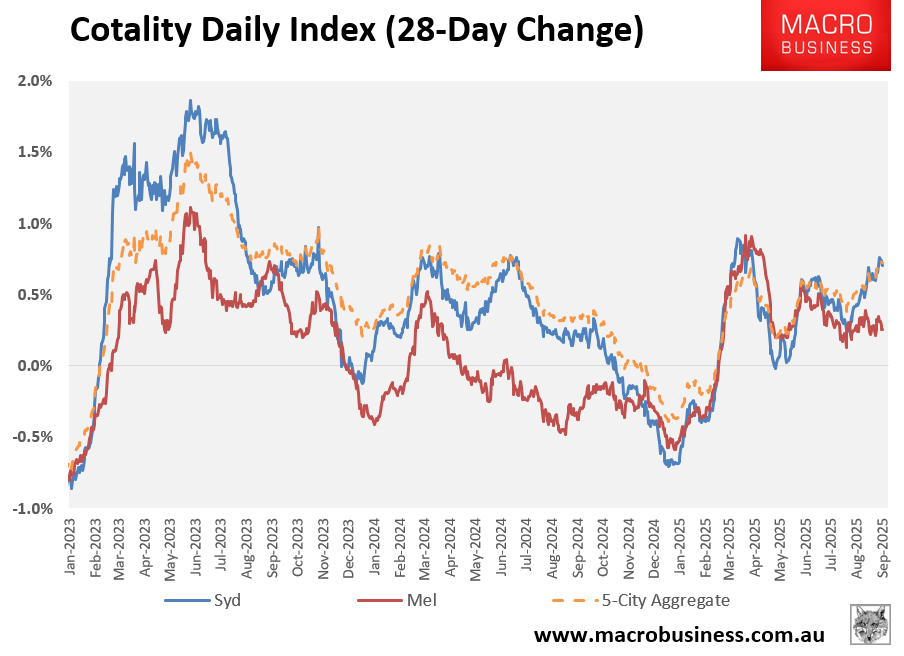

Indeed, the latest 28-day change from Cotality shows that Sydney home values are on the march, rising by 0.7% (circa 9% annualised).

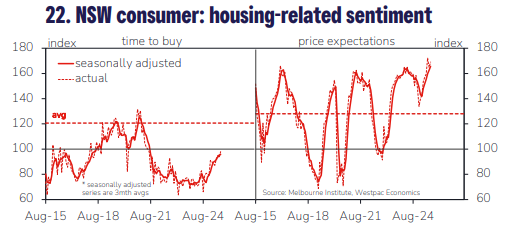

Meanwhile, Westpac’s latest consumer sentiment survey reported that NSW house price expectations have surged to cyclical highs, which historically has been a leading indicator for actual price growth.

“Housing sentiment has strengthened substantially”, Westpac noted. “The NSW Consumer Housing Sentiment Index posted the largest gain of the major states, led by a surge in price expectations, now at their highest in more than a decade”.

“Purchasing intentions have lifted 16.8% since the start of the year, sitting just shy of optimism territory”.

However, while indicators for Sydney property prices have turned bullish, it is worth emphasising that affordability constraints will limit the upswing.

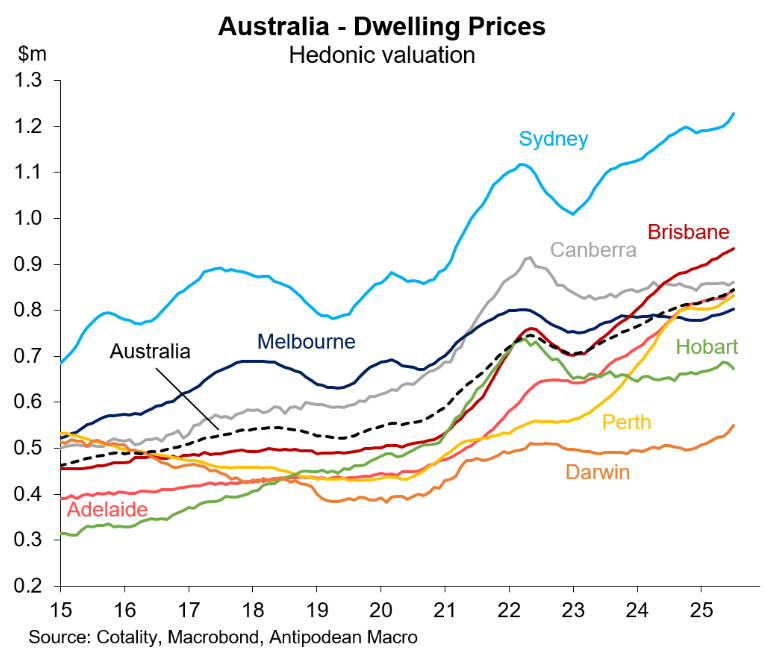

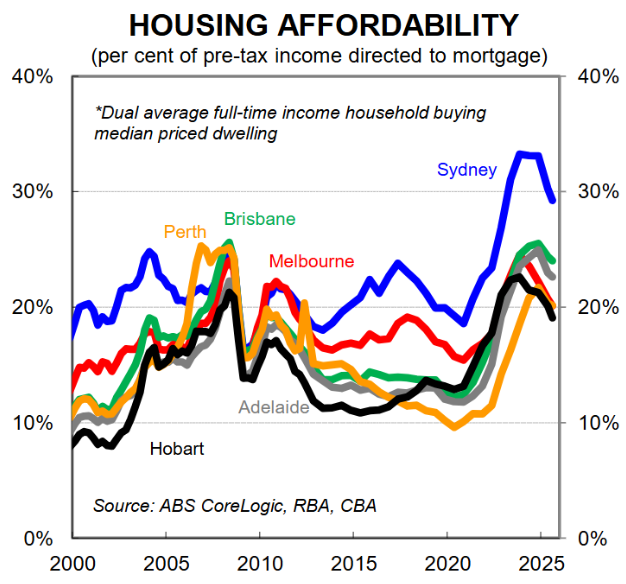

As illustrated below by Justin Fabo from Antipodean Macro, Sydney housing is easily the least affordable in the nation.

The number of purchasers who can afford to pay more than $1.2 million for a home in Sydney and take out a massive mortgage is limited.

Although the three rate cuts delivered by the RBA have improved mortgage affordability, it remains historically poor, with the dual average full-time income household still required to spend nearly 30% of their pre-tax income servicing a mortgage on a median-priced home.

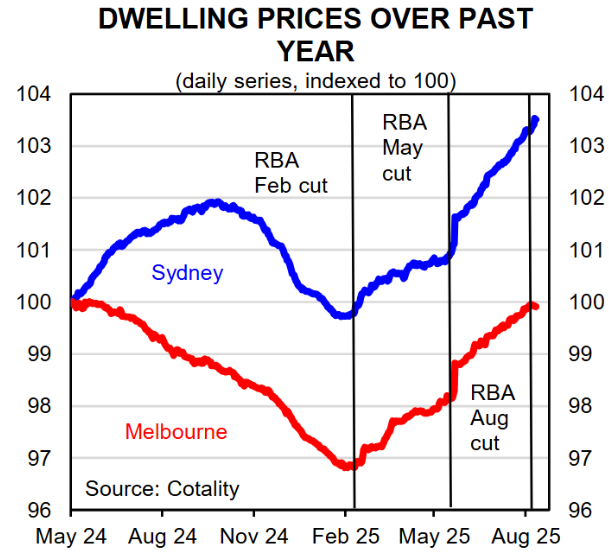

Even so, Sydney has responded positively to rate cuts, as illustrated below by CBA:

With the RBA expected to deliver at least another two 25 bp rate cuts by mid-2026, this means one thing for Sydney home values: acceleration.